Infinite MPX claims to be an online broker established in 2006, offering various trading services in forex, stocks, precious metals, cryptocurrencies, and more. However, there are numerous red flags regarding the platform’s authenticity, including false company details, plagiarized content, forged regulatory information, and high-return promises that suggest potential fraudulent activities. This article will analyze the issues with Infinite MPX and warn investors to remain cautious and avoid falling victim to its traps.

1. Company Overview: False Advertising and Inconsistent Information

1.1 Registration Information Flaws

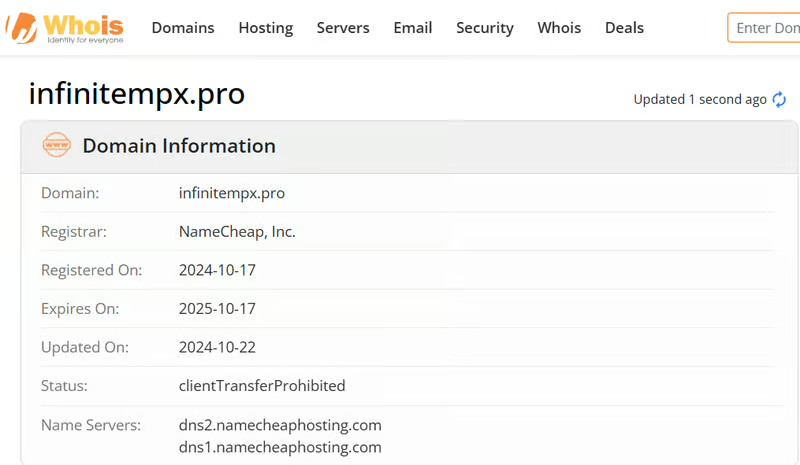

Infinite MPX claims to have been established in 2006 with its headquarters in Australia, yet its domain name, infinitempx.pro, was only registered on October 17, 2024. How can a platform that claims to have been operating for nearly two decades have such a recent domain registration? Even more troubling, the content on the company’s website is nearly identical to that of the well-known broker GO Markets. Is this just coincidental plagiarism, or does it indicate a deliberate attempt to impersonate a legitimate company?

1.2 Unverifiable Company Background

Infinite MPX claims a company address linked to a business in agricultural chemicals, which has no connection to the financial services industry. Why would a financial platform list an address tied to a business unrelated to finance? This mismatch raises significant concerns about the platform’s legitimacy. Real financial platforms typically provide clear and accurate company registration details, and the absence of such information here is highly unprofessional.

2. Offered Trading Services: High Return Promises with Lack of Transparency

2.1 Trading Products and Service Claims

Infinite MPX offers forex, stocks, indices, precious metals, commodities, and cryptocurrencies for CFD trading, but it does not provide any key details such as leverage, commissions, or spreads. Why would a platform fail to disclose such basic trading terms? Additionally, the descriptions of the account types are almost identical to those found on the GO Markets website. Is this simply a coincidence, or does it suggest a lack of originality and credibility?

2.2 High Return Investment Plans

The platform offers multiple investment plans, including the Lease Plan, Mutual Funds Plan, Flipping Plan, and Special Plan. The Special Plan requires a minimum investment of $1.5 million and promises high returns within just 30 days. How can a platform promise such high returns in such a short time? Are these returns realistic, or is it a classic scheme designed to attract victims into a Ponzi-like setup?

3. Trading Software and Technical Support: Unverifiable Technical Claims

3.1 “False Claims” of MetaTrader 4 and 5

Infinite MPX claims to use MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as trading platforms. However, investigations show that these platforms do not list any servers associated with Infinite MPX. If the platform truly offers these tools, why do they not appear in the server listings? Could it be that the platform is unable to deliver on its promised trading technology?

3.2 Deposit and Withdrawal Issues

Infinite MPX claims to support multiple payment methods, including Mastercard, Visa, Skrill, Neteller, and wire transfers. But due to the platform’s lack of regulatory oversight, the security of investor funds cannot be guaranteed. Why would a platform encourage deposits without any regulatory protection? Does this expose investors to the risk of losing their funds without recourse?

4. Agent Policies: False Partnership Opportunities

4.1 White Labels and Referral Program

The platform offers White Label and Referral Program opportunities, claiming to provide high returns for agents. However, investigations show that the content of these policies is nearly identical to that of GO Markets. Why would a platform that claims to have substantial expertise resort to copying another company’s policies? Does this suggest a lack of innovation or legitimate business practices?

4.2 Fraudulent Marketing Tactics

These so-called agent policies are essentially empty marketing schemes designed to lure in agents and increase funds flowing into the platform, rather than offering any real support. Why is the platform so eager to recruit agents? Could this indicate hidden motives behind its operations?

5. Educational Resources: Plagiarism and Lack of Originality

5.1 Unauthorized Content Copying

Infinite MPX offers various educational resources, including forex basics, trading psychology articles, and MetaTrader platform tutorials. However, it turns out that these resources are nearly identical to those found on the GO Markets website. Why would a platform choose to copy content from another company instead of creating its own educational material? Does this behavior reveal a disregard for professionalism and originality?

