Spacxtrade claims to be a multi-regulated forex broker offering various financial markets, but its false regulatory information, questionable registration background, and unclear account terms expose investors to significant financial risks.

1. Company Overview

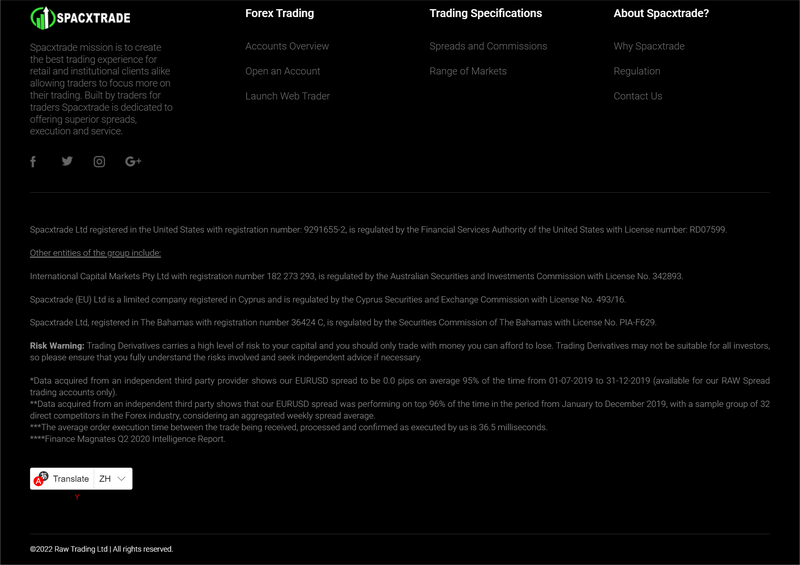

Spacxtrade is a forex broker with its website registered on March 20, 2024, claiming to offer access to various markets, including forex, commodities, indices, bonds, cryptocurrencies, stocks, and futures. Spacxtrade states that it operates through well-known trading platforms such as MT4, MT5, and cTrader, providing users with efficient and convenient trading tools. These platforms are widely recognized for their stability and versatility in global financial markets.

However, Spacxtrade explicitly states that it does not offer services in the U.S., Canada, Israel, New Zealand, Japan, and Iran. These regions often have stricter regulations, and this limitation may indicate potential issues with Spacxtrade’s regulatory compliance.

According to its website, Spacxtrade lists several registered entities across different countries, such as the U.S., Australia, Cyprus, and the Bahamas, all claiming to be regulated by relevant authorities. However, further investigation reveals significant discrepancies in these claims, with much of the information being fabricated or stolen from legitimate companies. This raises red flags for potential investors.

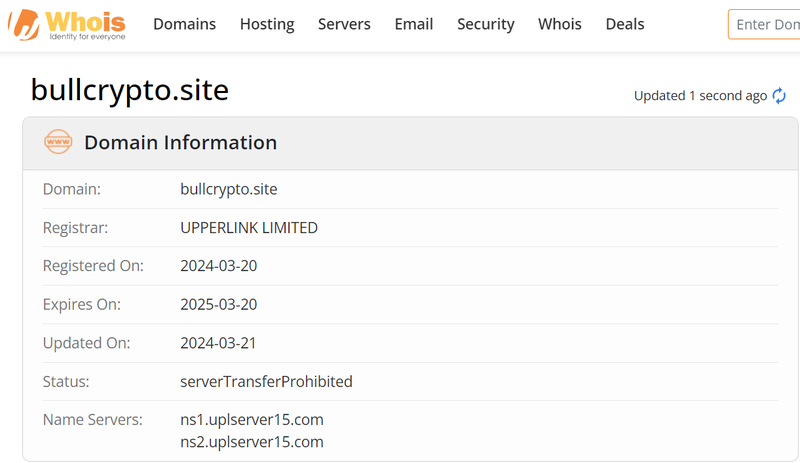

2. Doubts About Domain Information

Spacxtrade’s domain was registered on March 20, 2024, indicating that the platform is quite new. A newly established platform often struggles to build market reputation and collect user feedback within such a short timeframe, creating uncertainties about the safety of investors’ funds. Typically, well-established trading platforms have years of operational experience and customer reviews that help attract investors. In contrast, a new platform like Spacxtrade lacks the historical data needed for investors to assess its reliability.

