Capitalwaveexchange is a newly launched cryptocurrency and stock CFD trading platform with significant issues in transparency and regulatory oversight, warranting caution for investors.

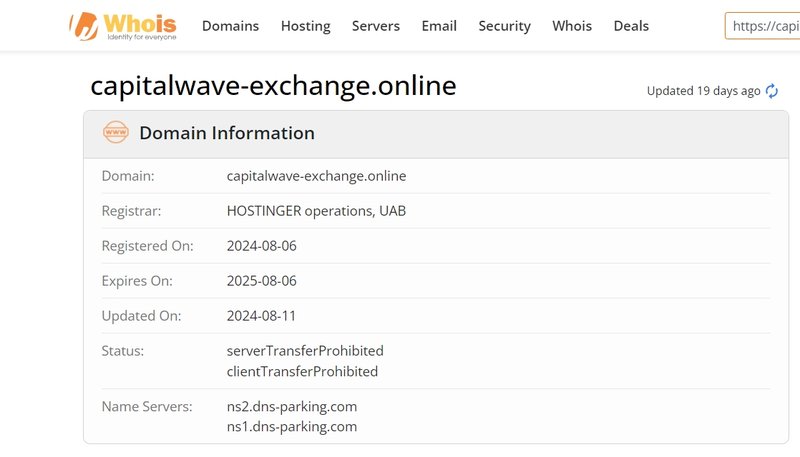

1. Domain Registration: The Risks of a New Platform

Capitalwaveexchange’s domain was registered on August 6, 2024, indicating it is very new to the market. For a trading platform, a longer operational history often reflects stability and reliability, while Capitalwaveexchange’s limited history raises concerns about its credibility. New platforms generally take time to accumulate user feedback and establish a reputation. For investors, the short history and lack of proven track record can signal potential risks and uncertainties.

1.1 Potential Risks of a Newly Established Platform

Inexperienced platforms face multiple challenges, such as system stability, customer service, and fund management. Established platforms typically perform better in areas like technology, regulatory compliance, and customer support. Capitalwaveexchange’s brief presence in the market raises concerns in these areas, which is a significant factor for investors who prioritize platform credibility.

1.2 Concerns About Domain Registration Location

While the platform claims an operating address in Irvine, California, the domain registration details do not provide further company background. This lack of transparency for a company that claims to operate out of California raises red flags. The absence of publicly available company registration information also implies that the platform’s operational and legal responsibilities across different countries are unclear.

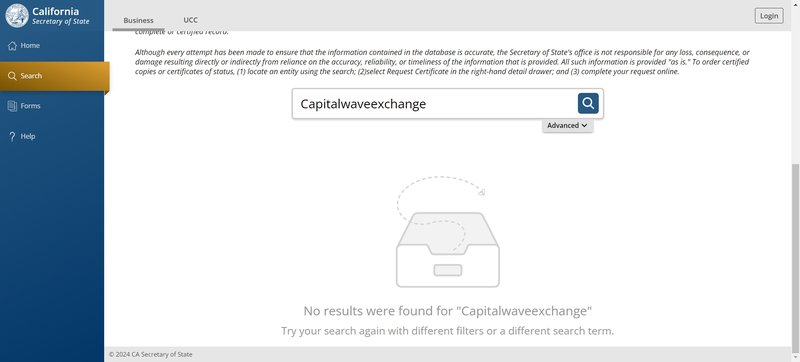

2. No Registered Entity: Lack of Corporate Background Transparency

Capitalwaveexchange’s website (https://capitalwave-exchange.online/) lists an address in Irvine, California, but there is no record of a legally registered company associated with this address. Legitimate trading platforms generally provide full company registration details, including entity name, registration number, and physical address, allowing users to verify the platform’s legitimacy. The absence of this information on Capitalwaveexchange’s website means users cannot confirm if a legal entity supports the platform.

2.1 Risks of a Lack of Registered Entity for Users

An unregistered platform leaves users without legal recourse if financial issues or disputes arise. For financial services platforms, publicly available registration details are essential to building trust and ensuring fund security. Without such registration information, users will have limited options for accountability in case of problems with the platform.

2.2 Importance of Transparent Registration Information for Legitimate Platforms

Regulated platforms are typically protected by law, ensuring users’ rights and legal support if disputes occur. Capitalwaveexchange’s lack of registration information makes it challenging for users to verify its legitimacy and compliance. Without a way to confirm the platform’s background, investors may hesitate to commit funds.

3. Unregulated Platform: Concerns About Security and Legitimacy

Currently, Capitalwaveexchange provides no evidence of regulatory oversight by financial authorities. Regulated platforms typically operate under the supervision of credible agencies, such as the Commodity Futures Trading Commission (CFTC) in the United States or the Financial Conduct Authority (FCA) in the UK, which ensures that user funds are protected under a legal framework. Capitalwaveexchange’s unregulated status raises concerns about fund security and compliance.

3.1 Potential Risks of an Unregulated Platform

Without regulatory oversight, platforms are not bound by legal standards, and users’ funds and personal information are at greater risk. Regulatory bodies protect users by ensuring fund safety and fair trading practices, but unregulated platforms may lack these safeguards, making it challenging to recover funds in case of disputes.

