CrpTrade, a new online trading platform, has not disclosed any registration information or regulatory status, posing high risks that investors should approach with caution.

CrpTrade’s Corporate Background

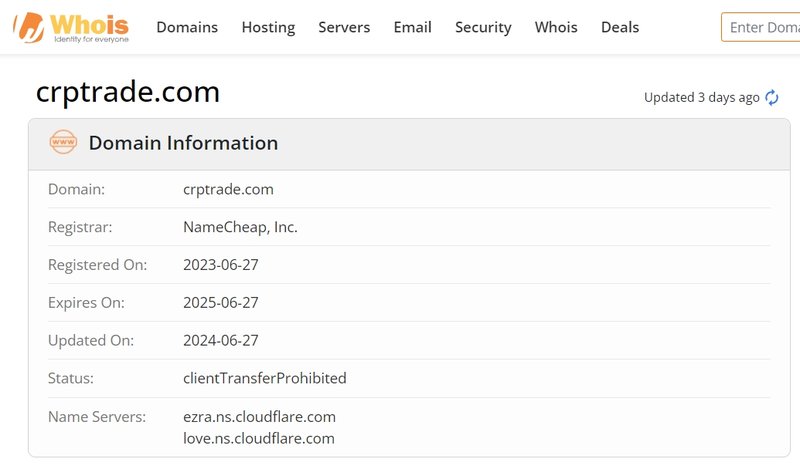

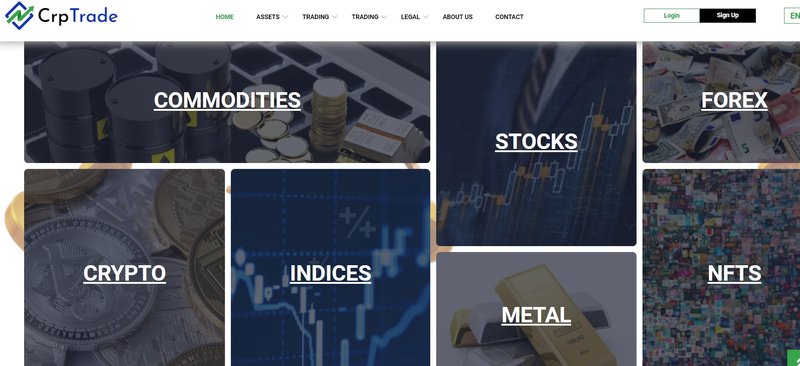

With the rapid development of global financial markets, numerous online trading platforms have emerged. CrpTrade is one of these new platforms, claiming to offer a wide range of financial products, including forex, stocks, cryptocurrencies, precious metals, indices, commodities, and NFTs. According to official information, CrpTrade’s domain was established on June 27, 2023. However, there is still no trace of the platform’s registration information or a detailed introduction to its parent company.

A legitimate trading platform usually provides clear company registration information, including its establishment date, operating address, and company name, allowing investors to verify its background. However, CrpTrade remains vague on these crucial details, lacking solid evidence to prove its legitimacy. Typically, a lack of transparency regarding corporate background is a warning sign that investors should be wary of.

CrpTrade’s Service Offerings

CrpTrade claims to offer trading services for a variety of financial products, including:

- Forex Trading: Buying and selling based on currency exchange rate fluctuations, a high-risk financial product.

- Stock Trading: Providing investment opportunities in major global market stocks.

- Cryptocurrency Trading: Covering popular cryptocurrencies such as Bitcoin, Ethereum, etc.

- Precious Metals Trading: Including trading of gold, silver, and other precious metals.

- Index Trading: Involving CFDs (Contracts for Difference) on major stock market indices.

- Commodities Trading: Such as oil, natural gas, and other commodities.

- NFT Trading: Offering trading of digital assets (non-fungible tokens).

Although these products appear diverse, investors must consider the platform’s reliability before trading. A platform that does not disclose its registration information or regulatory status may have safety hazards. Regardless of the range of trading products, investors face serious losses if the platform cannot guarantee fund security.

CrpTrade’s Regulatory Information

Financial regulatory agencies should supervise a legitimate financial trading platform. Various countries have established financial regulatory authorities, such as the Commodity Futures Trading Commission (CFTC) in the United States, the Financial Conduct Authority (FCA) in the United Kingdom, and the Australian Securities and Investments Commission (ASIC), which provide legal protection to traders.

