With the increasing popularity of online trading, more individuals and institutions are entering markets like Forex, options, and Contracts for Difference (CFD). However, this also means that some platforms lacking transparency have emerged, and Crypto Finance Market is one of them. The platform claims supervision by several international regulatory agencies. However, verification shows these claims are unsubstantiated. This article analyzes Crypto Finance Market’s background, regulatory status, and potential risks. It aims to help investors understand the possible dangers.

Background and Business Overview of Crypto Finance Market

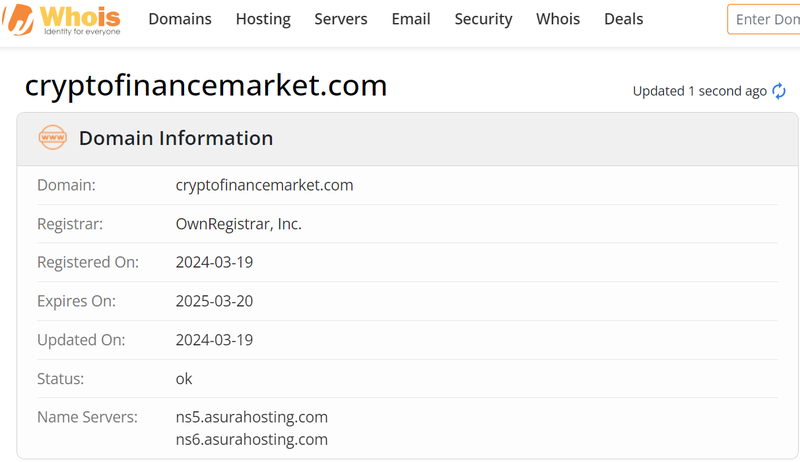

Crypto Finance Market emerged as a CFD broker, registering its domain on March 19, 2024. The platform’s website states it operates from New York, USA. It offers various trading markets, including Forex, options, and CFDs. The platform claims to use a proprietary trading system and serves global clients. However, it explicitly states that it avoids countries or regions where its services would violate local laws or regulations.

Although Crypto Finance Market appears to be a modern financial platform with diverse trading options, investors should be most concerned about its regulatory and legal legitimacy. Proper regulation is crucial for the safety of investor funds, and Crypto Finance Market lacks transparency in this regard.

Corporate Registration and Regulatory Status

Crypto Finance Market’s website claims its registered entity as “FINANCECRYPTOMARKET.” The company number is RS39INT, and the tax ID is 46587324334. It asserts regulation by the U.S. Commodity Futures Trading Commission (CFTC), the International Financial Services Commission of Belize (IFSC), and the Cyprus Securities and Exchange Commission (CySEC). At first glance, these claims seem to support the platform’s legitimacy. Regulators like CFTC, IFSC, and CySEC are highly regarded internationally.

However, upon further investigation and verification, these regulatory claims were found to be false. The specific findings are as follows:

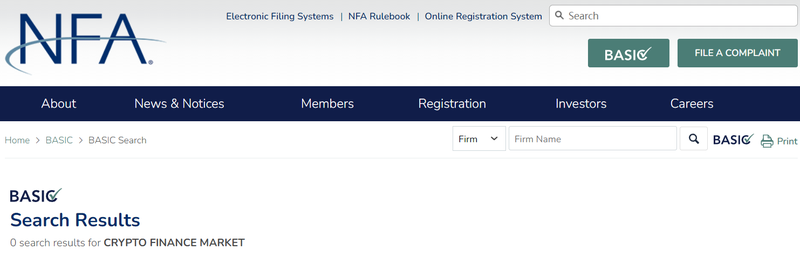

- CFTC and the National Futures Association (NFA): CFTC oversees the U.S. futures markets, and the NFA handles the registration and review of futures intermediaries under CFTC’s supervision. A search on the NFA’s website found no records for Crypto Finance Market, indicating the platform lacks a CFTC license, and its “New York headquarters” holds no official certification.

