In the forex and CFD (Contract for Difference) markets, choosing a trustworthy broker is crucial for successful investing. As these markets expand, some platforms try to mislead investors by falsifying regulatory information and corporate background, potentially trapping them in financial scams. Elite Stratton is a relatively new broker offering a variety of trading products and claiming to be regulated by several countries. However, after thorough investigation, numerous falsehoods were found in its registration and regulatory claims. This article provides a detailed analysis of Elite Stratton’s corporate background, domain registration, fictitious regulatory information, and high minimum deposit requirements to help investors identify potential risks.

I. Corporate Background: Basic Information on Elite Stratton

Elite Stratton is a forex broker registered on November 15, 2022. It claims to offer global users a range of financial products, including forex, stocks, indices, energy, metals, cryptocurrencies, and ETF CFDs, through its proprietary trading platform and mobile application. Unlike other brokers that rely on popular trading platforms like MT4 or MT5, Elite Stratton promotes its own trading system, claiming it provides a more efficient, smooth trading experience. However, despite the platform’s apparent variety of trading options, its background and regulatory status raise serious concerns.

1.1 Financial Products Offered

Elite Stratton offers a variety of financial products, including forex, stocks, indices, energy, metals, cryptocurrencies, and ETF CFDs. Forex and CFDs are high-risk, high-reward trading products that require investors to have strong market knowledge and trading skills. The platform provides a demo account and four different types of trading accounts to meet the needs of investors with varying experience and capital levels.

1.2 Account Types and Conditions

Elite Stratton offers users four types of accounts: STARTER, BASIC, PRO, and EXECUTIVE. Each account type has different minimum and maximum investment requirements:

- STARTER Account: Minimum deposit of $500, maximum of $19,999, includes demo trading and senior broker service.

- BASIC Account: Minimum deposit of $20,000, maximum of $49,999, includes basic broker service.

- PRO Account: Minimum deposit of $50,000, maximum of $99,999, includes professional broker service.

- EXECUTIVE Account: Minimum deposit of $100,000, maximum of $150,000, includes executive broker service.

Although these account types appear to cater to a range of investors, from beginners to advanced, the high minimum deposit thresholds are a barrier for average investors. Additionally, Elite Stratton’s operational and compliance issues raise questions about the security of investor funds.

Elite Stratton provides a range of financial products and account options, but its compliance and legitimacy are doubtful, especially given its high account thresholds that are unfriendly to small and medium investors.

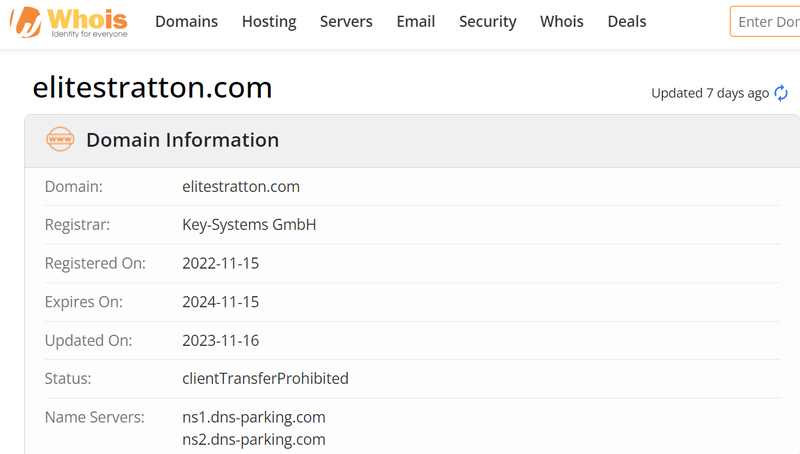

II. Domain Information: Potential Risks of Short-Term Registration

Analyzing domain registration data can help investors assess a platform’s operational history and stability. Elite Stratton’s website domain was registered on November 15, 2022, indicating that it is a relatively new broker.

2.1 Short Domain Registration Period

Elite Stratton’s domain was registered only about a year ago. Brokers in the financial market usually need a long operational history to demonstrate stability and earn investor trust. However, Elite Stratton, being newly registered, lacks this market verification, making its reputation and stability hard to evaluate.

2.2 Lack of Transparent Background Information

In addition to its short registration period, Elite Stratton’s website does not provide detailed corporate background information, such as the company’s founding date, operating team, or shareholder structure. Legitimate financial platforms typically disclose such information to increase investor confidence. Elite Stratton’s lack of transparency on these points further heightens its opacity, making it difficult for investors to confirm its operational legitimacy and fund security.

