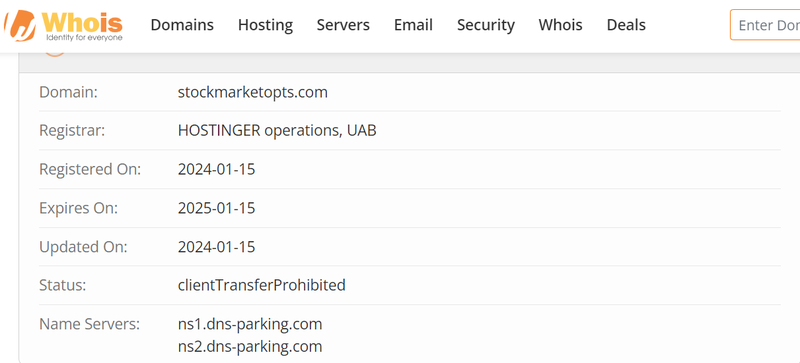

Stockmarketopts is a forex broker registered on January 15, 2024, claiming to provide various trading markets through its proprietary trading platform and mobile application. These include forex, stocks, indices, energy, metals, cryptocurrencies, and ETF contracts for difference (CFDs). However, the lack of transparency regarding its registration and regulatory status raises significant red flags for potential investors.

In this article, we will delve into Stockmarketopts, examining its regulatory status, operational practices, and the potential risks associated with investing in this broker, including the phenomenon of “pig butchering” scams.

Company Registration and Regulatory Status

Lack of Transparency

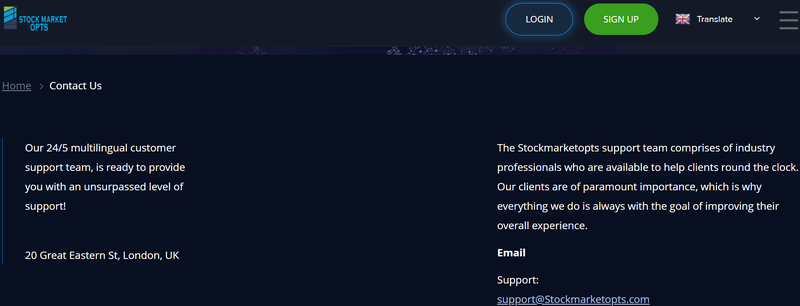

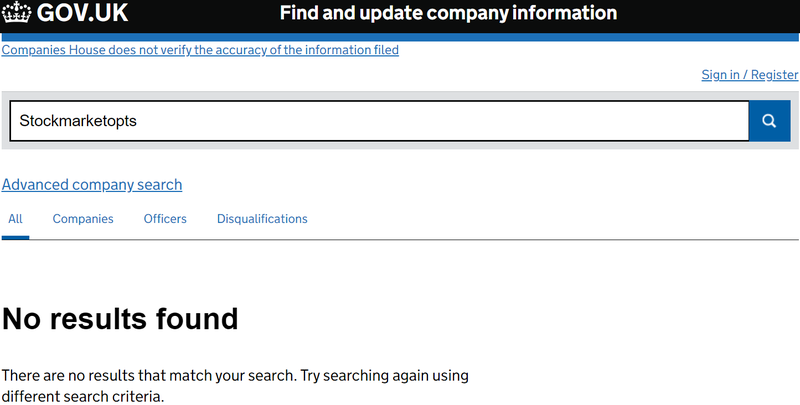

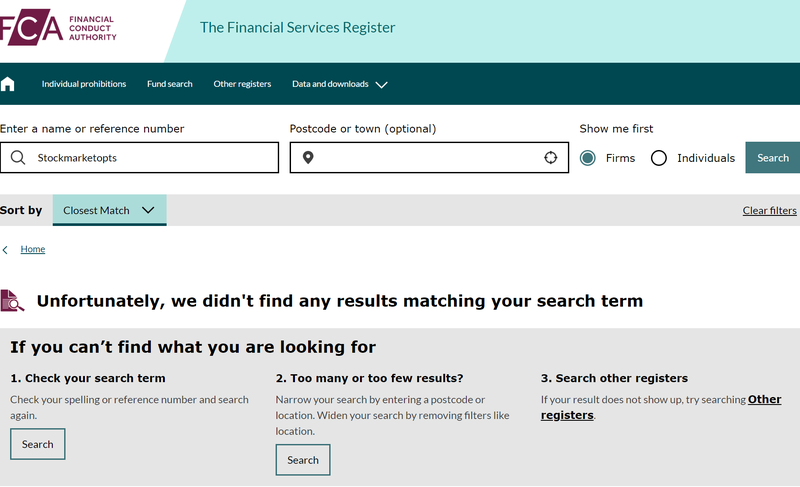

One of the most concerning aspects of Stockmarketopts is its failure to disclose any corporate entity registration information or regulatory details on its official website. The provided contact address, “20 Great Eastern St, London, UK,” has been checked against records from Companies House and the UK Financial Conduct Authority (FCA), but no registration information for this broker was found. This lack of verifiable registration is a critical warning signal that cannot be ignored.

