PROFITS OPTIONS claims to offer global CFD trading services, but its regulatory information and website design raise serious doubts, suggesting it may be a fraudulent platform. Investors should exercise caution.

Corporate Background of PROFITS OPTIONS: The Reality Behind This Forex Broker

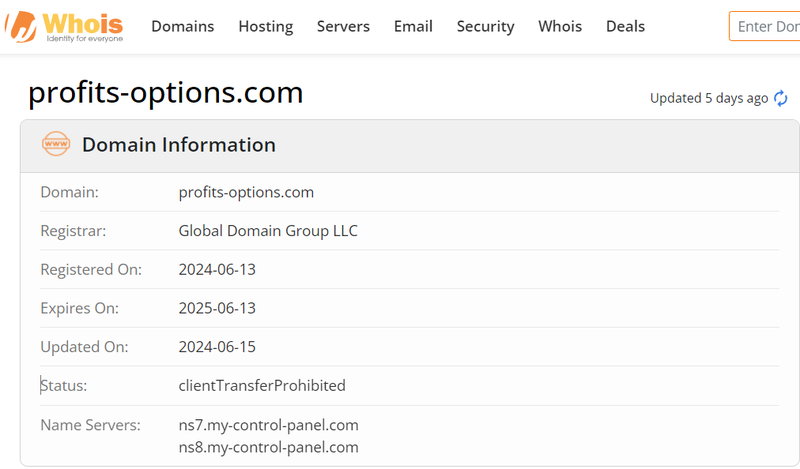

The official domain of PROFITS OPTIONS, profits-options.com, was registered on June 13, 2024. The platform claims to provide CFD trading services across markets such as forex, stocks, indices, and cryptocurrencies, and states that it is authorized and regulated in multiple jurisdictions. However, a deeper analysis of its corporate background and the regulatory information it provides reveals significant signs of potential fraud.

Domain Information of PROFITS OPTIONS: A Timeline That Doesn’t Match Its Claimed History

According to WHOIS data, PROFITS OPTIONS’ domain, profits-options.com, was registered on June 13, 2024. This registration date contradicts the platform’s claims of extensive market experience and a long-standing history. Generally, a well-established broker would have a domain registration date that aligns with its operational history. A significant discrepancy in these dates suggests a red flag, indicating that the platform’s actual operational history may be much shorter than it claims or that it could be a newly established scam platform.

Such a mismatch in dates suggests that PROFITS OPTIONS may be using misleading information to create a false impression of long-term stability to attract investor funds.

Regulatory Information of PROFITS OPTIONS: False Claims and Copying

Detailed Review of Regulatory Claims

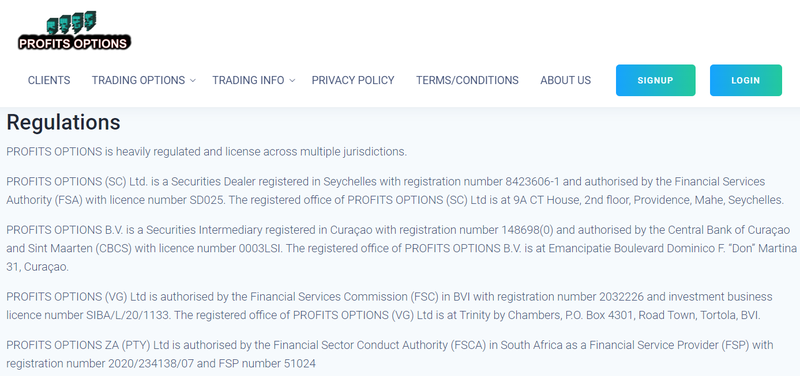

On its website, PROFITS OPTIONS lists several registered entities and claims regulation across multiple jurisdictions, including:

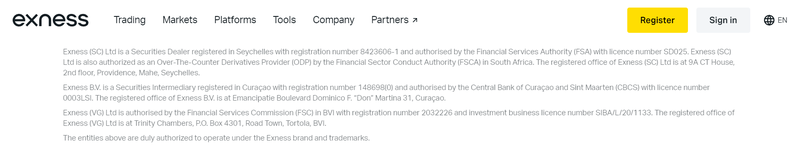

- PROFITS OPTIONS (SC) Ltd.: Registered in Seychelles, claiming regulation by the Seychelles Financial Services Authority (FSA), with registration number 8423606-1 and license number SD025.

