Rox Capitals Ltd may appear to be a legitimate trading platform at first glance, but a deeper investigation reveals troubling signs, particularly regarding its regulatory transparency and the security of investor funds.

1. Company Background: Unclear and Risky

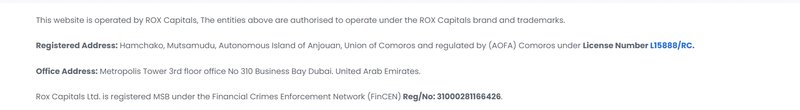

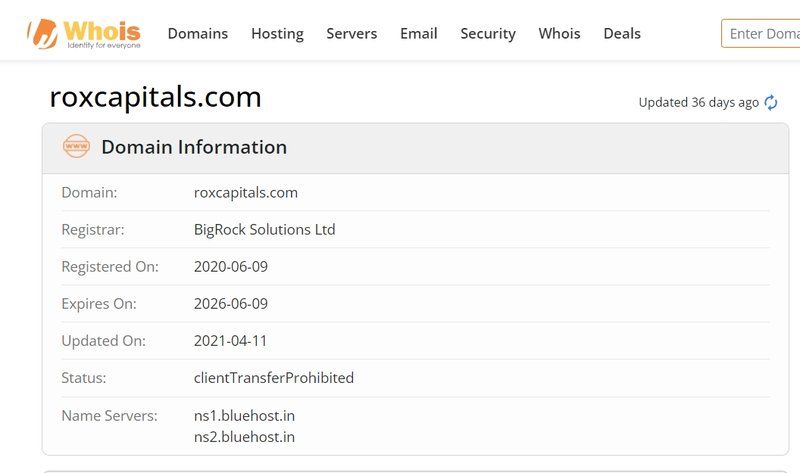

Rox Capitals claims to have been established in 2020, with the official website https://www.roxcapitals.com, and its domain was registered on June 9, 2020. The company claims its registered address is Mutsamudu Hamchako, Anjouan Island, Comoros Union. However, public records fail to show any company registration information associated with this address or the company name. Does this lack of transparency indicate potential fraudulent activities? The absence of clear regulatory information could mean that investor funds are not effectively protected. If you decide to trade with this platform, are you prepared for the possibility of losing your funds?

2. Regulatory Information: False Advertising, Ineffective Oversight

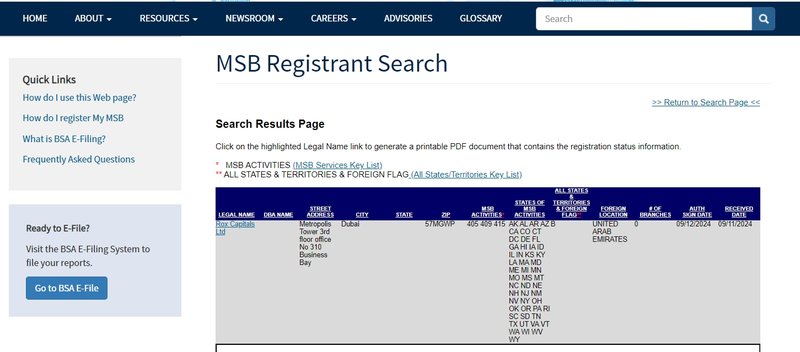

Rox Capitals claims to be regulated by the U.S. Financial Crimes Enforcement Network (FinCEN) and holds a cryptocurrency license (license number 31000281166426). However, the primary function of FinCEN is to prevent money laundering and terrorism financing, not to regulate forex trading platforms. Rox Capitals uses the FinCEN license to bolster its credibility, obscuring the fact that it is unregulated by more reputable financial regulators like the UK’s FCA or Australia’s ASIC. Relying on this false claim could expose investors to significant risk.

3. Trading Conditions: Enticing or Deceptive?

Rox Capitals offers multiple account types with leveraged trading, where leverage ratios range from 1:500 to 1:100. Micro and mini accounts offer leverage up to 1:500, while standard accounts are set at 1:200, and ECN accounts are at 1:100, with a fixed $6 commission per traded lot. While the ECN account provides tighter spreads, its overall trading costs are not competitive, and the platform does not specify whether it offers negative balance protection. This means that during volatile market conditions, users could lose more than their account balance.

4. Social Trading: Lack of Transparency, Financial Risk

Rox Capitals also claims to offer social trading, allowing users to copy the strategies of successful traders. While this may seem convenient for inexperienced traders, the lack of regulation means that social trading lacks transparency. Users may end up copying non-compliant or fraudulent trading strategies, leading to financial losses.

5. Educational Resources: Marketing-Oriented, Lacking Substance

The platform offers educational resources, including weekly Zoom meetings. However, the depth and quality of these meetings have not been independently verified and may be more geared toward marketing than providing real trading insights. Although the website offers some common tools, such as an economic calendar and spread calculator, these resources are not particularly unique and cannot be relied upon as a significant advantage for traders. Given the platform’s lack of regulation, the utility and reliability of these educational resources should be questioned.

6. Deposit and Withdrawal Methods: Convenience or Trap?

Rox Capitals supports various deposit and withdrawal methods, including bank transfers, PayU money, UPI, credit cards, and cryptocurrencies. Deposits are free of charge, but withdrawals incur a 0.5% fee. While the deposit and withdrawal process seems convenient, the lack of effective regulation raises concerns about the safety of funds. There is a risk of delays or even loss of funds, particularly in the absence of proper oversight.

Conclusion: A High-Risk Platform to Avoid

Rox Capitals Ltd operates with significant transparency issues, lacks effective regulation, and presents numerous potential risks. While the platform may offer appealing trading conditions and features, these are overshadowed by its fraudulent tactics and questionable business practices. Before engaging in any financial transactions with Rox Capitals, investors should be cautious and thoroughly verify the platform’s legal and regulatory status. In financial trading, safety and transparency should always come first—and these are areas where Rox Capitals is seriously lacking.

FAQ

1. Does Rox Capitals have legitimate regulatory oversight?

No, Rox Capitals is not effectively regulated. It claims to be regulated by FinCEN, but this agency does not oversee forex trading platforms.

2. Is the social trading feature reliable?

Due to the platform’s lack of regulation, social trading lacks transparency, and investors may end up copying non-compliant or fraudulent strategies, resulting in financial losses.

3. Are the educational resources offered by Rox Capitals effective?

The educational resources, mainly consisting of weekly Zoom meetings, lack independent verification and may be more focused on marketing than providing substantive trading knowledge.

4. What deposit and withdrawal methods does Rox Capitals offer?

Rox Capitals supports various methods such as bank transfer, PayU money, UPI, credit cards, and cryptocurrencies. Withdrawals incur a 0.5% fee.