Admiralholdings is presented as an international business company registered in the UK, with its operations headquartered at 25 Ropemaker St, London. The broker claims to provide a range of financial services, including access to flexible leverage of up to 1:500. However, upon verification, inconsistencies in its regulatory status raise serious concerns. This article examines Admiralholdings in detail. It covers the company’s background and regulatory claims. It also explores the risks of its high leverage. Finally, it outlines key points investors should consider before using such platforms.

Corporate Background Overview

1. Establishment and Headquarters Information

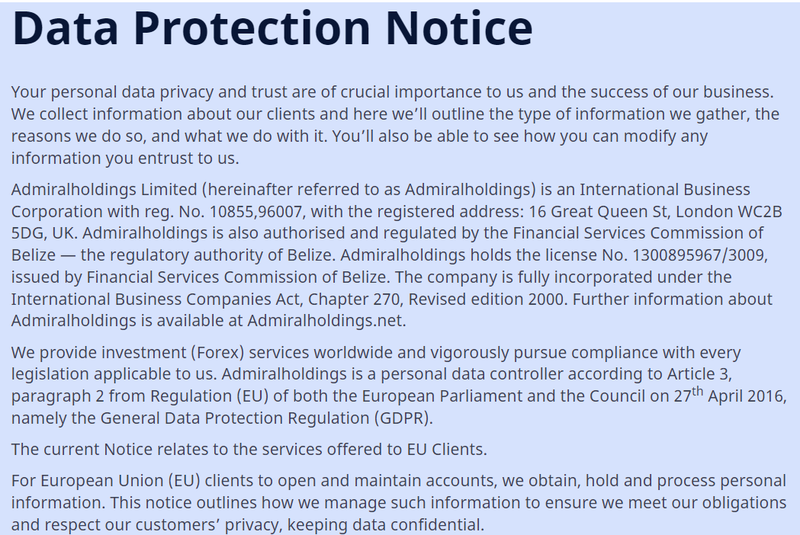

According to the information available on its official website, Admiralholdings Limited is registered in the United Kingdom with a company registration number of 10855,96007. The headquarters are claimed to be located at 25 Ropemaker St, London, UK. This address and the company’s stated details aim to present a sense of legitimacy and credibility, as London is a well-known global financial hub.

However, beyond the stated address, the information lacks further transparency. The company’s exact operational history, financial stability, and leadership structure remain undisclosed. Such a lack of transparency raises questions about the broker’s legitimacy and whether it truly has the infrastructure and resources necessary to support a global clientele.

2. Claim of International Regulation

Admiralholdings also claims to be authorized and regulated by the Belize Financial Services Commission (FSC) with license number 1300895967/3009. Belize is a known offshore financial jurisdiction. The broker uses this to appear internationally regulated. However, these claims must be verified. Offshore regulation can sometimes be a tactic to bypass stricter rules in other countries. Always confirm such details before trusting the platform.

Domain Registration Information

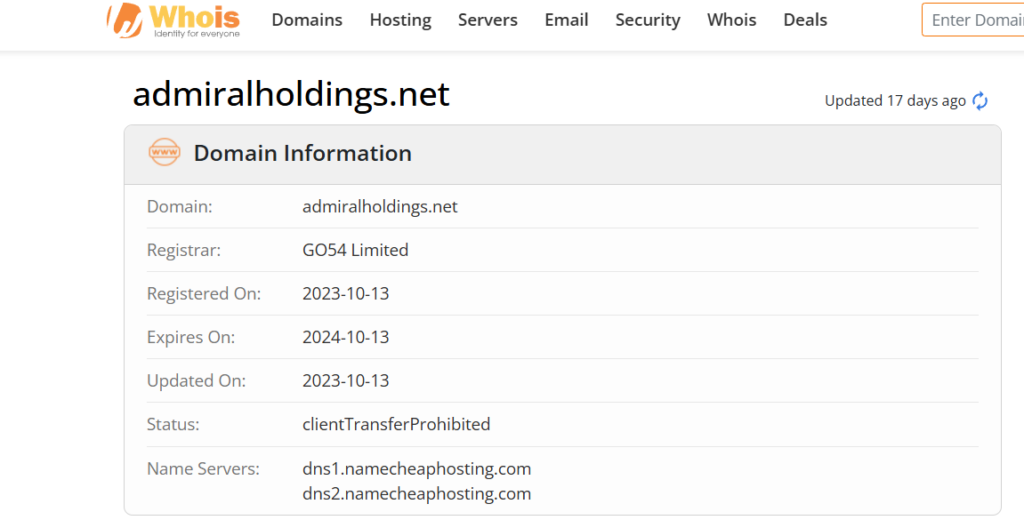

1. Recent Domain Registration: A Cause for Caution

The domain for Admiralholdings’ official website, admiralholdings.net, was registered on October 13, 2023. The domain is set to expire on October 13, 2024, and was last updated on the same day it was registered. This short domain history indicates that Admiralholdings is a very new player in the industry. A short operational history often signifies a lack of proven reliability and stability, making it challenging for potential investors to trust the platform’s long-term viability.

