Scope Markets, operating under RS Global Ltd, claims to offer forex, CFDs, and various financial instruments. However, its unverified regulatory status, operational flaws, and limited transparency raise serious concerns. This article analyzes its weaknesses, focusing on risks that may affect potential investors.

1. Questionable Regulatory Status

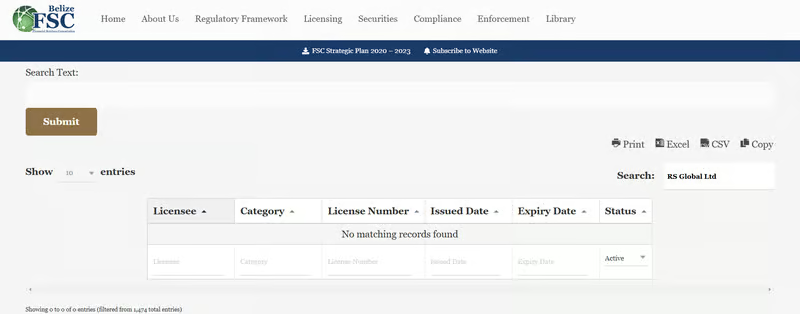

1.1 Claims of FSC Regulation

Scope Markets asserts that it is regulated by the Belize Financial Services Commission (FSC) under RS Global Ltd with license number 000274/2. Yet, upon verifying the FSC database, no records confirm this registration.

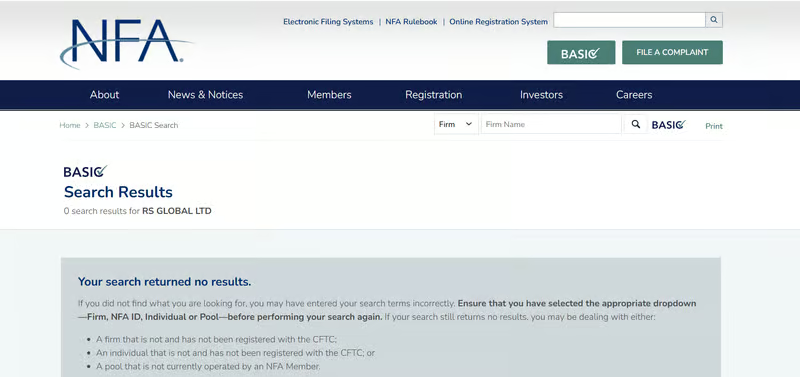

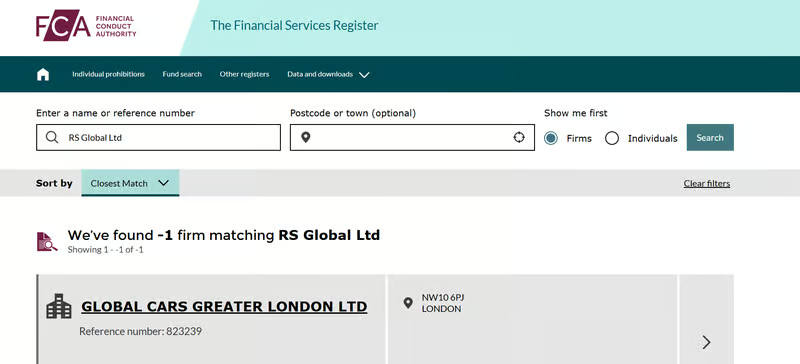

1.2 Missing from Other Regulatory Bodies

The broker is also absent from prominent regulatory bodies like the National Futures Association (NFA) in the United States and the Financial Conduct Authority (FCA) in the UK. This absence signals a lack of credible oversight. Without regulatory backing, how can traders trust the platform with their funds?

1.3 Why Regulation Matters

Regulation ensures brokers adhere to industry standards, protect client funds, and provide fair trading conditions. Scope Markets’ unverified claims leave investors vulnerable to potential fraud or mismanagement.

