This article provides an in-depth analysis of Parkway-Market, examining its background, registration details, regulatory status, account structure, trading conditions, and potential risks to help investors understand its compliance and safety.

1. Company Background: Overview and Development of Parkway-Market

1.1 Background of Parkway-Market

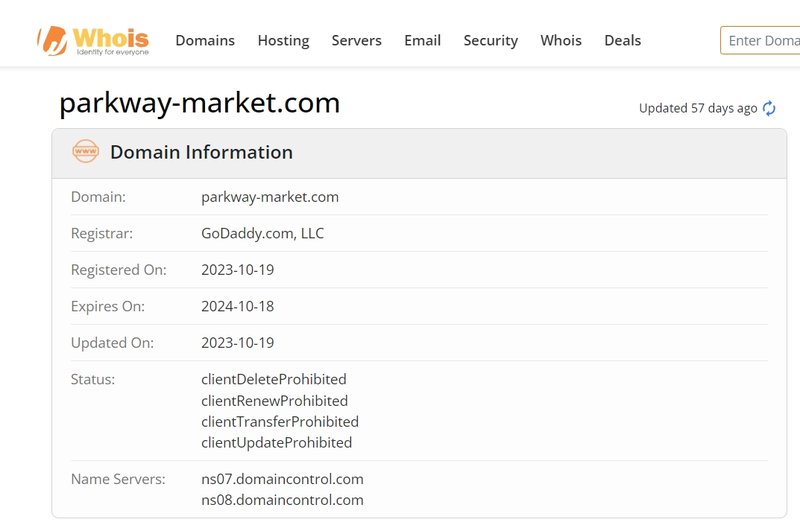

Parkway-Market is a recently established online financial trading platform that offers a range of investment options, including forex, commodities, cryptocurrencies, and stock CFDs. CFDs (Contracts for Difference) are financial derivatives that allow investors to profit from price fluctuations without owning the actual assets, making transparency and regulatory compliance crucial. Parkway-Market’s domain was registered on October 19, 2023, indicating that the platform has a relatively short operating history.

1.2 Lack of Registration Information

Currently, no specific registration information for Parkway-Market can be found, raising significant concerns. Without registration details, investors cannot verify the platform’s compliance and legitimacy. Generally, legitimate financial platforms disclose their registration location and operating licenses on their website to demonstrate their credibility and compliance. Such transparency allows investors to verify the platform’s legal standing and compliance with financial regulations. However, Parkway-Market does not provide this information, which increases the risks for investors considering the platform.

1.3 Risks of a Short Operating History

Compared to long-established financial platforms, Parkway-Market lacks a solid market history and accumulated user feedback. Established platforms typically demonstrate consistent market performance, positive customer reviews, and a history of navigating market fluctuations, while newer platforms lack these validations and may lack market trust. For investors, choosing a newly launched platform presents a higher risk, as there is limited support from historical performance data and user experiences.

2. Domain and Company Information: Lack of Transparent Company Details

2.1 Domain Registration Time and Trust Issues

Public records indicate that Parkway-Market’s domain was registered on October 19, 2023, giving it only a short operating period. Investors generally prefer platforms that have been in the market for a longer time, as these platforms have undergone market testing and typically offer stronger customer support and service assurance.

2.2 Risks from Missing Entity Information

Currently, Parkway-Market’s website does not disclose any specific company entity information, such as registration location, company name, or operating licenses. This lack of information is a potential red flag, as legitimate financial companies usually provide detailed company information on their websites for verification purposes. Platforms lacking transparency are more likely to be non-compliant or unlicensed and may even be fraudulent operations posing as legitimate businesses. Investors should be cautious in such cases.

2.3 Unverifiable Operating Address

Parkway-Market does not clearly disclose its physical address, preventing investors from verifying its actual operating location. Many fraudulent platforms often use fictitious addresses to appear legitimate. Therefore, when choosing a platform, investors are advised to prioritize companies that openly disclose their physical address and registration information to reduce financial risks.

3. Regulatory Status: Evaluating Parkway-Market’s Legitimacy and Compliance

3.1 Lack of Regulatory Information

Parkway-Market’s website does not provide any information regarding its regulatory status. Regulatory information is a critical indicator of a financial platform’s legitimacy, as regulated platforms are typically overseen by recognized financial bodies (such as the UK’s FCA or Australia’s ASIC) that ensure transparency, fairness, and compliance with local regulations. Regulatory agencies monitor platforms for operational integrity, fund segregation, and financial stability to safeguard user funds.

3.2 Risks of Unregulated Platforms

Unregulated platforms pose substantial financial risks, such as the inability to guarantee the safety of user deposits, and investors may have limited legal recourse in case of disputes. Regulated companies are required to follow strict fund segregation policies to keep user funds separate from company operational funds, ensuring that users are unaffected by the platform’s financial issues. Additionally, regulation ensures platforms adhere to transparent and fair trading conditions, without using tactics like hidden spreads or excessive leverage to exploit investors.

3.3 Potential Risks Due to Lack of Regulation

As Parkway-Market currently lacks regulatory oversight, investors cannot be assured of the platform’s financial security. Unregulated platforms often act as a breeding ground for fraud and may result in unclear fund usage, withdrawal difficulties, and other issues. Investors should exercise high caution when considering such platforms and conduct thorough background research before committing substantial funds.

