MidasFX, a forex broker offering a variety of trading products, carries high risks due to its lack of transparency in registration and regulatory information.

Platform Background Overview

MidasFX is a forex broker that has been operational for several years, specializing in providing various financial derivative trading services. It mainly caters to global investors, offering trading products such as forex, metals, energy, cryptocurrencies, and indices. Although the platform aims to establish a global presence and allows clients to trade using multiple currencies, it has not disclosed its headquarters’ location, making its actual operational base and corporate background unclear.

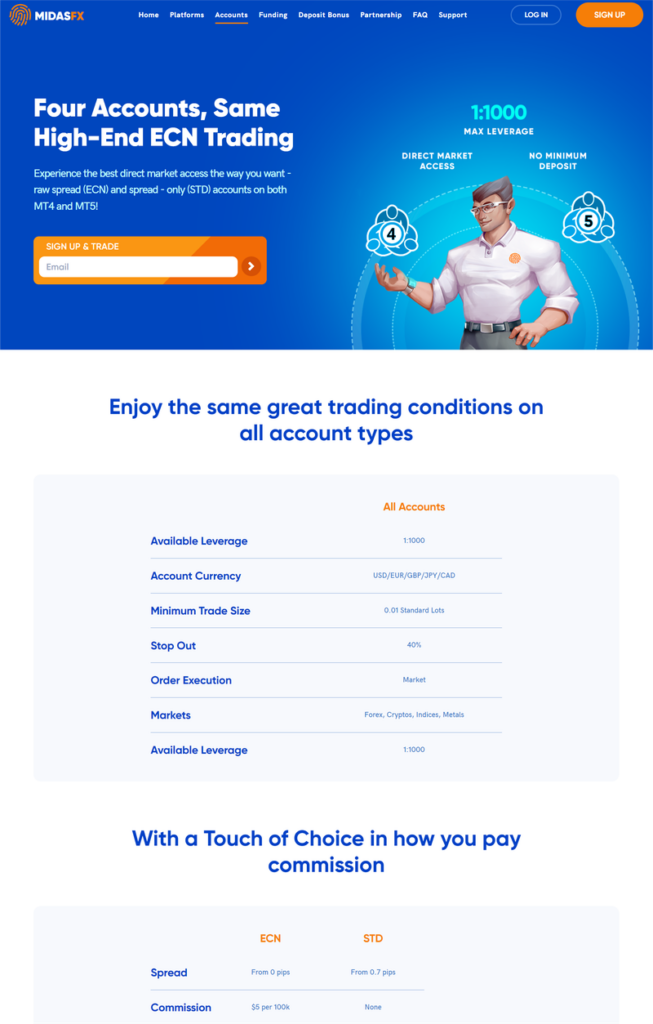

MidasFX offers a wide range of services, allowing investors to participate in market trading through its MT4 and MT5 platforms. It provides two types of accounts, ECN and STD, both of which offer leverage up to 1:1000. Additionally, MidasFX restricts access to certain jurisdictions, stating that it does not provide services in countries with strict financial regulations, such as the United States.

Despite MidasFX appearing to have been operating for years and offering a variety of services, its corporate background and legitimacy lack transparency in several key areas. These issues pose potential financial risks to investors, warranting caution when selecting this platform for trading.

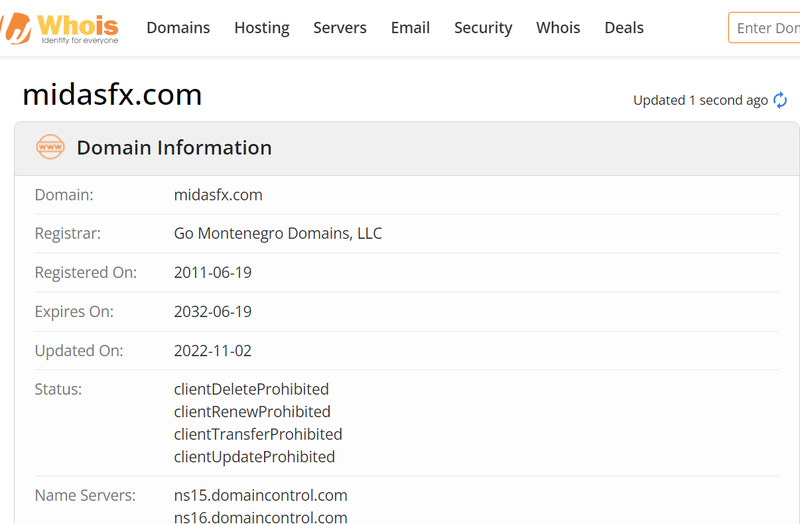

Domain Information

MidasFX’s website domain was registered on June 19, 2011, indicating that the platform has been in existence for quite some time. A long domain history can provide some reference value for assessing a platform’s stability and credibility. A domain that has been active for over ten years usually suggests that the platform has acquired operational experience and technical expertise.

However, domain registration duration alone is not sufficient to determine a platform’s legitimacy and security. While a long domain history can serve as a useful reference, it does not reveal the corporate structure, fund protection measures, or regulatory compliance of the platform. Therefore, investors should conduct a more thorough investigation of MidasFX’s registration, regulatory status, and fund protection mechanisms.

