FAIR LANE claims to offer forex and CFD trading services, but its lack of regulation and transparency, particularly regarding financial information and trading conditions, poses significant risks for investors.

Company Background Overview

FAIR LANE is a forex and contract for difference (CFD) broker based in Phnom Penh, Cambodia. The company claims to offer a variety of financial trading services, including forex and precious metals, aiming to attract international traders. Its website states that it does not provide services in certain regions, including the United States, Canada, North Korea, Japan, Iran, and others, suggesting possible regulatory or legal restrictions in those jurisdictions.

According to the company’s website, FAIR LANE’s entity is registered as Fair Lane Ltd, with an office address at Building 36, St. 169, Sangkat Veal Vong, Khan 7 Makara, Phnom Penh, Cambodia. The company claims to be authorized and regulated by the Securities and Exchange Regulator of Cambodia (SERC), which would provide a legal framework for its operations. However, further investigation reveals serious discrepancies regarding its regulatory status.

Registration Information and False Regulatory Claims

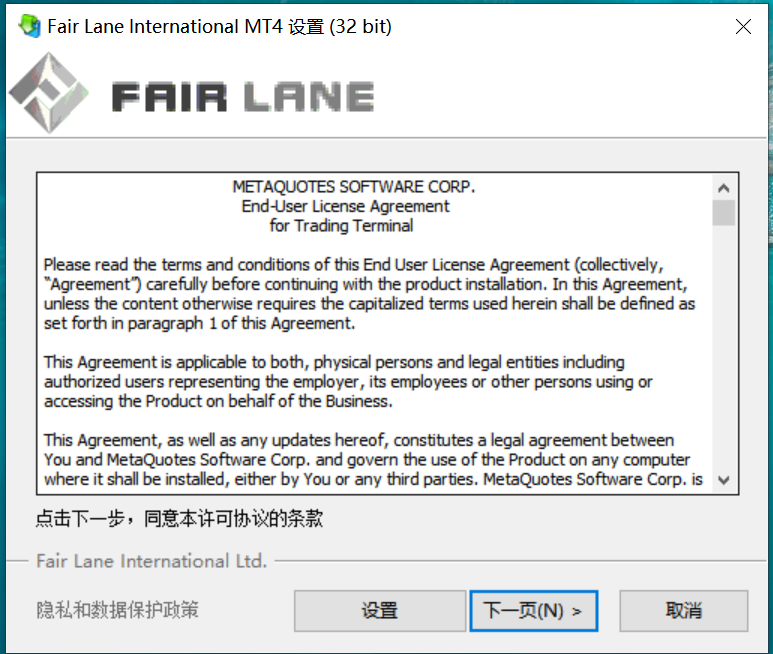

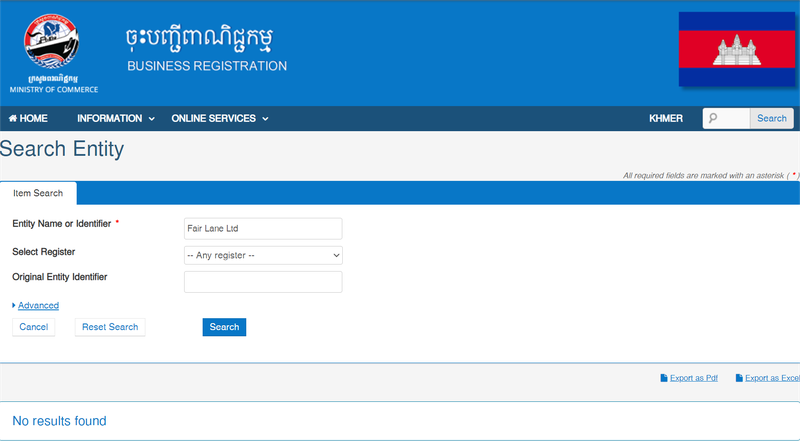

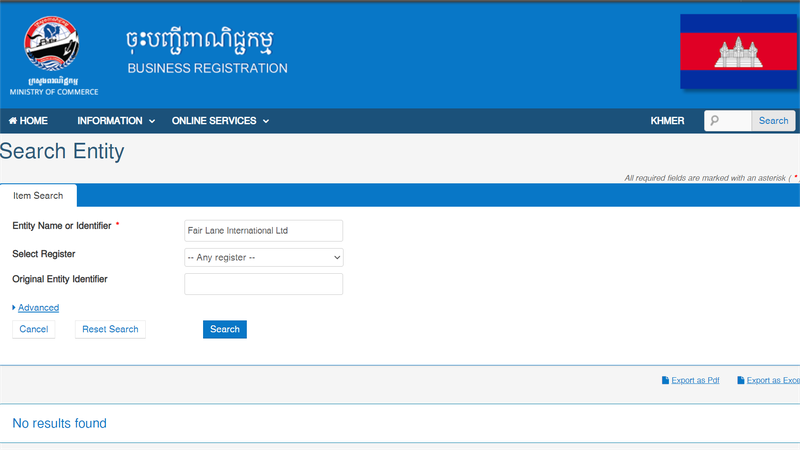

FAIR LANE claims that its entity, Fair Lane Ltd, is regulated by the Securities and Exchange Regulator of Cambodia (SERC). However, after further research, it became clear that this claim is misleading. The MetaTrader 4 (MT4) download link provided on its website shows that the server is operated by a different entity, Fair Lane International Ltd, rather than the listed Fair Lane Ltd. This discrepancy raises concerns about the transparency and legitimacy of its corporate structure.

More importantly, a check with the Cambodia business registry and SERC’s list of authorized derivatives brokers revealed no records for either Fair Lane Ltd or Fair Lane International Ltd. Furthermore, these entities are also absent from major international financial regulatory databases, confirming that FAIR LANE operates without proper regulation.