3.2 The Role of Regulation in User Protection

On regulated platforms, user funds are often required to be stored in segregated accounts, ensuring user funds remain separate from operational funds. This policy significantly reduces the risk of fund misuse. Unregulated platforms are not required to adhere to these standards, which increases users’ risk. In the financial market, unregulated companies may close unexpectedly due to financial instability, leaving investors without recourse.

4. Lack of Transparency on Spreads and Leverage: Vague Trading Conditions

Capitalwaveexchange does not provide detailed information on account types, minimum deposits, leverage, spreads, or commissions. Transparent trading conditions are essential for users deciding to open accounts, as they directly affect trading costs and profitability. This lack of clarity adds uncertainty for users during trading.

4.1 Risks of High Leverage and Hidden Fees

Leverage is a double-edged sword; while it can increase potential returns, it also magnifies risks. Without clearly disclosed leverage, users may not fully understand the risks involved in their trades. Similarly, vague information on spreads and commissions could result in unexpected fees for users. Established trading platforms typically provide clear information on spreads, leverage, and fees, helping users manage costs and make informed decisions.

4.2 Importance of Transparent Fee Structure for Users

Clear information on spreads and fees helps users plan their costs before trading, while hidden fees can erode profits unexpectedly. Platforms that do not disclose transaction costs may have high hidden fees, which are especially concerning for users seeking consistent returns.

5. Lack of Transparency in Deposit and Withdrawal Methods: Limited Fund Accessibility

Capitalwaveexchange does not specify its deposit and withdrawal methods or list fees and processing times. Generally, legitimate platforms outline available payment methods and detail associated fees and processing times, enabling users to manage funds efficiently. Transparency in deposit and withdrawal methods is essential to fund accessibility and liquidity.

5.1 Risks of Opaque Deposit and Withdrawal Policies

Without transparent deposit and withdrawal policies, users may face unexpected fees or delays when attempting to access funds. Clear policies on these procedures allow users to make informed choices, particularly in cases where timely withdrawals are needed. Capitalwaveexchange’s lack of transparency in this area may pose challenges for users seeking flexible fund access.

5.2 Importance of Transparent Deposit and Withdrawal Procedures

Transparent deposit and withdrawal processes give users accurate expectations about fund liquidity, preventing unnecessary issues during urgent fund withdrawals. Established platforms often list various payment methods, including bank transfers, credit cards, and e-wallets, providing users with more options. Capitalwaveexchange’s lack of information in this regard could lead to inconvenience or restricted fund access for users.

6. Lack of Educational Resources: Challenges for Beginner Users

Capitalwaveexchange does not provide any educational resources. Mature trading platforms usually offer resources such as market analysis, trading guides, and video tutorials to help users improve their trading skills. For beginners, educational materials are essential to understanding market dynamics and basic trading strategies.

6.1 Importance of Educational Resources

Educational resources not only help beginners understand trading basics but also help experienced traders refine strategies and reduce unnecessary risks. Without these resources, users may be more prone to making uninformed decisions. Capitalwaveexchange’s lack of educational resources may put beginner users at higher risk.

6.2 Impact of Educational Resources on Trading Experience

Without educational resources, users are more vulnerable to market fluctuations, which can lead to impulsive trading decisions. Well-established platforms often provide resources that help users understand the market and build confidence in trading. Capitalwaveexchange’s lack of these resources could increase the likelihood of losses for beginners and reduce overall trading satisfaction.

7. Reputation and Public Opinion: Limited User Feedback

As a new platform, Capitalwaveexchange currently has limited online feedback and reviews. Reputable trading platforms typically gather user reviews on social media and financial forums, allowing potential users to learn about platform safety and user experience. The lack of public feedback for Capitalwaveexchange makes it challenging for users to assess its credibility.

7.1 Risks of Limited Public Opinion

Without public opinion, users face greater uncertainty when choosing Capitalwaveexchange. User reviews are a vital source of information on platform quality and reliability. The limited market feedback on Capitalwaveexchange leaves new users without reliable references, which may lead them to seek more transparent platforms.

As a new cryptocurrency and stock CFD trading platform, Capitalwaveexchange has significant issues with transparency, regulatory oversight, and a lack of company registration details. The platform’s vague trading conditions, unconfirmed deposit and withdrawal methods, limited customer support, and absence of educational resources further raise concerns about user experience and fund security. Given the lack of user feedback, investors should approach Capitalwaveexchange with caution to avoid potential risks due to the platform’s lack of transparency.

FAQ

1. Is Capitalwaveexchange regulated by any financial authority?

Capitalwaveexchange does not provide any evidence of regulatory oversight by a financial authority, meaning user funds lack legal protections.

2. What deposit and withdrawal methods are available?

Capitalwaveexchange has not specified deposit or withdrawal options, nor has it disclosed associated fees or processing times.

3. What account types and trading conditions does Capitalwaveexchange offer?

The platform has not disclosed details on account types, leverage, spreads, or commissions, leaving trading costs unclear.

4. How responsive is Capitalwaveexchange’s customer support?

The platform currently only offers email support and lacks additional options such as phone or live chat, making support limited.

5. Does Capitalwaveexchange offer any educational resources?

No, the platform does not provide market analysis, guides, or other resources, which is a disadvantage for beginner users.

6. What is Capitalwaveexchange’s market reputation?

Currently, there is little online feedback on Capitalwaveexchange, making its market reputation unclear.