Inclusive Global Markets launched in August 2024, presenting itself as a highly efficient and technologically driven CFD trading platform, offering services in forex, commodities, stocks, indices, and cryptocurrencies. However, its false regulatory claims, unclear fund safety commitments, and vague operational background raise serious concerns about its transparency and trustworthiness. This article delves into the platform’s offerings and highlights potential risks.

1. Overview of Inclusive Global Markets

1.1 Key Information

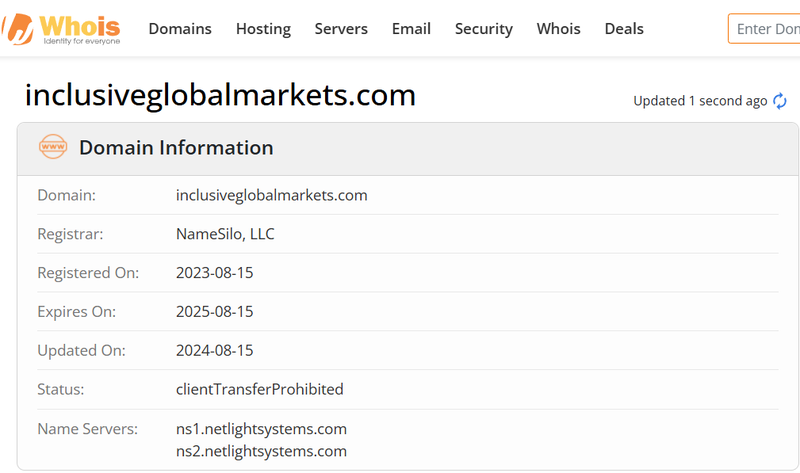

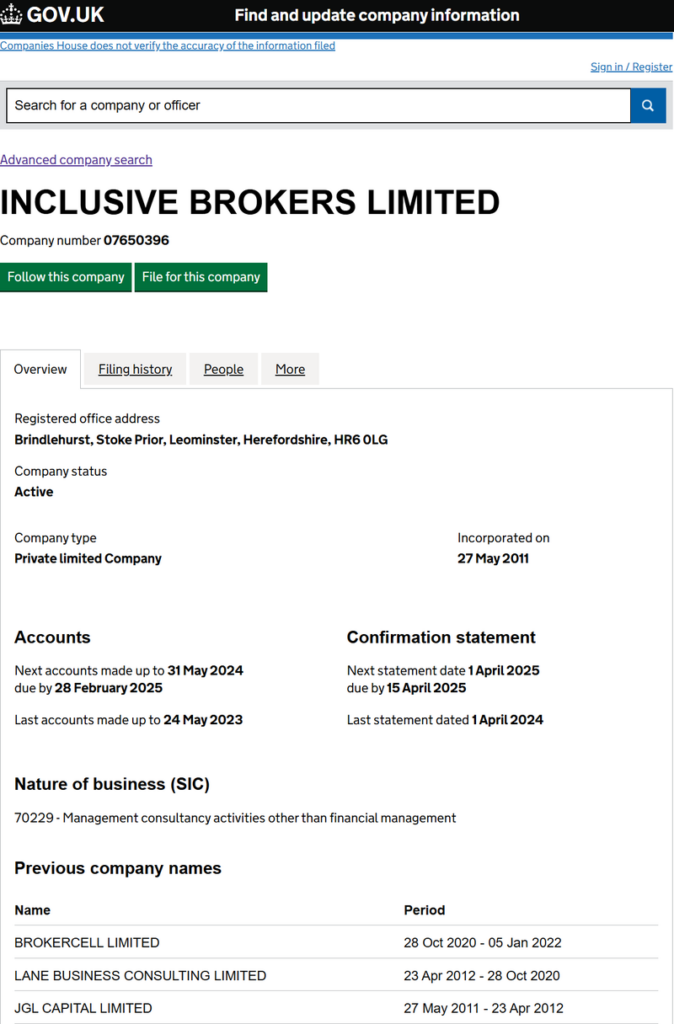

Inclusive Global Markets claims to operate under INCLUSIVE BROKERS LIMITED and positions itself as a globally competitive trading platform. Its domain, inclusiveglobalmarkets.com, was registered in August 2023. However, the platform provides no office address or other evidence of its operational presence, an unusual practice in the trading industry.