The lack of regulatory oversight means that FAIR LANE operates outside the purview of financial laws designed to protect investors. Without regulation, investors face greater risks of fraud, mismanagement, or the platform suddenly shutting down with limited recourse. For any forex broker, regulatory status is a fundamental factor in ensuring the safety of client funds and the broker’s adherence to fair trading practices.

Lack of Transparency in Financial Information

Transparency is critical for building trust in the financial markets, but FAIR LANE falls short in this area. The platform does not provide clear information about account types, spreads, leverage, minimum/maximum trade sizes, maximum positions, or trading commissions. This lack of key financial details increases the risks for potential investors, as they cannot properly assess the true costs or risks of trading on the platform.

- Missing Account Types Information

FAIR LANE does not mention the types of accounts it offers. As a result, investors cannot determine whether the platform provides accounts suited to their trading needs. Reputable brokers typically offer different account options, such as standard, ECN, or VIP accounts, each with distinct features and cost structures. - Missing Spreads and Trading Fees

Spreads directly impact trading costs, but FAIR LANE provides no information about the spreads it offers. Additionally, there is no mention of trading commissions, leaving investors in the dark about potential hidden fees. Unclear cost structures can lead to higher-than-expected trading expenses, affecting profitability. - Leverage Ratios and Risk Management

Leverage is a critical factor in forex trading, allowing traders to control larger positions with less capital. However, FAIR LANE has not provided any details on its leverage policies, leaving traders unable to properly assess their risk. High leverage can magnify both potential profits and losses, and well-regulated brokers typically impose strict leverage limits to protect clients. - Hidden Deposit and Withdrawal Policies

FAIR LANE has not disclosed information on its minimum deposit requirements or withdrawal policies. For traders, knowing these details is crucial for managing their funds effectively. Hidden withdrawal conditions or high fees can complicate fund management and erode profits.

Without transparency in these key areas, investors cannot accurately evaluate the potential risks and costs of trading on the FAIR LANE platform, which adds significant uncertainty to their investment decisions.

