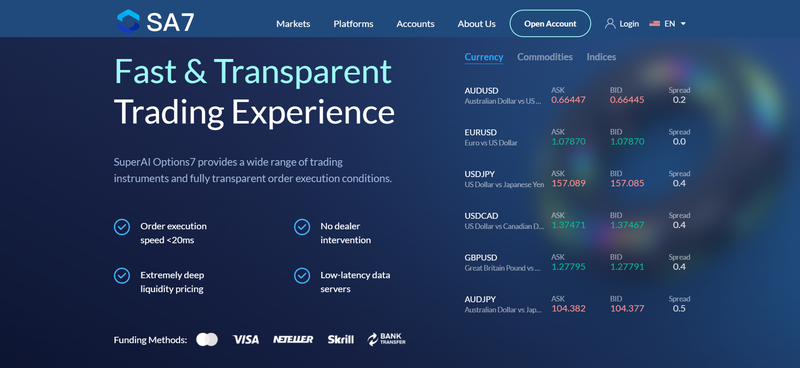

SuperAI Options7, established in January 2024, offers a range of Contract for Difference (CFD) trading services covering assets such as forex, precious metals, commodities, and indices. While the platform seems to provide plenty of trading opportunities with attractive leverage options, is SuperAI Options7 really as trustworthy as it appears? Upon closer inspection, there are several issues lurking beneath the surface that potential investors should be aware of before diving in.

