Although Leverage Portfolio Ltd is registered in New Zealand, its lack of regulatory oversight, insufficient disclosure of information, and limited customer support raise caution flags for investors.

1. Overview of Leverage Portfolio Ltd

1.1 Platform Background

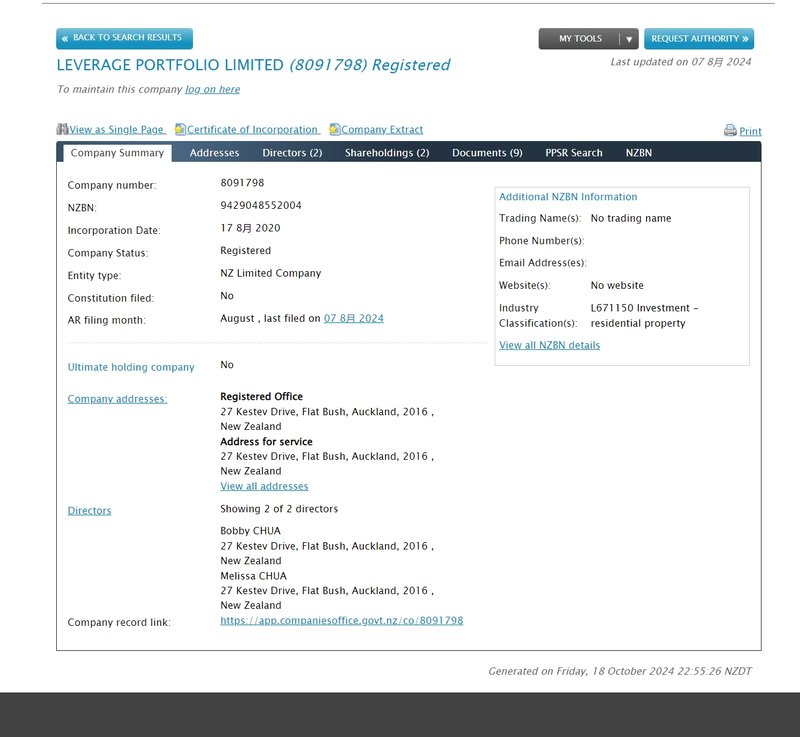

Established in 2020, Leverage Portfolio Ltd operates as an online trading platform registered in New Zealand. The high-risk nature of financial services makes regulatory oversight and transparency essential for securing investors’ funds.

1.2 Key Investor Concerns

Investors are mainly concerned about Leverage Portfolio Ltd’s regulatory status, fund security, and operational transparency. However, as the platform is unregulated by any New Zealand or international financial institution, it poses certain security risks.

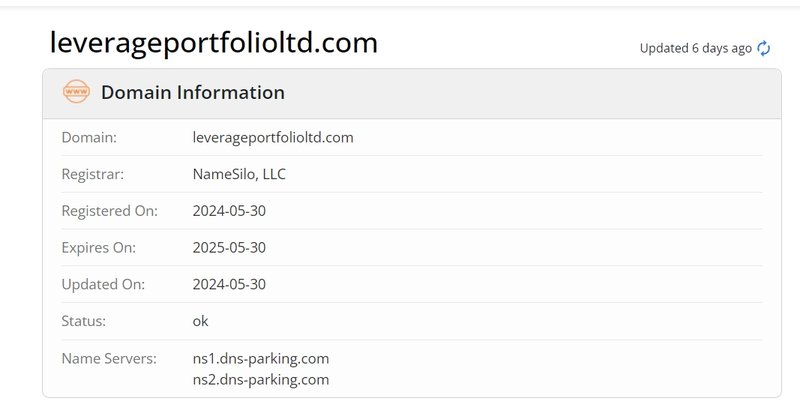

2. Domain Information: Leverage Portfolio Ltd’s Online Presence

2.1 Domain Registration Details

Leverage Portfolio Ltd’s website domain was registered on May 30, 2024, though the company itself was founded in 2020. This delay in launching online operations could influence investor trust in the platform’s compliance and track record.

2.2 The Impact of Domain Registration Date on Platform Credibility

In the financial sector, an earlier domain registration date can increase credibility, as it often indicates a longer operational history. Conversely, newer domains tend to lack the perceived stability that an established, longer-term presence can provide.

3. Analysis of the Registered Address: 27 Kestev Drive, Flat Bush, New Zealand

3.1 Physical Address vs. Platform Compliance

Leverage Portfolio Ltd is registered at 27 Kestev Drive, Flat Bush in Auckland, New Zealand. Although this address is listed in official records, it doesn’t imply that the platform has received regulatory approval, meaning investors should proceed cautiously.

3.2 Limitations of Registered Physical Addresses

Many platforms use actual addresses to instill trust, but a physical address alone doesn’t guarantee regulatory credentials. For financial platforms, obtaining formal financial regulation is critical to ensuring fund security, compliance, and credibility.

4. The Importance of Financial Regulation and Leverage Portfolio Ltd’s Status

4.1 The Role of Financial Regulation

Financial regulation ensures that a platform operates according to industry rules, helping to prevent fraud and fund mismanagement. Regulatory bodies set strict standards for capital adequacy, fund management, and operational transparency to protect investors’ rights.

4.2 Leverage Portfolio Ltd’s Regulatory Status

Leverage Portfolio Ltd is registered in New Zealand but operates without oversight from any New Zealand or international regulatory agency. An unregulated platform lacks robust safeguards and may lack effective risk controls, exposing investors’ funds to unmitigated risk.