4. Account Types and Minimum Deposit Requirements: Are They Suitable for Different Investors?

4.1 Analysis of Each Account Type and Minimum Deposit Requirements

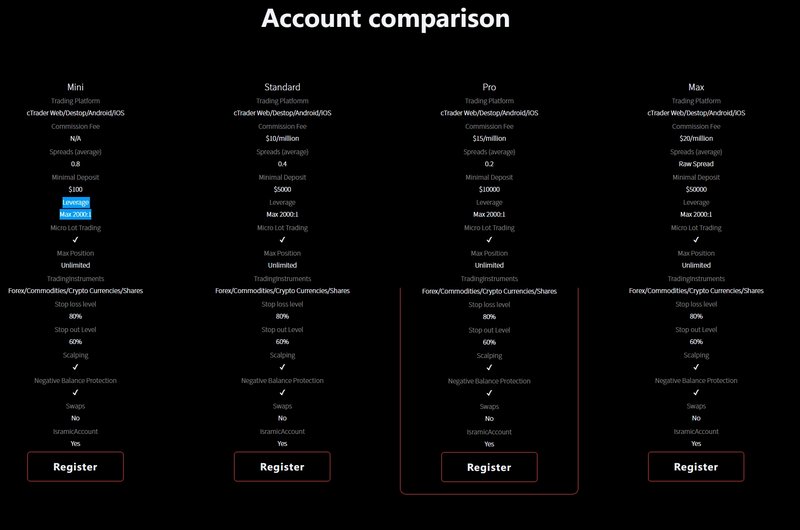

Parkway-Market offers four account types to meet various investment needs. Here is a breakdown of the account types:

- Mini Account: Minimum deposit of $100, starting spread from 0.8 pips, leverage up to 2000:1, suitable for beginner investors.

- Standard Account: Minimum deposit of $5,000, spread starting at 0.4 pips, commission of $10 per million.

- PRO Account: Minimum deposit of $10,000, commission of $15 per million.

- MAX Account: Minimum deposit of $50,000, zero spread, commission of $20 per million.

These accounts require minimum deposits ranging from $100 to $50,000, with higher-tier accounts demanding significantly higher deposits. For an unregulated platform, these higher deposit requirements increase financial risk for investors. Compared to industry standards, Parkway-Market’s minimum deposit requirements are relatively high, requiring users to commit considerable funds before gaining a thorough understanding of the platform’s reliability.

4.2 Risks of High Deposit Requirements on an Unregulated Platform

Due to the lack of regulatory information, Parkway-Market’s high minimum deposit requirements may create financial pressure for investors. Regulated platforms generally offer trading support and benefits proportional to different account levels, but Parkway-Market does not specify service differences among its account types, leaving investors uncertain. Before choosing an account type, investors should assess their risk tolerance carefully and consider the rationality of these high deposit requirements.

5. Trading Conditions: Spreads, Commissions, and Leverage Settings

5.1 Transparency of Spreads, Commissions, and Fees

In financial trading, the transparency of spreads, commissions, and other fees is crucial for investors to assess trading costs. Parkway-Market sets different spreads and commissions for each account type but lacks detailed explanations regarding fees, including:

- Mini Account starting spread of 0.8 pips;

- Standard Account starting spread of 0.4 pips, with a $10 per million commission;

- PRO Account with a commission of $15 per million;

- MAX Account with zero spread but a $20 per million commission.

Although basic spread and commission information is provided, Parkway-Market does not offer detailed calculations or cost explanations, which could lead to hidden fees and impact investors’ ability to predict trading costs accurately.

5.2 Risks of High Leverage

Parkway-Market offers leverage as high as 2000:1. While high leverage can increase potential returns for experienced investors, it also substantially heightens the risk of significant losses, especially for beginners or mid-level investors. Typically, regulated platforms set leverage limits based on account type or investor experience to ensure effective risk management. Parkway-Market’s 2000:1 leverage exceeds industry norms and may cause rapid losses during volatile market conditions, so caution is advised.

6. Summary of Parkway-Market’s Advantages and Risks

In summary, Parkway-Market presents several potential risk factors, including lack of background transparency, lack of regulatory oversight, high minimum deposits, and high leverage rates. Although the platform offers various account types and trading conditions, the absence of regulatory status, short operating history, and missing registration information make it challenging to assess its security. For investors, choosing a platform requires a thorough evaluation of its legitimacy and potential risks. Opting for a regulated platform can better protect funds.

FAQ

1. Is Parkway-Market regulated?

No regulatory evidence has been found for Parkway-Market, nor has it provided any relevant information on its website. Investors should exercise caution.

2. What account types does Parkway-Market offer?

Parkway-Market offers four account types: Mini, Standard, PRO, and MAX, with minimum deposits ranging from $100 to $50,000.

3. What are Parkway-Market’s spreads and commissions?

Mini Account’s starting spread is 0.8 pips, Standard Account 0.4 pips, PRO Account $15 per million, and MAX Account offers zero spread but charges $20 per million.

4. What is Parkway-Market’s leverage ratio?

The platform provides leverage up to 2000:1, which is relatively high compared to industry standards.

5. Are Parkway-Market’s minimum deposits reasonable?

Higher-tier accounts, such as the MAX account, have significant minimum deposit requirements, and investors should assess their financial capacity and platform safety before committing.

6. Is Parkway-Market suitable for beginner investors?

Due to high leverage, lack of regulation, and high minimum deposit requirements, Parkway-Market may pose high risks for beginner investors, who should carefully evaluate these factors.