Dutch Prime Securities claims to be a regulated broker offering CFD (Contracts for Difference) trading services in stocks, indices, and precious metals. However, a closer investigation into its background, regulatory claims, website performance, educational resources, and traffic data reveals numerous inconsistencies and potential risks. This article provides a comprehensive analysis of Dutch Prime Securities’ true nature, uncovers possible scams, and offers tips to help investors avoid falling into similar traps.

1. Dutch Prime Securities’ Company Background: An Illusion of Credibility

1.1 Fake Establishment Timeline: Discrepancies Between Domain and Claims

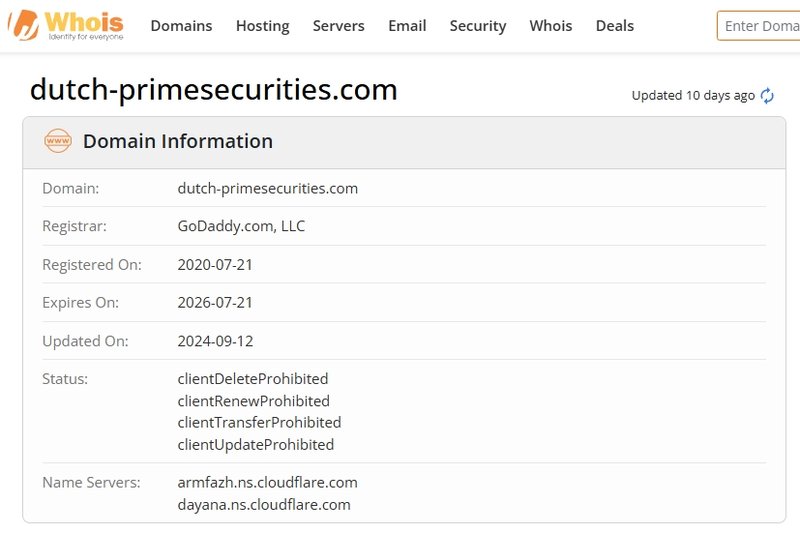

According to Whois, Dutch Prime Securities’ domain was registered on July 21, 2020, while its website claims the platform was founded in 2018.

1.1.1 Contradictory Timelines

- Domain registration postdating the claimed establishment: This inconsistency raises doubts about its so-called “long-standing history.”

- Intentional fabrication: The manipulated timeline appears to be an effort to portray itself as a well-established broker, but instead, it exposes the lack of authenticity.

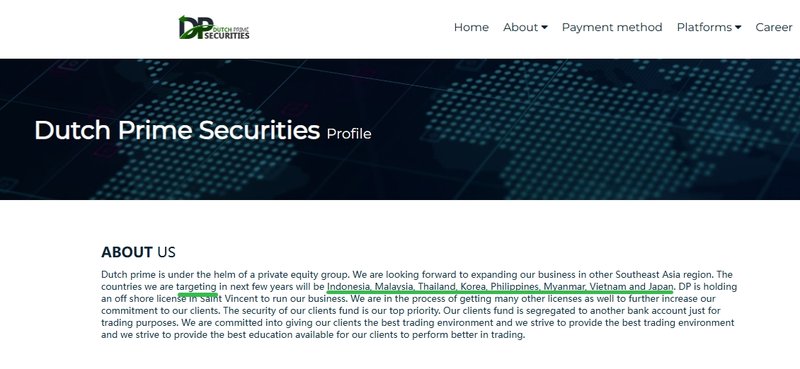

1.2 Misleading International Image

The name “Dutch Prime Securities” implies ties to the Netherlands, but the reality is quite different:

- Registered in Saint Vincent and the Grenadines (SVG): This well-known offshore tax haven is notorious for its lax regulatory requirements, attracting many fraudulent companies.

- Headquartered in Kuala Lumpur, Malaysia: Despite its name, Dutch Prime Securities has no actual connection to the Netherlands, using the name to mislead investors.

