BKS Fintech presents itself as a comprehensive broker, providing a wide range of trading options including forex, commodities, indices, bonds, cryptocurrencies, stocks, and futures. Established in Canada on March 24, 2021, the broker utilizes the MetaTrader 5 (MT5) platform to offer these services. On the surface, it appears as a legitimate choice for traders seeking a diverse market. However, a deeper dive into its registration information and regulatory claims paints a different picture, raising serious concerns about its authenticity and the safety of investors’ funds.

BKS Fintech’s Registration Claims and Regulatory Status

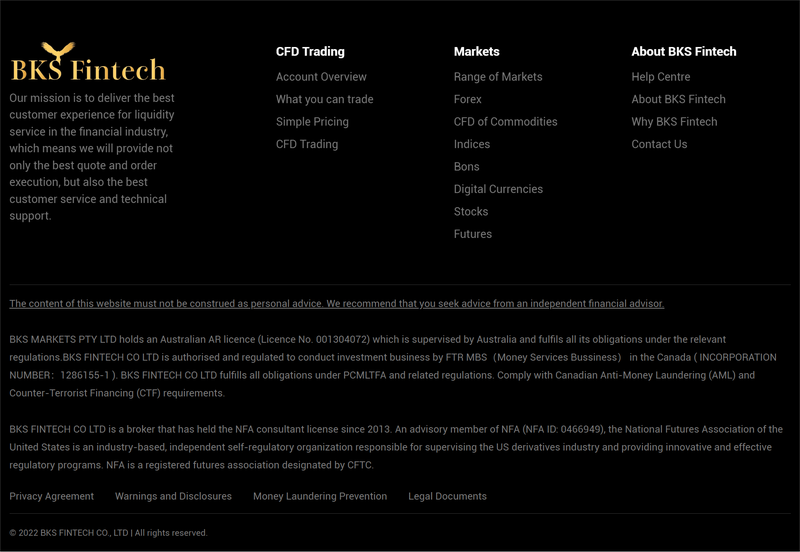

BKS Fintech’s website prominently displays information about its various business entities and purported regulatory licenses in different countries. The broker claims to be registered and regulated through the following entities:

- BKS MARKETS PTY LTD (Australia): This entity allegedly holds an Australian Financial Services (AR) license issued by the Australian Securities and Investments Commission (ASIC), license number 001304072.

- BKS FINTECH CO LTD (Canada): The company registers in Canada with the business number 1286155-1 and asserts authorization and regulation by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). It also mentions a registration with the National Futures Association (NFA) in the United States, NFA ID: 0466949.

- BKS FINTECH LLC (Saint Vincent and the Grenadines): BKS Fintech claims to be regulated by the Financial Services Authority (FSA) of Saint Vincent and the Grenadines, license number 3040 LLC 2023.

On the surface, these claims might seem reassuring, suggesting that BKS Fintech is a well-regulated, legitimate broker. However, after a thorough examination, it becomes clear that these regulatory assertions are misleading and largely false.

Unpacking the False Regulatory Claims

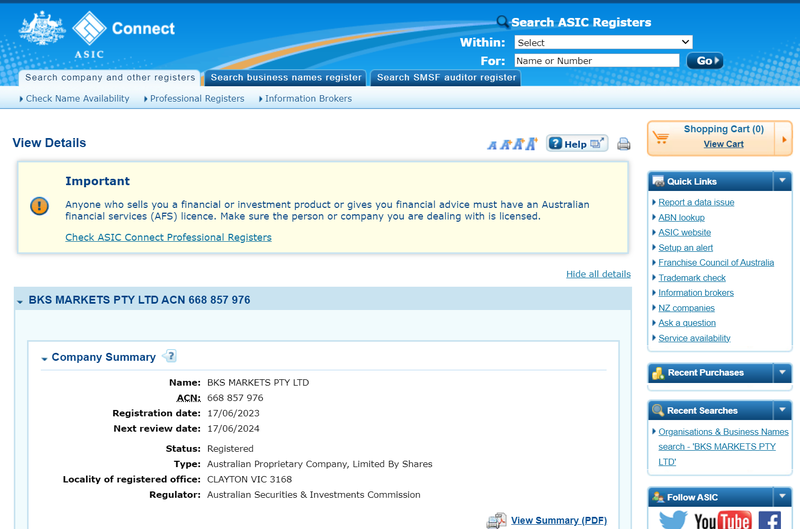

1. BKS MARKETS PTY LTD in Australia: License Expired

BKS Fintech claims that its Australian entity, BKS MARKETS PTY LTD, holds an ASIC-issued Australian Financial Services (AR) license. While this entity was indeed licensed at some point, a closer inspection reveals that this license expired on August 21, 2023. Following the expiration, there has been no record of BKS MARKETS PTY LTD renewing or obtaining a new license from ASIC.