- PROFITS OPTIONS B.V.: Registered in Curacao, allegedly regulated by the Central Bank of Curacao and Sint Maarten (CBCS), with registration number 148698(0) and license number 0003LSI.

- PROFITS OPTIONS (VG) Ltd.: Claims registration in the British Virgin Islands, with regulation from the British Virgin Islands Financial Services Commission (FSC), registration number 2032226, and investment business license number SIBA/L/20/1133.

- PROFITS OPTIONS ZA (PTY) Ltd.: Registered in South Africa, claiming regulation by the South African Financial Sector Conduct Authority (FSCA), registration number 2020/234138/07, FSP number 51024.

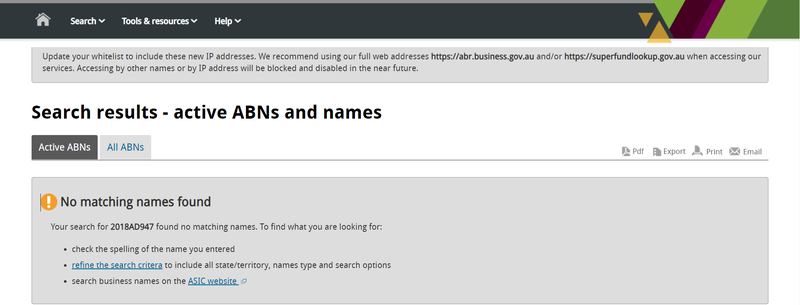

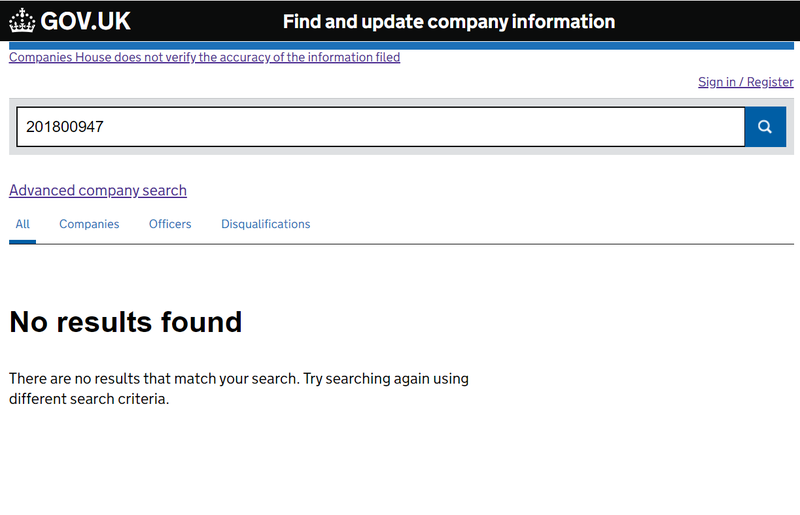

- UK and Australian Entities: PROFITS OPTIONS also claims to have a registered entity in the UK with registration number 201800947 and another in Australia with ABN number 2018AD947.

However, upon verification, these claims contain significant discrepancies. A search on the UK’s Companies House database shows no company with the registration number 201800947. Similarly, no company with ABN number 2018AD947 exists in the Australian Business Register (ABR). This indicates that PROFITS OPTIONS’ registration information in these jurisdictions is false.

