By analyzing the background information and market performance of Alpine Liquidity Limited, this article explores its compliance and potential risks as a forex broker.

Introduction: Overview of Alpine Liquidity Limited

On September 4, 2023, a forex broker named Alpine Liquidity Limited was registered in Saint Lucia. According to its website, the company primarily offers forex, CFDs (Contracts for Difference), indices, metals, and commodity trading services. Alpine Liquidity Limited targets global investors, excluding regions where local laws prohibit such services, like the U.S., Cuba, and North Korea. Despite its transparent public information, investors still question its regulatory status, registration details, and overall legitimacy.

This article will delve into Alpine Liquidity Limited’s background, legality, and market risks, providing case analysis to help investors make more informed decisions.

Alpine Liquidity Limited’s Corporate Background

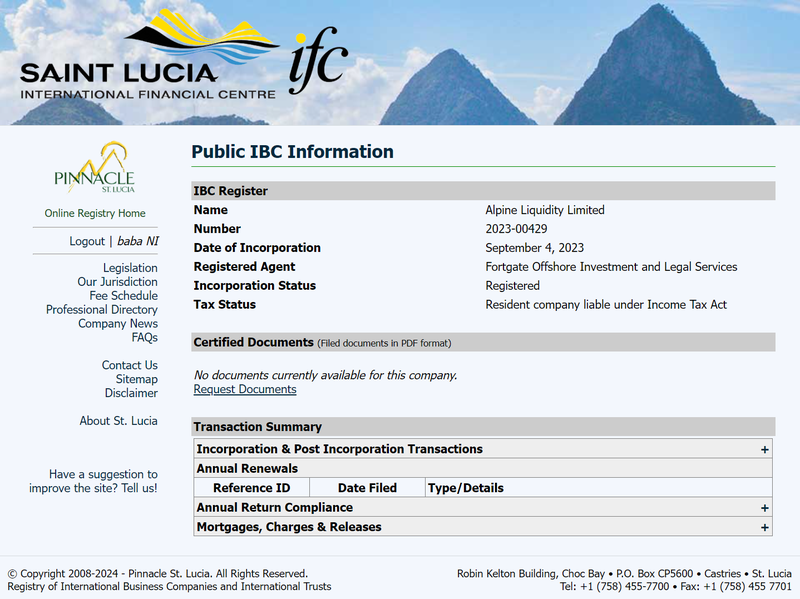

Based on the information disclosed on its official website, Alpine Liquidity Limited is registered in Saint Lucia, with its official address listed as Rodney Bay, Gros-Islet, Saint Lucia. The company’s registration number is 2023-00429. In addition, Alpine Liquidity Limited has an office in India at Akanksha Tower, Karad Satara Jakhinwadi. This global operational model is common among forex brokers. Saint Lucia’s International Business Company (IBC) framework supports such businesses. It offers lower tax rates and more lenient regulations, enabling companies to operate internationally.

