IVZ FX is a newly established CFD broker offering a range of trading markets and services. However, the platform’s lack of clear regulatory information and absence from social media suggests that investors should carefully evaluate its safety and reliability before trading.

1. Company Background

IVZ FX, a CFD broker founded in 2024, offers global investors a wide range of markets, including forex, precious metals, commodities, indices, stocks, and cryptocurrencies. Its official website states that a team of professional traders established IVZ FX in Australia to deliver fast and reliable trading. The platform connects trading to the Equinix NY4 data center via a fiber-optic network, ensuring low latency and high execution speed.

1.1 Service Orientation

IVZ FX positions itself as a multi-asset broker offering a highly professional trading experience, using the tagline “The Ideal Platform for Global Traders.” To ensure smooth trading, IVZ FX states that it uses the latest fiber-optic technology with the Equinix NY4 data center to enhance data transmission speeds. However, the platform’s brief history provides limited information on its operational background, leaving potential users without sufficient data to assess its service reliability.

2. Entity Information and Transparency

IVZ FX’s website provides limited information about its Australian headquarters but lacks specific details such as a business registration number or office address. While the website mentions a connection with the Equinix NY4 data center, it does not provide any contract or certification to substantiate this partnership. This lack of information may raise concerns among users, particularly those prioritizing transparency and security of funds.

2.1 Existence of an Operating Team

IVZ FX claims that the company was founded by a team of professional traders to offer global investors a high-quality trading experience. However, the platform does not disclose details about the founding team or management, making it difficult for the public to verify this information. This lack of transparency can be a concern for investors looking for a platform with verifiable public records.

3. Regulatory Verification: Gaps Between Claims and Reality

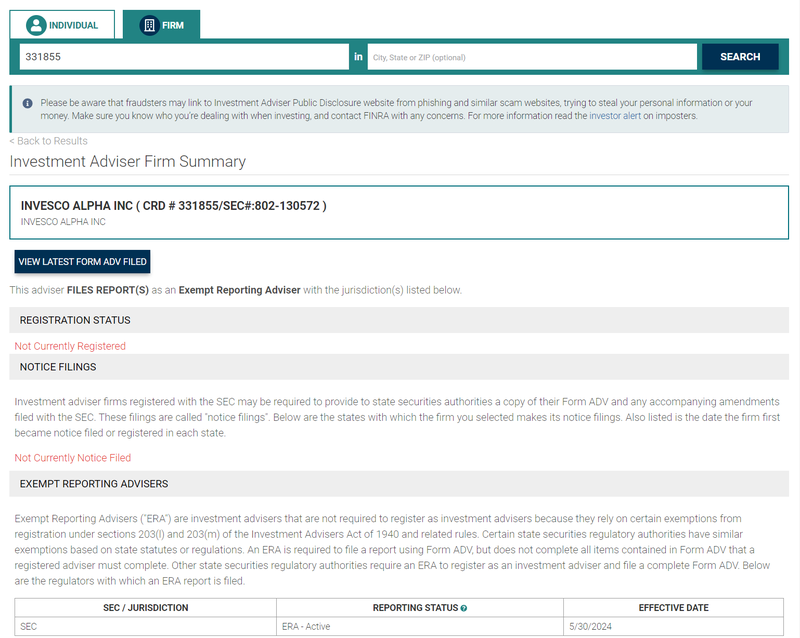

IVZ FX claims on its website to be authorized and regulated by the U.S. Securities and Exchange Commission (SEC), under SEC number 802-130572. As the U.S. financial regulatory body, the SEC provides oversight for trading and can offer investors a degree of security. However, upon further investigation, the SEC number 802-130572 actually belongs to a company named INVESCO ALPHA INC., which has no relation to IVZ FX. Furthermore, INVESCO ALPHA INC. holds an SEC registration as an Exempt Reporting Adviser (ERA) rather than a fully registered investment adviser.

