The forex market has always attracted investors globally. However, as the market expands, the varying quality of platforms brings significant investment risks. TravelEX, a newly established online forex broker, offers trading services in forex, commodities, stocks, and indices. Despite the company’s claims of being regulated on its website, the lack of transparency regarding its regulatory status and unclear information has caused confusion and concern among many investors. This article will analyze TravelEX’s corporate background, domain registration details, regulatory status, spreads, and commission structure to help investors understand the potential risks of this platform and make informed decisions.

1. Background Information: Basic Details About TravelEX

TravelEX is an online forex broker registered in 2023, primarily serving global investors by offering trading in forex, commodities, stocks, and indices. Although TravelEX provides a wide range of trading products, its lack of transparency raises widespread concerns about its legitimacy and operational status.

1.1 Missing Key Information

On its website, TravelEX fails to disclose critical details about its company entity, top management, and specific address. Typically, legitimate financial institutions or brokers will list the company’s establishment location, operational address, key management personnel, and more background information on their website to increase investor trust. However, TravelEX does not provide such information, making it difficult for investors to assess the platform’s compliance. This lack of transparency, especially for a new company, is often a characteristic shared with fraudulent platforms.

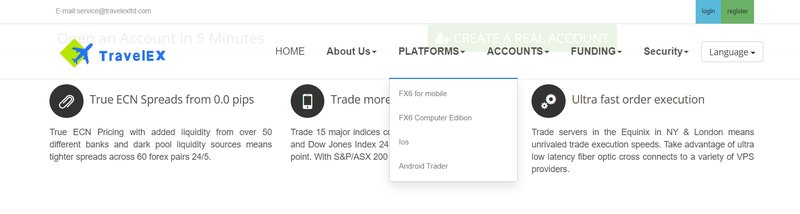

1.2 Proprietary Trading Platform FX6

Unlike many mainstream forex brokers, TravelEX does not support widely used trading platforms like MT4 and MT5. Instead, it has launched its proprietary platform, FX6. While proprietary platforms can offer innovation and customization, investors generally prefer market-tested platforms. MT4 and MT5 are widely trusted because they provide powerful technical analysis tools, a stable user experience, and broad market support. TravelEX’s FX6 platform lacks market validation and sufficient user feedback, creating uncertainty about its trading environment.

Although TravelEX offers a variety of trading products, the platform’s lack of transparency, especially regarding critical information, severely undermines investor trust. Additionally, its proprietary FX6 platform has not undergone broad market testing, so investors should approach it with caution.

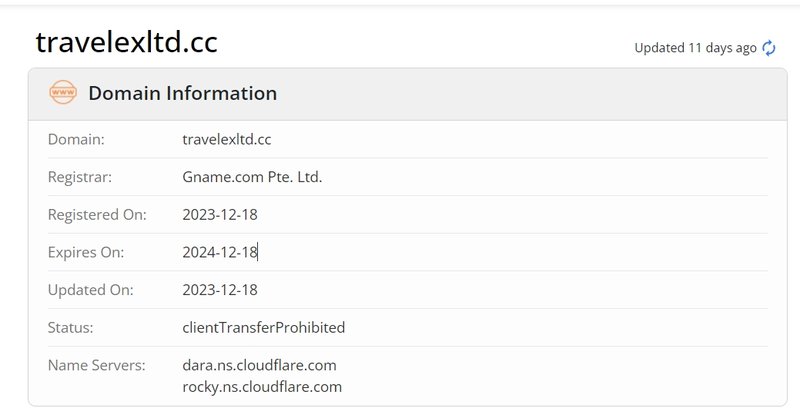

2. Domain Information and Risks: Potential Dangers of a Short-Term Registration

Domain registration information provides insight into the history and background of a platform. TravelEX’s domain was registered on December 18, 2023, indicating that the platform is very new. A short domain registration period often means the platform has not undergone long-term market scrutiny, raising concerns about its stability and reliability.

2.1 Risks of a Short Domain Registration Period

TravelEX’s domain was registered only a few months ago, making its operating time very short. In the financial services industry, particularly in forex trading, investors tend to favor platforms with years of operating history. A long operational record not only indicates that the platform has established a certain reputation in the market but also shows that it has been tested through multiple market cycles. In contrast, newly registered platforms, especially new companies, may not have enough financial reserves or market influence. If the platform faces market volatility or operational issues, investors’ funds could be at significant risk.