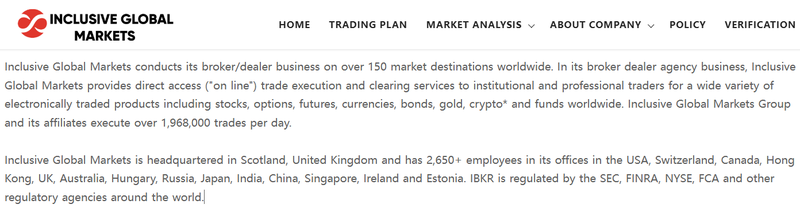

The website also makes some impressive claims:

- A founding team with 44 years of brokerage experience.

- Over $10.6 billion in managed assets.

- 1,968,000 daily trades across more than 150 markets.

- A workforce of 2,650 employees across the United States, United Kingdom, China, Japan, and more.

While these figures sound impressive, investigations reveal that many of these claims lack substantiation.

2. Trading Services Offered by Inclusive Global Markets

2.1 Available Trading Instruments

Inclusive Global Markets advertises a wide range of trading options:

- Forex: Major pairs like EUR/USD and USD/JPY, as well as minor pairs, leveraging the high liquidity and 24/7 nature of forex markets.

- Commodities: Energy (oil, natural gas), precious metals (gold, silver), and agricultural products (coffee, wheat), offering diversification and inflation hedging opportunities.

- Stocks: CFDs on major companies like Tesla, Apple, and Microsoft, enabling investors to benefit from corporate growth without directly owning shares.

- Indices: Popular indices such as the S&P 500, Dow Jones, and FTSE 100, allowing users to track overall market performance.

- Cryptocurrencies: Digital assets like Bitcoin and Ethereum, catering to those seeking high-volatility markets with 24/7 trading.

2.2 Account Types

Inclusive Global Markets offers four account types: Basic, Classic, Standard, and Premium. The features improve with higher deposit amounts, offering lower spreads, higher leverage, and VIP services. However, lower-tier accounts, such as the Basic account, charge spreads as high as 1.9 pips, making them less competitive.

2.3 Service Issues

Despite offering a range of services, several key issues undermine the platform’s credibility:

- High Account Thresholds: The best trading conditions are available only to high-net-worth individuals, alienating average investors.

- Expensive Spreads: The high spreads on entry-level accounts are unappealing compared to industry averages.

- Limited Features: The Basic account lacks scalping capabilities and daily trading signals, making it less suitable for short-term traders.

3. Platform and Payment Methods

3.1 Questionable Trading Platform

The platform claims to offer access to the MetaTrader 4 (MT4) trading platform, one of the most trusted names in the industry. However, upon verification, neither Inclusive Global Markets nor INCLUSIVE BROKERS LIMITED is listed as an authorized broker on the official MetaTrader platform, casting doubt on this claim.

3.2 Ambiguity in Payment Methods

The website displays icons for Bitcoin, Neteller, Skrill, and PayPal but provides no details on deposit and withdrawal fees, processing times, or availability. This lack of clarity raises concerns about fund accessibility and security.