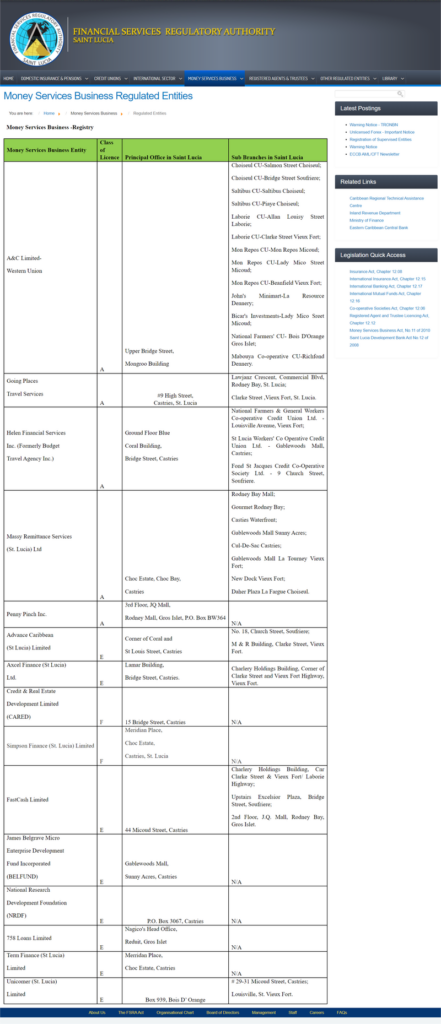

However, Alpine Liquidity Limited’s regulatory status remains relatively unclear. The Saint Lucia IBC registry confirms Alpine Liquidity Limited’s corporate entity. However, it is not listed with the Financial Services Regulatory Authority (FSRA) of Saint Lucia. Additionally, it lacks recognition from other major financial regulatory agencies. This lack of regulatory oversight raises concerns about the company’s compliance and legitimacy.

Regulation and Compliance: Risks and Challenges

For investors, regulatory transparency is a crucial factor when choosing a forex broker. Regulation in the financial markets is not just a legal requirement—it also serves as a protective mechanism for investors. In the absence of regulation, investors may face higher risks, including potential security issues regarding their funds. Alpine Liquidity Limited holds a legitimate registration in Saint Lucia, but its lack of supervision by the country’s Financial Services Regulatory Authority (FSRA) raises doubts about its legitimacy.

Most forex brokers are subject to strict supervision by financial regulators in their respective countries or regions. For instance, the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) regulate the well-known forex broker IG Group. These dual regulations ensure the broker’s compliance and operational transparency. In contrast, Alpine Liquidity Limited’s lack of clear regulation amplifies concerns about its operations.

It is also worth noting that some brokers registered in offshore jurisdictions may choose to avoid stricter regulatory environments to gain more operational freedom. However, such practices often pose significant risks to investor funds, especially in leveraged trading, where potential dangers increase.

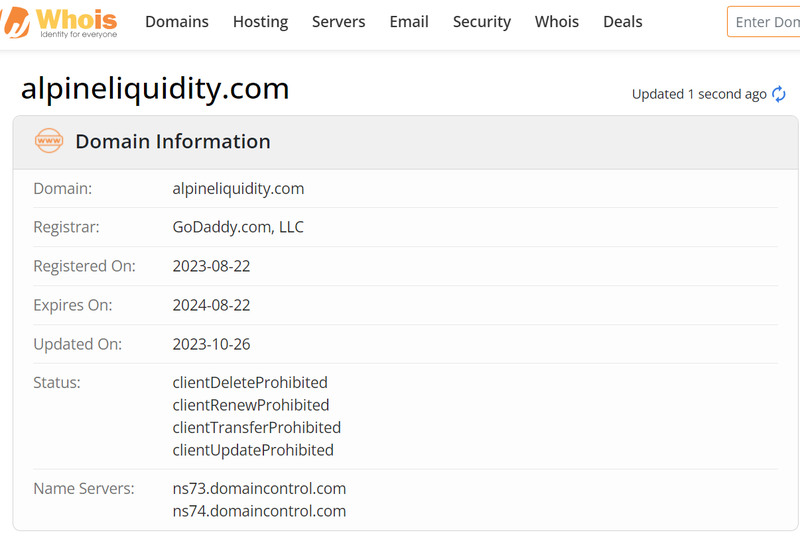

Alpine Liquidity Limited’s Domain and Operational Timeframe

A Whois search shows that Alpine Liquidity Limited registered its domain on August 22, 2023, indicating the company has been in the market for a very short time. As of January 16, 2024, the company has only been in operation for four months. Compared to other brokers that have been operating for several years in the forex market, Alpine Liquidity Limited’s brief existence makes it difficult for investors to gather enough market data to assess its performance.

Consider this example: In 2010, FX Solutions, a forex broker, entered the Chinese market. It attracted many traders with high leverage and generous bonuses. However, due to regulatory transparency issues and poor early performance, the company left the Chinese market within a year. Similarly, Alpine Liquidity Limited, with its short track record, has an emerging market performance. Investors should exercise caution.