The long-term stability of a financial platform is critical for investors. Engaging with a platform that has a short registration history and no feedback puts investors’ funds at significant risk. This is particularly concerning for those looking to make large or long-term investments, as the platform’s track record is often a key factor in evaluating its trustworthiness.

It is also important to note that many financial scam platforms register domains for a short period, making quick gains before disappearing, leaving investors unable to recover their losses. Given that Spacxtrade is a new platform, its background and operational history warrant further scrutiny.

3. False Regulatory Information

Spacxtrade claims to be regulated by several international financial authorities, including the “Financial Services Authority of the United States,” the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Securities Commission of the Bahamas (SCB). Furthermore, Spacxtrade claims to have registered entities in these countries. However, in-depth investigations reveal that much of this regulatory information is false or stolen from legitimate companies.

First, Spacxtrade claims its U.S. entity is regulated by the “Financial Services Authority of the United States,” but no such regulatory body exists. The main financial regulators in the U.S. are the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), but Spacxtrade has not obtained any licenses from these authorities.

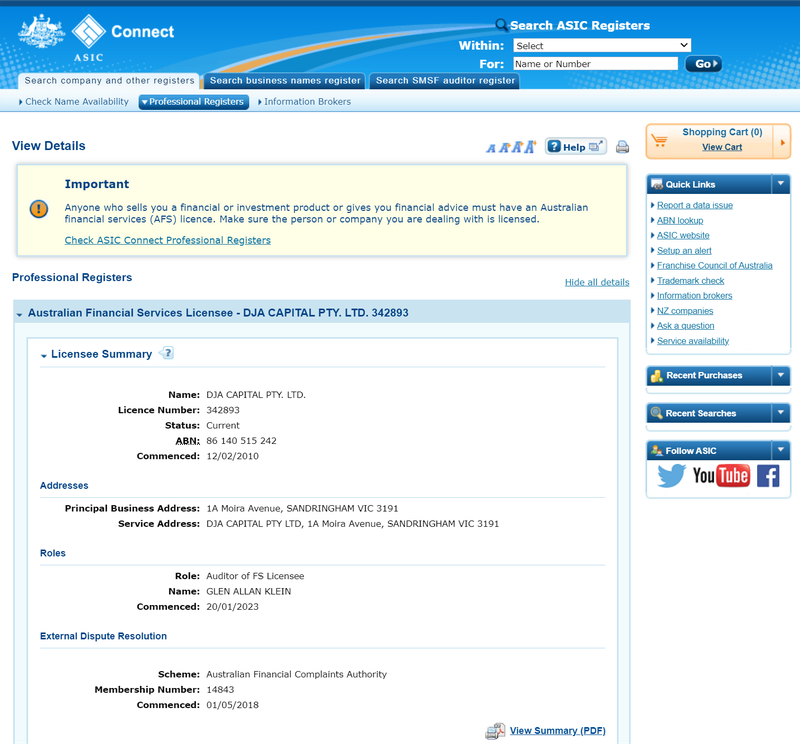

Second, Spacxtrade claims its Australian entity is International Capital Markets Pty Ltd, which holds an ASIC license. However, the actual International Capital Markets Pty Ltd is a legitimate company operating under IC Markets, with no connection to Spacxtrade. This indicates that Spacxtrade is attempting to deceive investors by using IC Markets’ registration information to falsely claim ASIC regulation.