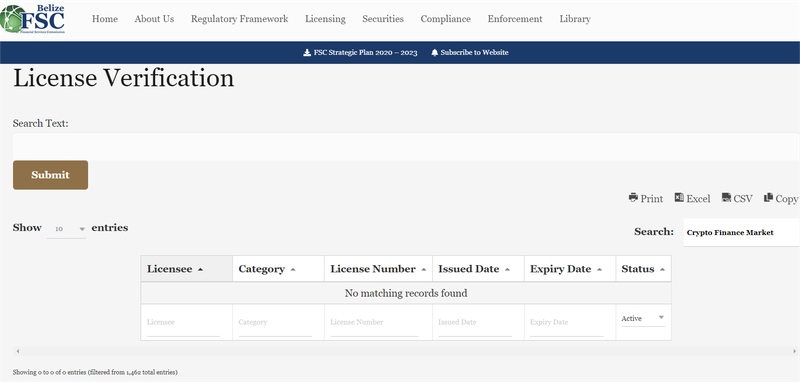

- IFSC of Belize: IFSC regulates financial services companies in Belize, especially in the Forex and CFD markets. A database search on IFSC’s website revealed no registration for Crypto Finance Market, indicating the company lacks legal regulation in Belize.

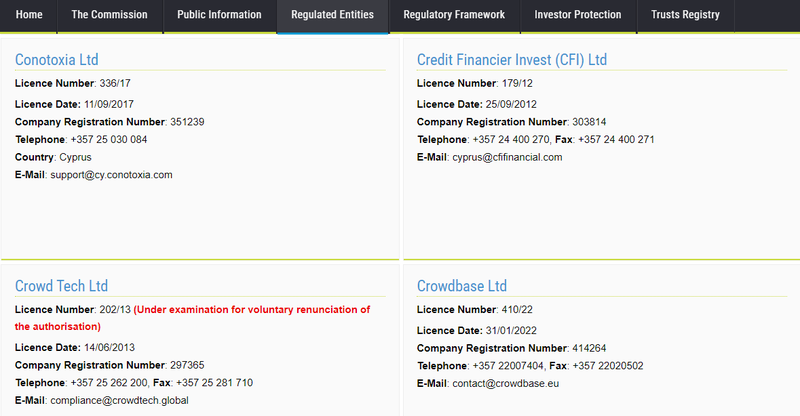

- CySEC of Cyprus: CySEC plays a vital role in regulating Forex and CFD brokers in the European Union. A search on CySEC’s official site showed that Crypto Finance Market does not appear as a regulated entity.

These findings clearly indicate that Crypto Finance Market is not under the supervision of any international financial regulatory bodies. All the platform’s claims regarding regulation seem to be fabricated to attract investors.

Risks of Unregulated Platforms

When investors choose an unregulated platform, they face risks regarding the safety of their funds and the transparency of their trades. Here are some of the major risks associated with unregulated platforms:

- Lack of Fund Security: Legitimate regulated platforms typically segregate customer funds from the company’s operating funds, ensuring the company cannot misuse clients’ money. On unregulated platforms, investors face a high risk of illegal misuse of their funds. If the platform shuts down, it will be difficult for investors to recover their money.

- Questionable Trade Transparency: Regulated platforms must follow strict trading execution standards to ensure that prices are transparent and fair. Unregulated platforms may manipulate trade data, such as adjusting spreads or deliberately delaying order execution, negatively affecting investors’ trading outcomes.

- False Advertising and Exaggerated Profits: Unregulated platforms often use false advertising to lure investors, promising high returns or risk-free investments, which are often scams. After collecting significant funds, these platforms tend to shut down or refuse clients’ withdrawal requests.

- Difficulties in Seeking Justice: On regulated platforms, investors can file complaints with relevant regulatory agencies and seek legal recourse. On unregulated platforms, investors face significant challenges when financial issues arise, especially if the platform registers in offshore regions with lax legal oversight, which makes recovering losses extremely difficult.

Case Study: A Platform’s Fraud Tactics

Platforms like Crypto Finance Market are not uncommon in the market. In 2022, authorities exposed the Forex and CFD trading platform InvestPro for fraudulent advertising and fund embezzlement. InvestPro claimed regulation by the UK’s Financial Conduct Authority (FCA) and Australia’s Securities and Investments Commission (ASIC), using heavy online advertising to attract thousands of global investors.