This raises immediate red flags. Operating as a broker in Australia without a valid license is illegal and suggests that BKS Fintech is falsely presenting itself as a regulated entity in an effort to gain investors’ trust. ASIC requires genuine brokers to strictly comply with financial regulations, including protecting client funds, risk disclosure, and operational transparency. BKS MARKETS PTY LTD lacks a current ASIC license, indicating no oversight and posing a potential risk for investors who might believe they are dealing with a regulated broker.

2. BKS FINTECH CO LTD in Canada: Regulatory Smoke and Mirrors

In Canada, BKS Fintech claims to be registered with FINTRAC, the Canadian financial intelligence unit. However, FINTRAC primarily oversees anti-money laundering (AML) and counter-terrorism financing activities; it does not regulate financial derivatives trading or securities markets. Even if BKS Fintech registers with FINTRAC, this registration does not provide the regulation and oversight needed for a broker offering complex financial products like forex and CFDs.

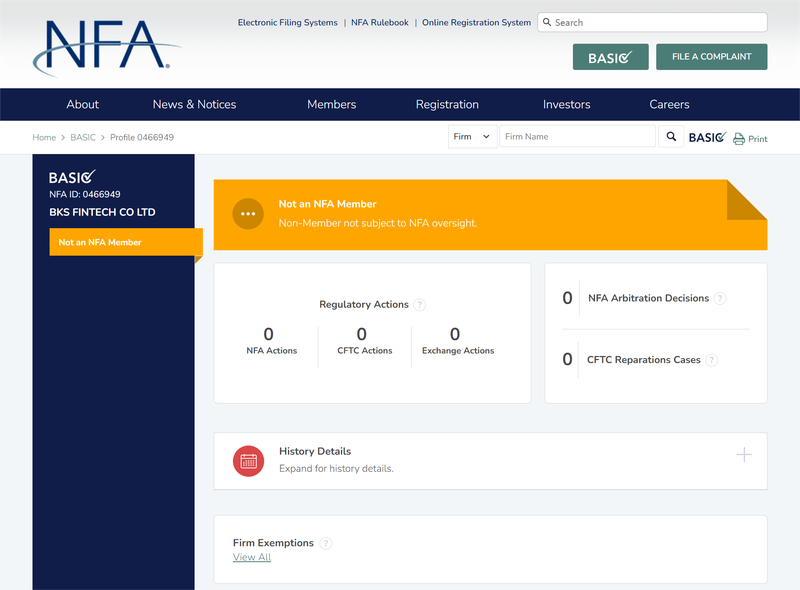

Moreover, BKS Fintech states that it is registered with the NFA in the United States (NFA ID: 0466949). Upon verification, this registration is also misleading. The entity may be listed as a non-member unit with the NFA, but this does not mean it receives regulation from the NFA. Non-member units are not subject to the NFA’s rules and regulations, meaning BKS Fintech does not operate under the NFA’s stringent guidelines that typically govern legitimate futures and forex brokers in the U.S. This is a critical distinction that BKS Fintech appears to exploit, presenting its mere registration as full-fledged regulatory compliance.

3. BKS FINTECH LLC in Saint Vincent and the Grenadines: A False Sense of Security

BKS Fintech’s claim of regulation through the Financial Services Authority (FSA) of Saint Vincent and the Grenadines is another attempt to create a facade of legitimacy. The company registers in Saint Vincent and the Grenadines, but the FSA there does not regulate forex or CFD trading. This jurisdiction is known for its lenient company registration processes and lack of regulatory oversight in financial services. This means that brokers registered there can operate with minimal restrictions and are not subject to the regulatory requirements found in more reputable jurisdictions.

BKS Fintech claims FSA regulation to mislead investors into thinking it follows standards of transparency, capital requirements, and client protection. In reality, registration in Saint Vincent and the Grenadines provides no investor protection since no active regulatory mechanisms oversee brokers’ activities there.

