ORSFX is a newly established forex broker with significant uncertainties regarding its registration and regulatory information. This article analyzes its background, regulatory status, and the cautious steps investors should take when selecting a financial platform, providing a comprehensive understanding of ORSFX’s operating model and potential risks.

ORSFX’s Background and Global Expansion

ORSFX is a forex broker based in Australia that offers trading services in foreign exchange, precious metals, commodities, stocks, and indices. While the company claims to target global investors, questions remain regarding its compliance and regulatory transparency.

1.1 ORSFX’s Establishment and Market Positioning

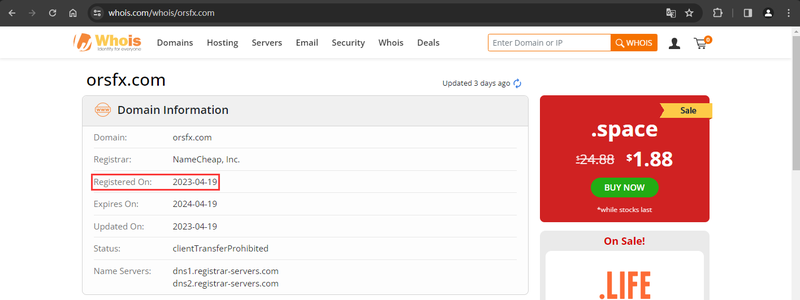

According to the ORSFX website, the broker provides global investors with a variety of trading options, covering assets such as forex, precious metals, commodities, and stocks. Although ORSFX claims its headquarters are in Australia, the website lacks detailed company registration information. ORSFX registered its domain on April 19, 2023, and has operated for less than a year, raising concerns about its compliance and long-term sustainability.

For investors, legitimate financial companies generally disclose detailed company registration and legal information to enhance transparency. The absence of such information from ORSFX should be a warning sign for potential investors.

1.2 The Relationship Between Domain Registration and Company Establishment

ORSFX’s domain was registered in 2023, which does not necessarily imply illegitimacy, but new brokers in the forex market lack the long-term market validation that reduces risk. Investors typically prefer brokers with a stable operating history to mitigate potential issues that may arise during trading.

ORSFX’s Regulatory Status and Legitimacy

Legitimate forex brokers are usually subject to strict regulation to protect investors’ funds and ensure fair market practices. However, in the case of ORSFX, the lack of clear regulatory information is a critical issue.

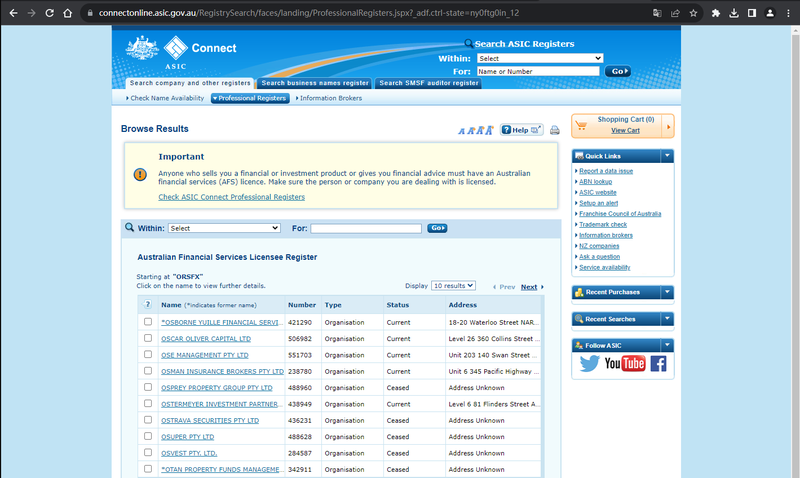

2.1 Missing ASIC Regulatory Information

Although ORSFX claims to be based in Australia, the Australian Securities and Investments Commission (ASIC) website shows no registration or authorization information for the company. ASIC is Australia’s primary financial regulatory body, responsible for regulating financial service providers, including forex brokers.

Without ASIC registration or regulatory oversight, ORSFX is not legally authorized to operate in Australia. This could be a significant risk for investors, as they may not be able to seek assistance or compensation from ASIC if any fund or trading issues arise.

2.2 Investment Risks of Unregulated Companies

Unregulated forex brokers operate outside legal frameworks and do not follow standards like fund segregation. As a result, they might misuse investor funds for company operations instead of keeping them in secure, independent accounts. If such companies go bankrupt or engage in fraudulent activities, it can be extremely difficult for investors to recover their money.

Cautious Choices in Financial Investment: How to Evaluate a Forex Broker

When investing in the financial market, selecting a legitimate, transparent, and well-regulated forex broker is crucial. Here are the steps investors should take to evaluate forex brokers carefully:

3.1 Verify if the Company is Regulated

Verify that reputable financial authorities regulate the forex broker, such as the UK’s Financial Conduct Authority (FCA), Australia’s Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). These regulators set strict standards on fund segregation, transparency, and capital adequacy requirements. If a broker lacks proper regulation, investors face a higher risk.

