Ascuex is a newly established forex broker, but concerns over its regulatory transparency and the risks of high-leverage trading have raised doubts about its safety.

Company Overview

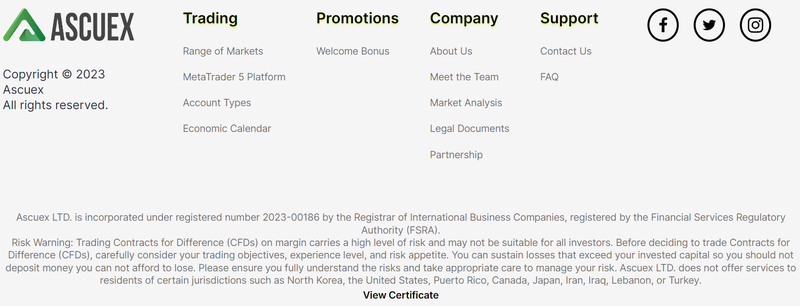

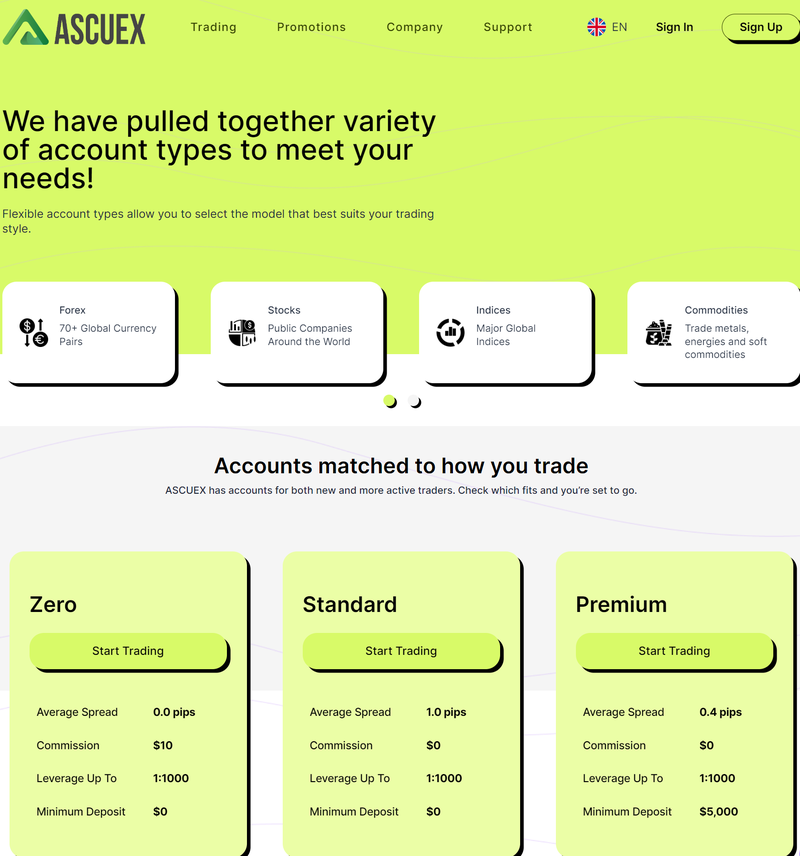

Ascuex is a forex broker founded on May 18, 2023, registered in Saint Lucia. The company offers global investors a variety of financial trading services, including forex, stocks, commodities, indices, and cryptocurrencies. Ascuex serves a wide range of traders by providing access to multiple financial instruments. However, it restricts services to certain jurisdictions, including North Korea, the United States, Puerto Rico, Canada, Japan, Iran, Iraq, Lebanon, and Turkey, due to local laws and regulations.

As a new forex broker, Ascuex promises competitive trading conditions, including leverage of up to 1:1000. However, given the company’s short history and issues surrounding its regulatory transparency, many investors have raised concerns about its credibility.