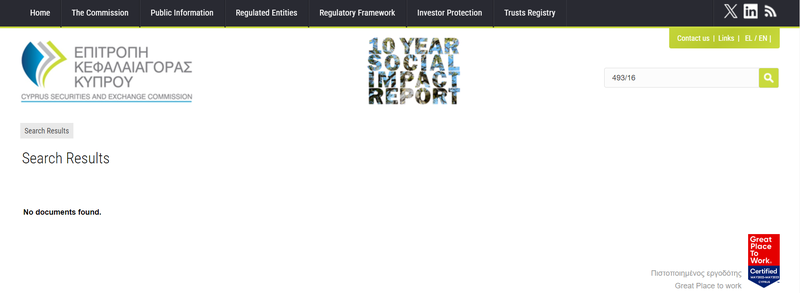

Similarly, Spacxtrade’s claimed CySEC license cannot be found on the official CySEC website. As for its Bahamas entity, the SCB regulatory information provided by Spacxtrade is also unverifiable. Furthermore, the Spacxtrade website footer shows that the platform’s copyright belongs to Raw Trading Ltd, which is affiliated with IC Markets, suggesting that Spacxtrade has stolen information from legitimate businesses to mislead investors.

False regulatory information presents a significant risk to investors. In regulated financial markets, licensed companies are subject to strict audits and compliance requirements, ensuring the safety of investors’ funds. However, Spacxtrade’s false claims of regulation mean that the platform is operating without any oversight, leaving investors with no legal recourse if their funds are lost.

4. Analysis of Registration Information

Upon examining Spacxtrade’s registration claims, it becomes clear that most of the information is fabricated or borrowed from other legitimate entities. The platform claims to have registered entities in the U.S., Australia, Cyprus, and the Bahamas, but further investigation reveals that much of this information is either false or unrelated to Spacxtrade.

For example, Spacxtrade claims its U.S. entity is registered with the number 9291655-2. However, this registration number does not exist in the U.S. regulatory database, and the “Financial Services Authority of the United States” is not a legitimate financial regulator.

In Australia, Spacxtrade claims that its entity, International Capital Markets Pty Ltd, operates under ASIC regulation. However, this is actually a registered entity of IC Markets, a legitimate broker, and Spacxtrade has no affiliation with this company. Additionally, Spacxtrade falsely uses the ASIC license number 342893, which belongs to DJA Capital Pty Ltd, a financial advisory company that has no connection to Spacxtrade.

Spacxtrade also claims to be regulated by CySEC under license number 493/16, but this number does not match any records on the official CySEC website. Moreover, its Bahamas entity’s SCB license information is also unverifiable. This pattern of using false or stolen regulatory information to mislead investors is a serious concern.

5. Trading Accounts and Fund Risks

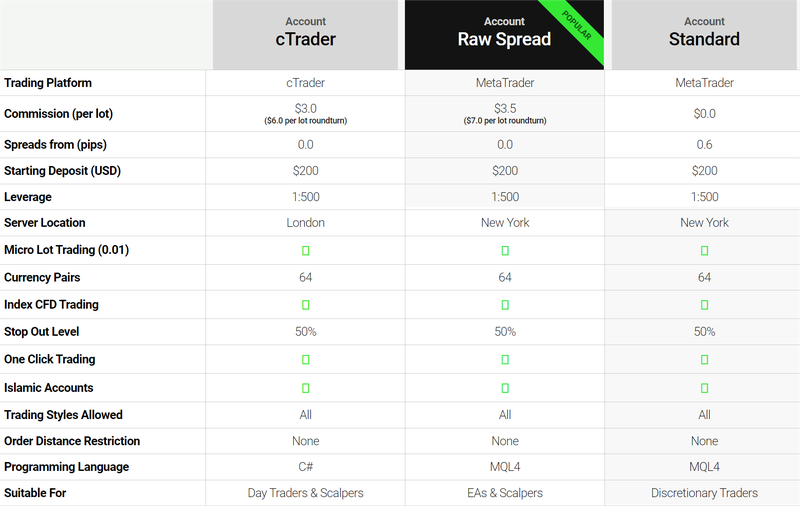

Spacxtrade offers three different types of trading accounts: cTrader Account, Raw Spread Account, and Standard Account. Each account type has varying trading conditions, such as spreads, commissions, leverage, and minimum deposit requirements. However, while these account types appear attractive on the surface, the risks associated with investing through Spacxtrade should not be ignored.