Evidence of Copying from Other Companies

Further investigation reveals that the regulatory information provided on the PROFITS OPTIONS website actually belongs to another well-known broker, Exness. PROFITS OPTIONS has copied Exness’s regulatory details to present itself as a legitimate, regulated company. This copying indicates that PROFITS OPTIONS lacks any real regulatory authorization, and all its compliance claims are fabricated.

If a broker cannot provide genuine regulatory information and resorts to copying another company’s credentials to mislead investors, it is likely a scam platform. Investors should always verify a platform’s regulatory information on official regulatory sites. Any false regulatory information should be regarded as a serious warning sign.

Unrealistic Investment Plans: The Trap Behind Tempting Returns

Unachievable Promises of High Returns

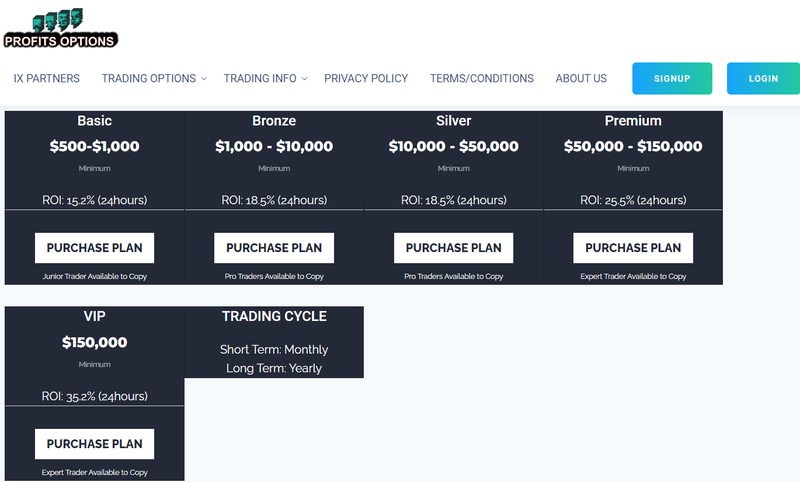

PROFITS OPTIONS claims to offer five different investment plans, each promising high short-term returns:

- Basic: Investment of $500 to $1,000, with a 24-hour return of 15.2%, offering a beginner trader copying option.

- Bronze: Investment of $1,000 to $10,000, with a 24-hour return of 18.5%, offering a professional trader copying option.

- Silver: Investment of $10,000 to $50,000, with a 24-hour return of 18.5%, again offering a professional trader copying option.

- Premium: Investment of $50,000 to $150,000, with a 24-hour return of 25.5%, offering an expert trader copying option.

- VIP: Investment of $150,000 and above, with a 24-hour return of 35.2%, also offering an expert trader copying option.

These plans promise high returns over a short period, which is highly appealing but unrealistic in real financial markets. Legitimate forex and CFD trading platforms do not guarantee fixed short-term returns due to market volatility and unpredictability. Such high-return promises are likely a tactic to lure investors quickly, with little chance of actual payout.

Lack of Transparency on Leverage and Spreads

PROFITS OPTIONS claims to offer high-leverage trading, yet does not specify the exact leverage ratio or spread information. Reputable brokers usually provide clear details about spreads and leverage levels across asset classes to maintain transparency and enable investors to accurately assess trading costs and risks. PROFITS OPTIONS’ lack of disclosure on these factors suggests that it may charge high hidden fees or that its trading conditions are not as favorable as advertised.

This lack of transparency increases the risk for investors using the platform. Investors should choose brokers with high transparency on trading fees and leverage details.

