This article takes an in-depth look at BizzTrade LTD’s bizzglobalfx.com CFD trading platform, analyzing its company background, license information, alleged brand plagiarism, unreasonable deposit and withdrawal policies, and customer support issues.

1. Background of BizzTrade LTD

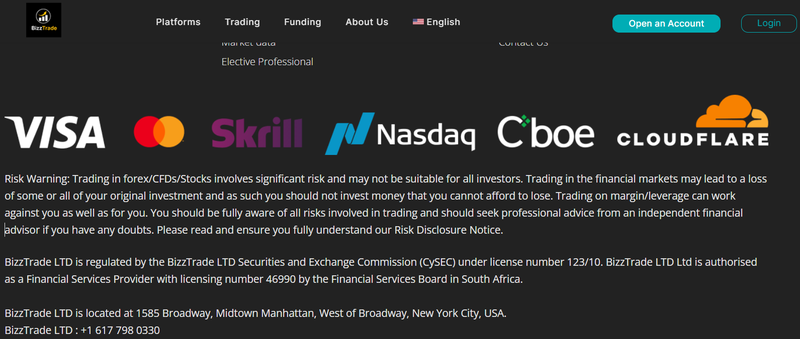

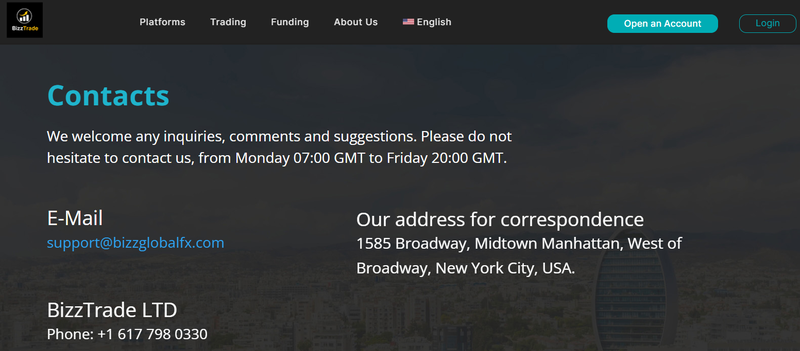

BizzTrade LTD claims to have been founded in October 2024, with its platform, bizzglobalfx.com, offering a range of contract-for-difference (CFD) trading services across assets like stocks, forex, commodities, and indices. According to the company, its headquarters are located at 1585 Broadway in Manhattan, New York. However, given the strict regulatory standards in today’s financial industry, some of BizzTrade LTD’s practices and policies have raised concerns among investors.

1.1 Scope of Business for BizzTrade LTD

The bizzglobalfx.com platform, operated by BizzTrade LTD, mainly provides the following types of CFD trading:

- Stock CFDs: Covering a range of global large-cap stocks.

- Forex CFDs: Including major currency pairs like USD/EUR, GBP/USD, etc.

- Commodity CFDs: Offering trading in major commodities like gold and oil.

- Index CFDs: Featuring global major indices, such as the S&P 500 and Nasdaq.

While the platform offers a wide range of trading options, its transparency remains a question mark, especially regarding branding information, fund security, and customer support.

