KOT4X, founded in 2018, is a forex broker offering trading services in forex, precious metals, energy, indices, and stocks. On the surface, the platform attracts investors with high leverage (up to 1:500) and the MetaTrader 4 (MT4) platform, claiming to meet diverse trading needs. However, a closer look at its background, regulatory status, and operational details reveals significant concerns, including lack of regulation, insufficient transparency, and potential operational risks, posing serious threats to investor funds.

This article provides an in-depth analysis of KOT4X’s background, regulatory status, market performance, and the risks associated with unregulated platforms. It also offers guidance on how to protect your assets and seek recourse if you fall victim to fraud.

1. KOT4X Background: Five Years of History Doesn’t Equal Reliability

1.1 Website Registration and Operational History

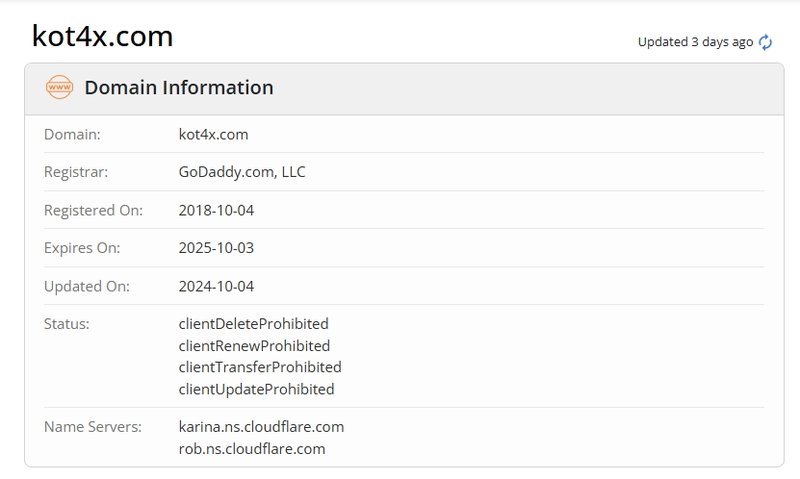

KOT4X’s official domain was registered on October 4, 2018, giving it a five-year online history. While this indicates a certain level of stability, a long domain registration doesn’t necessarily equate to operational credibility. In KOT4X’s case, its lack of transparency and regulatory oversight diminishes the significance of its operational history.

1.2 Legal Risks of Offshore Registration

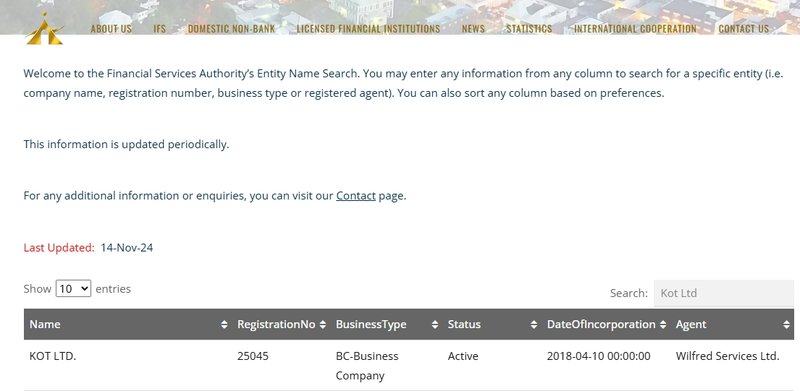

KOT4X is operated by KOT LTD., a company registered in Saint Vincent and the Grenadines (SVG). Known for its lax regulatory requirements, SVG attracts many brokers seeking to avoid stringent oversight.

The SVG Financial Services Authority (SVGFSA) does not provide actual financial regulation, only basic business registration. This means that even though KOT4X is officially registered in SVG, this offers no assurance of its compliance with financial standards or protection for investor funds.