Registration Information and Risks

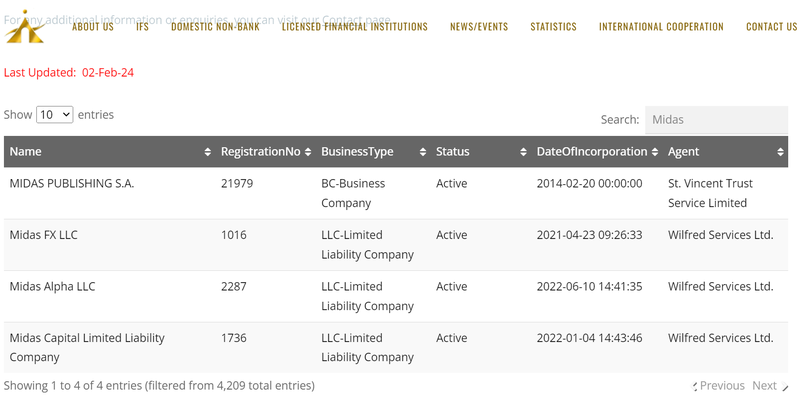

MidasFX’s website does not clearly disclose its corporate entity information. It only provides a company address located in Saint Vincent and the Grenadines, but does not reveal the specific company name or registration number. Publicly available information shows that the Financial Services Authority (SVGFSA) in Saint Vincent and the Grenadines lists a company named “Midas FX LLC,” with registration details matching MidasFX’s description. However, it remains unconfirmed whether this company operates the platform.

Even if Midas FX LLC is indeed the registered entity for MidasFX, having Saint Vincent and the Grenadines as the registration location introduces certain risks. The SVGFSA does not strictly regulate, monitor, or license companies engaged in forex or financial derivative trading. This means that although MidasFX may be legally registered, its financial activities are not subject to meaningful regulation. Such a regulatory vacuum poses obvious risks, particularly for trading platforms that handle investor funds. Without effective regulation, investor funds may not be adequately protected, and legal recourse may be limited in case of disputes.

Regulatory Concerns

One of MidasFX’s major issues is the lack of transparency regarding its regulatory information. The platform lists an address in Saint Vincent and the Grenadines but provides no financial regulation details. This is crucial because the forex and derivatives industry requires strict regulation to ensure client fund safety and proper trading practices.

The SVGFSA in Saint Vincent and the Grenadines explicitly states that it does not provide substantial regulation for forex brokers or CFD platforms. As a result, even if MidasFX’s registration appears in the SVGFSA database, no regulatory authority oversees its trading activities. This creates significant risk for investors, as resolving disputes or misconduct by the platform through legal means becomes challenging.

The regulatory status of a forex broker directly impacts the safety of investor funds and trading transparency. Top global regulators, such as the UK’s Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), impose strict regulations on forex brokers, including fund segregation, audit requirements, and anti-fraud measures. In contrast, MidasFX lacks such regulatory support, significantly increasing the risks for investors.

Account Types and Trading Concerns

MidasFX offers two main types of accounts: ECN and STD. Both accounts allow access through MT4 and MT5 platforms and offer leverage up to 1:1000. While such high leverage may appeal to experienced traders, it also presents considerable risks, particularly for beginners or those without solid risk management skills. This section details the concerns and potential risks associated with these account types.

1. ECN Account Concerns and Risks

The main appeal of the ECN account lies in its low spreads and high leverage. MidasFX claims that ECN accounts have spreads starting from 0 pips, with a trading commission of $5 per standard lot. This account allows trading in various financial instruments such as forex, cryptocurrencies, indices, and metals, attracting active traders seeking low trading costs.

(1) Sustainability of Ultra-Low Spreads and Market Fairness

- Concerns: Ultra-low spreads are highly sought after, especially for high-frequency traders, as they can significantly reduce trading costs. However, spreads starting from 0 pips are unusual, particularly in volatile market conditions, where it is nearly impossible to maintain such low spreads. Investors should be cautious about potential spread manipulation by the platform. Unregulated platforms may adjust spreads at will, especially during periods of high market volatility.

- Risks: Some platforms temporarily offer low spreads to attract customers, but spreads can suddenly widen during volatile markets, causing a significant increase in trading costs at critical times. Additionally, low spreads may hide other costs, such as hidden fees or high slippage. Slippage refers to the difference between the expected trade price and the actual executed price, and unregulated platforms are more likely to manipulate slippage, resulting in losses for investors.

(2) Dangers of High Leverage Trading

- Concerns: MidasFX offers leverage of up to 1:1000 for ECN accounts, allowing traders to control large positions with relatively small amounts of capital. While high leverage can amplify potential profits, it also dramatically increases the potential for losses. At 1:1000 leverage, even minor market fluctuations can result in significant losses.