1.2 Claimed Regulatory Credentials

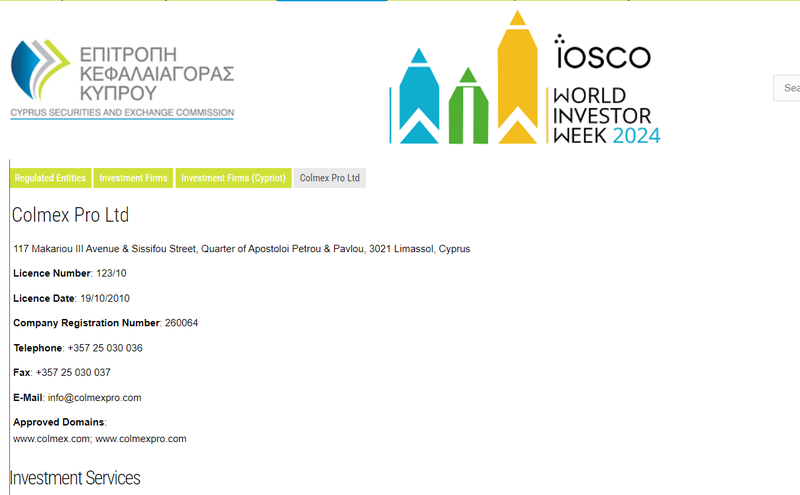

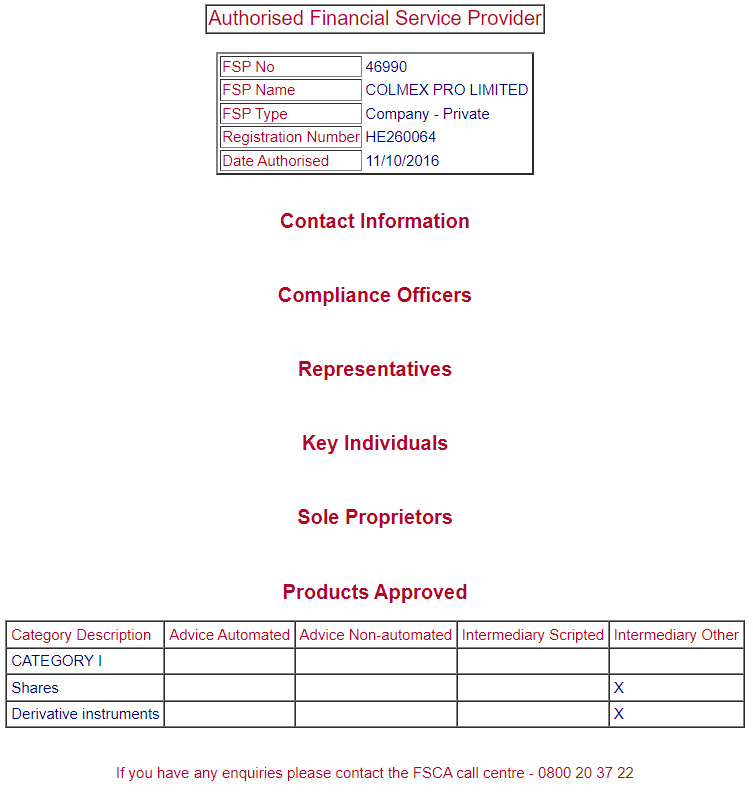

The official information on bizzglobalfx.com indicates that BizzTrade LTD holds licenses from both the Cyprus Securities and Exchange Commission (CySEC) and the Financial Sector Conduct Authority (FSCA) of South Africa, with license numbers 123/10 and 46990, respectively. However, further investigation reveals these licenses actually belong to Colmex Pro Ltd, not BizzTrade LTD. This discrepancy raises significant concerns about the platform’s compliance and legal standing.

2. Authenticity of Regulatory Licenses

BizzTrade LTD claims dual regulation by CySEC and FSCA, but official data reveals these licenses belong to other companies, which casts doubt on the platform’s legitimacy.

2.1 Verifying CySEC License

Upon checking the CySEC website, license number 123/10 is registered to Colmex Pro Ltd, with the official website www.colmexpro.com. This discrepancy suggests that BizzTrade LTD may be misleading clients by attempting to “borrow credibility” through these false claims.

2.2 Issues with FSCA Licensing

A similar situation occurs with the FSCA. License number 46990 also belongs to Colmex Pro Ltd, not BizzTrade LTD. This could imply that bizzglobalfx.com is not actually regulated by either of these organizations, posing a significant risk to investor fund safety.

3. Possible Brand Plagiarism of BizzTrade CFD

In the financial services industry, a platform’s unique branding is crucial for credibility. However, the brand name and design elements of bizzglobalfx.com bear a strong resemblance to the established broker BizzTrade CFD, raising questions about possible plagiarism.

3.1 Similarities in Name and Trademark

The bizzglobalfx.com brand name, “BizzTrade,” is nearly identical to that of BizzTrade CFD (bizztradecfd.com). This could easily mislead clients and suggests potential intellectual property infringement. Such brand overlap is often viewed as a red flag by investors who are concerned with fund security and trading transparency.

3.2 Website Design Similarities

Besides the brand name, bizzglobalfx.com’s website layout, color scheme, and navigation structure are strikingly similar to BizzTrade CFD’s. Reputable companies usually develop a distinctive user interface that reflects their own unique identity, so bizzglobalfx.com’s apparent imitation raises further doubts about its team’s professionalism and legitimacy.

4. Unreasonable Deposit and Withdrawal Policies

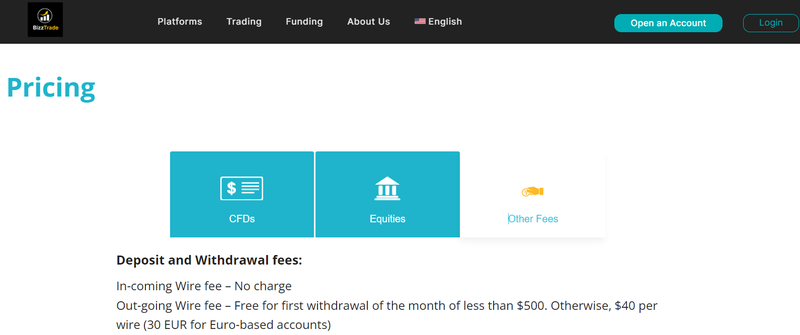

The deposit and withdrawal policies on bizzglobalfx.com differ significantly from other major platforms, especially in terms of withdrawal fees, which are notably high and lacking in transparency.

