This article analyzes Prime Digital Assets’ background, domain registration, regulatory warnings, account types, and the transparency of its trading conditions to help investors evaluate the platform’s legitimacy and potential risks.

1. Overview of the Background

Prime Digital Assets claims to offer trading services across various financial products, including forex, cryptocurrencies, stocks, and indices. Its official website is https://primedigitalassets.net/en/. The platform presents itself as offering global, diversified investment opportunities in popular financial markets such as forex and cryptocurrencies. However, its operational background and regulatory status lack transparency.

According to public records, Prime Digital Assets’ domain was registered on August 3, 2023. While the platform claims to be headquartered in New York, further investigation reveals that its actual address is located in London, UK. This discrepancy, coupled with the false claim of being regulated, raises serious doubts about the platform’s legitimacy.

2. Domain and Registration Information

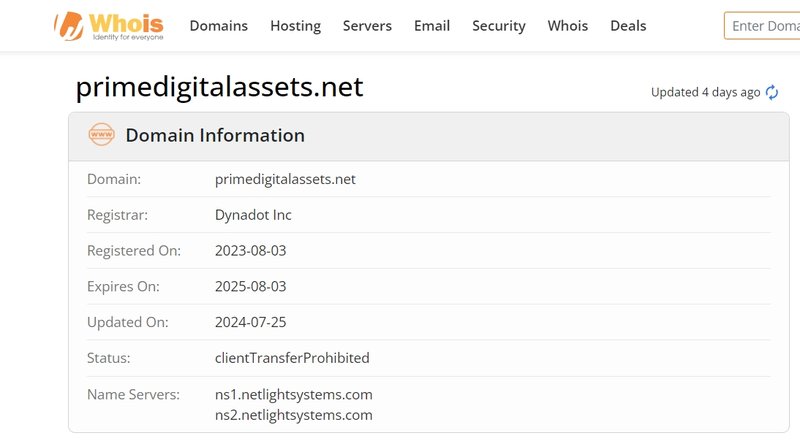

2.1 Domain Registration and Background Information

Prime Digital Assets’ domain was registered on August 3, 2023, making it only a few months old at the time of this writing. New domain registrations typically indicate a short operating history, which means the platform has not yet been tested by the market over a long period. In contrast, many legitimate financial platforms have years of operational history and positive user feedback, providing valuable data for investors to evaluate. New platforms, however, lack this track record, making it difficult for investors to assess their reliability.

In the financial industry, especially in forex and CFD trading, a platform’s market reputation is built over time. Legitimate platforms usually provide transparent company backgrounds and history, showcasing their business growth and customer success stories. Prime Digital Assets’ short operating history means there is little market feedback available, making it hard for investors to judge its trustworthiness.

Additionally, domain registration longevity is often a factor in evaluating a company’s stability. The longer a domain has been registered, the more convincing the platform’s legitimacy and market presence appear. However, recently registered platforms like Prime Digital Assets are more prone to skepticism regarding their credibility.

2.2 Mismatched Registration Address and Operating Information

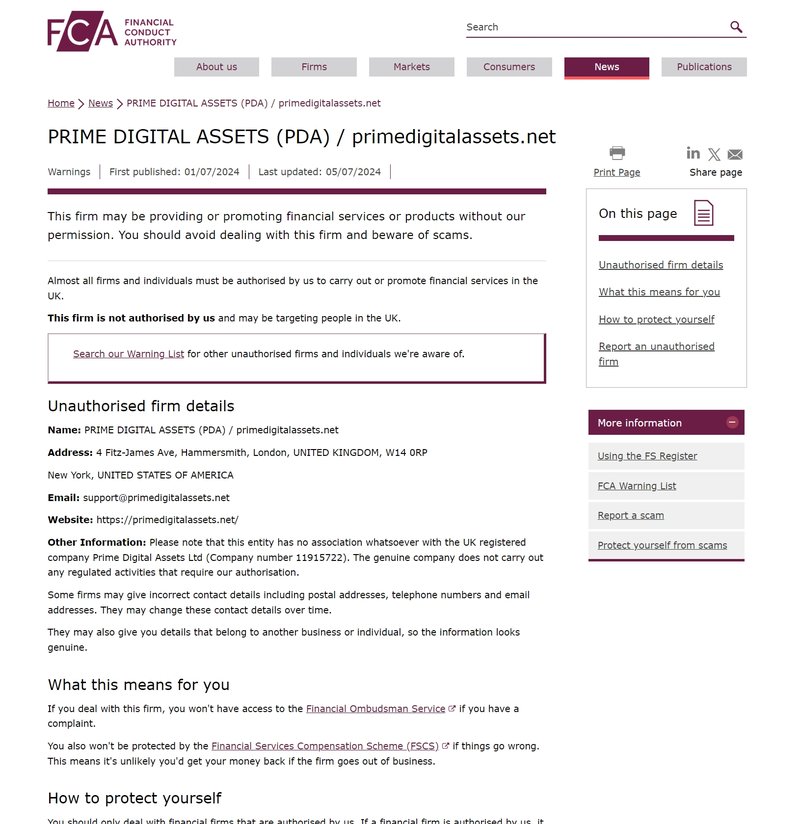

Prime Digital Assets claims its headquarters is in New York, at the heart of the U.S. financial industry. However, further research shows that its actual address is 4 Fitz-James Ave, Hammersmith, London, UNITED KINGDOM, W14 0RP. This inconsistency between the claimed and actual addresses, along with the absence of verified registration information in New York, raises further concerns about the platform’s transparency.