4. Regulatory and Compliance Red Flags

4.1 False Regulatory Claims

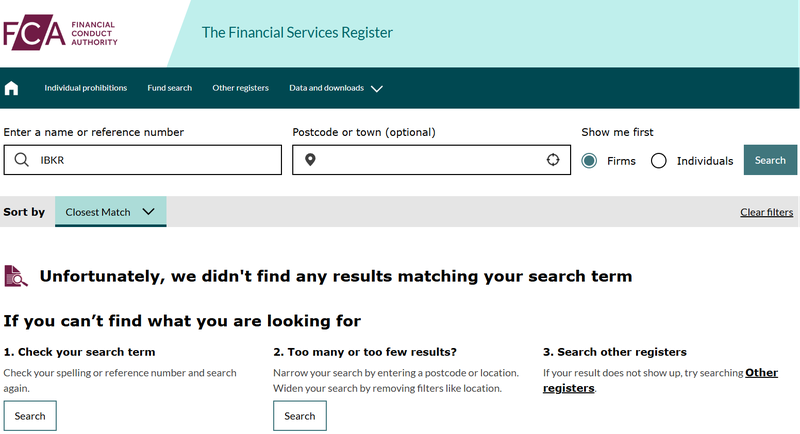

Inclusive Global Markets asserts that it operates under the supervision of multiple global regulators, including:

- The U.S. Securities and Exchange Commission (SEC)

- The UK Financial Conduct Authority (FCA)

- The U.S. Financial Industry Regulatory Authority (FINRA)

However, investigations reveal:

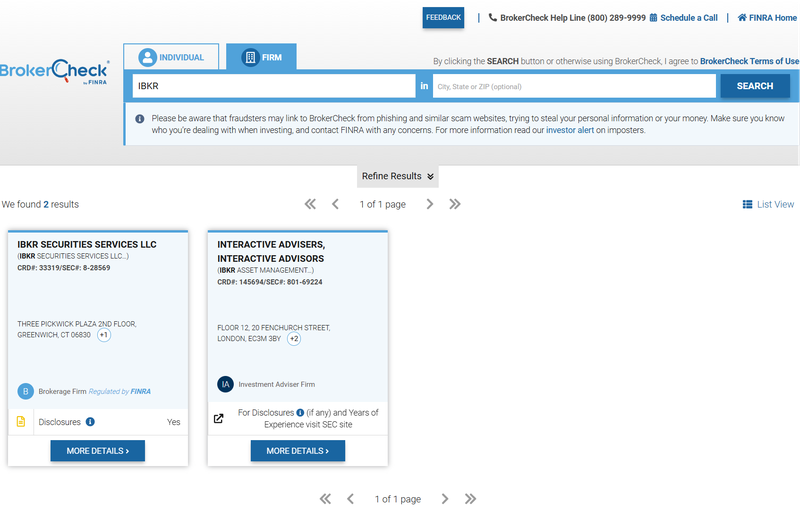

- SEC and FINRA: The mentioned “IBKR” actually refers to Interactive Brokers, an entirely separate and legitimate entity with no ties to Inclusive Global Markets.

- FCA: The platform is not registered or authorized by the FCA, confirming that it lacks the regulatory oversight it claims.