1.2.1 Questionable Communication Address

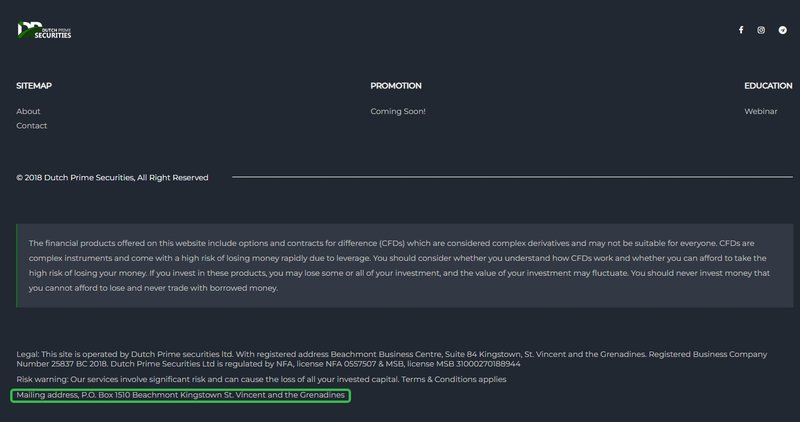

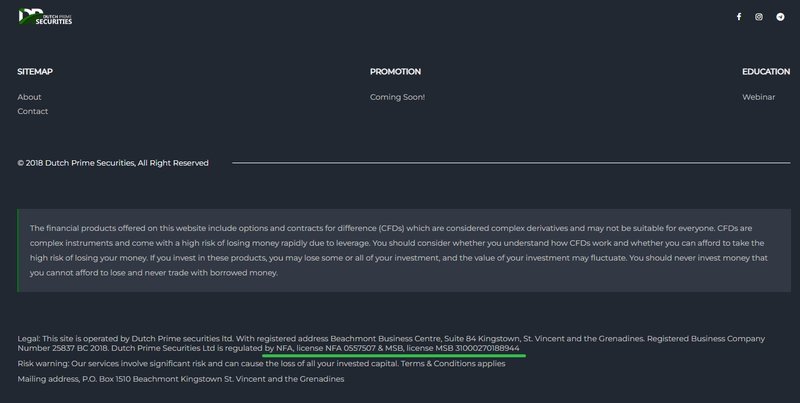

The platform lists its address as P.O. Box 1510 Beachmont Kingstown, Saint Vincent and the Grenadines, but investigations reveal:

- This address actually belongs to Integra Holdings Ltd, a company unrelated to Dutch Prime Securities.

- Such discrepancies severely undermine the platform’s credibility and reveal its attempts to obscure its actual operations.

2. Dutch Prime Securities’ Regulatory Claims: False and Misleading

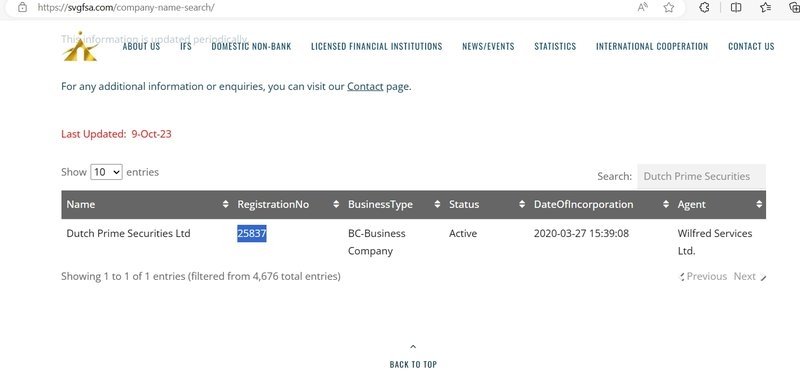

2.1 Dubious SVGFSA Regulation

2.1.1 What is SVGFSA?

The Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) does not regulate forex or CFD trading. Its primary role is overseeing banks, insurance companies, and mutual funds.

- Dutch Prime Securities’ claim of SVGFSA regulation is entirely misleading.

2.1.2 Risks of Being Unregulated

Without proper regulation:

- Funds are unprotected: Clients’ funds can be misused or withheld.

- Arbitrary trading conditions: The platform can manipulate trading terms at will, leading to significant losses for traders.