Risks in the Forex Market and Mitigation Strategies

The forex market itself is highly volatile and complex, especially in the absence of effective regulation, which further increases the risks for traders. In addition to the uncertainty surrounding brokers’ regulatory status, investors must also consider the market’s inherent risks. With a global daily trading volume in the trillions of dollars, the forex market attracts many participants, including some non-compliant entities.

One of the most notable forex scams occurred in 2017 with the “iTrader fraud,” which affected investors across multiple countries. The company claimed to offer forex trading services but, in reality, manipulated client funds and issued fake orders. Although the company registered in several jurisdictions, inadequate oversight caused significant losses for investors.

For Alpine Liquidity Limited, despite its legitimate registration, the absence of regulation presents a similar risk. Investors should carefully assess the broker’s market standing and operating practices before committing to trading.

How to Verify a Broker’s Legitimacy and Safety

For those looking to engage in forex trading, verifying the legitimacy and safety of a forex broker is crucial. Here are some key steps to follow:

- Check Regulatory Authorities: Investors should first check whether the broker is registered with a financial regulatory authority. Major regulators such as the FCA and ASIC provide information on registered entities that comply with industry standards. When a broker claims registration in a particular country but does not show up in that country’s regulatory database, it signals a red flag.

- Verify Registration Information: Confirm the broker’s legal existence by checking its registration details. For instance, Alpine Liquidity Limited’s registration can be verified through the Saint Lucia International Business Companies registry. While this confirms the broker’s legal entity, it does not imply regulatory oversight.

- Review Trading Terms and Conditions: A broker’s trading terms and leverage ratios can often provide insight into its compliance and transparency. Given the lack of regulatory information on Alpine Liquidity Limited, investors should pay close attention to its terms regarding fund security and avoid engaging in high-risk trades.

- Check Operational History: The broker’s operational history is another key factor. Brokers with short track records, like Alpine Liquidity Limited, have yet to establish a strong market reputation or operational consistency. Investors should continue to monitor its market performance and client feedback.

- Look for Third-Party Reviews: Independent financial forums and customer reviews offer valuable insights into other traders’ experiences with a broker. While such feedback is not always 100% accurate, it can provide useful guidance.

Conclusion: How Should Alpine Liquidity Limited Be Viewed?

In summary, Alpine Liquidity Limited holds a legitimate registration and provides transparent information as a newly established forex broker. However, its lack of regulatory oversight and short operational history require investors to proceed with caution. The company offers a wide range of trading services in forex, CFDs, and commodities, but investors must consider the potential compliance risks and market uncertainties.

For investors, choosing brokers with a strong regulatory background and transparent operations is typically the safer option. As for Alpine Liquidity Limited, while its initial market presence is still developing, the associated risks warrant careful consideration.

Frequently Asked Questions (FAQ)

- Is Alpine Liquidity Limited regulated?

Public information shows that Alpine Liquidity Limited lacks registration with Saint Lucia’s Financial Services Regulatory Authority or any other major financial regulators, indicating it operates without formal regulatory oversight. - What services does the company provide?

Alpine Liquidity Limited offers trading services in forex, CFDs, indices, metals, and commodities, aiming to provide a broad range of financial products to global clients. - When was Alpine Liquidity Limited established?

The company registered on September 4, 2023, in Saint Lucia, with an operational period of less than a year as of the time of writing. - Why was the company registered in Saint Lucia?

Saint Lucia’s International Business Company framework offers tax benefits and less stringent regulatory requirements, making it attractive for financial companies looking to operate internationally. - Is it safe to invest with Alpine Liquidity Limited?

Due to its lack of regulatory oversight and short operational history, investors should approach Alpine Liquidity Limited with caution and consider the associated risks before investing. - How can I verify a forex broker’s compliance?

Investors can check a broker’s registration with relevant financial regulatory bodies and examine its trading terms. Additionally, reviews and client feedback can offer valuable insights into the broker’s market standing.

More information:https://www.inves2win.com/