1. Is the Platform’s Legitimacy and Regulatory Information Reliable?

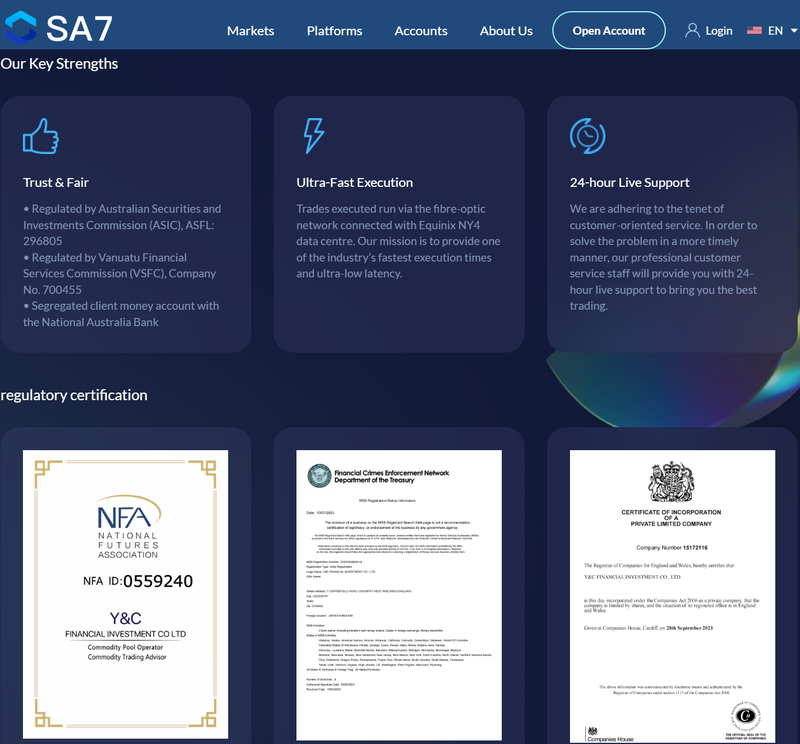

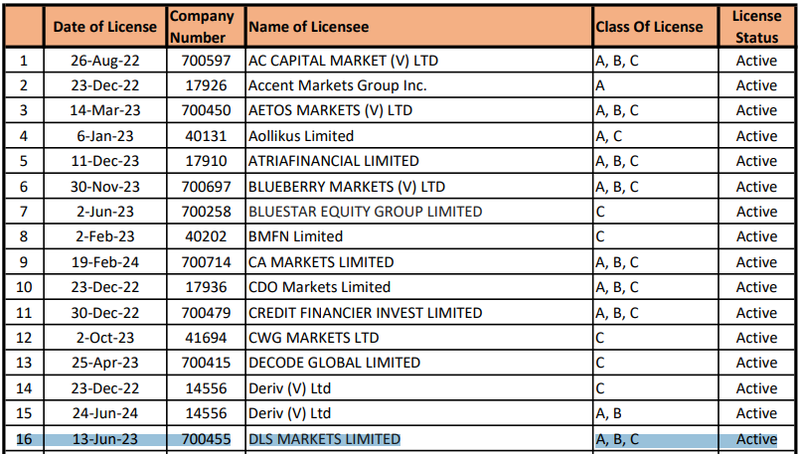

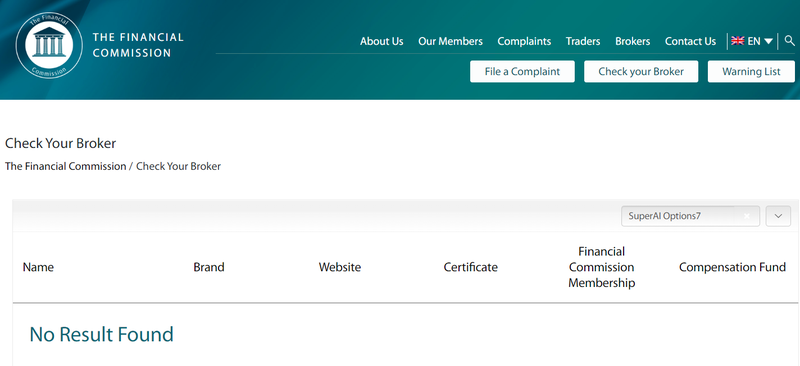

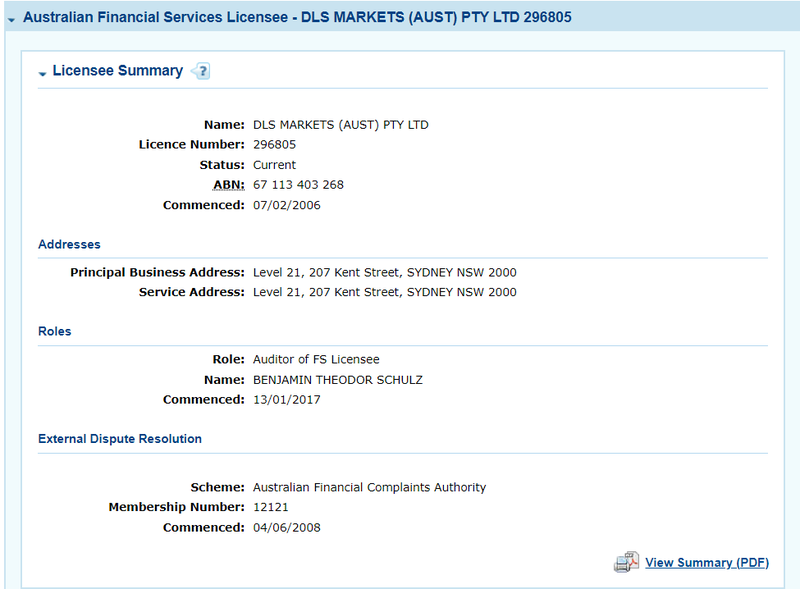

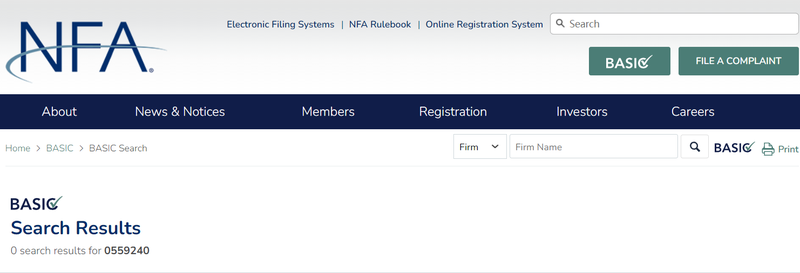

SuperAI Options7 claims to be regulated by the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investments Commission (ASIC). However, is this really the case? A further investigation reveals discrepancies in the platform’s regulatory claims. The VFSC website does not list SuperAI Options7; instead, the license number belongs to another company—DLS MARKETS LIMITED. Similarly, the ASIC website lists DLS MARKETS (AUST) PTY LTD as the license holder, not SuperAI Options7 Limited.