- No legal recourse: Investors have no protection or legal grounds to recover their money in case of disputes.

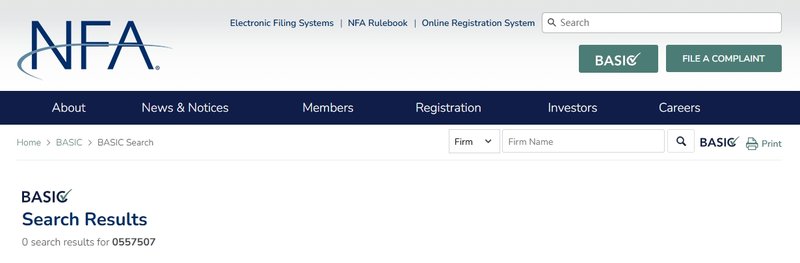

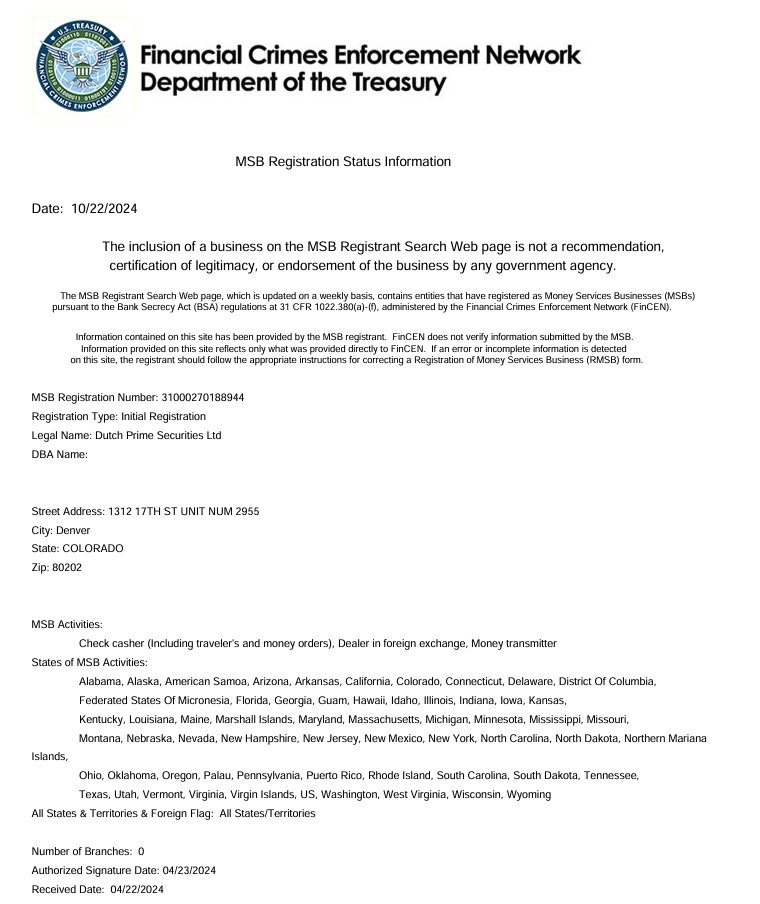

2.2 False Claims of NFA and MSB Licenses

- Nonexistent NFA ID: The NFA ID provided by Dutch Prime Securities does not exist in the NFA database, making their claim of NFA regulation entirely fabricated.

- MSB License Limitations: Even if Dutch Prime Securities possesses an MSB (Money Services Business) license, its scope is limited to the United States. This contradicts their claimed focus on markets like Indonesia, Malaysia, Japan, and others.

3. Website Traffic: Low Volume and Lack of User Base

3.1 Insufficient Traffic Data

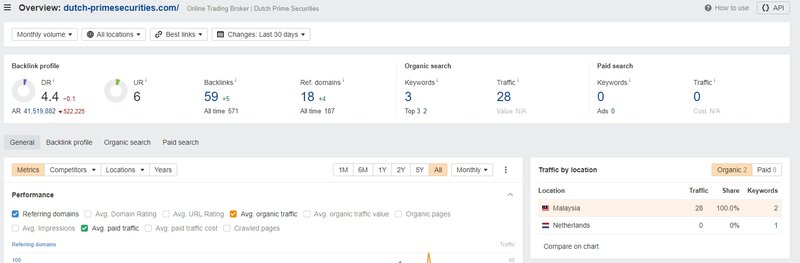

According to Ahrefs, Dutch Prime Securities’ website receives just 28 monthly visits, all originating from Malaysia.

