KIWI Arbitrage is a broker website claiming to provide trading services in forex, indices, metals, energy, stocks, and cryptocurrencies. The website kiwiarbitrage.org, registered on August 20, 2023, claims headquarters in Wellington, New Zealand, and registration in Australia. However, further investigation shows the platform’s registration and regulatory claims lack any basis. With no genuine corporate entity or regulatory credentials, KIWI Arbitrage may be a potential financial scam. This article provides a thorough analysis of KIWI Arbitrage’s background information, domain registration history, risks of a lack of corporate entity, and other potential issues to help investors identify the risks associated with this platform.

I. Background: KIWI Arbitrage’s False Information

1.1 Fake Company Registration Information

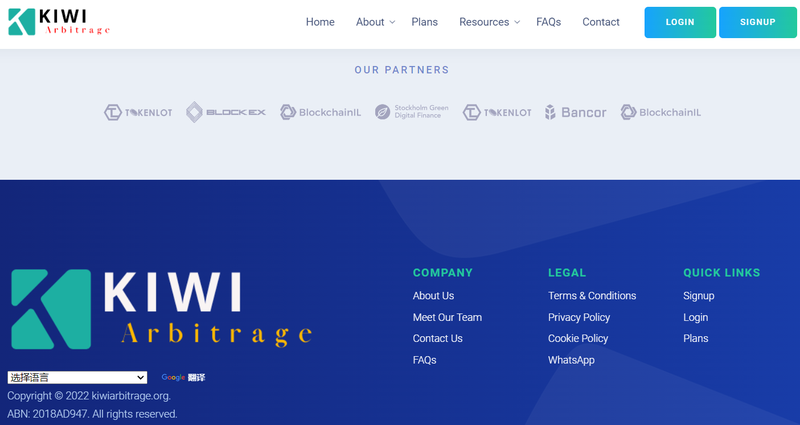

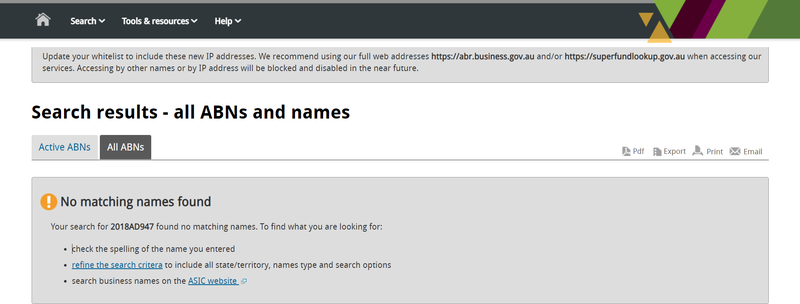

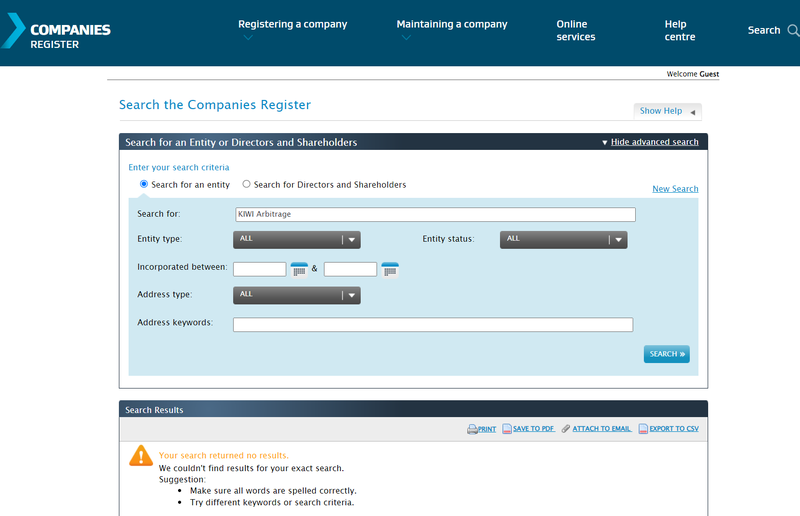

KIWI Arbitrage claims on its website to be registered in Australia with the company number “ABN 2018AD947” and states its headquarters are in Wellington, New Zealand. However, a deeper investigation reveals that the Australian Business Register (ABR) does not list any company with the registration number 2018AD947, nor does the New Zealand Companies Register show any company named KIWI Arbitrage. This suggests that KIWI Arbitrage’s provided company information is entirely fabricated.

In the financial market, regulated platforms usually disclose their registration information and address on their official website, ensuring investors can trace the company entity. However, KIWI Arbitrage fails to provide these basic details, significantly undermining its legitimacy. For investors, the transparency of a company’s registration information is crucial. A platform without a genuine entity cannot ensure fund security, leaving users with no recourse if issues arise.