6. Regulatory Information: Attempt to Impersonate a Regulated Platform

6.1 Forged Regulatory Credentials

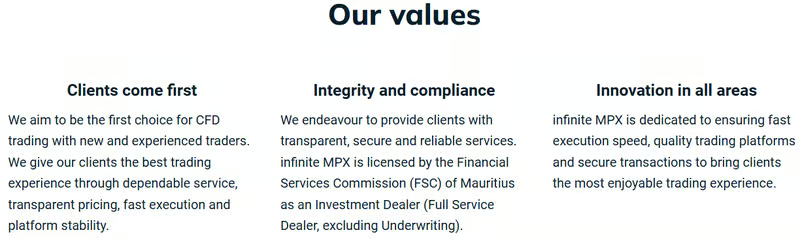

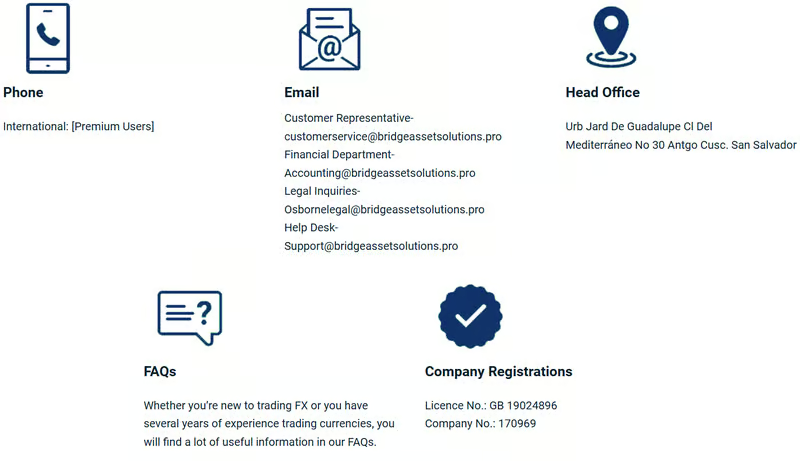

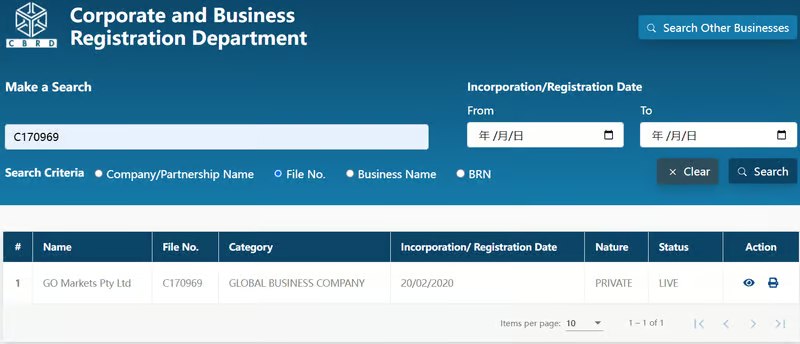

Infinite MPX claims to be regulated by the Mauritius Financial Services Commission (FSC) with license number GB19024896, yet further investigation shows that this license number actually belongs to GO Markets Pty Ltd. Why would the platform resort to using another company’s regulatory information? Does this suggest the platform lacks the legal ability to operate and is trying to mislead investors?

7. Website Traffic and Brand Exposure: Minimal Impact

7.1 Extremely Low Website Traffic

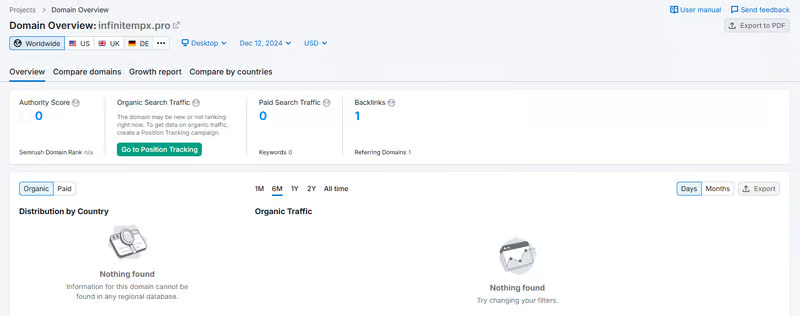

According to Semrush data, Infinite MPX’s website receives fewer than 100 visits per month, indicating that it has little to no market presence or appeal. Why would a platform that claims years of experience have such low web traffic? Does this suggest the platform has virtually no impact or credibility in the market?

7.2 Similarities to Other Scam Platforms

Infinite MPX uses the same website template as several other known scam platforms (such as Adepts Group and HX Finance), further suggesting that it may be another fraudulent operation targeting investors. Why would so many scam platforms use the same template? Could this be a common characteristic of fraudulent schemes?

7.3 Lack of Social Media Presence

The platform has no social media accounts and only offers email and an online contact form as ways to reach them. Why would a legitimate platform not utilize social media for communication with clients? Does the absence of social media suggest a desire to avoid public scrutiny and customer feedback?

Conclusion

In conclusion, Infinite MPX displays numerous warning signs of a fraudulent platform. From plagiarized content to fake regulatory information, the platform’s operations are far from legitimate. Investors should exercise extreme caution and avoid any financial dealings with Infinite MPX.

FAQ

1. Why is Infinite MPX considered a scam?

The platform has numerous signs of fraud, including false company details, forged regulatory credentials, unrealistic return promises, and a lack of transparency in its services.

2. Are the trading services offered by this platform legal?

While the platform claims to offer forex and other CFD trading services, it lacks transparency in its trading conditions and does not have legitimate regulatory oversight, making its operations questionable.

3. How can I verify the legitimacy of a forex platform?

Investors should check for clear and valid regulatory information, customer reviews, transparent pricing and trading conditions, legitimate contact methods, and original educational content to ensure the platform is legitimate.