3.1.1 What Low Traffic Indicates

- Minimal user base: The lack of significant traffic suggests the platform has few active users, raising questions about its reliability and liquidity.

- Contradicts its global claims: Dutch Prime Securities markets itself as an international broker, but its traffic data proves otherwise.

3.2 Low Authority Scores

Third-party analysis tools like Semrush show Dutch Prime Securities’ domain authority score is below 20, indicating weak credibility and a lack of market influence.

4. Educational Resources: Contradictory Content and Dubious Faculty

4.1 Issues with Educational Content

The platform offers a “Webinar” section under its Education tab, but its content raises several concerns:

- Mismatched languages: The webinars are in Chinese, while the rest of the website is in English, creating confusion about their target audience.

- Fake student numbers: Dutch Prime Securities claims to have over 500 students, but given its low traffic, this number seems fabricated.

4.2 Questionable Faculty Credentials

The platform lists a mentor named “William Wong,” claiming he has ten years of investment experience. However:

- Searches on LinkedIn and other professional networks yield no results for this person.

- This lack of verifiable background undermines the credibility of their educational offerings.

5. Risks of Investing with Dutch Prime Securities

5.1 Dangers of High Leverage

The platform offers leverage of up to 1:400, which may appeal to novice investors but carries substantial risks:

- Rapid losses: High leverage amplifies both profits and losses, leading to quick depletion of funds for inexperienced traders.

- Manipulated trades: Unregulated platforms can exploit high leverage to manipulate trading outcomes, increasing losses.

5.2 Withdrawal Issues

Unregulated platforms often delay or deny withdrawal requests, and Dutch Prime Securities’ lack of regulatory oversight means users have no assurance of accessing their funds.

6. How to Avoid Traps Like Dutch Prime Securities

6.1 Warning Signs to Watch For

- False regulatory claims: For example, nonexistent NFA IDs or irrelevant SVGFSA statements.

- Exaggerated marketing: Claims of long-established history or large student numbers without evidence.

- Unrealistic leverage: Extremely high leverage offerings are often a red flag for scams.

6.2 Verify Platform Legitimacy

- Check regulatory credentials: Use official sites like FCA, ASIC, or CySEC to confirm the broker’s licenses.

- Read user reviews: Look for genuine feedback from other traders to gauge the platform’s reliability.

6.3 Choose Safer Platforms

Opt for regulated brokers with transparent operations and a proven track record, especially for beginners.

7. Conclusion: Stay Away from Dutch Prime Securities

Dutch Prime Securities presents itself as a legitimate and reliable broker but relies on false regulatory claims, misleading company information, and questionable educational content. Its low traffic, lack of transparency, and fabricated credentials highlight its risks. Investors should prioritize regulated, trustworthy platforms to ensure the safety of their funds.

8. FAQ (Frequently Asked Questions)

1. Is Dutch Prime Securities regulated?

No, its claims of SVGFSA and NFA regulation are entirely fabricated and unsupported by evidence.

2. What are the risks of high leverage?

High leverage can magnify losses significantly, especially on unregulated platforms where manipulation is more likely.

3. Does low website traffic indicate unreliability?

Yes, low traffic suggests a lack of user base and contradicts Dutch Prime Securities’ claim of being a global platform.

4. How can I avoid scams like this?

Choose brokers regulated by reputable authorities, and thoroughly verify their credentials and user reviews.

5. Are Dutch Prime Securities’ educational resources credible?

No, their content is inconsistent, and their listed mentors lack verifiable credentials.

By understanding the risks and exposing the red flags of Dutch Prime Securities, investors can better protect themselves and avoid falling for unregulated platforms.