2. Operational Transparency Issues

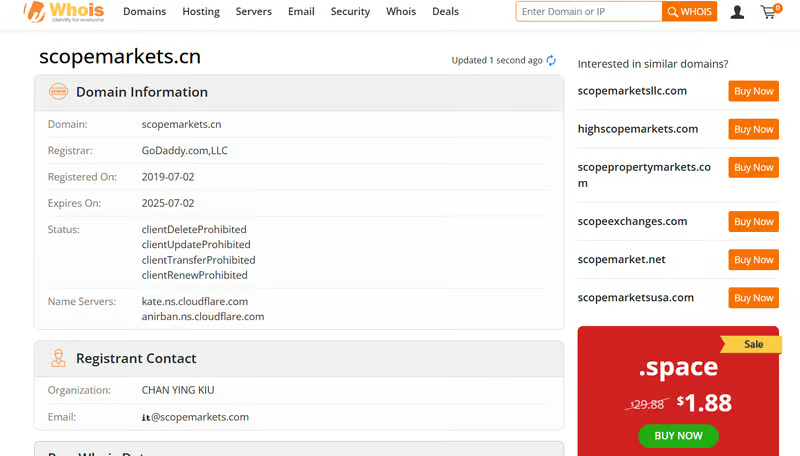

2.1 Short Operational History

Founded in July 2019, Scope Markets is relatively new to the market. While young companies can still be legitimate, its limited history does not provide a reliable track record.

2.2 Low Website Engagement

According to Semrush, Scope Markets’ website receives fewer than 100 monthly visits. This extremely low engagement raises questions about its market presence and credibility. Why does a broker claiming global operations attract so few visitors?

2.3 Lack of Corporate Information

The broker provides minimal information about its leadership, ownership, or internal structure. A legitimate financial institution would typically disclose these details to build trust.

3. Problems with Trading Platforms

3.1 MetaTrader Platforms with Accessibility Issues

Scope Markets offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two industry-standard platforms. While these platforms are known for their reliability, users have reported issues accessing them:

- The desktop download links for PC are broken.

- Mobile app downloads on iOS and Android devices are frequently inaccessible.

How can traders rely on a platform they can’t consistently access?

3.2 Basic Features but Limited Innovation

Both MT4 and MT5 provide standard features like chart types, technical indicators, and real-time quotes. However, Scope Markets doesn’t offer advanced proprietary tools, AI-driven analytics, or custom trading solutions. Does this make it less competitive than other brokers offering enriched trading ecosystems?

4. Account Offerings Raise Concerns

4.1 High Barriers for Premium Accounts

Scope Markets provides three account types:

- One Account: Minimum deposit of $50, leverage up to 1:1000, with a 0.9 pips average spread.

- Scope Invest: Requires a $50 deposit, no leverage, with spreads as low as 0.1 pips.

- Scope Elite: Minimum deposit of $20,000, leverage up to 1:1000, with spreads as low as 0.0 pips.

The Scope Elite account demands a significant financial commitment. Are its features, such as 0.0 spreads and lower commissions, enough to justify such a high barrier to entry?

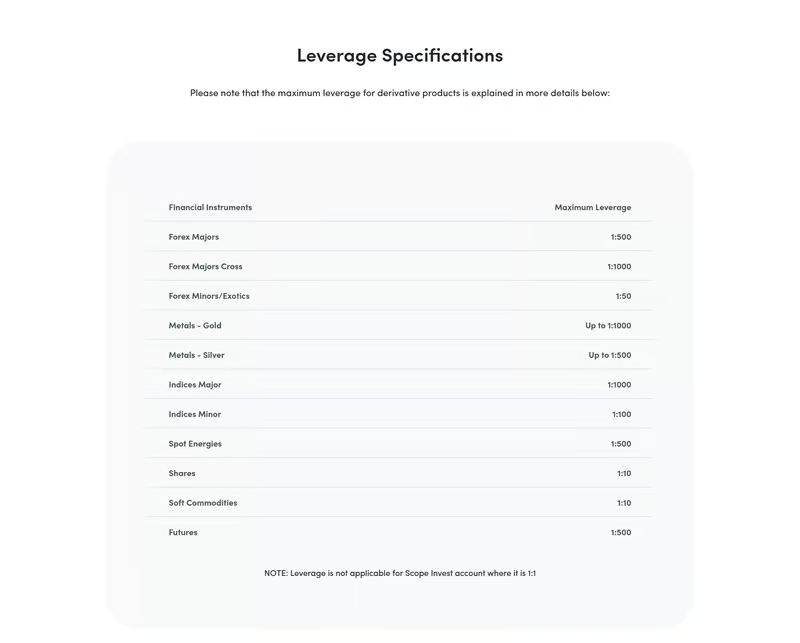

4.2 Extreme Leverage Risks

Offering leverage of up to 1:1000 for One Account and Scope Elite may seem appealing, but it introduces significant risks, especially for inexperienced traders. With such leverage, even minor market fluctuations can lead to substantial losses.