Initially, InvestPro allowed small deposits and withdrawals, gaining some user trust. However, after a significant number of investors deposited large sums, the platform suddenly disabled withdrawals, citing “technical maintenance” or “account security checks” as reasons. Eventually, the InvestPro platform shut down completely, and investors’ funds became irretrievable. Subsequent investigations revealed that InvestPro had no registration with the FCA or ASIC, and its regulatory claims were entirely false.

This case highlights the typical tactics of unregulated platforms: attracting investors through false advertising and then disappearing with their funds. Investors must be vigilant when selecting a platform and scrutinize its background and regulatory information.

What to Do if You Encounter Fraud on a Platform

If investors experience fraud or frozen funds in financial trading, they should promptly take the following steps to minimize losses and increase the likelihood of recovering their funds:

- Stop Trading and Withdraw Funds Immediately:

If you suspect fraud, immediately halt trading and try to withdraw any remaining funds. While the platform may set barriers or refuse withdrawals, filing a withdrawal request early could still help recover some funds.

- Keep All Transaction and Communication Records:

Investors should save all records related to the platform, including transactions, emails, chat logs, and notifications. These materials are critical for subsequent legal action or complaints to regulatory bodies and serve as vital evidence for pursuing justice.

- File a Complaint with Financial Regulators:

If the platform claims regulation by a specific country, investors should file a complaint with the relevant regulatory authority. For example, when a platform claims regulation by CFTC, CySEC, or ASIC, investors can report it through these agencies’ official websites for investigation and assistance.

- Seek Legal Help:

Once investors confirm the fraud, they should contact a lawyer or legal services specializing in financial fraud cases. Legal counsel can help plan the next steps, such as filing a lawsuit or seeking compensation from related legal bodies.

- Use International Mediation and Arbitration Services:

For significant amounts, investors may consider seeking mediation through international arbitration institutions (e.g., the Financial Services Dispute Resolution Organization). Some international financial platforms cooperate with these bodies, providing additional avenues for claims.

- Dispute Payments with Providers:

If investors made deposits using a credit card, bank transfer, or third-party payment systems, they can contact the payment provider to dispute the charge or recover funds. Some payment platforms allow users to file claims and request refunds in cases of fraud.

- Warn Other Investors:

To prevent others from falling victim, investors can share their experiences on financial forums, social media, or related platforms. Publicly exposing the fraud can help other investors avoid the risks and put pressure on the fraudulent platform.

Preventive Measures Against Future Scams

Even experienced investors can be targeted by fraudulent platforms, so taking additional precautions to secure funds is critical. Below are some suggestions for avoiding future scams:

- Verify Platform Legitimacy Through Multiple Channels: Always verify the platform’s regulatory information, company background, and user feedback through multiple sources, not just the information provided by the platform itself.

- Be Wary of Promises of High Returns in a Short Time: Any platform promising quick or high returns should be considered high-risk. Legitimate investments always carry risks and market volatility.

- Diversify Investments and Manage Risks Properly: Avoid placing all your funds on a single platform or trade. Diversifying investments can reduce the risks of concentrated losses.

By promptly responding to fraudulent behavior and taking preventive measures, investors can maximize the protection of their funds and effectively manage potential risks in the financial markets.

FAQ

- Is Crypto Finance Market regulated?

Verification shows that Crypto Finance Market lacks registration with any international or local financial regulatory agencies, and its claimed regulatory qualifications remain unverified. - Is Crypto Finance Market’s trading platform safe?

Since the platform lacks regulation, it cannot guarantee the security of funds, and investors face significant risks during the trading process. - How can I verify whether a trading platform is regulated?

Investors can check a platform’s registration information on financial regulatory websites such as CFTC, CySEC, ASIC, etc., to confirm its legitimacy. - What should I do if I encounter financial issues on Crypto Finance Market?

If you experience financial issues, stop trading immediately, keep all transaction records, and seek legal assistance or file a complaint with relevant regulators. - How does Crypto Finance Market differ from other legitimate Forex platforms?

Crypto Finance Market lacks regulation, setting it apart from other Forex platforms that operate under legitimate supervision. Investors should be cautious of its risks. - How can I avoid scams from unregulated platforms?

Investors should verify the platform’s regulatory information, check genuine user feedback, and be cautious of exaggerated promises of high returns to avoid falling into scams.

More information:https://www.inves2win.com/