Prime Trading Market is a newly established CFD broker, officially launched on December 3, 2024. Despite claiming a 2006 origin, its domain registration dates and operational details reveal significant contradictions. This article critically examines its trading services, platform integrity, regulatory claims, and overall credibility to help investors make informed decisions.

1. Platform Background: Gaps Between Claims and Reality

1.1 Discrepancies in Establishment Year

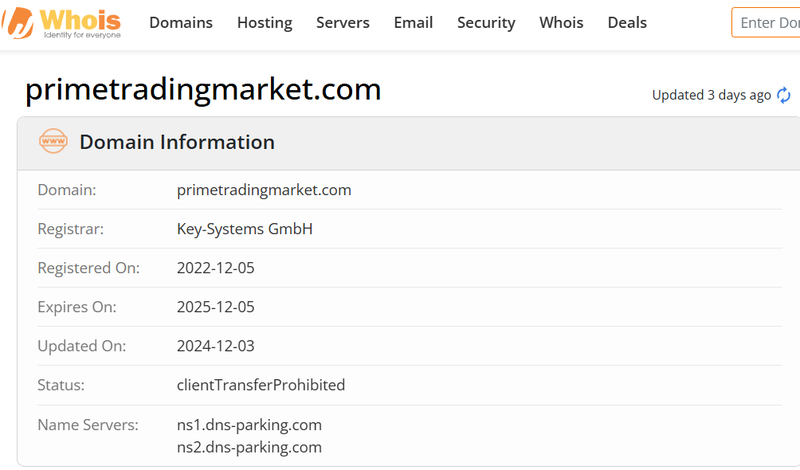

Prime Trading Market claims to have originated in 2006. However, domain records show that its website was registered on December 5, 2022, and only repurposed as the official site by the current team in December 2024. These conflicting dates question the platform’s historical claims.

1.2 Contradictions in Branding and History

The platform asserts a long-standing presence in financial markets, yet lacks any verifiable proof of past operations or achievements, making its historical narrative dubious.

2. Trading Products and Services: Offerings in Question

2.1 Variety of Tradable Assets

Prime Trading Market advertises over 350 CFD instruments across multiple asset classes:

- Forex: Major and minor currency pairs.

- Stocks and Indices: Global stock CFDs and indices.

- Precious Metals and Commodities: Gold, silver, and energy commodities.

- Cryptocurrencies: Leading digital assets like Bitcoin and Ethereum.

While the selection appears comprehensive, the absence of user reviews and market verification raises concerns about whether these offerings are genuinely accessible.

2.2 Leveraged Trading and Account Options

The platform provides two account types:

- GO Plus+ Account: Offers spreads starting at 0.0 pips with AUD 3 per-side commission.

- Standard Account: Spreads start at 1 pip with no commission.

Maximum leverage is capped at 1:500, which may attract high-risk traders. However, whether these trading conditions are delivered as advertised remains unproven.

3. Trading Platform and Software Concerns

3.1 Promised MT4 and MT5 Support

Prime Trading Market claims to offer the widely trusted MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, compatible with mobile and web devices. However:

- No associated servers were found on MT4/MT5 directories, contradicting their claims.

- This raises the possibility that the platform uses non-genuine or manipulated software.

3.2 Questionable Platform Reliability

Given the lack of proof supporting MT4/MT5 integration, the platform’s ability to provide a secure and functional trading experience is doubtful.

4. Deposits and Withdrawals: Transparency Issues

4.1 Available Payment Methods

The platform advertises support for Mastercard, Visa, Skrill, Neteller, bank transfers, and Fasapay. However, the deposit and withdrawal process lacks:

- Clarity: No transparent policies or timelines.

- User Feedback: No evidence of successful fund withdrawals shared publicly.

4.2 Potential Withdrawal Challenges

Platforms with similar profiles are notorious for imposing withdrawal delays or outright refusing to process transactions, leaving users financially vulnerable.

5. Educational Resources: Marketing or Real Value?

5.1 Overview of Offered Materials

Prime Trading Market provides resources aimed at both novice and experienced traders, including:

- Forex Basics: Tutorials for beginners.

- Trading Psychology: Content on market trends and risk management.

- MetaTrader Tutorials: Video guides for platform usage.

5.2 Effectiveness in Doubt

Although the materials appear diverse, their originality, accuracy, and practical value are unverified, leaving their educational merit questionable.