2. Regulatory Issues: From Temporary Compliance to No Regulation

2.1 Expired ASIC License

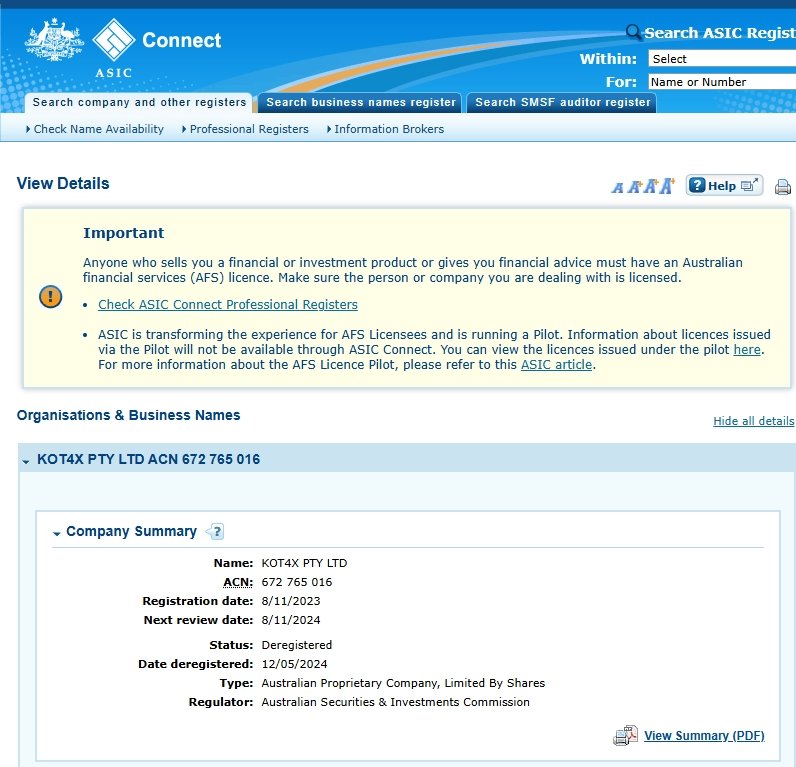

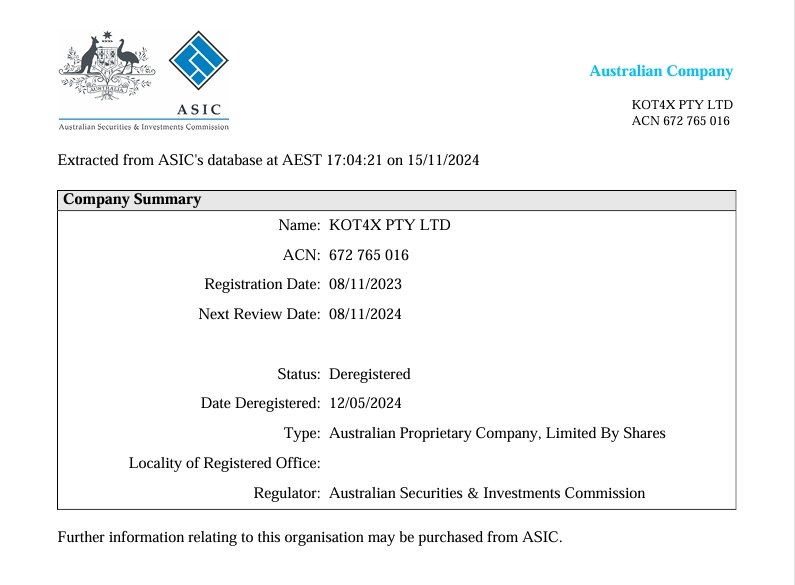

KOT4X previously advertised holding an Australian Securities and Investments Commission (ASIC) Authorized Representative license, which was once seen as a sign of credibility. However, ASIC’s official website confirms that this license expired on May 12, 2024. Currently, KOT4X has no valid regulatory accreditation. Alarmingly, the platform quietly removed this information from its website without informing investors, raising further concerns about its transparency.

2.2 Risks of an Unregulated Platform

Operating without regulatory oversight poses significant risks, including:

- Lack of Fund Protection: Investor funds are vulnerable to misuse without third-party oversight.

- Arbitrary Rule Changes: The platform can alter trading conditions, such as widening spreads or adding hidden fees, at will.

- Limited Legal Recourse: Investors face significant challenges in recovering losses through legal means.

- Increased Fraud Risk: Unregulated platforms can manipulate market prices or impose unfair terms to maximize their gains.

Investors should prioritize brokers with strict regulatory compliance to ensure a safe and transparent trading environment.

3. Website Traffic Performance: A Regional Platform with Limited Reach

3.1 Traffic Data Analysis

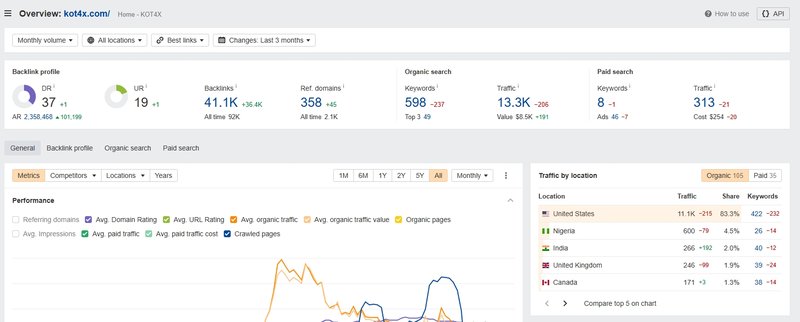

Data from Ahrefs and Semrush indicates that KOT4X’s monthly organic traffic ranges between 13,000 and 29,000, with approximately 1,500 keywords driving this traffic. While these numbers show a moderate online presence, they fall short of industry-leading standards.