Elite Stratton’s short domain registration period and lack of transparent corporate information warrant high caution from investors.

III. Falsified Registration and Regulatory Information: Deceptive Tactics

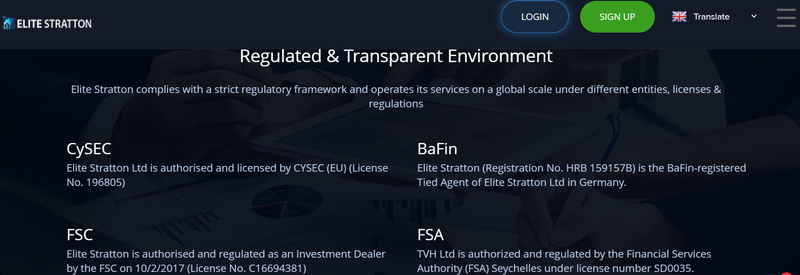

A legitimate forex broker must register with regulatory bodies in various countries and regions and undergo strict financial supervision. Elite Stratton claims to be regulated by several internationally recognized agencies, including the Cyprus Securities and Exchange Commission (CySEC), the Federal Financial Supervisory Authority (BaFin) in Germany, the Financial Services Commission (FSC) in Mauritius, and the Financial Services Authority (FSA) in Seychelles. However, further investigation reveals that all these registration and regulatory claims are false or fabricated.

3.1 False CySEC Regulation Claim in Cyprus

Elite Stratton claims to have authorization and licensing from the Cyprus Securities and Exchange Commission (CySEC), under license number 196805. However, a check of CySEC’s official website finds no entity listed under this license number. This indicates that Elite Stratton’s CySEC regulatory claim is false, as it is neither legally registered in Cyprus nor subject to CySEC’s supervision.

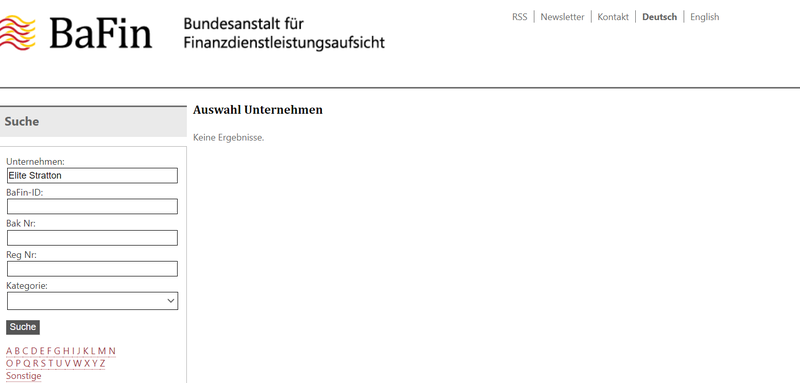

3.2 False BaFin Registration in Germany

Elite Stratton claims to be registered with the Federal Financial Supervisory Authority (BaFin) in Germany, under registration number HRB11677B. BaFin’s official database does not list any company under this registration number. This indicates that Elite Stratton is neither legally registered nor regulated in Germany. Platforms often use fake registration details to appear trustworthy, creating a facade of legitimacy. Elite Stratton seems to be employing this deceptive tactic.