2.2 Link Between Short-Term Platforms and Financial Scams

One characteristic of many financial scam platforms is short-term domain registration. These platforms often accumulate funds quickly, then shut down and disappear. Scam platforms typically entice investors with promises of high short-term profits. Once they gather enough funds, they quickly close their domains and platforms, leaving investors unable to recover their losses. Given TravelEX’s short registration time, investors should be highly cautious about the platform’s credibility.

The short domain registration of TravelEX, combined with its lack of long-term market scrutiny, raises concerns about the platform’s stability and reliability. Investors should be vigilant about such short-term platforms to avoid potential financial losses.

3. Unclear Registration Information: Risks of a Vague Company Background

The legitimacy of financial trading platforms is often based on their detailed registration information. Investors can evaluate a platform’s compliance by reviewing the company’s registration location, operational address, founding date, and management team. However, TravelEX provides very limited information about its registration, further raising concerns about its legitimacy.

3.1 Undisclosed Registration Information

TravelEX does not publicly disclose its company registration details on its website. Legitimate financial platforms typically share their registration details with local financial regulators and provide their operational address and management team information for investors to verify. However, TravelEX fails to disclose these critical details, significantly reducing the platform’s transparency and leading to doubts about its legitimacy.

3.2 Impact of Missing Company Entity Information

When choosing a financial trading platform, investors should focus not only on trading conditions and products but also on the legitimacy of the company entity. Without detailed company entity information, investors cannot confirm whether the platform complies with local laws, nor can they verify it through official channels. In case of disputes or trading issues, investors may face difficulty seeking legal recourse or recovering their funds.

TravelEX’s lack of transparency regarding its registration information significantly undermines the platform’s credibility. Investors should be highly cautious when considering such a platform with unclear details.

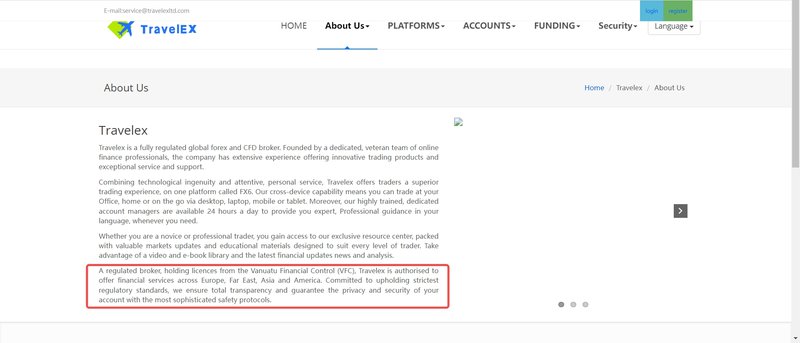

4. Lack of Effective Regulation: False Regulatory Claims and Real Risks

Regulation by financial authorities is key to safeguarding investors’ funds. Regulatory bodies ensure that platforms comply with laws and regulations, providing legal protection for investors. TravelEX claims to be regulated by the Vanuatu Financial Control (VFC); however, this claim raises serious concerns.

4.1 Risks of False Regulatory Claims

TravelEX’s website claims it is regulated by the Vanuatu Financial Control (VFC), but this entity is unrelated to the legitimate Vanuatu Financial Services Commission (VFSC). The VFSC is a well-known regulatory body responsible for overseeing financial services providers in Vanuatu. However, VFC is a little-known entity with virtually no background in financial regulation. In reality, VFC lacks regulatory powers and cannot provide any real oversight or enforcement over TravelEX’s operations.

4.2 Dangers of Unregulated Platforms

Unregulated financial platforms carry high risks. Once investors deposit funds into such platforms, they may face difficulties with withdrawals, frozen funds, or even the misappropriation of funds. Moreover, unregulated platforms can manipulate trading data or exaggerate market trends, misleading investors and causing significant losses.

Typically, platforms regulated by credible financial authorities must adhere to strict standards of financial transparency and customer protection, ensuring the safety of investors’ funds. TravelEX’s claimed regulator, VFC, lacks authority and has no clear role, which greatly increases the risk to investors’ funds.

TravelEX’s claim of being regulated by VFC is false. The platform operates without legitimate regulatory oversight, meaning investors’ funds and trading fairness are unprotected.

5. Non-Transparent Spreads and Leverage: Hidden Risks in Trading Costs

In forex and CFD trading, spreads and leverage are crucial factors that affect an investor’s costs and risk exposure. Transparent spreads and leverage help investors control costs and manage risks effectively. However, TravelEX does not disclose these important details on its website.