cTrader Account

- Trading platform: cTrader

- Commission: $3 per lot (round-turn $6)

- Spreads: From 0.0 pips

- Leverage: 1:500

- Minimum deposit: $200

- Server location: London

Raw Spread Account

- Trading platform: MetaTrader

- Commission: $3.5 per lot (round-turn $7)

- Spreads: From 0.0 pips

- Leverage: 1:500

- Minimum deposit: $200

- Server location: New York

Standard Account

- Trading platform: MetaTrader

- Commission: None

- Spreads: From 0.6 pips

- Leverage: 1:500

- Minimum deposit: $200

- Server location: New York

Although these accounts offer seemingly competitive trading conditions, such as low spreads and high leverage, the lack of legitimate regulation raises serious concerns about fund safety. If Spacxtrade manipulates trading prices, restricts withdrawals, or suffers from server issues, investors could face significant financial losses.

Case Study: Typical Financial Scam Operations

In the real financial markets, unregulated brokers often use false regulatory information and enticing trading conditions to attract investors. In 2019, a well-known forex scam platform promised high leverage and zero-spread accounts, attracting a large influx of deposits. Within a few months, the platform froze accounts, making withdrawals impossible, and eventually vanished with millions of dollars in investor funds. This case mirrors the behavior currently exhibited by Spacxtrade, highlighting the potential dangers.

The attractive trading conditions offered by Spacxtrade may be designed to lure investors, but behind these enticing offers could be the risk of losing all funds. Unregulated platforms often promise unrealistic advantages, but ultimately lock investors’ funds or vanish entirely. Given Spacxtrade’s lack of legitimate oversight, the risks associated with its accounts should not be taken lightly.

6. Financial Risks in the Market

In financial markets, choosing a regulated and transparent platform is crucial, particularly in forex and CFD trading. Unregulated platforms often lack safeguards for investor funds and may engage in practices such as price manipulation, withdrawal restrictions, or even account closures, resulting in significant financial losses for investors. Spacxtrade’s questionable registration and regulatory status significantly increase the likelihood that it may be a fraudulent platform.

While high leverage can amplify gains, it also increases market risk. If the platform itself is unregulated or engaged in fraudulent behavior, investors are exposed to more than just market volatility. For example, unregulated platforms may suddenly change trading rules or restrict withdrawals, leaving investors unable to recover their funds.

Similar scams are not uncommon in the market, particularly in high-leverage and CFD trading. Many platforms use promises of high returns to attract investors, only for those investors to lose their funds. Therefore, investors must ensure that any platform they choose is properly regulated by legitimate financial authorities.

Spacxtrade uses false regulatory claims and stolen registration information to conceal its true background and legitimacy. Investors should ensure that any forex trading platform they choose is properly regulated by recognized financial authorities, and should avoid platforms like Spacxtrade that lack transparency and regulatory oversight to prevent financial losses.

7. Spacxtrade Frequently Asked Questions (FAQ)

1. Is Spacxtrade a legitimate platform?

Spacxtrade’s registration and regulatory information is largely fabricated or stolen from other companies. Its legitimacy is highly questionable, and investors should exercise extreme caution.

2. What markets does Spacxtrade offer?

Spacxtrade claims to offer forex, commodities, indices, stocks, and futures. However, due to its lack of regulatory transparency, investors face significant risks when trading these markets.

3. Which regulators oversee Spacxtrade?

While Spacxtrade claims to be regulated by authorities such as ASIC and CySEC, these claims are false or stolen. The platform is not regulated by any legitimate financial authority.

4. What are the risks with Spacxtrade’s trading accounts?

Although Spacxtrade’s accounts appear to offer attractive conditions, the platform’s false regulatory information puts investors’ funds at serious risk, including the potential for withdrawal restrictions or fund misappropriation.

5. What are the main risks of investing with Spacxtrade?

The primary risks include false regulatory information, unclear account terms, and the possibility of frozen or inaccessible funds. These factors make it difficult for investors to trust that their money is safe.