1.2 False Regulatory Claims

KIWI Arbitrage’s “Terms and Conditions” page claims its services follow “New Zealand law.” However, further investigation reveals the company holds no registration in New Zealand and lacks recognition from any New Zealand financial regulatory authority. This claim aims to mislead investors into thinking the platform operates under New Zealand law, but this is untrue. Operating without regulatory authorization means the platform is not bound by any regulatory standards, leaving user funds without legal protection.

II. Domain Registration Information: Risks of Short-Term Registration

2.1 Short Domain Registration Time Lacks History

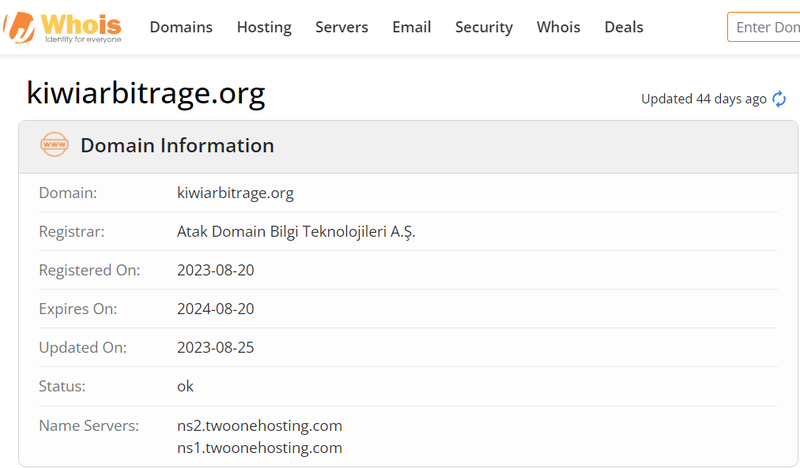

KIWI Arbitrage’s domain, kiwiarbitrage.org, was registered on August 20, 2023. Domains registered for short periods are typically seen as higher risk, especially in the financial industry, where short-lived platforms often lack market history and user feedback. In contrast to well-established platforms with proven market track records, newly registered platforms lack operational stability and long-term reliability.

2.2 Risks Associated with Short-Term Domain Registrations

Many financial scams register short-term domains to evade legal responsibility and user accountability. Once they’ve gathered enough funds, scammers can quickly shut down the website and avoid legal consequences. These short-term registered platforms often continue attracting investors by frequently changing domain names. For investors, choosing a platform with an established history and a market reputation can effectively reduce such risks.

III. High Risks of No Corporate Entity and No Regulatory Credentials

3.1 Lack of Genuine Corporate Entity

KIWI Arbitrage claims to have a headquarters in Wellington, New Zealand, and company registration in Australia. However, checks reveal that the platform’s provided company number does not exist, nor is there any company information in the New Zealand Companies Register. The absence of a real corporate entity means investors will face extreme challenges in recourse if there are issues with funds. A financial platform without a corporate presence lacks legal protections, raising doubts about its credibility and increasing the risk of misappropriation or loss of funds.

3.2 Potential Risks of an Unregulated Platform

An unregulated platform often implies operations are not legally constrained. In New Zealand and Australia, legitimate financial institutions must undergo strict financial regulation, safeguarding client funds with fund segregation mechanisms. However, KIWI Arbitrage is not certified or audited by any financial regulatory body, meaning investor funds have no legal protection. When choosing cryptocurrency and forex platforms, it is critical to prioritize companies with regulatory oversight and legal accountability.

IV. Risks of Minimum Investment Amount

4.1 Tempting High-Return Plans

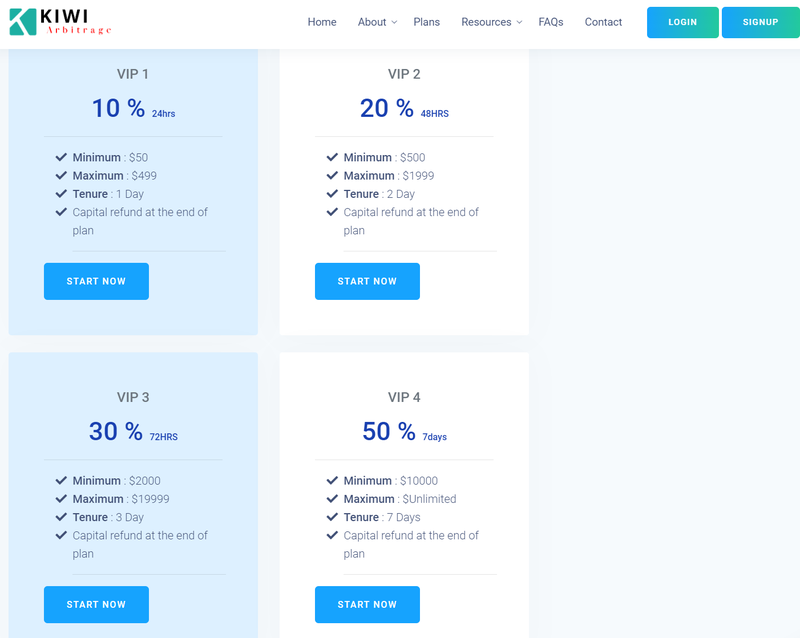

KIWI Arbitrage advertises four VIP investment plans, with minimum deposits starting at $50. Each plan has a short-term investment period ranging from 1 to 7 days, promising returns as high as 50%. The plans include:

- VIP 1: 10% return, 1-day investment period, minimum $50, maximum $499.