2. Risks Associated with New and Unproven Domains

Newly registered domains can be a red flag in finance. If a broker lacks proof of stability and transparency, it’s concerning. A short domain history shows no proven track record. It may indicate a lack of client trust, platform stability, or financial security. Investors should be cautious with brokers without established histories. Such platforms may carry risks like fraud or sudden shutdowns.

Verification of Registration and Regulatory Information

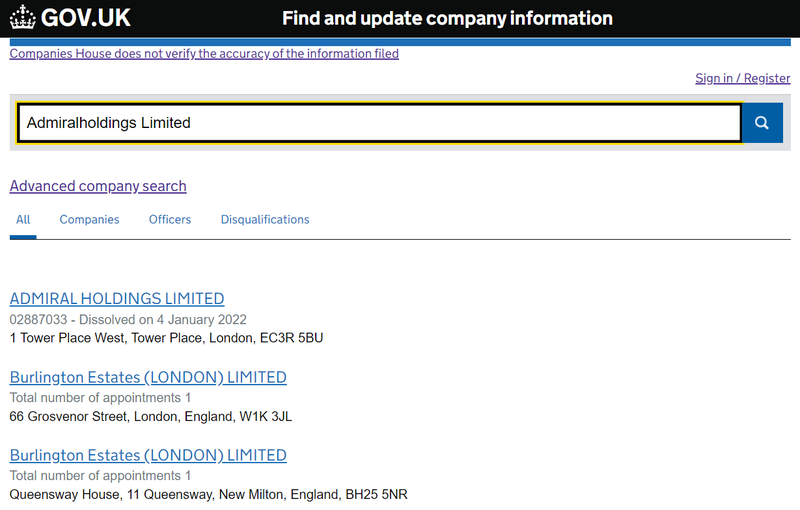

1. Verification with the UK Companies House

Admiralholdings claims to be a UK-registered business entity under the registration number 10855,96007. A search on the UK Companies House website found no record for this number or “Admiralholdings Limited.” The company does not appear in the official UK registry. This absence raises doubts about its authenticity. It also questions its credibility as a legitimate business.

2. Verification with the Belize Financial Services Commission (FSC)

Similarly, Admiralholdings claims to hold a license from the Belize FSC under license number 1300895967/3009. However, a review of the Belize FSC’s official records does not confirm the existence of any such license or company. Moreover, the license number format provided does not align with the typical structure used by the FSC, further highlighting potential discrepancies in the broker’s regulatory claims. This misrepresentation could be a strategy to falsely assure investors of regulatory compliance and safety.

3. The Importance of Transparent Regulatory Information

For investors, transparency in regulatory information is a critical factor in assessing a broker’s legitimacy. When a broker’s regulatory details are unverifiable or inconsistent, it may indicate that the platform is not subject to proper oversight, increasing the risks of fraud or unethical practices. Investors should verify the authenticity of regulatory claims through official sources to protect their investments.