Website Design Similarities: Evidence of Possible Cloning

Signs of Imitation from Other Platforms

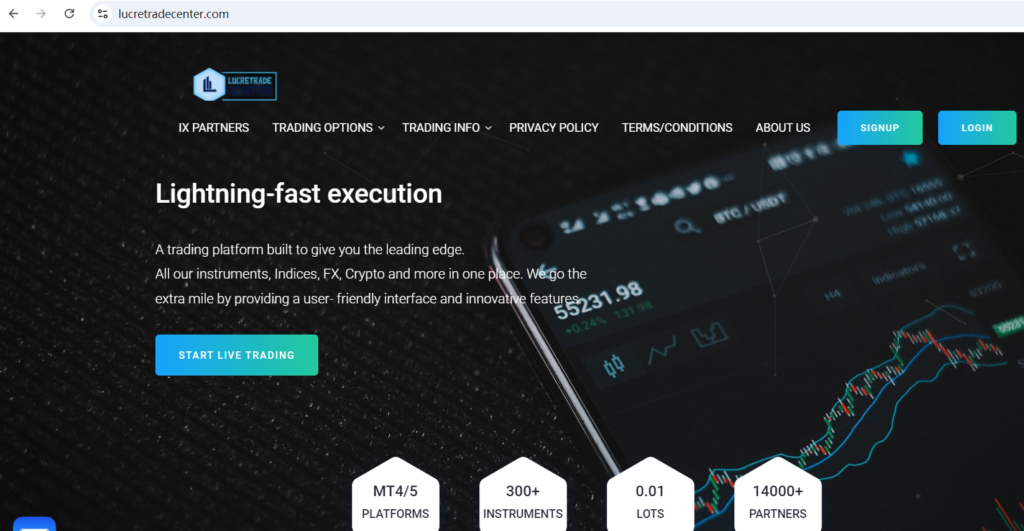

Further investigation reveals that PROFITS OPTIONS’ website design is almost an exact copy of another broker’s site, Lucretradecenter. The page layout, color scheme, content, and overall style are nearly identical. This high level of similarity suggests that PROFITS OPTIONS could be a cloned site.

Clone scams are often run by the same fraudulent organization, creating multiple sites that appear independent but share the same content and design. The goal is to impersonate a legitimate and professional company to deceive investors. Once funds are deposited, these platforms may shut down or switch to a new domain, evading detection. This design and content similarity further indicates that PROFITS OPTIONS may be a network of scams using false information to deceive investors.

Can PROFITS OPTIONS Be Trusted?

While PROFITS OPTIONS promotes attractive elements such as high-return investment plans and diverse trading services, a detailed examination of its regulatory information, domain history, and identical website design to other platforms suggests that it may not be as legitimate and reliable as it claims. Instead, its behavior and patterns align more closely with those of a typical scam platform. Investors should exercise extreme caution, verify all details, and consider choosing brokers with high transparency and genuine regulatory compliance.

Frequently Asked Questions (FAQ)

1. Can PROFITS OPTIONS’ regulatory information be trusted?

No, PROFITS OPTIONS’ regulatory information is false. Verification shows that the regulatory details on its website actually belong to another legitimate broker, Exness, and it has no real regulatory oversight.

2. Why does PROFITS OPTIONS’ domain registration date not match its claimed history?

PROFITS OPTIONS’ domain was registered in 2024, despite its claim of long-standing market experience. This discrepancy is a common sign of false advertising, so investors should be cautious.

3. Are PROFITS OPTIONS’ high-yield investment plans credible?

The high returns promised by PROFITS OPTIONS are nearly impossible to achieve in such short timeframes, indicating that these promises are likely used to attract deposits, with little chance of fulfillment.

4. Why does PROFITS OPTIONS’ website look similar to other brokers?

The PROFITS OPTIONS website design closely resembles other platforms, suggesting that it may be part of a clone scam network. Such scams often share similar designs and content to mislead investors.

5. How can investors verify PROFITS OPTIONS’ regulatory status?

Investors should check the relevant regulatory bodies (such as FSA, CBCS, and FSC) to confirm its information. Any discrepancies from official records are serious warning signs.

6. What payment methods does PROFITS OPTIONS offer?

PROFITS OPTIONS may only support cryptocurrency or other less traceable payment options, which increase risk. Investors should be cautious with such non-traceable funding channels.