6. Regulatory Status and Compliance

6.1 Alleged Mauritius FSC Regulation

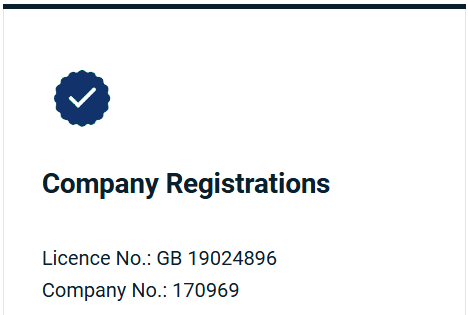

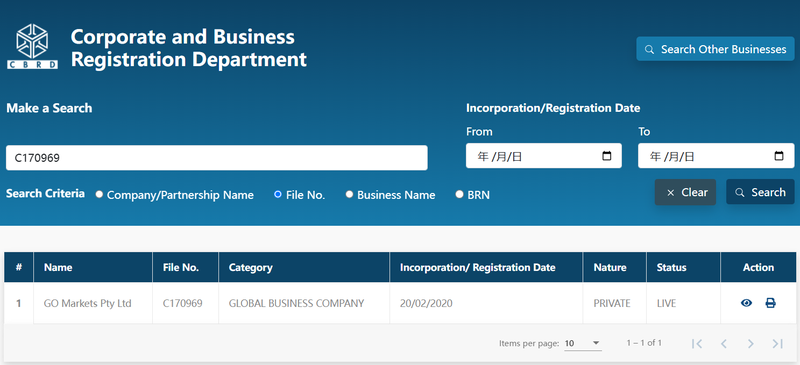

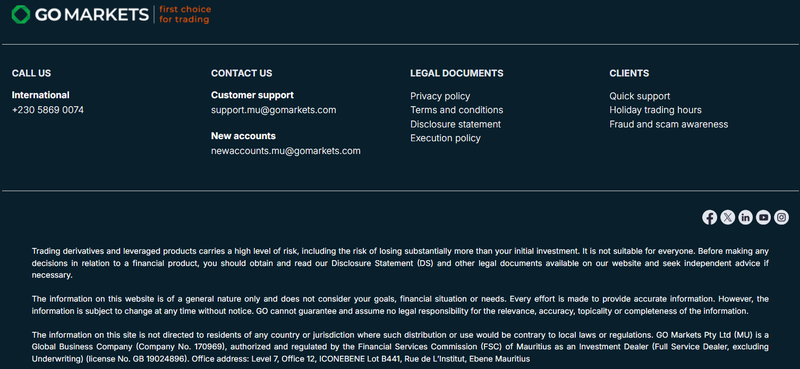

Prime Trading Market claims to be regulated by the Mauritius Financial Services Commission (FSC) under:

- Registration Number: 170969.

- License Number: GB19024896.

6.2 Evidence of Regulatory Misrepresentation

An investigation revealed that these credentials belong to GO Markets, a well-known broker. This suggests Prime Trading Market is falsely presenting itself as a regulated entity, undermining its legitimacy.

7. Website Traffic and Public Exposure

7.1 Minimal Online Presence

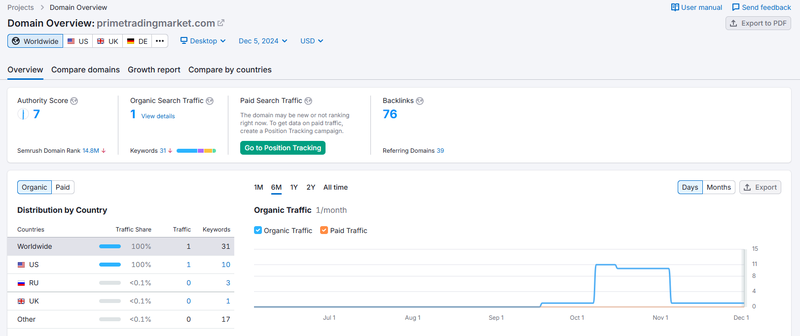

Semrush data shows Prime Trading Market’s monthly website visits are fewer than 100, indicating:

- Low Engagement: Very few users actively use the platform.

- Poor Visibility: Lack of reputation-building or marketing efforts.

7.2 Absence of User Reviews and Media Coverage

There are no publicly available reviews or news reports discussing the platform, making it nearly invisible in the financial trading community.

8. Contact Information and Social Media Red Flags

8.1 Questionable Contact Options

The platform lists telephone numbers, email addresses, and a contact form but offers no real-time support.

8.2 Nonexistent Social Media Accounts

Despite featuring LinkedIn, Facebook, Instagram, and Twitter icons on its website, none of these accounts exist. This misleading presentation further erodes the platform’s credibility.

9. White Label and Referral Policies

9.1 White Label Partnerships

The platform advertises custom MetaTrader solutions for institutions, claiming to offer advanced tools and flexible branding.

9.2 Referral Programs

Partners can allegedly earn commissions via cookie tracking and promotional support. However, given the platform’s dubious history, these promises remain unverified.

10. Website Design and Transparency Issues

10.1 Generic Template Design

The website uses a design identical to known scam platforms like Crypto Classic Markets and Trust Worthy Traders. This templated approach hints at mass production, a common trait among fraudulent sites.

10.2 Lack of Employee Information

There is no mention of the team or employees behind Prime Trading Market, further reducing its transparency and trustworthiness.

11. Conclusion: Risks for Investors

11.1 Summary of Key Red Flags

- Contradictory Founding Claims: Significant discrepancies in the stated and actual establishment dates.

- Falsified Regulatory Information: Misuse of GO Markets’ credentials.

- Dubious Platform Support: Claimed MT4/MT5 integration lacks verification.

- Nonexistent Social Media: No functional accounts despite being advertised.

- Minimal Online Presence: Negligible traffic and no user feedback.

11.2 Advice for Investors

Investors should exercise extreme caution and prioritize brokers with verified regulatory credentials, transparent operations, and established reputations.

FAQs

1. Was Prime Trading Market really established in 2006?

No. Domain registration records indicate the website was registered in 2022 and operational only in 2024.

2. Is Prime Trading Market regulated?

No. Its claimed Mauritius FSC credentials belong to a different broker, GO Markets.

3. Does Prime Trading Market offer genuine MT4 and MT5 support?

Unlikely. No servers linked to Prime Trading Market were found in MetaTrader directories.

4. Are deposits and withdrawals safe with this platform?

There is no evidence to confirm the safety or transparency of its payment processes.

5. Can the educational resources on the platform be trusted?

While diverse, the quality and accuracy of the resources remain unverified.

6. Should I invest with Prime Trading Market?

Given its numerous inconsistencies and lack of credibility, it’s safer to explore well-regulated and established brokers.