- VIP 2: 20% return, 2-day investment period, minimum $500, maximum $1999.

- VIP 3: 30% return, 3-day investment period, minimum $2000, maximum $19,999.

- VIP 4: 50% return, 7-day investment period, minimum $10,000, no upper limit.

Such high short-term returns are highly unusual in legitimate markets. Many scam platforms often use high returns to lure investors in, only to disappear once funds are deposited. Genuine financial institutions do not offer such high short-term returns, so investors should be wary of these suspiciously high rates of return.

4.2 Potential Risks of High Return Promises

In financial markets, returns and risks are proportional. Legitimate investment firms make realistic forecasts based on market fluctuations and risk controls. However, KIWI Arbitrage’s high return promises are unrealistic and not aligned with market norms. Investors should avoid believing in such exaggerated claims to prevent falling into a scam driven by the lure of high returns.

V. Security Concerns with Single Trading Platform and Single Deposit/Withdrawal Option

5.1 Web-Based Proprietary Trading Platform Only

KIWI Arbitrage claims to offer users a proprietary web-based trading platform. Unlike industry-standard platforms like MT4 and MT5, the security of a web-based proprietary platform is difficult to verify. Reputable trading platforms typically offer multiple independent software platforms to ensure trading system stability and user data security. However, KIWI Arbitrage lacks a professional platform, and the safety and stability of its proprietary platform are questionable, increasing user risk.

5.2 Single Deposit/Withdrawal Method Increases Fund Flow Risks

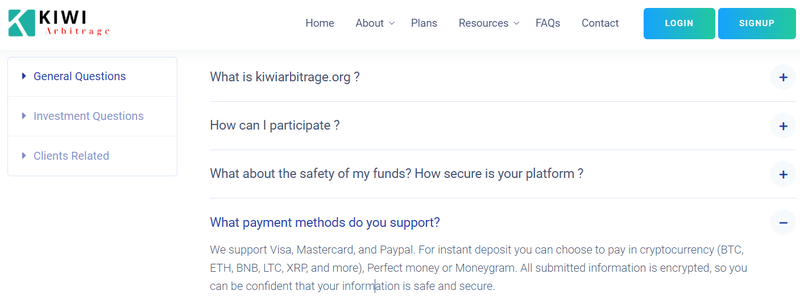

KIWI Arbitrage only supports deposits and withdrawals via cryptocurrency (BTC, ETH, BNB, LTC, XRP, etc.) and Perfect Money. These payment methods are challenging to trace, and once funds are transferred, they are difficult to recover. In contrast, reputable platforms usually offer multiple deposit and withdrawal options, such as bank transfers and credit card payments, to ensure fund flow security. The limited deposit/withdrawal options heighten fund risks, leaving investors in a difficult position if the platform restricts withdrawals after receiving deposits.

VI. KIWI Arbitrage as a High-Risk Investment Trap

In summary, KIWI Arbitrage, as a new platform, fails to provide a genuine corporate entity or valid regulatory credentials and uses unreasonable high-return plans and a single deposit/withdrawal method to attract investors. The platform poses a high risk of fraud, and investors should avoid depositing funds into unregulated platforms. For investors, choosing a legally regulated platform with transparent company information is essential for fund security. KIWI Arbitrage’s numerous irregularities make it a highly suspicious platform, and investors should remain cautious and steer clear of such high-risk investment traps.

VII. FAQ

- Is KIWI Arbitrage regulated?

No, KIWI Arbitrage claims to be registered in Australia, but verification shows it is not supervised by any regulatory authority. - When was KIWI Arbitrage’s domain registered?

KIWI Arbitrage’s domain was registered on August 20, 2023, making it a new platform with limited history. - Are KIWI Arbitrage’s high-return plans trustworthy?

No, KIWI Arbitrage’s promised returns are far above market norms and lack feasibility. Investors should be skeptical. - Does KIWI Arbitrage provide a secure trading platform?

No, KIWI Arbitrage only offers a web-based proprietary platform, which lacks verified security and stability, posing increased user risks. - How can one identify high-risk fake financial platforms?

Investors should verify company information, regulatory credentials, and be cautious of platforms promising unusually high returns. - What deposit/withdrawal methods does KIWI Arbitrage support?

It only supports cryptocurrency and Perfect Money, which increases the risk of funds being difficult to retrieve.