4.3 Ambiguity in Account Features

The broker’s account descriptions are vague, failing to detail additional benefits or advanced features for high-tier accounts. How can traders assess whether these accounts are worth their investment?

5. Funding and Withdrawal Concerns

5.1 Limited Payment Options

Scope Markets supports bank transfers, credit cards, and e-wallets for deposits and withdrawals. However, the range of options is narrower than competitors who offer payment solutions like PayPal or cryptocurrency.

5.2 Withdrawal Delays

While deposit processes are relatively straightforward, the broker’s withdrawal timelines are unclear. Reports of delays lasting several days to weeks cast doubts on its efficiency.

5.3 Transparency Issues in Fees

Scope Markets does not explicitly disclose deposit or withdrawal fees. Hidden charges can erode profits, leaving traders frustrated.

6. Lackluster Customer Support

6.1 Inadequate Communication Channels

The broker offers only email support ([email protected]) and a phone number (+442035193851). It lacks live chat or a dedicated support portal, which are standard among reputable brokers. Can Scope Markets provide timely assistance in urgent situations?

6.2 Limited Availability

With no 24/7 support, clients may face delays in resolving critical issues. For a global broker, limited availability is a significant disadvantage.

7. Social Media Presence: Style Over Substance?

Scope Markets maintains accounts on platforms like Facebook, Instagram, YouTube, and Twitter. While these profiles may create an appearance of engagement, they lack meaningful interaction or updates about trading features. Is the social media presence just for show?

8. Questionable Education Resources

8.1 Generic Content

The broker offers basic tools like dividend and holiday calendars, economic updates, and forex trading basics. However, this content lacks depth and originality, offering little value to experienced traders.

8.2 Absence of Advanced Learning Tools

Unlike top-tier brokers, Scope Markets does not provide webinars, expert analysis, or tailored training programs. How can traders grow without comprehensive educational support?

9. Referral Program: Incentives Over Integrity?

Scope Markets promotes an Introducing Broker (IB) program with cashback rewards up to 70% of client commissions. While this may appeal to partners, it raises concerns about prioritizing recruitment over the quality of services offered to actual traders.

10. Key Red Flags

- Regulatory Ambiguity: Claims of FSC regulation remain unverified.

- Platform Accessibility Issues: Users report broken links and download problems.

- High Leverage Risks: Leverage up to 1:1000 poses significant risks for novices.

- Transparency Concerns: Lack of clarity on fees, account benefits, and leadership erodes trust.

Conclusion: Should You Trust Scope Markets?

Scope Markets raises several red flags that cannot be ignored. Unverified regulatory claims, inaccessible platforms, vague account details, and insufficient customer support make it a risky choice for traders. While it offers popular platforms like MT4 and MT5, its operational flaws outweigh any benefits. Investors should approach with caution and consider more transparent, regulated alternatives.

FAQ: Frequently Asked Questions

1. Is Scope Markets regulated?

No reliable evidence confirms its claimed regulation by the Belize FSC or other authorities.

2. What trading platforms does it offer?

Scope Markets provides MetaTrader 4 and MetaTrader 5 but has issues with accessibility.

3. Are its high-leverage accounts safe?

Leverage up to 1:1000 increases risks significantly, particularly for inexperienced traders.

4. How can I contact customer support?

Support is available via email and phone, but the lack of live chat limits immediate assistance.

5. Does Scope Markets disclose fees?

The broker lacks transparency regarding deposit, withdrawal, and trading fees.

6. Should I trade with Scope Markets?

Given its regulatory ambiguities and operational shortcomings, it’s best to explore more trustworthy and regulated options.