This article provides an in-depth analysis of Arena Trading’s corporate background, false regulatory claims, margin risk, and the importance of regulation to help investors understand the platform’s potential risks.

I. Overview

Arena Trading is a broker offering forex, commodities, and indices trading services, aiming to provide investors with a wide range of trading options. According to its official website, the company is registered in Australia and claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, upon further investigation, significant doubts arise regarding the company’s regulatory status and legitimacy.

While Arena Trading offers multiple account types and has a domain registered for several years, investors should remain cautious about its transparency, regulatory protection, and the safety of funds. This article will analyze various issues surrounding the platform to help investors make more informed decisions.

II. Domain and Registration Information

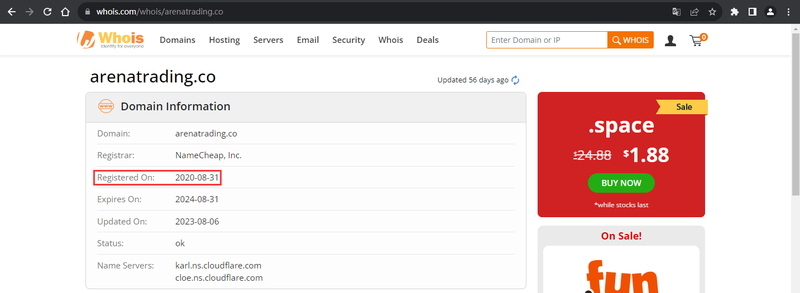

According to a Whois search, the domain for Arena Trading’s official website (https://www.arenatrading.co/) was registered on August 31, 2020, giving it over three years of registration history. Compared to many emerging forex platforms, a longer domain history might increase the platform’s credibility to some extent. However, domain registration length does not guarantee operational legitimacy.

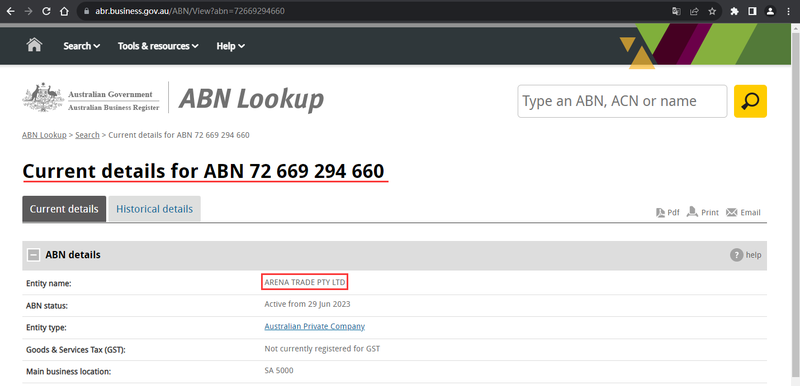

The company claims registration in Australia and holds authorization from the Australian Business Registry (ABN), and checks confirm the registration is genuine. However, a more important issue is whether the platform follows strict regulations and its financial services meet investors’ safety requirements.

III. False Regulatory Claims

Arena Trading claims ASIC regulation, but it actually holds only an Authorized Representative (AR) license, not a direct ASIC regulatory license. This means Arena Trading lacks full ASIC regulation and operates as an authorized representative of MGF Capital Pty Ltd.

Further investigation reveals that MGF Capital Pty Ltd sells such AR licenses to multiple companies, including Arena Trading. This practice allows these firms to use the license for marketing without being genuinely regulated, which can mislead investors. AR licenses offer weaker regulatory oversight, and investors lack the protection that fully ASIC-regulated companies provide.

Even more concerning, MGF Capital Pty Ltd has no substantial relationship with these authorized representatives, including Arena Trading. The companies purchase the license for promotional purposes, without strict monitoring of their operations and management. This increases the risk of potential fraud and puts investors’ funds in jeopardy.

IV. Risks of No Margin Information

Arena Trading’s website offers three different account types: Lite Account, Standard Account, and Premium Account. While the site details the differences in minimum deposits, trading products, spreads, and commissions, it provides no information on margin requirements.

The absence of margin information poses significant risks for investors. Margin is crucial in forex trading as it determines the efficiency of fund usage and risk levels when holding positions. Without clear margin guidelines, traders may struggle to manage risks effectively, increasing the likelihood of account liquidation during market volatility.

Lacking transparency in margin requirements also prevents investors from assessing how much capital is needed to maintain positions under varying market conditions, further complicating risk management and decision-making.

V. Importance of Margin and Regulation

Margin is a key mechanism in financial markets used to control risk. Appropriate margin requirements ensure that traders have enough funds to maintain positions during market fluctuations, reducing the risk of margin calls and liquidation. Proper margin policies also help investors allocate their funds wisely and protect them from significant losses during volatile market periods.

Regulation plays a crucial role in enforcing margin requirements and trading rules. In well-regulated markets, regulatory bodies mandate brokers to disclose detailed margin policies and ensure their operations meet investor protection standards. This oversight enhances transparency and minimizes trading risks.

Since Arena Trading operates under an AR license without clear margin guidelines, its risk management and fund protection measures are significantly lacking. Compared to fully regulated brokers, Arena Trading falls short in offering the necessary safeguards, and investors should be cautious about its platform’s safety.

VI. Conclusion

In summary, while Arena Trading offers multiple account types and a wide range of trading products, its lack of regulatory transparency, use of misleading licenses, and absence of margin information all significantly increase investment risks. The AR license it operates under offers weak regulatory oversight, and its use of third-party licenses for marketing purposes raises concerns of potential fraud. As a result, investors’ fund security and the platform’s transparency are hard to guarantee.

When choosing a trading platform, investors should prioritize brokers that are strictly regulated, transparent, and have strong fund protection measures. Although Arena Trading appears legitimate on the surface, its lack of regulatory oversight and use of misleading licenses make it a high-risk platform. Investors should exercise extreme caution when using this platform and avoid making large trades without verifying its regulatory status.

FAQ

- Is Arena Trading strictly regulated?

Arena Trading claims to be regulated by ASIC, but it only holds an AR license, offering weaker oversight and lacking full protection. - What are Arena Trading’s margin requirements?

The platform’s website does not provide any information on margin requirements, increasing the risk for investors. - How does an AR license differ from direct regulation?

AR licenses offer weaker oversight, as licensed companies operate as authorized representatives rather than being subject to the strict regulations that fully licensed brokers face. - Why does the lack of margin information pose a risk?

Without margin details, investors cannot assess the capital required to maintain positions, increasing the risk of mismanagement and liquidation during market volatility. - Is Arena Trading suitable for beginner investors?

Due to its low regulatory transparency and high risks, beginner investors should avoid making large trades on this platform. - How can I choose a safe forex trading platform?

Look for brokers that are strictly regulated, offer transparency, secure fund protection, and provide detailed trading rules and margin information.