OBV Markets LLC offers trading services in forex, metals, energy, and indices, but its registration and regulatory information are uncertain, and investors should carefully consider the associated risks.

Company Overview

OBV Markets LLC is an online brokerage that provides trading services in forex, metals, energy, and indices. The company caters to a global market and supports multiple languages to facilitate user access. According to its official website, OBV Markets LLC claims to offer a wide variety of asset trading options, aiming to provide a seamless trading experience through a modern technological platform.

The company advertises its use of advanced trading technology and a broad range of market tools, attracting investors interested in forex, metals, and other assets. However, despite its seemingly comprehensive product offerings, there are significant questions surrounding OBV Markets LLC’s registration, regulation, and operational compliance, which may pose risks to potential investors.

Registration Information

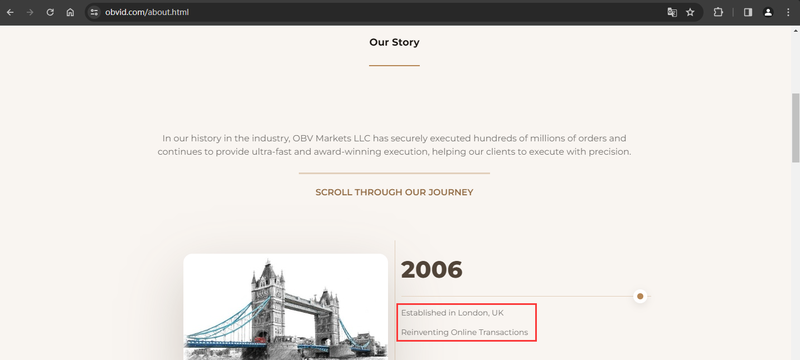

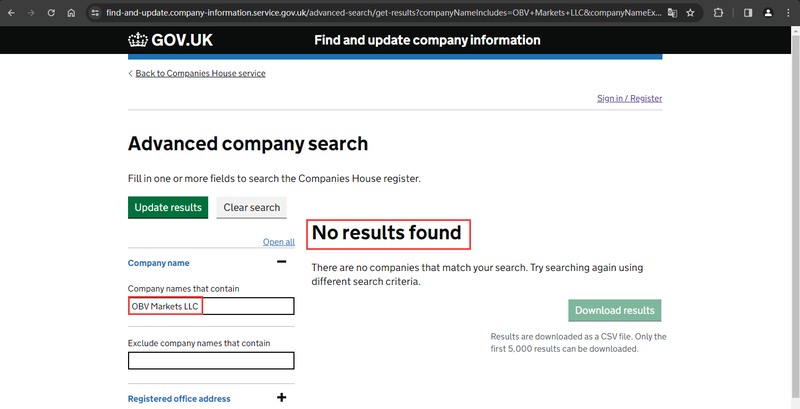

According to information from OBV Markets LLC’s website, the company claims to be registered in the United Kingdom. However, a search of the UK’s Companies House, which maintains public records of company registrations, reveals no registration records related to OBV Markets LLC. This indicates that, despite its claims, the company may not be legally registered in the UK, which raises concerns about its legitimacy.

A properly operating brokerage should have publicly accessible company registration information that can be easily verified in the relevant country’s registry. The lack of such records for OBV Markets LLC raises doubts about the company’s authenticity and whether its claimed registration aligns with reality. Investors should be aware that this could create legal or compliance risks in future transactions.