The Importance of Leverage and Minimum Deposits

Leverage is a powerful tool in forex trading, allowing traders to control larger market positions with a smaller amount of capital, thereby increasing profit potential. However, high leverage also brings significant risks, especially during periods of market volatility. Most reputable brokers provide detailed information on leverage levels to help traders manage risk effectively.

FAIR LANE does not provide any information about its leverage ratios, which is a red flag for potential investors. Without knowing the leverage available, traders may find themselves exposed to risks they cannot properly assess, especially in volatile markets.

Additionally, FAIR LANE has not disclosed its minimum deposit requirements. For investors, knowing the minimum deposit is essential, particularly for beginners or those with limited capital. Brokers usually set different minimum deposit levels based on account types, and this information helps traders decide whether the platform suits their financial goals. The absence of this key detail further increases the platform’s risk profile.

What Should a Legitimate Financial Platform Provide?

A trustworthy forex trading platform should meet several key criteria:

- Regulation and Legitimacy

A legitimate broker must be regulated by a recognized financial authority, such as the UK’s Financial Conduct Authority (FCA) or Australia’s Securities and Investments Commission (ASIC). Regulatory oversight ensures that the broker adheres to financial laws and protects client funds. - Transparent Trading Conditions

A reliable platform should provide clear information about account types, spreads, leverage, commissions, and minimum/maximum trade sizes. Any hidden fees or vague terms can jeopardize investors’ funds. - Segregation of Funds and Security

Regulated brokers typically separate client funds from their operational accounts, ensuring protection for client money in case of company insolvency or financial issues. - Long-Term Operating History

Brokers with a long-standing track record in the market often have a proven reputation for reliability and professionalism. Investors should prioritize brokers with a stable market presence. - Effective Customer Support

A legitimate broker will offer timely and responsive customer support to help clients with technical, financial, or trading-related issues. Good customer service ensures that traders can resolve problems quickly. - Secure Trading Platforms

Reputable brokers provide access to well-known and secure trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These platforms offer robust tools for trading and analysis while maintaining high security standards.

FAIR LANE fails to meet several of these criteria, particularly in terms of regulation and transparency, making it a risky choice for investors.

While FAIR LANE claims to offer global forex and CFD trading services, its lack of transparent regulatory information, unclear financial conditions, and absence of critical trading details make it a high-risk platform. Although it provides a variety of financial products, the lack of regulation and transparency significantly exposes investors to potential fraud, mismanagement, or unexpected platform closures.

In the competitive world of forex trading, investors should prioritize brokers that offer clear regulatory oversight, transparent trading conditions, and a proven track record. FAIR LANE fails to meet these essential standards, making it difficult to trust. Investors should exercise caution when considering this platform to avoid potential exposure to an uncertain and high-risk trading environment.

FAQ

1. Is FAIR LANE regulated?

FAIR LANE claims to be regulated by the Securities and Exchange Regulator of Cambodia (SERC), but no records of the company can be found, indicating it is not regulated.

2. What is the minimum deposit required by FAIR LANE?

FAIR LANE has not disclosed any minimum deposit requirements on its website, leaving potential clients uncertain about the entry costs.

3. Does FAIR LANE provide information on leverage and spreads?

No, FAIR LANE has not provided any details about leverage, spreads, or other key trading costs, making it harder for traders to assess risks.

4. How long has FAIR LANE been in operation?

FAIR LANE has a limited operational history with no verifiable long-term track record, making it difficult to assess its market performance.

5. Is it safe to trade with FAIR LANE?

Due to its lack of regulation, lack of transparency, and failure to disclose key trading conditions, trading with FAIR LANE carries significant risks. Investors should proceed with caution.

6. What trading platform does FAIR LANE use?

FAIR LANE uses the MetaTrader 4 (MT4) platform, but the server is operated by the unregulated Fair Lane International Ltd.