4.1 Deposit Options and Fees

The platform only supports bank wire transfers for deposits, with no deposit fees. However, limiting users to wire transfers and excluding popular alternatives like credit cards, PayPal, or Skrill may inconvenience users who prefer other payment methods.

4.2 Stringent Withdrawal Fees

bizzglobalfx.com imposes a strict fee structure on withdrawals: the first monthly withdrawal under $500 is free, but if over $500, each transaction incurs a $40 fee (30 euros for euro accounts). Such a high fee structure is unusual in the industry and may impose an excessive financial burden on users. Moreover, the restricted withdrawal options can limit user access to funds, further increasing costs.

5. Limited Customer Support and Lack of Social Media Presence

The quality of customer support often directly impacts investor trust. Unfortunately, bizzglobalfx.com’s customer support options are quite limited, which calls into question the professionalism of the platform’s operations.

5.1 Limited Customer Support Channels

bizzglobalfx.com provides only a phone number and an email address listed on its website for customer support, without any official accounts on popular social media platforms (like Facebook, Instagram, or Twitter). Most financial platforms today use multiple communication channels to enhance user interaction and provide prompt support, so bizzglobalfx.com’s limited options reduce communication efficiency and make it harder for users to obtain assistance.

5.2 Lack of Transparency on Social Media

Social media is not only a marketing tool but also an important platform for building trust with customers. By lacking official social media channels, bizzglobalfx.com cannot engage openly with user feedback, which reduces transparency and can weaken trust in the platform. This closed-off communication approach deviates significantly from industry norms, and users should exercise caution.

6. Would a Legitimate Platform Imitate a Brand? Evaluating Industry Standards

Legitimate, regulated trading platforms generally invest in creating a unique brand image to distinguish themselves. bizzglobalfx.com’s branding, which is nearly identical to BizzTrade CFD, may reflect non-standard management practices.

6.1 Brand Plagiarism and Platform Professionalism

In the financial industry, brand distinctiveness is not only essential for attracting clients but is also a sign of a company’s professionalism and credibility. A legitimate trading platform will establish a recognizable brand identity rather than attempting to mimic another brand. bizzglobalfx.com’s alleged brand plagiarism raises concerns about the platform’s commitment to investor interests and professional integrity.

6.2 How Investors Should Interpret Brand Imitation

When selecting a platform, investors should examine whether the brand has a unique identity. Brand imitation can indicate that a platform does not prioritize investor interests and may endanger user funds. Investors are advised to choose platforms with a reputable name, trustworthy practices, and a track record of customer care to avoid potential losses.

7. Conclusion: Investors Should Approach bizzglobalfx.com with Caution

In summary, bizzglobalfx.com exhibits numerous potential red flags, including misleading regulatory claims, possible brand plagiarism, high withdrawal fees, and limited customer support. A reputable trading platform should have verified credentials, transparent fees, convenient payment methods, and multi-channel customer support, yet bizzglobalfx.com falls short in these areas.

When choosing a trading platform, investors should focus on regulatory compliance and user reviews, ensuring that the platform is trustworthy and meets industry standards. Investors should exercise caution with platforms showing significant warning signs like bizzglobalfx.com and choose more established alternatives.

Frequently Asked Questions (FAQ)

1. Is BizzTrade LTD really regulated by CySEC and FSCA?

Official verification shows that the CySEC and FSCA license numbers actually belong to Colmex Pro Ltd, not BizzTrade LTD, which raises questions about bizzglobalfx.com’s regulatory status.

2. What are bizzglobalfx.com’s withdrawal fees?

bizzglobalfx.com charges high withdrawal fees: a $40 fee (or 30 euros for euro accounts) applies to each transaction above $500, which is rare in the industry.

3. Does bizzglobalfx.com have active social media support?

Currently, the platform only provides phone and email support, with no official presence on mainstream social media platforms, limiting user feedback and communication channels.

4. Does bizzglobalfx.com appear to be plagiarizing another brand?

Yes, the platform’s brand name and website design bear a strong resemblance to another well-known broker, BizzTrade CFD, which could indicate potential brand plagiarism.

5. How can investors choose a reliable trading platform?

When selecting a trading platform, look for confirmed regulatory credentials, clear fee structures, customer feedback, and effective customer support. Legitimate platforms typically meet these standards.

6. Can a platform suspected of brand imitation be trusted?

Brand imitation may signal a lack of professionalism and transparency on the platform’s part. Investors are encouraged to choose well-established platforms with unique brands to ensure a safer trading environment.