Before choosing ORSFX or any other platform, investors should check the company’s registration and regulatory information on official regulator websites. If a broker claims to be regulated but cannot be verified through these channels, it is a major red flag.

3.2 Avoid High-Risk Unregulated Platforms

While some unregulated platforms may offer higher leverage, low spreads, or special promotions, these come with greater risks to fund safety. Unregulated companies often do not follow proper fund management practices and may commingle client funds with company operational accounts. These platforms are also at higher risk of bankruptcy, and investors may not recover their funds. It is essential not to be swayed by promises of high returns or attractive conditions while overlooking a platform’s regulatory status.

3.3 Be Cautious with Newly Established Companies

Newly established companies generally have not been tested by the market over time, leaving investors with limited means to assess their reputation and capabilities. While emerging platforms may offer innovative features or promotions, choosing brokers with a stable history and market experience can significantly reduce risk. Investors should check third-party platforms for the company’s track record and user reviews to ensure its long-term stability and legitimacy.

3.4 Verify Fund Management Practices

When choosing a forex broker, ensure they implement proper fund management practices. Regulated brokers are required to keep client funds in segregated accounts and provide compensation schemes. Investors should verify whether the platform has deposit protection mechanisms to minimize risk if the company faces financial difficulties.

For example, companies regulated by the FCA must keep client funds in separate accounts and participate in the Financial Services Compensation Scheme (FSCS), which compensates up to £85,000 in case of company insolvency. This level of protection is crucial, whereas unregulated companies like ORSFX may not offer such safeguards.

3.5 Test the Withdrawal Process

Before making large deposits, it is advisable to perform a small withdrawal test to evaluate the platform’s withdrawal efficiency and reliability. Long delays or complex processes indicate potential issues with fund management. If a broker processes withdrawals slowly or refuses withdrawal requests, it is a significant warning that investors may face frozen funds or other financial risks.

ORSFX’s Customer Service and User Experience

Beyond regulatory concerns, customer service and user experience are important factors in evaluating a forex broker. Initial feedback suggests that ORSFX has some limitations in these areas.

4.1 Language Barriers in Customer Service

ORSFX only provides English language support, which can create communication barriers for global investors, particularly those whose first language is not English. Investors from regions like Asia and the Middle East may face challenges in accurately expressing concerns or understanding platform operations due to this limitation.

4.2 User Experience and Trading Issues

Although ORSFX’s platform is simple and intuitive, some users have reported delays in trade execution, especially during times of market volatility. Additionally, long withdrawal processing times and account fund freezes are common complaints, which raise concerns about the platform’s fund management and customer service efficiency.

Protective Measures Investors Should Take

Given ORSFX’s lack of regulatory oversight and potential risks, investors should exercise caution when considering the use of such platforms. Here are some practical protective measures:

5.1 Prioritize Regulated Brokers

Investors should choose brokers regulated by well-known financial authorities such as FCA, ASIC, or CySEC. These institutions enforce strict standards on fund segregation, capital adequacy, and regular audits, ensuring better protection for investors’ funds.

5.2 Verify the Platform’s Regulatory Information

Before committing funds, investors should carefully verify the platform’s regulatory information to ensure it holds a valid operating license. This can be done by checking the company’s registration on the relevant regulatory body’s website. If the broker cannot provide legitimate regulatory information, it’s best to proceed with caution.

5.3 Avoid Large Deposits

Before fully understanding a platform’s legitimacy and fund management practices, avoid making large deposits. Start by testing the platform with smaller amounts to verify trade execution and the withdrawal process, ensuring that funds are handled securely.

5.4 Keep Records of Transactions and Communication

Investors should maintain records of all transactions and communications with the platform’s customer service. In case of a dispute, these records can serve as evidence to protect investor rights and assist in taking legal action if necessary.

FAQ

1. Is ORSFX regulated?

Currently, ORSFX is not regulated by any recognized financial authority, which poses a risk to investors’ fund safety.

2. Is it safe to trade with ORSFX?

Due to the lack of regulation, ORSFX’s fund management and transparency present significant risks. Investors should exercise caution.

3. What are the primary risks of unregulated platforms?

Unregulated platforms typically lack fund protection measures, and investors’ funds may be misused or at risk of being frozen or inaccessible.

4. How can I verify ORSFX’s legitimacy?

Investors can check ORSFX’s registration status with ASIC or other regulatory bodies. If the platform cannot provide legitimate regulatory information, proceed with caution.

5. How can I protect my investment with ORSFX?

If you decide to use ORSFX, test the platform with small amounts and keep records of all transactions to protect yourself in case of disputes.

6. Is ORSFX suitable for beginner investors?

Due to ORSFX’s lack of regulation and frequent issues with customer service and withdrawals, it may not be suitable for inexperienced investors.

More information:https://www.inves2win.com/