In the financial market, having accurate registration information and a clear company address is critical for evaluating a platform’s reliability. Investors need to know where the platform operates to ensure they can trace the legal entity if disputes arise. Prime Digital Assets’ failure to provide clear registration details makes it difficult for investors to fully understand its operations. This lack of transparency suggests the platform may be concealing its true activities, adding to the risks for investors.

Inconsistent registration information is a common trait of fraudulent or illegal platforms. By using fake addresses and misleading details, these platforms aim to hide their true identity and avoid legal consequences. In the case of Prime Digital Assets, its false address and mismatched registration information suggest potential fraudulent behavior, warranting extreme caution from investors.

3. Regulatory Warnings

3.1 False FCA Regulation Claims

Prime Digital Assets claims to be regulated by the UK’s Financial Conduct Authority (FCA), a well-known regulator overseeing the financial markets in the UK. However, after further investigation, the FCA’s official website does not list Prime Digital Assets as a registered entity. This means that the platform’s claim of FCA regulation is false.

The FCA imposes strict oversight on financial service providers, ensuring their compliance with regulations and protecting investor interests. Any platform offering financial services in the UK must be authorized by the FCA and meet its standards. Prime Digital Assets, by operating without FCA authorization, is in violation of UK financial laws.

More concerning is that the FCA has issued a regulatory warning against Prime Digital Assets. This warning highlights that the platform is illegally offering financial services without authorization and advises investors to avoid using it. FCA warnings typically indicate that a platform may be involved in fraudulent activities, putting investors’ funds at significant risk. The FCA warning against Prime Digital Assets not only highlights the platform’s illegal status but also suggests that it lacks the credentials necessary to protect investor funds.

3.2 The Risks of Unregulated Platforms

Prime Digital Assets lacks regulatory approval from any recognized financial body and does not provide transparent regulatory certificates, meaning it operates without oversight. Unregulated platforms expose investors to substantial risks regarding fund safety, trading transparency, and customer protection. Legitimate financial platforms must be supervised by regulators in their home countries to ensure they operate in compliance with the law and safeguard investors’ assets.

Unregulated platforms often use opaque trading practices and unclear customer agreements, increasing the chances of high-risk activities that investors may find difficult to track. If fund-related issues or illegal activities occur, it becomes nearly impossible for investors to recover their losses. Regardless of how attractive Prime Digital Assets’ trading conditions may seem, its unregulated status makes it an unsafe choice for investors.

4. Questionable Account Information

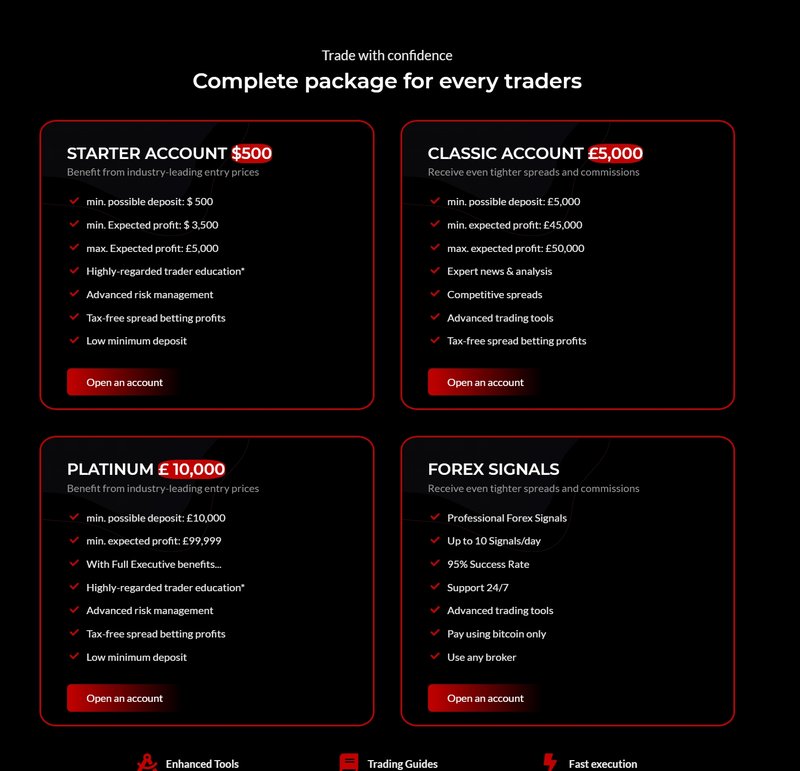

Prime Digital Assets offers three different account types, each designed to suit various investor budgets. However, there are serious concerns about the transparency and legitimacy of these accounts.