Domain Registration Information and Risks

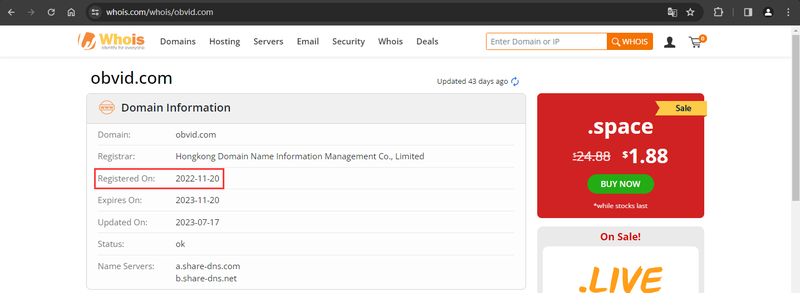

By performing a Whois search of the OBV Markets LLC domain, it is revealed that the website’s domain was registered on November 20, 2022. The domain has been active for less than a year, which may raise concerns about the company’s stability and reliability.

When choosing a trading platform, investors typically consider the platform’s operational history. While a newly registered domain and company may offer emerging opportunities, it also presents the challenge of a platform that has not yet been tested over time. Particularly in the financial sector, the stability and credibility of the platform are critical. OBV Markets LLC’s short operating history may lead investors to question whether the company can provide long-term, reliable services.

Additionally, although OBV Markets LLC’s website supports multiple languages, such as Traditional Chinese, English, Japanese, and Vietnamese, facilitating global use, the lack of transparency in its domain and registration information adds to the potential risk behind the company.

Uncertainty in Regulatory Information

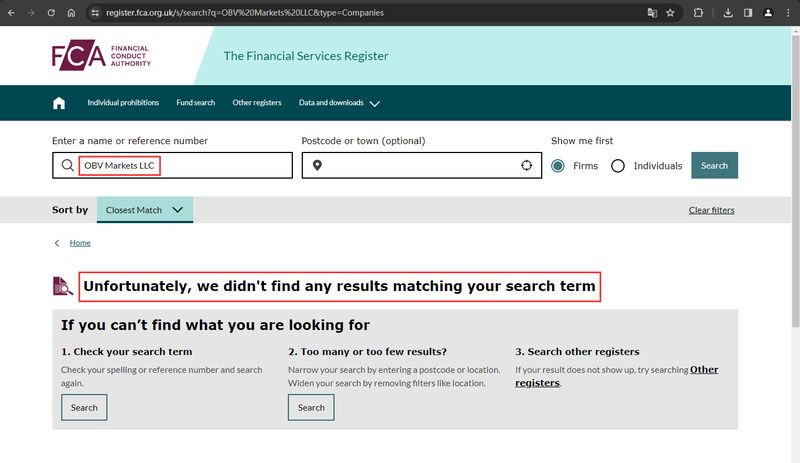

In the financial sector, especially when it comes to forex, commodity, and energy trading, regulation is essential to ensure brokers operate legally, transparently, and with accountability to client funds. Notably, OBV Markets LLC’s website provides no information regarding its regulatory status or licenses. This suggests that the company may not be licensed by any legitimate financial regulatory authority.

Further investigation shows that there are no records of OBV Markets LLC on the UK’s Financial Conduct Authority (FCA) website. As one of the most recognized financial regulators globally, the FCA oversees financial companies and brokers operating within the UK, ensuring they meet stringent regulatory standards. OBV Markets LLC’s absence from the FCA registry suggests that it may be operating without regulation within the UK, denying investors the protection provided by FCA oversight.

Unregulated brokers often carry higher risks, including the potential for fund mismanagement, market manipulation, and a lack of customer protection. Investors should exercise extreme caution when dealing with companies like OBV Markets LLC, which do not provide regulatory information, especially when handling large transactions or complex financial products.