4.2 False Fund Safety Promises

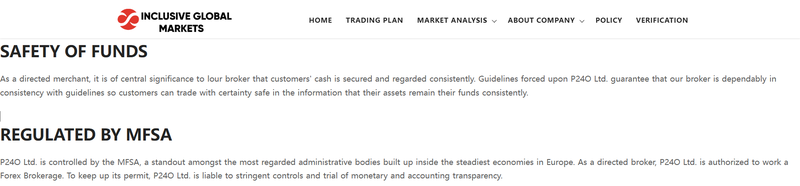

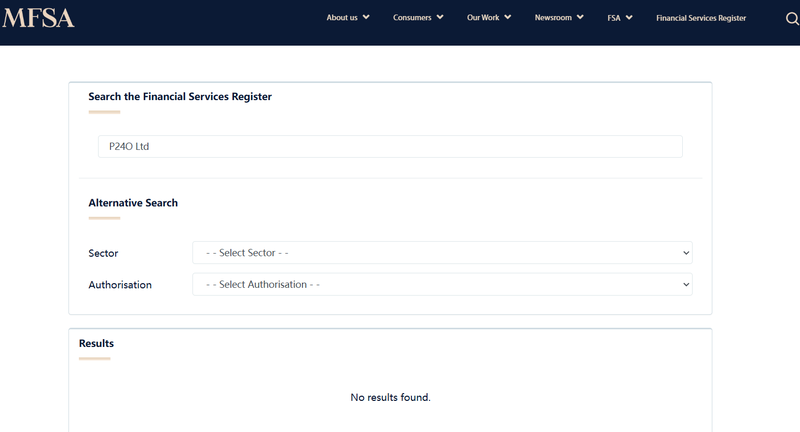

The platform claims client funds are stored with a company called P24O Ltd, regulated by the Malta Financial Services Authority (MFSA). However, a search of MFSA’s records shows no trace of P24O Ltd, casting further doubt on the platform’s assurances.

5. Transparency and Operational Concerns

5.1 Unclear Corporate Connections

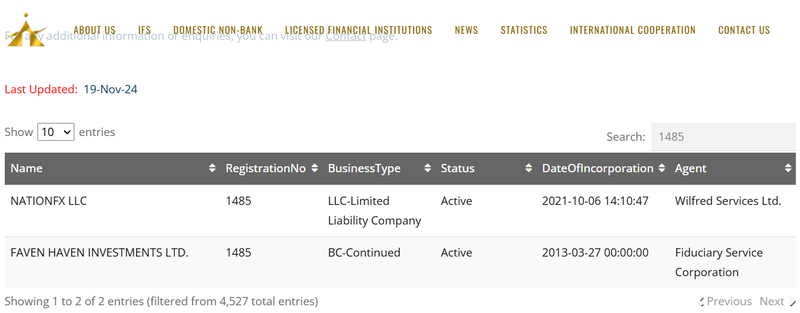

The “Customer Agreement” section redirects users to a separate website, NATION-FX.COM, which is operated by NATIONFX LLC, an unregulated entity based in St. Vincent and the Grenadines. This suggests a potential link between Inclusive Global Markets and an unregulated operator.

5.2 Lack of Social Media Presence

Unlike legitimate trading platforms, Inclusive Global Markets has no social media accounts on platforms like Facebook or Twitter and engages in no public marketing efforts. This absence of transparency further undermines its credibility.

5.3 Minimal Website Traffic

According to Semrush and Ahrefs data, the website has almost no traffic, which contradicts its claims of handling nearly 2 million trades daily. This discrepancy highlights the potential exaggeration of its market reach and operational scale.

6. Conclusion: Credibility in Doubt

While Inclusive Global Markets presents itself as a global trading platform with advanced technology, multiple red flags raise doubts about its reliability:

- False Regulatory Claims: The platform is not regulated by any credible authority.

- Unverified Fund Security: Its claims about fund storage and protection lack evidence.

- Opaque Operations: The company’s background is unclear, and it appears to have ties with unregulated entities.

- Expensive Trading Conditions: High spreads and account thresholds make the platform unappealing to most traders.

- Exaggerated Market Presence: Its traffic and user base claims do not align with reality.

Investors are strongly advised to approach this platform with caution and opt for more transparent, regulated alternatives.

FAQ

1. Is Inclusive Global Markets regulated?

No, the platform falsely claims to be regulated by the SEC, FCA, and FINRA, but these statements have been debunked.

2. What trading services does Inclusive Global Markets offer?

The platform advertises CFDs on forex, commodities, stocks, indices, and cryptocurrencies.

3. Are client funds safe?

The platform’s claims about fund safety cannot be verified, raising significant concerns about fund security.

4. Is Inclusive Global Markets suitable for beginners?

No, its high spreads, limited features, and unclear operations make it unsuitable for novice investors.

5. How can I identify a trustworthy trading platform?

Verify regulatory information, examine user reviews, and look for transparent operations and credible fund storage practices.