4.1 Account Types and Deposit Requirements

The account types offered by Prime Digital Assets are as follows:

- STARTER ACCOUNT: Minimum deposit of $500

- CLASSIC ACCOUNT: Minimum deposit of £5,000

- PLATINUM ACCOUNT: Minimum deposit of £10,000

While these accounts appear to cater to different investment levels, there is no clear explanation of the specific trading conditions and benefits of each account. Investors are left without clear guidance on the differences between the account types. High deposit requirements, especially for the CLASSIC and PLATINUM accounts, could lead to significant risks, including fund freezes or losses for investors.

Moreover, key trading information such as leverage, commissions, and withdrawal rules are not clearly outlined on the website, making it difficult for investors to evaluate whether the platform’s services meet their needs or assess the risks associated with each account.

4.2 Simplified Account Registration Process and Risks

Prime Digital Assets has a very simple account registration process, requiring users to fill out a basic form and submit identity verification documents. While this may seem convenient, it also suggests that the platform has a lax approach to user identity verification. Legitimate financial platforms implement strict KYC (Know Your Customer) procedures to verify users’ identities and ensure compliance with anti-money laundering laws.

Simplified registration might indicate that the platform lacks necessary customer identity checks, making it easier for illegal activities such as money laundering or fund transfers. It also increases the risk for ordinary investors, as funds could be misused by the platform.

Another risk is that unregulated platforms with simple registration procedures often have poor customer protection measures. Once investors deposit funds, the platform may employ various tactics to delay or refuse withdrawal requests. Investors should be extremely cautious of the simplified registration process and the potential risks associated with it.

5. Lack of Transparency in Spreads and Leverage Information

5.1 Opaque Spread, Leverage, and Commission Information

Prime Digital Assets does not clearly disclose details on spreads, leverage, or commission structures on its website. This information is essential for traders to evaluate the costs associated with trading. Spreads determine the cost of each trade, leverage amplifies potential profits or losses, and commissions impact overall profitability.

Without clearly listing spreads and commissions, investors are unable to gauge actual trading costs. Even worse, unregulated platforms like Prime Digital Assets often impose hidden fees or use non-transparent fee structures, increasing trading costs. Investors may encounter unexpected high costs after trades are completed, making it difficult to avoid losses in advance.

5.2 The Dangers of High Leverage

Although Prime Digital Assets does not publicly disclose its leverage ratio, unregulated platforms often offer extremely high leverage to attract investors into risky trades. High leverage can magnify profits but also significantly increases losses. During market volatility, highly leveraged accounts can be wiped out, leading to severe financial losses.

Most regulated markets impose limits on leverage ratios to protect investors from excessive risk. For example, the European Securities and Markets Authority (ESMA) caps retail forex leverage at 1:30, and the Australian Securities and Investments Commission (ASIC) has limits between 1:30 and 1:50. Unregulated platforms like Prime Digital Assets, however, often offer leverage as high as 1:500 or more, greatly increasing the risk to investor funds.

6. Conclusion

The analysis of Prime Digital Assets reveals numerous high-risk factors. First, the platform’s short domain registration time means it has limited operational history. Second, its registration information is inconsistent, with a claimed headquarters in New York but operations in London. Third, the platform has received a regulatory warning from the FCA for offering unauthorized financial services. Additionally, its account types are vague, trading conditions lack transparency, and the platform likely offers high-risk leverage without regulation.

Investors should prioritize platforms regulated by well-known financial authorities such as the FCA, ASIC, or CySEC to ensure fund safety and transparent trading. Prime Digital Assets, with its lack of regulation and numerous risk indicators, is not a trustworthy option for investors.

FAQ

- Is Prime Digital Assets regulated?

No, Prime Digital Assets is not regulated by any financial authority and has been listed on the FCA’s warning list. - When was Prime Digital Assets’ domain registered?

The platform’s domain was registered on August 3, 2023, indicating a short operating history with little market validation. - What account types does Prime Digital Assets offer?

The platform offers three account types: STARTER ACCOUNT (minimum deposit $500), CLASSIC ACCOUNT (minimum deposit £5,000), and PLATINUM ACCOUNT (minimum deposit £10,000), but its trading conditions are unclear. - Does Prime Digital Assets disclose spreads and leverage information?

No, Prime Digital Assets does not publicly disclose spread, leverage, or commission details, exposing investors to unclear costs and risks. - Is Prime Digital Assets’ registration information reliable?

No, the platform claims to be headquartered in New York but operates from London and fails to provide credible registration documentation. - How do I choose a safe trading platform?

Investors should select platforms regulated by globally recognized financial authorities such as the FCA, CySEC, or ASIC to ensure transparency and fund security while avoiding unregulated platforms like Prime Digital Assets.