These inconsistencies raise serious questions about the platform’s legitimacy. If a platform cannot provide clear and truthful regulatory credentials, how can investors be sure about the safety of their funds and the fairness of the trading environment?

2. Are the Trading Account Conditions Really as Advertised?

SuperAI Options7 offers two main types of trading accounts—Standard Account and ECN Account—designed to suit different types of traders. But do these account options really offer what they promise? Are they as beneficial as they appear?

- Standard Account: For beginners, the minimum deposit of $200, high leverage of 1:500, and zero commissions seem very appealing. However, is such high leverage safe? In volatile markets, high leverage can significantly amplify risks. For novice traders, this might lead to substantial losses or even margin calls.

- ECN Account: The ECN account offers lower spreads (starting from 0.0 pips) but charges a $6 commission per trade. While ECN accounts may provide better liquidity and transparency, is the commission cost worth the potential benefits? Frequent traders may find the commission fees eating into their profits over time.

Both accounts offer different features, but the high leverage risk is still a major concern. Investors need to carefully evaluate their experience and risk tolerance before opting for one of these accounts.

3. Is the SuperAI Options7 Trading Platform Stable and Reliable?

SuperAI Options7 claims to offer its proprietary trading platform—SuperAI Options7—compatible with both desktop and mobile versions. However, the reality seems to differ. The platform mentions MetaTrader 4 (MT4) in its introduction, but this does not appear to be true. Instead, the platform is actually a self-developed system. Furthermore, many users have reported that the mobile download links are non-functional.

If a platform cannot even guarantee basic functionality for its trading tools, can investors trust it with their money? Technical issues such as delayed or interrupted trades and data errors could greatly impact the trading experience and even result in potential losses.

4. Are Deposit and Withdrawal Methods Convenient and Secure?

SuperAI Options7 supports several deposit and withdrawal methods, including VISA, Mastercard, NETELLER, Skrill, and bank transfers. While these options seem convenient, are they really smooth and secure? Have users reported any issues with withdrawal delays or long deposit times?

For any trading platform, the ability to quickly and securely deposit and withdraw funds is crucial. If the process is hindered by delays or complications, it could interfere with traders’ decisions and overall trading strategy, not to mention the safety of their funds.

5. Why is There No Official Contact Information or Social Media Channels?

SuperAI Options7 does not have official accounts on mainstream social media platforms like Facebook, Instagram, or Twitter, and it does not provide a phone number or email for customer support. How can investors communicate with the platform if they run into problems or need assistance?

A legitimate trading platform typically offers multiple communication channels to ensure transparency and provide customer support. The lack of these channels raises concerns about the platform’s reliability and trustworthiness.

Conclusion

Although SuperAI Options7 promises high leverage and a wide range of trading accounts, there are several serious issues regarding its regulatory credentials, platform stability, and customer support. Before investing, potential users should carefully assess the risks associated with this platform.

Risk Warning

CFD trading is a high-risk investment activity, particularly when leverage is used, as both risks and potential returns are magnified. Market volatility can lead to significant losses, and investors should ensure they fully understand the mechanics of CFD trading before getting involved. It’s crucial to evaluate personal risk tolerance and make informed decisions.

FAQ

1. Is SuperAI Options7’s regulatory information reliable?

Not reliable. After further investigation, it was found that the platform’s regulatory claims do not match the official records. The regulatory licenses listed appear to belong to other companies.

2. Is the SuperAI Options7 trading platform stable?

No, it is not. The platform claims to offer MetaTrader 4 but actually uses a self-developed system. Additionally, the mobile app download links are broken, which could significantly impact trading performance.

3. Are SuperAI Options7’s deposit and withdrawal methods secure?

While the platform supports a range of deposit and withdrawal methods, there is insufficient evidence to confirm that these processes are smooth and secure. There could be delays or complications when withdrawing funds.

4. Why doesn’t SuperAI Options7 provide contact information?

SuperAI Options7 lacks phone, email, and social media contact options. This raises concerns about its transparency and the ability to provide timely support in case of issues.

5. Should I trade with SuperAI Options7?

Given the platform’s issues with regulation, platform stability, and lack of transparency, it is not advisable to trade with SuperAI Options7 without thoroughly considering the risks and seeking more reliable alternatives.