Leverage Options and Trading Conditions

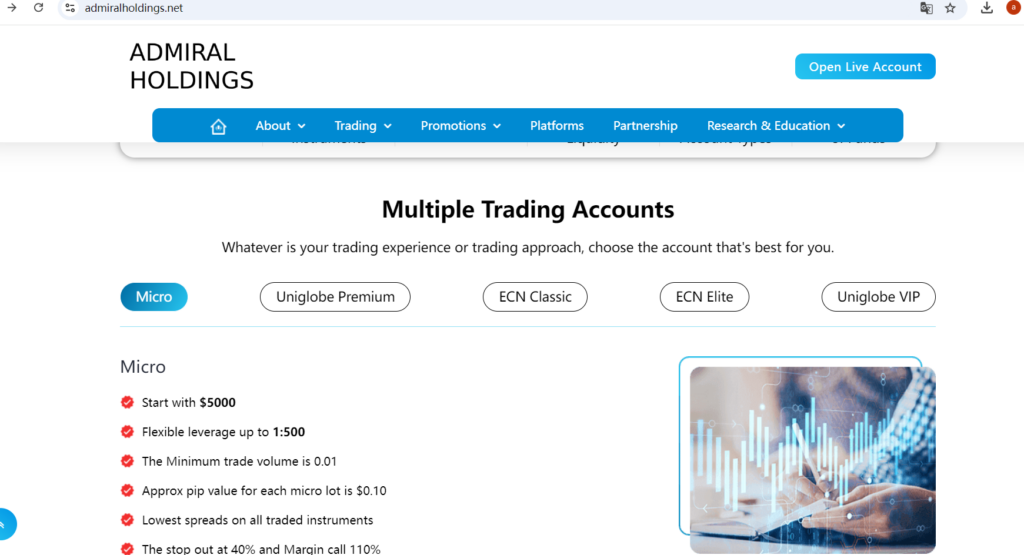

1. Flexible Leverage Options Up to 1:500

Admiralholdings offers flexible leverage options ranging from 1:1 to a maximum of 1:500, with a minimum trading volume starting at 0.01 lots. While such flexibility might appeal to experienced traders, the high leverage of 1:500 is well above what most regulated brokers offer. Regulated brokers typically provide leverage ranging from 1:30 to 1:100, designed to limit excessive risk exposure for their clients. A leverage of 1:500 significantly amplifies both potential profits and losses, making it suitable only for traders with advanced risk management strategies.

2. Trading Conditions: Minimum Deposit and Margin Requirements

The broker’s trading conditions state a minimum deposit requirement of $5,000, which is relatively high for the industry. Additionally, the margin call is set at 110%, and the stop-out level is 40%. While these terms are outlined, the transparency regarding the spreads offered on different trading instruments is lacking, as the broker does not disclose specific spread values on its website. This lack of detailed information may prevent traders from making informed decisions, potentially leading to higher trading costs or unexpected losses.

Risks Associated with High Leverage: A Real-World Case

1. High Leverage Amplification of Market Risks

Leverage is a double-edged sword in the trading world. A leverage ratio of 1:500, as offered by Admiralholdings, allows traders to control large positions with a small amount of capital. However, it also means that even minor market fluctuations can result in significant account losses. The amplified risk can be catastrophic if not managed with proper knowledge and strategies.

2. Real-World Case: The 2020 Oil Market Collapse

A notable example of the dangers of high leverage occurred during the 2020 oil market collapse. When the price of crude oil plummeted into negative territory for the first time in history, traders using high leverage found their accounts wiped out within minutes. The dramatic price movements meant that those trading on high leverage were not only exposed to large losses but, in some cases, ended up owing more than their initial deposits. This incident highlights the risk that high leverage poses, especially during unexpected market events. Traders considering platforms like Admiralholdings must be fully prepared and understand the dangers involved.

The Necessity of a Well-Structured Corporate Foundation

1. Importance of Regulatory Compliance and Transparency

A legitimate broker must demonstrate regulatory compliance and transparency by providing verifiable information about its license and registration. For investors, ensuring that a broker has a sound regulatory framework is crucial. It not only guarantees a level of oversight but also offers legal protection in cases of disputes or malpractices. Admiralholdings’ inability to provide verifiable regulatory credentials puts investors at a higher risk.

2. Corporate Stability and Accountability

Beyond regulatory compliance, a well-structured corporate foundation includes having a transparent management team, a clear history of operations, and a secure financial structure. These elements help build trust and demonstrate the broker’s ability to manage client funds responsibly. Brokers like Admiralholdings that fail to meet these criteria should be approached cautiously, as their lack of accountability and transparency may put investor funds in jeopardy.

Conclusion: Is Admiralholdings Trustworthy?

In light of the discrepancies between Admiralholdings’ regulatory claims and the actual information verified through official sources, investors should approach the platform with caution. The absence of regulatory confirmation and the offering of high leverage up to 1:500, along with limited transparency in trading conditions, suggest that Admiralholdings may not be a safe or reliable option for traders. Investors should prioritize brokers with clear regulatory oversight, established histories, and comprehensive disclosure of trading terms to ensure their investments are secure.

FAQ

- Is Admiralholdings truly regulated by the Belize FSC?

No, verification shows that Admiralholdings is not listed under the Belize FSC’s regulatory authority, and its license number format is inconsistent. - What leverage does Admiralholdings offer?

Admiralholdings offers leverage options from 1:1 to 1:500, which is higher than most regulated brokers. - Is the $5,000 minimum deposit requirement typical for the industry?

No, $5,000 is relatively high compared to other brokers that often require much lower minimum deposits. - Why is verifying a broker’s regulatory status important?

Regulatory verification ensures that a broker is subject to oversight, reducing the risk of fraud and ensuring legal recourse in case of disputes. - What are the risks of trading with high leverage like 1:500?

High leverage amplifies both profits and losses, increasing the potential for significant account depletion during market volatility. - Are there safer alternatives to Admiralholdings?

Yes, investors should choose brokers regulated by recognized authorities (e.g., FCA, ASIC) with transparent trading conditions and a proven track record.