3.1 Differences Between ERA and RIA

The SEC number referenced by IVZ FX belongs to an Exempt Reporting Adviser (ERA). Under ERA regulations, a company only needs to submit partial documentation (Form ADV) to satisfy minimum reporting requirements, unlike a fully registered investment adviser (RIA) that must comply with more rigorous disclosure and compliance requirements. ERA-registered companies are not subject to the same level of regulatory scrutiny as RIAs, as ERA oversight focuses mainly on anti-fraud provisions and some reporting obligations. IVZ FX’s claimed SEC number does not provide full regulatory protection for investors, as it is associated with an ERA rather than a fully registered entity.

3.2 Doubts About Regulatory Claims

In the investment industry, regulated platforms generally offer secure fund management and information protection services. IVZ FX has not provided any further details on its SEC registration status on its website, and the inaccurate SEC number could mislead investors. Investors considering this platform should verify any regulatory claims to ensure the information is accurate and to avoid potential losses due to misinformation.

4. Leverage: Is It Reasonable?

IVZ FX’s standard account offers a maximum leverage of 1:500, which may appeal to traders looking to increase trading volume. However, higher leverage also entails greater risk. In forex and CFD trading, leverage can amplify profits but can also significantly increase potential losses.

4.1 Risks of High Leverage

Leverage levels directly impact the potential for gains and losses. A 1:500 leverage ratio may increase returns but also exposes traders to greater loss potential, especially in highly volatile market conditions. High leverage can lead to rapid account depletion and even trigger margin calls in the event of adverse market movements. Most investors benefit from using moderate leverage to control risk, and users should consider their tolerance for risk before using high-leverage accounts.

4.2 Transparency of Leverage Policy

Additionally, IVZ FX has not provided specific details about its leverage policies, such as leverage limits on different products or adjustments based on market volatility. Professional trading platforms generally disclose leverage policies to ensure users understand the risks involved before trading. Investors using high-leverage platforms should consult customer service about the terms of leverage use to confirm these align with their risk management needs.

5. Social Media Verification: Why Does It Matter?

The IVZ FX website displays icons for social media platforms, including Facebook, Instagram, and Twitter, giving the impression of active engagement on these channels. However, upon verification, these links are inactive or unavailable. Currently, IVZ FX provides only an official email as the sole contact method listed on the website.

5.1 Authenticity of Social Media Links

Reputable trading platforms often use social media to interact with users, publishing market news, trading updates, and platform announcements to build user trust. While IVZ FX displays social media icons, these channels are inactive, which could weaken user confidence in the platform.

5.2 The Importance of Social Media

Social media not only increases a platform’s visibility but also helps users stay updated on key developments. By following social media, users can gain timely access to updates, market analysis, and investment advice. A platform’s social media activity level often reflects its operational status, with active engagement signaling quality service. When evaluating financial platforms, investors should check their social media presence to gain a clearer understanding of the platform’s operations.

6. Conclusion

As an emerging CFD platform, IVZ FX offers diverse trading products, including forex, precious metals, and cryptocurrencies. While it advertises features such as low spreads, no commission, and high leverage, the platform’s lack of company background, regulatory information, and social media interaction may raise concerns for some users. When considering platforms like IVZ FX, investors should prioritize caution and verify information thoroughly to ensure fund and data security.

Frequently Asked Questions (FAQ)

- Is IVZ FX regulated?

- IVZ FX claims SEC regulation, but the SEC number provided belongs to another company with an ERA status, not a full registration. Caution is advised.

- Is the leverage on the platform reasonable?

- The standard account offers up to 1:500 leverage, which can amplify both profits and losses. Traders should choose leverage based on their risk tolerance.

- What contact methods does IVZ FX provide?

- Currently, only an official email is listed on the website; the social media links are inactive.

- Why is it important to check a platform’s social media?

- Social media activity can help users stay updated and gauge platform reliability, as it reflects ongoing engagement and transparency.

- What risks should be considered with IVZ FX?

- Lack of verifiable regulatory information, potential risks with high leverage, and limited contact options are all factors that investors should consider carefully.