- Risks: With excessive leverage, investors are highly susceptible to margin calls, causing their accounts to quickly deplete due to market volatility. For inexperienced traders, the allure of 1:1000 leverage can be tempting, but they may not fully understand the potential consequences. Worse, as MidasFX is unregulated, there are concerns about whether the platform handles margin settlements fairly if investors face sudden losses.

(3) Transparency of Order Execution

- Concerns: ECN accounts typically involve market execution, where trader orders are directly sent to liquidity providers. Without regulation, it’s unclear if MidasFX operates under an ECN structure or follows a “market maker” model, where the platform acts as the counterparty to trades, creating a conflict of interest risk.

- Risks: If the platform operates as a market maker, its interests may conflict with those of investors. The platform could manipulate prices or order execution speeds to increase its own profitability. Without regulation, the risk of unfair trading practices, such as price manipulation, order delays, or forced liquidations, becomes significantly higher.

2. STD Account Concerns and Risks

STD (Standard) accounts offer more relaxed trading conditions, with no trading commission but spreads starting from 0.7 pips. Although the trading costs are not as low as ECN accounts, the STD account also offers leverage of up to 1:1000 and supports trading in forex, cryptocurrencies, indices, and metals.

(1) Hidden Costs in “Commission-Free” Trading

- Concerns: MidasFX promotes the STD account as commission-free, but platforms usually compensate for this by widening spreads to maintain revenue. While the platform claims spreads start from 0.7 pips, spreads can exceed this level during periods of market volatility. Additionally, investors may not be fully aware of when and why spreads widen, especially on unregulated platforms where spread fluctuations may occur arbitrarily.

- Risks: For long-term investors, unpredictable spreads can significantly increase cumulative trading costs. Without regulation, the platform may profit by widening spreads or manipulating the trading environment, directly harming investors.

(2) Delays in Order Execution and Fairness of Trading

- Concerns: STD accounts use market execution, but MidasFX’s lack of strict regulation raises doubts about whether orders are executed fairly. Execution speed is particularly important for short-term traders, as any delays during volatile market conditions can lead to significant losses.

- Risks: Some platforms may deliberately delay or reject order execution to increase their profitability. In highly leveraged trading, even a few seconds of delay can result in large differences between the expected and executed price, further increasing trading costs.

(3) Stop-Loss Levels and Forced Liquidation Mechanisms

- Concerns: MidasFX sets a stop-loss level at 40%, appearing to be a risk management tool to limit losses. On unregulated platforms, stop-loss mechanisms may trigger or adjust arbitrarily. With the potential for conflicts of interest between the platform and its customers, stop-loss triggers and conditions may work against investors.

- Risks: The platform might arbitrarily trigger stop-loss levels or close positions prematurely, causing unnecessary investor losses. With high leverage and a 40% stop-loss, even small market changes can lead to significant losses. Without regulation, platforms can make forced liquidation decisions without external oversight, leading to frequent abuse on unregulated platforms.

Leverage Risks and Fund Management

MidasFX offers leverage of up to 1:1000 on both its ECN and STD accounts. Such extreme leverage allows investors to control large positions with relatively small capital. In many strictly regulated financial markets, such as Europe and the United States, financial regulators have already imposed leverage limits to prevent excessive risk. For example, the European Securities and Markets Authority (ESMA) limits leverage for retail clients to between 1:30 and 1:50.

The Double-Edged Sword of Leverage

- Concerns: High leverage amplifies both profits and losses. With 1:1000 leverage, even a 1% market move could result in the complete loss of an investor’s capital. MidasFX, being unregulated, does not adequately warn clients about the risks of high leverage and instead uses it as a way to attract customers.

- Risks: High leverage trading can make minor market fluctuations devastating, especially for novice investors without risk management skills. Unregulated platforms may not implement protective measures when clients face excessive risk, such as margin calls or early warnings, leaving investors highly vulnerable.

Conclusion

MidasFX has operated for years as a forex broker, offering various trading services and flexible account options. However, the lack of transparent corporate registration and financial regulation raises significant risks. Investors should be very cautious, especially when using high leverage or large capital, as fund security is a key concern.

MidasFX lacks the regulatory safeguards found in top globally regulated platforms, raising concerns about investor fund safety. In financial markets, choosing a regulated platform is crucial for fund security, and unregulated brokers like MidasFX should be avoided.

FAQ

- Where is MidasFX registered?

MidasFX provides an address in Saint Vincent and the Grenadines but does not fully disclose its registered entity details. - Is MidasFX regulated?

MidasFX is not regulated by any internationally recognized financial authorities. Saint Vincent and the Grenadines does not provide substantial regulation for forex trading activities. - What products does MidasFX offer?

MidasFX offers trading services in forex, metals, energy, cryptocurrencies, and indices. - What is MidasFX’s leverage?

MidasFX offers leverage of up to 1:1000 for both ECN and STD accounts. - How is MidasFX’s fund security guaranteed?

The lack of clear regulation and compliance mechanisms with MidasFX creates significant risks for fund security, offering no guarantees for investor protection. - Is MidasFX reliable?

MidasFX’s lack of transparency in its regulation and registration raises doubts about its reliability. Investors should exercise caution, especially when trading with high leverage.

More information:https://www.inves2win.com/