Concerns Regarding Margin Information

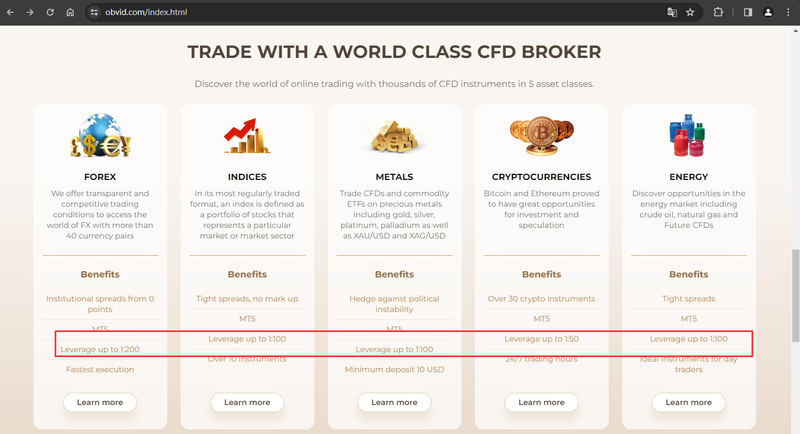

OBV Markets LLC’s website mentions some margin details related to its trading products, indicating that the company offers a maximum margin (leverage) ratio for different asset classes. However, the company does not disclose detailed margin information for each specific asset class. Margin is an important consideration for investors when trading, as it directly affects leverage and risk management strategies.

Higher margin ratios allow investors to trade larger positions with less capital, but they also increase potential risks, especially during volatile market conditions. The lack of specific margin details on OBV Markets LLC’s website creates a risk for investors, as they cannot fully assess the financial risks associated with different trades.

For investors, understanding and having access to clear margin ratio information is crucial. OBV Markets LLC’s lack of transparency in this area may prevent investors from properly evaluating the financial risks involved in their trading decisions.

Risks of Unclear Leverage Information

OBV Markets LLC does not provide clear details regarding the leverage ratios available for its trading products. Leverage refers to the ability for investors to amplify their capital in trades. Generally, higher leverage allows investors to gain greater market exposure with less capital, but it also significantly increases risk.

Although OBV Markets LLC claims to offer high leverage, it does not specify the leverage ratios for different asset classes, making it harder for investors to assess their risk management capacity. Investors may not fully understand the level of leverage risk they are taking on when trading specific assets.

Brokers that do not provide clear leverage information may expose traders to greater risks, especially in volatile markets like forex and commodities. OBV Markets LLC’s lack of transparency in this regard means investors may not have enough information to fully understand the leverage risk they face, potentially leading to unforeseen financial losses.

OBV Markets LLC offers a wide range of trading products and multilingual support, seemingly positioning itself as a convenient platform for global investors. However, its lack of clear company registration information, absence of regulation, and failure to provide transparent margin and leverage details raise significant concerns about its legitimacy and trustworthiness.

When selecting a trading platform, investors should ensure the company has verifiable registration, is subject to regulatory oversight, and provides transparent trading conditions. OBV Markets LLC’s shortcomings in these areas make it a potentially high-risk platform, and investors should carefully assess the risks before engaging with this broker.

Frequently Asked Questions (FAQ)

1. Where is OBV Markets LLC registered?

OBV Markets LLC claims it is registered in the UK, but no records of the company exist in the UK’s Companies House.

2. Is OBV Markets LLC regulated?

OBV Markets LLC provides no regulatory information, and the UK’s Financial Conduct Authority (FCA) has no records of the company, suggesting it may operate without regulatory oversight.

3. When was OBV Markets LLC’s domain registered?

A Whois search shows that OBV Markets LLC’s domain was registered on November 20, 2022, meaning the company has been operating for less than a year.

4. What trading products does OBV Markets LLC offer?

OBV Markets LLC claims to offer trading services in forex, metals, energy, and indices but does not provide specific margin or leverage details for these products.

5. What are the margin ratios offered by OBV Markets LLC?

While OBV Markets LLC mentions offering high margin ratios for different asset classes, it does not provide specific details on margin requirements for each product category.

6. What leverage ratios are available with OBV Markets LLC?

OBV Markets LLC has not provided clear leverage information, increasing the difficulty for investors to evaluate the potential risks involved with their trades.

More information:https://www.inves2win.com/