3.2 Geographic Distribution of Traffic

Semrush data reveals that 91% of KOT4X’s traffic originates from the United States, while Ahrefs shows an 83.3% share. Other markets, including Nigeria, India, the UK, and Canada, contribute less than 5% each.

This over-reliance on a single market highlights the platform’s limited international presence and raises concerns about its ability to cater to a diverse global audience. For investors, such narrow geographic focus could indicate operational instability and a lack of adaptability to broader market demands.

4. Educational Resources: Limited to Basic Support

4.1 FAQs Page as the Primary Resource

KOT4X’s educational offerings are largely limited to an FAQs page, which addresses common issues such as account registration, payment processes, and using trading tools. While helpful for resolving basic queries, this format lacks the depth needed for comprehensive trader education.

4.2 Lack of Advanced Learning Tools

Unlike many brokers that provide webinars, video tutorials, and market analysis tools, KOT4X falls short in offering resources for skill development and market insights. This lack of educational support limits opportunities for beginner traders to grow and advanced traders to refine their strategies.

5. Risks of Operating on an Unregulated Platform

5.1 Potential for Arbitrary Rule Changes

Unregulated platforms can change their terms and conditions without prior notice, leading to issues such as:

- Increased Trading Costs: Widening spreads or introducing unexpected fees.

- Account Freezes: Restricting account access or delaying withdrawal requests without justification.

- Hidden Fees: Charging unannounced fees that erode investor profits.

Such practices directly harm investors, and without regulatory oversight, holding the platform accountable becomes nearly impossible.

5.2 Legal Recourse Challenges

Offshore-registered, unregulated platforms often operate in jurisdictions with lenient legal frameworks, making it difficult and costly for investors to pursue legal action. This lack of accountability leaves investors exposed to significant financial risks.

6. What to Do if You’ve Been Scammed

If you’ve experienced losses on an unregulated platform, consider these steps:

- Contact Customer Support

Document all communications with the platform’s support team as evidence for future claims. - Seek Assistance from Payment Providers

If you deposited funds via credit/debit card or bank transfer, reach out to your payment provider to request a chargeback or dispute the transaction. - File a Complaint

Report the incident to your local financial regulatory authority. While the platform may not be regulated, raising awareness can prompt investigations and prevent further victimization. - Consult Legal Experts

Seek advice from lawyers with experience in offshore financial disputes to assess the feasibility of recovering your funds. - Beware of Recovery Scams

Avoid “fund recovery” services that promise to retrieve lost funds but may further defraud victims. Choose reputable organizations for assistance.

7. Conclusion: KOT4X’s Risks and Red Flags

While KOT4X has an established online presence and moderate user base, its lack of regulation and reliance on an offshore registration present serious risks to investors. Key concerns include:

- Lack of Regulation: The expired ASIC license leaves the platform entirely unregulated.

- Insufficient Transparency: Critical details such as minimum deposit requirements and withdrawal options are missing.

- Limited Educational Support: Resources are confined to an FAQs page, offering minimal value to traders.

- Geographic Limitations: Over-concentration in the US market and limited global reach.

- Operational Risks: Arbitrary changes to rules and a lack of fund protection.

Investors are strongly advised to opt for brokers regulated by reputable authorities such as the FCA or ASIC, which provide greater transparency, fund security, and a fair trading environment.

FAQ: Common Questions About KOT4X

1. Is KOT4X regulated?

No, KOT4X’s ASIC license expired in May 2024, leaving it without regulatory oversight.

2. Are investor funds safe with KOT4X?

Without regulation, investor funds are at high risk and lack protection.

3. What should I do if I’ve been scammed by KOT4X?

Contact the platform’s support, dispute transactions with your payment provider, report the case to regulators, and consult legal experts.

4. Is KOT4X suitable for beginners?

No, the platform lacks comprehensive educational resources and does not provide adequate support for new traders.

5. Why are unregulated platforms riskier?

Unregulated platforms can arbitrarily change terms, manipulate trading conditions, and mishandle funds without accountability.

6. How can I choose a reliable broker?

Look for brokers regulated by authorities like the FCA or ASIC, with transparent policies, positive user reviews, and robust fund protection measures.