5.1 Unclear Spread and Commission Information

The spread is the difference between the buy and sell price and represents the basic cost of every trade. Reputable platforms typically list the spreads for various financial products on their websites to help investors understand trading costs. However, TravelEX does not disclose any spread information, making it difficult for investors to estimate trading costs. This lack of transparency likely indicates the presence of hidden fees, increasing investor costs.

Additionally, commissions are an important component of trading costs. Legitimate forex brokers typically provide a clear breakdown of their commission structure. TravelEX, however, has not publicly explained its commission policy, adding more uncertainty to trading. Investors may find their actual costs are far higher than expected after trading, which undermines profitability.

5.2 Leverage Risk

Leverage is a crucial tool in forex and CFD trading that can amplify both gains and losses. TravelEX does not disclose details about its leverage ratio, leaving investors unsure whether the leverage offered suits their risk tolerance. High leverage can lead to greater profits, but it also increases the risk of a margin call, especially during market volatility, where investors may lose their funds quickly.

Many regulatory authorities globally impose clear limits on leverage, such as the European Securities and Markets Authority (ESMA), which restricts leverage for retail clients to a maximum of 1:30 to prevent large losses during market fluctuations. Since TravelEX has not provided detailed information about its leverage limits, it may offer excessively high leverage, increasing risk for investors.

TravelEX’s lack of transparency on spreads and commissions means investors may face hidden costs during trading. Furthermore, undisclosed leverage ratios could expose investors to substantial risks, especially during volatile market conditions.

6. Importance of Spreads and Leverage in Financial Markets

In financial trading, spreads and leverage are core factors that determine trading costs and risk levels. Spreads represent the fee investors pay for each trade. Generally, lower spreads mean lower trading costs, improving investors’ chances of profitability. Leverage, on the other hand, allows investors to control larger market positions with less capital.

6.1 Importance of Spreads

Spreads directly impact trading costs. Higher spreads mean higher costs per trade, requiring larger market movements to cover costs and generate profits. In forex and CFD trading, spreads are often adjusted based on market volatility and liquidity levels, so investors should choose platforms with transparent and reasonable spreads.

6.2 Impact of Leverage on Risk and Returns

Leverage can magnify both profits and losses. For example, with 1:100 leverage, a 1% market movement can lead to a 100% gain or loss. Therefore, leverage is a double-edged sword. Investors should choose their leverage carefully based on their risk tolerance. Legitimate platforms limit leverage to protect investors from excessive risk.

Transparent and reasonable spreads, along with appropriate leverage, are essential for ensuring safe and profitable trading. TravelEX’s lack of transparency on these points leaves investors vulnerable to unpredictable costs and risks.

7. Conclusion: TravelEX’s Credibility is Doubtful, Investors Should Exercise Caution

A detailed analysis of TravelEX’s background, domain registration, regulatory claims, and trading conditions reveals several red flags. Although TravelEX claims to offer a wide range of financial products, its lack of transparency and credible regulation severely undermines its credibility. Its false regulatory claims, opaque trading conditions, and short operating history increase the risk of financial loss for investors.

When choosing a forex or CFD trading platform, investors should prioritize platforms regulated by authoritative financial regulators and those that operate with transparency. TravelEX’s numerous red flags suggest that investors should be highly cautious and avoid investing in this platform without clear evidence of its legitimacy.

Frequently Asked Questions (FAQ)

- Is TravelEX regulated?

TravelEX claims to be regulated by the Vanuatu Financial Control (VFC), but VFC is not a legitimate regulatory authority, meaning the platform is not properly regulated. - When was TravelEX’s domain registered?

TravelEX’s domain was registered on December 18, 2023, indicating that it has a short operating history and has not been tested by the market over time. - What trading products does TravelEX offer?

TravelEX offers trading in forex, commodities, stocks, and indices, but its trading conditions are unclear. - Are TravelEX’s spreads and commissions transparent?

TravelEX does not clearly disclose its spreads and commissions, leaving investors vulnerable to hidden fees and unclear trading costs. - Is TravelEX’s leverage ratio reasonable?

TravelEX does not provide detailed information about its leverage, potentially exposing investors to excessive risks through high leverage. - How can investors identify legitimate forex trading platforms?

Investors should choose platforms regulated by reputable financial authorities (such as the FCA, ASIC, or CySEC) and ensure they offer transparent trading conditions and fee structures.