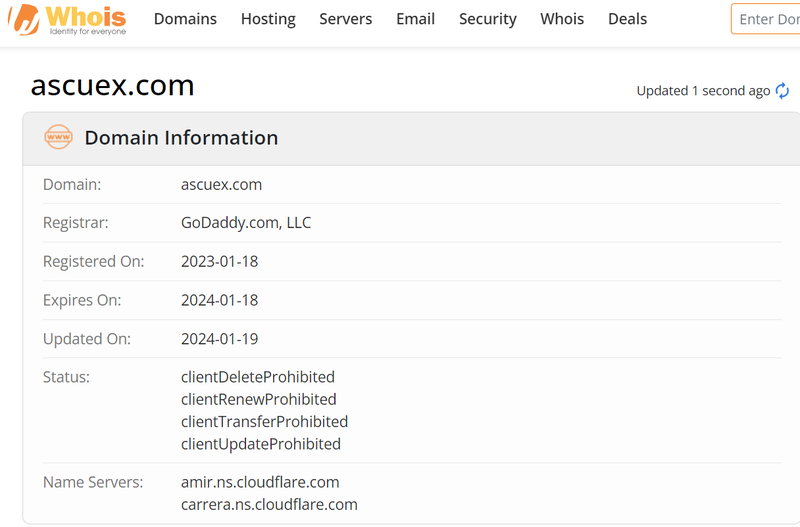

Domain Information

Whois data shows Ascuex registered its website domain on January 18, 2023, just a few months before the company officially launched in May. Despite the recent domain registration, the company has only been in operation for a short period. With less than a year in the market, investors may question the broker’s experience and long-term stability.

In the forex market, well-established brokers build investor trust through a proven track record and long operational history. The limited duration of Ascuex’s operations may cause some investors to doubt its long-term reliability and legitimacy.

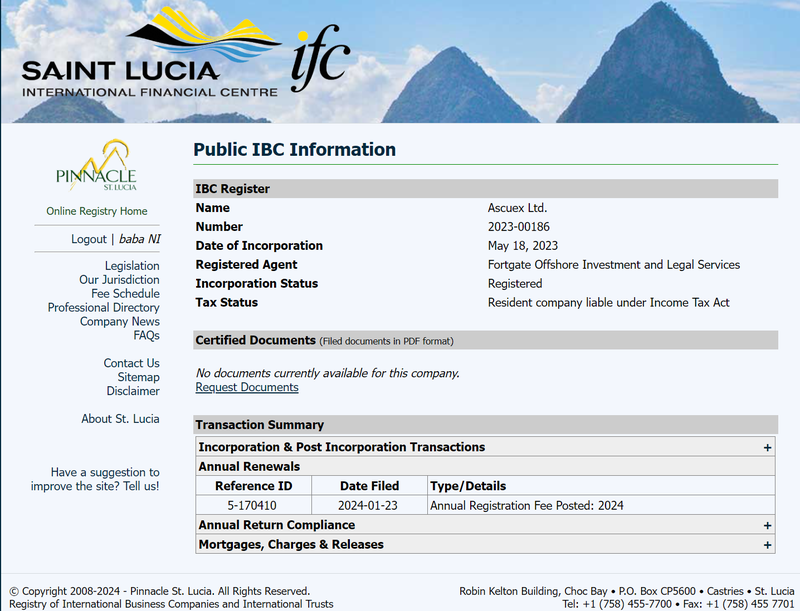

Registration Information

Ascuex’s website states that Ascuex Ltd registers with the Saint Lucia International Business Companies and Trust Registry (IFC) under registration number 2023-00186. The company’s address is Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia. It also claims to register with the Financial Services Regulatory Authority (FSRA) of Saint Lucia, implying compliance with local regulations.

However, further investigation reveals that while the company is listed in the Saint Lucia International Business Companies and Trust Registry (IFC), it is not registered with the Saint Lucia FSRA. This means that Ascuex does not have official financial regulatory oversight from the FSRA. Additionally, searches in other international financial regulatory databases did not yield any results for this company.

The lack of clear financial regulation raises significant concerns for investors regarding Ascuex’s fund safety, transparency, and overall credibility. Regulation is essential in ensuring that brokers operate legally and that investor funds are protected. Ascuex’s regulatory gaps significantly increase the risks associated with its operations.