5. Risks Associated with High Deposit Requirements

5.1 Leverage Portfolio Ltd’s Account Types and Deposit Requirements

The platform offers four account types with varying minimum deposit levels:

- Silver Plan: Minimum deposit $100, maximum deposit $4,999

- Silver Plan Plus: Minimum deposit $5,000, maximum deposit $19,999

- Gold Plan: Minimum deposit $20,000, maximum deposit $49,999

- Diamond Plan: Minimum deposit $50,000, no maximum limit

5.2 Potential Risks of High Deposit Accounts

Leverage Portfolio Ltd’s high deposit requirements pose significant risks, particularly for average investors. On an unregulated platform, larger deposits increase the risk of potential losses. Investors should exercise caution when placing large sums on unregulated platforms, as they risk fund inaccessibility or withdrawal issues.

6. Lack of Transparency in Financial Information: Spreads, Leverage, and Commissions

6.1 The Importance of Spreads, Leverage, and Commissions in Trading

- Spreads: The difference between the buy and sell price, which directly impacts transaction costs.

- Leverage: The ratio of borrowed funds used in trading, which can amplify both gains and losses.

- Commissions: A fixed fee for each transaction, representing the platform’s direct revenue from trades.

6.2 Transparency Issues in Leverage Portfolio Ltd’s Financial Information

Leverage Portfolio Ltd has not disclosed key information on spreads, leverage, or commissions, which are critical in assessing transaction costs and potential hidden fees. This lack of transparency could suggest high hidden fees, presenting significant risk for investors.

7. Potential Issues Stemming from Lack of Deposit and Withdrawal Options Disclosure

7.1 Importance of Deposit and Withdrawal Methods

On a legitimate platform, users typically have multiple deposit and withdrawal options, including bank transfers, e-wallets, credit cards, and cryptocurrencies. Clear and diverse payment methods ensure that users have secure and flexible control over their funds.

7.2 Risks with Leverage Portfolio Ltd’s Deposit and Withdrawal Policy

Leverage Portfolio Ltd has not disclosed specific deposit and withdrawal options, indicating potential issues for users, including:

- Liquidity Constraints: Users may face delays in accessing funds or lengthy withdrawal times.

- Hidden Fees: Undisclosed fees could lead to unexpected additional expenses.

- Fund Security: Limited transparency around payment methods could increase uncertainty in managing funds on the platform.

8. Lack of Customer Support and Its Implications

8.1 The Importance of Customer Support in Financial Platforms

Most financial platforms provide customer support through various channels like phone, email, and live chat to assist users in resolving issues, particularly for technical or account-related concerns.

8.2 Leverage Portfolio Ltd’s Customer Support Deficiencies

Leverage Portfolio Ltd has not offered any customer support information, which is a considerable drawback in the financial sector. Lack of customer support increases the risk for users who might face challenges accessing their accounts, resolving technical issues, or managing funds safely.

9. The Impact of Insufficient Educational Resources

9.1 Why Educational Resources Matter for Investors

Educational resources aid users in understanding market dynamics, trading fundamentals, risk management, and market analysis. For new investors, these resources are essential for making informed trading decisions.

9.2 Absence of Educational Resources on Leverage Portfolio Ltd

Leverage Portfolio Ltd lacks educational resources, leaving novice investors without vital knowledge support. Without educational resources, users are more vulnerable to potential market fluctuations and trading errors that can result in losses.

10. How to Assess the Safety of a Trading Platform

10.1 Key Elements in Evaluating Platform Safety

When choosing a trading platform, investors should prioritize the following factors:

- Regulatory Status: Ensure the platform is regulated by reputable financial authorities.

- Transparency: Look for clear information on spreads, leverage, and commissions.

- Customer Support: Multiple support channels help resolve user issues.

- Deposit/Withdrawal Options: Clear payment methods reduce liquidity risks.

10.2 Assessing Leverage Portfolio Ltd’s Safety

Leverage Portfolio Ltd lacks regulatory oversight, transparent trading information, customer support, and educational resources. These factors make it challenging for investors to fully trust the platform’s security.

11. How to Choose a Safe Trading Platform

11.1 Choose a Regulated Platform

Investors should select platforms regulated by financial authorities such as the FCA (Financial Conduct Authority, UK) or ASIC (Australian Securities and Investments Commission).

11.2 Ensure Transparent Information Disclosure

Legitimate platforms disclose trading spreads, leverage, and commission information. Transparency in these areas helps users accurately gauge trading costs.

11.3 Prioritize Customer Support and Educational Resources

Effective customer support and rich educational resources significantly reduce trading risk and offer critical guidance and support during the trading process.

12. Conclusion and Investment Recommendations

Although Leverage Portfolio Ltd is registered in New Zealand, it operates without regulatory oversight. The platform’s lack of transparent information, customer support, and educational resources raise concerns. Investors are advised to prioritize regulated platforms with transparent operations and robust support services to reduce risk.

FAQ

- Is Leverage Portfolio Ltd regulated?

No, Leverage Portfolio Ltd operates without regulatory oversight from any financial institution. - Does the platform offer clear information on account options?

The platform provides four account types, but disclosure of deposit and withdrawal options is limited. - What are Leverage Portfolio Ltd’s spreads, leverage, and commissions?

These key trading details have not been disclosed, increasing potential hidden fees. - Does Leverage Portfolio Ltd offer educational resources?

No, there are no educational resources or trading guides available on the platform. - Is customer support available?

The platform has not provided any information on customer support channels. - What factors should investors consider when selecting a trading platform?

Investors should prioritize regulated platforms with transparent information, customer support, and educational resources to ensure safe and reliable trading.