However, CrpTrade has not disclosed any company name or regulatory information on its website. This means investors cannot verify whether it is regulated by any regulatory agency. Platforms without regulation are likely to ignore international financial regulations and present high risks. Investors may not receive effective protection for fund security, trading fairness, and potential dispute resolution.

Potential Risks of Unregulated Trading Platforms

- Fund Security Issues: Platforms lacking regulation cannot ensure the security of user funds, and there is a high risk of withdrawal difficulties or even embezzlement.

- Trading Fairness: Unregulated platforms have opaque trading mechanisms and may engage in price manipulation, order delays, or failure to execute trades, causing users to incur losses.

- User Data Privacy: Legitimate platforms encrypt user data and protect sensitive information, while unregulated platforms may misuse user information for illegal purposes.

- Difficulty in Seeking Justice: In the event of disputes, the absence of regulatory intervention makes it difficult for users to pursue legal action, resulting in economic losses.

Real-life Example: The Trap of Unregulated Platforms

In the financial market, there have been cases where emerging trading platforms like CrpTrade have quickly risen to prominence. For instance, a platform named CryptoTrade accumulated a large number of users in 2018, claiming to offer high returns. However, after attracting significant investor funds, the platform suddenly shut down, making it impossible for investors to withdraw their funds. This led to substantial losses for thousands of users. Subsequent investigations revealed that CryptoTrade was not subject to any financial regulation, and its operators had implemented a Ponzi scheme through opaque trading mechanisms.

Such examples serve as a warning to investors: no matter how professional or attractive a platform seems, its legitimacy must be thoroughly verified before investing. Investors need to understand that unregulated platforms not only pose a risk of absconding but also make it nearly impossible to recover funds legally if problems arise.

How to Identify a Trading Platform’s Legitimacy

- Verify Company Registration Information: Check the platform’s registration information and verify if an official authority has registered it. For instance, CrpTrade has not disclosed any company name, which is a clear warning sign.

- Check Regulatory Status: Visit the official websites of regulatory agencies to see if the platform is regulated. For example, the websites of the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC) provide channels for checking regulatory information.

- Read User Reviews: Use investment forums, social media, and other channels to learn about other users’ feedback and complaints. Exercise extra caution when dealing with platforms that have numerous negative reviews, especially those related to withdrawal issues.

- Transparency and Customer Support: Legitimate platforms typically disclose detailed service terms, trading rules, and customer support information on their website. Platforms with high transparency and responsive customer support are generally more trustworthy.

Anti-Fraud Tips for Investors

- Stay Alert: Be vigilant when dealing with unregulated trading platforms, and avoid investing funds too easily.

- Test with Small Amounts: If there are doubts about a platform, test it with a small investment to assess its withdrawal speed and service quality.

- Don’t Be Tempted by High Returns: Regardless of how attractive a platform’s claimed returns are, investors should remember that high returns often come with high risks.

- Use Regulated Platforms: Choose trading platforms with legitimate regulatory credentials to ensure fund security.

Actions Investors Should Take

If you have already invested in CrpTrade, take immediate steps to minimize potential losses:

- Request Withdrawal Promptly: Submit a withdrawal request as soon as possible to test the platform’s withdrawal speed and identify any issues.

- Save All Records: Keep all transaction records and communication logs with the platform as evidence for future dispute resolution.

- Seek Help If Problems Arise: If issues occur, contact relevant financial regulatory agencies or consult legal professionals for assistance.

FAQ

- Is CrpTrade Regulated by Any Authority?

CrpTrade has not disclosed any company name or regulatory information, making it impossible to confirm if it is regulated by any financial regulatory authority. - How Can Investors Verify a Trading Platform’s Legitimacy?

Investors should verify the platform’s company registration information and check its regulatory status on the official websites of financial regulatory agencies in various countries. - Why Are Unregulated Platforms Riskier?

Unregulated platforms are not bound by financial regulations, which can lead to issues with fund security, trading transparency, and data privacy, leaving investors’ rights unprotected. - What Should I Do If I Have Already Invested in CrpTrade?

It is advisable to stop adding more funds immediately, attempt withdrawal, save all transaction records, and seek help from relevant regulatory authorities if necessary. - What Financial Products Does CrpTrade Offer?

CrpTrade claims to offer trading services for various financial products, including forex, stocks, cryptocurrencies, precious metals, indices, commodities, and NFTs. - Why Is Platform Transparency Important?

Transparent platforms typically disclose detailed registration information, trading rules, and regulatory status, helping investors assess their legitimacy and ensure fund security.

More information:https://www.inves2win.com/