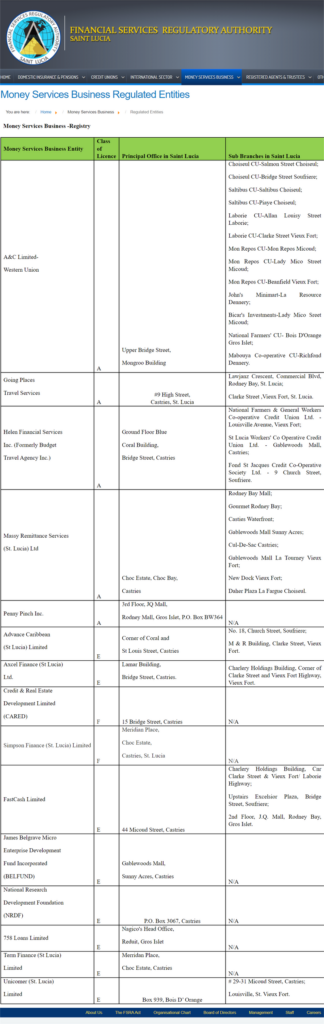

False Regulatory Information

Ascuex claims to be regulated by the Financial Services Regulatory Authority (FSRA) of Saint Lucia. However, upon checking, the company does not appear in the FSRA’s registry, indicating that its regulatory claims are inaccurate or misleading. For investors, regulatory oversight is crucial to ensure fund safety, provide a legal framework for resolving disputes, and ensure brokers comply with strict standards.

For unregulated forex brokers, there is significant uncertainty about the protection of client funds. Without proper regulation, investors risk having their deposits inadequately segregated, and disputes may not be effectively resolved. The false regulatory claims by Ascuex significantly damage its reputation and raise questions about its trustworthiness.

Risks of High Leverage

Ascuex offers clients leverage of up to 1:1000. High leverage allows investors with smaller capital to increase their trading size, potentially boosting profits. However, it also poses significant risks, especially in the highly volatile forex market. The higher the leverage, the greater the potential losses investors could face.

With high leverage, even small market movements can have a major impact on an investor’s account. If the market moves against a trader’s position, losses can accumulate quickly, and the account may be wiped out, known as a margin call or stop-out. While high leverage can increase profit potential, it also significantly amplifies the risk of large losses, particularly for inexperienced traders.

Reasonable Leverage Limits

Leverage in the forex market typically ranges from 1:30 to 1:500, depending on regulatory requirements and broker policies. Lower leverage, such as 1:30, is common in heavily regulated markets, where restrictions are put in place to protect investors from excessive risk. Higher leverage, like 1:500 or more, is more common in loosely regulated or unregulated markets, targeting speculative traders seeking higher returns.

Ascuex’s 1:1000 leverage exceeds the limits set by most regulatory authorities, exposing traders to greater risk. When opting for high leverage, traders must carefully manage their risk, maintain strict control over their positions, and ensure they are prepared for market volatility.

Although high leverage can offer opportunities for experienced traders, a leverage range of 1:100 to 1:500 is generally considered more reasonable and safe for most investors. Regulatory authorities impose leverage caps to safeguard investors from losing substantial amounts in highly volatile market conditions.

Conclusion

Ascuex is a newly established forex broker offering leverage up to 1:1000 and various trading services. However, the lack of transparent regulation and unclear fund safety measures raise doubts about its credibility in the financial market. For a trading platform, transparent regulation and proper fund protection are fundamental requirements, and Ascuex’s shortcomings in these areas mean that investors should exercise caution when considering this broker.

Before choosing Ascuex for forex trading, investors should fully understand the risks involved, particularly those related to the lack of proper regulation and the potential for significant losses due to high leverage. For those seeking long-term investment security, opting for a regulated broker with clear protection mechanisms is a safer and more reliable approach.

FAQ

- Is Ascuex regulated?

Ascuex claims to be regulated by the Financial Services Regulatory Authority (FSRA) of Saint Lucia, but checks show that the company is not registered with the FSRA. - What types of trading services does Ascuex offer?

Ascuex provides trading services for forex, stocks, commodities, indices, and cryptocurrencies. - What is the maximum leverage offered by Ascuex?

Ascuex offers a maximum leverage of 1:1000. - What are the risks of high-leverage trading?

High-leverage trading can magnify profits but also increases the risk of significant losses, especially during market volatility, which can result in rapid account depletion. - How secure are funds with Ascuex?

Since Ascuex lacks reliable regulation, its fund security mechanisms are unclear, posing a risk to investors. - Is Ascuex suitable for beginner traders?

Ascuex’s high leverage poses significant risks, particularly for inexperienced traders. It is advisable for beginners to be cautious.