The Risk of Investing with Unregulated or Mislabeled Brokers

BKS Fintech’s misleading claims of regulatory status expose investors to significant risks. Operating without proper regulatory oversight means the broker does not maintain segregated client accounts, adhere to risk management protocols, or follow fair trading practices. Here’s why these discrepancies matter:

- Lack of Investor Protection: Without valid regulation, investors have no recourse in case of disputes, unfair trading practices, or withdrawal issues. Regulatory authorities like ASIC, FCA, or the NFA provide mechanisms to protect clients’ funds and ensure ethical conduct, none of which apply to BKS Fintech.

- High Risk of Fraud: Brokers who falsely claim regulatory status often engage in fraudulent activities. They may manipulate trading conditions, prevent withdrawals, or even vanish with investors’ funds, leaving no legal pathway for recovery.

- False Sense of Security: BKS Fintech’s use of known regulatory bodies (ASIC, FINTRAC, NFA) in its claims can create a false sense of security among investors, making them believe their funds are safe when, in reality, they are at significant risk.

Real-World Example: Lessons from Similar Cases

There have been several instances where brokers operated under false regulatory claims to deceive investors. A case in point is “TradeFinancials,” a broker that claimed to be regulated by top-tier financial authorities. It offered a similar array of trading products as BKS Fintech and presented fabricated registration numbers and licenses. Investors initially trusted the broker due to its regulatory claims. However, as soon as they attempted to withdraw their funds, they encountered difficulties. The broker deployed various tactics, including demanding additional fees and denying withdrawals based on dubious terms. Eventually, the broker ceased operations, taking investors’ funds with it.

TradeFinancials’ downfall serves as a stark reminder that regulation claims must be independently verified and that mere registration in offshore jurisdictions like Saint Vincent and the Grenadines does not equate to investor protection. BKS Fintech’s pattern of misrepresenting its regulatory status and exploiting the lack of financial oversight in certain jurisdictions suggests a similar risk profile.

Protecting Yourself: How to Identify and Avoid Scam Brokers

Given the risks associated with brokers like BKS Fintech, investors need to be vigilant when selecting a trading platform. Here are steps to help identify potential scams:

- Verify Licenses: Always verify the broker’s claimed licenses with the official regulatory bodies’ websites. Real regulators like ASIC, FCA, or NFA provide searchable databases for public verification.

- Check Regulatory Authority: Be cautious of brokers registered in jurisdictions with no real financial regulation, such as Saint Vincent and the Grenadines. Look for licenses from well-known and reputable authorities.

- Read User Reviews: Research online for reviews and experiences from other investors. Scam brokers often have numerous complaints regarding withdrawal issues and unfair trading practices.

- Contact Regulatory Bodies: If unsure, directly contact the regulatory body to confirm the broker’s status and inquire about its compliance with financial regulations.

FAQ: BKS Fintech and Regulatory Concerns

Q1: Is BKS Fintech regulated by ASIC in Australia?

A1: No, BKS Fintech’s entity in Australia, BKS MARKETS PTY LTD, had an AR license with ASIC, but it expired on August 21, 2023, and has not been renewed. It currently operates without valid Australian regulatory oversight.

Q2: Does registration with FINTRAC in Canada mean BKS Fintech is regulated?

A2: No, FINTRAC registration only involves anti-money laundering monitoring and does not regulate financial derivatives trading or brokerage services.

Q3: What does it mean if BKS Fintech is a non-member unit with the NFA?

A3: Being a non-member unit means BKS Fintech is listed with the NFA but is not subject to its regulatory framework. It is not overseen or protected by NFA’s rules, which apply to member firms.

Q4: Is registration in Saint Vincent and the Grenadines a sign of proper regulation?

A4: No, registration in Saint Vincent and the Grenadines does not provide any financial oversight or investor protection for trading activities, as the FSA there does not regulate forex or CFD brokers.

Q5: How can I check if a broker is genuinely regulated?

A5: Visit the official website of the regulatory body (e.g., ASIC, FCA, NFA) and use their license search feature to verify the broker’s details. Ensure that the information matches the broker’s claims.

Q6: What should I do if I have already invested with BKS Fintech?

A6: Immediately attempt to withdraw your funds. If you encounter difficulties, gather all communication and transaction records, then report the broker to relevant regulatory authorities and seek legal advice.

BKS Fintech’s lack of valid regulatory status and misleading claims pose serious risks to investors. It is crucial to conduct thorough due diligence and verification of a broker’s regulatory claims before engaging in any trading activities.

More information:https://www.inves2win.com/