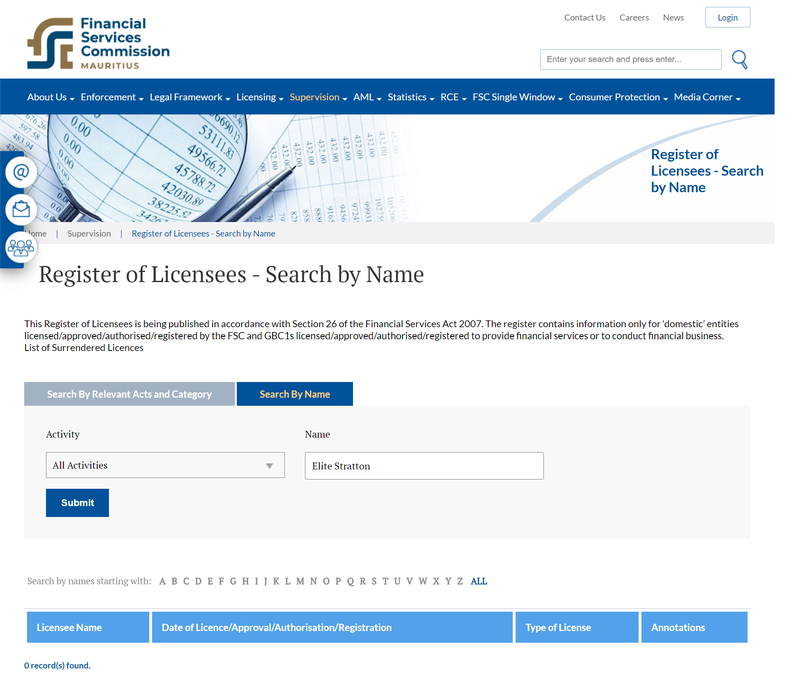

3.3 Fabricated Regulatory Information from Mauritius and Seychelles

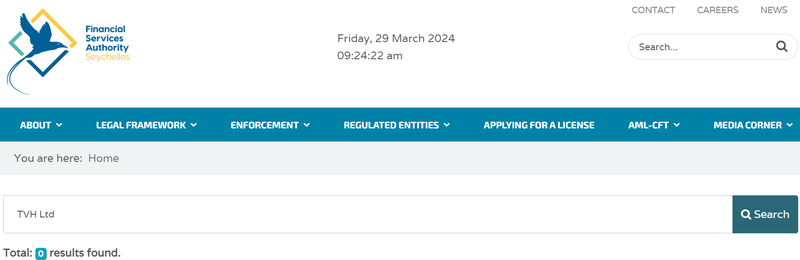

Elite Stratton also claims to be registered with the Mauritius Financial Services Commission (FSC) with an investment dealer license, under license number C159157B. Additionally, it claims that its subsidiary, TVH Ltd, is regulated by the Financial Services Authority (FSA) in Seychelles, with license number SD0035. However, checks with both regulators’ official websites reveal that these license numbers do not correspond to any registered company. These fake regulatory claims further confirm Elite Stratton’s deceptive practices.

Elite Stratton uses false registration and regulatory claims to mislead investors, with no actual oversight from any legitimate authority, leaving investor funds without protection.

IV. High Minimum Deposit Requirements: Investors Beware

Elite Stratton offers four types of trading accounts, each with significantly different minimum deposit requirements ranging from $500 to $150,000. However, these high deposit requirements pose risks for the average investor.

4.1 Risks of High Deposit Requirements

The STARTER account requires a minimum deposit of $500, while the BASIC account requires at least $20,000. Such high deposit thresholds not only limit participation from ordinary investors but also expose them to significant risks. If the platform encounters issues, investors may face the possibility of being unable to recover their funds, especially given the platform’s lack of regulatory oversight.

4.2 Demo Trading and High Risk

Elite Stratton offers demo trading, which might appear to help beginners get familiar with the platform, but it may also be a tactic to mask high risks. Demo trading can create a false sense of profitability, encouraging investors to commit more real funds. Once deposits are made, the platform may restrict withdrawals or freeze accounts, leading to financial losses for investors.

Elite Stratton’s high deposit requirements increase investors’ financial risk, especially as the platform lacks regulatory safeguards. Investors should be cautious.

V. Conclusion: Revealing the Investment Risks of Elite Stratton

After analyzing Elite Stratton’s corporate background, domain information, false registration and regulatory claims, and deposit requirements, it’s clear that this platform has serious compliance issues. Its fake registration and regulatory statements show that it is not a legitimate trading platform. Additionally, its high deposit thresholds and lack of transparency add further risks to investors’ funds.

When choosing a trading platform, investors should prioritize those regulated by reputable authorities and that provide transparent operational information to ensure fund security. For platforms like Elite Stratton, which lack transparency and legitimate regulation, investors should be highly vigilant to avoid unnecessary financial losses.

Frequently Asked Questions (FAQ)

1. Is Elite Stratton regulated?

Elite Stratton claims to be regulated by multiple agencies, but verification reveals that all regulatory claims are false, and it is not regulated by any legitimate authority.

2. When was Elite Stratton’s domain registered?

Elite Stratton’s domain was registered on November 15, 2022, meaning it has a short operating history that has not undergone long-term market verification.

3. What financial products does Elite Stratton offer?

Elite Stratton offers forex, stocks, indices, energy, metals, cryptocurrencies, and ETF CFDs.

4. Is Elite Stratton’s registration information real?

Elite Stratton’s registration and regulatory claims are false; there is no record of it in any reputable regulatory agency.

5. What is Elite Stratton’s minimum deposit requirement?

Elite Stratton’s minimum deposit starts at $500, but higher-tier accounts require at least $20,000, which investors should approach with caution.

6. How can I assess whether a trading platform is legitimate?

Investors should check the platform’s registration and regulatory status, ensuring it is overseen by reputable authorities (such as the FCA, CFTC, or ASIC) to secure their funds.