Importance of Regulation

Regulation plays a crucial role in the financial services industry. Regulated brokers are required to adhere to strict rules designed to protect investors and ensure fair trading. These regulations include maintaining certain capital levels, segregating client funds, and complying with fair advertising standards. In the absence of regulation, brokers like Stockmarketopts may engage in unethical practices, putting investors’ funds at significant risk.

Risks of Non-Regulated Brokers

Investing with non-regulated brokers like Stockmarketopts can lead to several serious risks:

1. Loss of Funds

Without regulation, the security of your funds cannot be guaranteed. Non-regulated brokers can easily misappropriate client funds, resulting in substantial financial losses for investors.

2. Lack of Accountability

If issues arise, non-regulated brokers are not held accountable by any authority, making it extremely difficult for investors to seek compensation. This lack of accountability means that clients have virtually no recourse for recovering their investments.

3. Manipulative Practices

Non-regulated platforms may engage in manipulative practices, such as slippage, spread manipulation, and other unethical trading conditions, which can adversely affect traders. These practices can lead to poor trade execution and unexpected losses.

4. Withdrawal Difficulties

Many non-regulated brokers create obstacles when clients attempt to withdraw their funds, which may include unreasonable delays, high fees, or outright denial of withdrawal requests.

Understanding “Pig Butchering” Scams

The situation surrounding Stockmarketopts closely relates to a common type of financial scam known as “pig butchering.” This scam typically involves fraudsters enticing unsuspecting individuals to invest large sums of money by promising substantial returns.

How Pig Butchering Scams Operate

- Initial Contact: Fraudsters usually reach out to potential victims via social media, dating sites, or online forums, pretending to be friendly investors or financial advisors.

- Building Trust: They build trust by sharing fake success stories, exploiting the victim’s greed.

- Encouraging Investment: Once trust is established, the fraudsters persuade victims to make larger investments, often showcasing false trading results to indicate success.

- Withdrawal Difficulties: When victims attempt to withdraw their funds, they encounter numerous obstacles, such as unexpected fees or requests for personal information, ultimately leading to financial loss.

Connection Between Stockmarketopts and Pig Butchering

Based on the characteristics of Stockmarketopts, it can be inferred that it may be part of a pig butchering scam:

- Lack of Transparency: The broker’s failure to provide any registration or regulatory information makes it impossible to verify its true identity, aligning with the characteristics of pig butchering scams.

- False Promises: By claiming to offer a wide range of trading markets while failing to display any actual trading records or success stories, it may be attempting to appeal to investors’ greed.

- Withdrawal Challenges: If users face significant obstacles when trying to withdraw funds, this is often a hallmark of pig butchering, indicating that the broker has no intention of allowing investors to profit.

Characteristics of Pig Butchering Scams

Recognizing potential scams can help investors protect themselves. Here are common characteristics:

- Lack of Transparency: If a broker fails to provide clear information about its registration and regulatory status, consider this a warning sign.

- Unrealistic Returns: Be wary of brokers that promise high returns with minimal risk.

- High-Pressure Tactics: Scammers often create a sense of urgency, encouraging quick investments without allowing time for due diligence.

- Withdrawal Difficulties: If a broker complicates the withdrawal process or charges unexpected fees, this is an important warning sign.

User Experience and Feedback

Analyzing User Feedback

User reviews can provide valuable insights into a broker’s operational practices. In the case of Stockmarketopts, many complaints and negative feedback focus on the following points:

- Withdrawal Issues: Many users report significant delays or outright denials when attempting to withdraw funds.

- Customer Service: Complaints about unresponsive or ineffective customer service are common, indicating a lack of support when users encounter issues.

- Trading Conditions: Some users express concerns about poor trade execution, high spreads, and unexpected fees impacting profitability.

Identifying Patterns in User Reviews

When assessing a broker, it is essential to look for patterns in user experiences. Ongoing negative feedback, especially regarding withdrawal issues and customer service complaints, may indicate deeper systemic problems within the broker.

What to Do if You Encounter Stockmarketopts

If you suspect you are dealing with a fraudulent broker like Stockmarketopts, you can take the following steps:

1. Cease Communication

Immediately stop all communication with the broker. This will help prevent further potential losses.

2. Document Everything

Keep records of all interactions, including emails, chat logs, and any financial transactions. These documents may be crucial for future legal actions or recovery attempts.

3. Report the Broker

Report your experience to the relevant authorities, such as local financial regulatory bodies or consumer protection agencies. This can help protect other potential victims from the same scam.

4. Consult Professionals

If you have suffered financial losses, consider consulting a legal professional or a financial recovery service specializing in fraud cases. They can advise you on the best course of action.

In conclusion, Stockmarketopts presents serious concerns regarding its legitimacy and regulatory status. Its lack of transparency and absence of regulation categorize it as a potential pig butchering scam, making it essential for investors to conduct thorough research before committing any funds. Recognizing signs of fraud and understanding the risks associated with non-regulated brokers can protect individuals from significant financial losses in online trading.

Frequently Asked Questions (FAQ)

1. Is Stockmarketopts a legitimate broker?

No, Stockmarketopts lacks transparency and regulatory registration, raising serious doubts about its legitimacy.

2. What is a “pig butchering” scam?

A “pig butchering” scam involves fraudsters enticing victims with promises of high returns, encouraging larger investments until victims can no longer withdraw their funds.

3. How can I verify if a broker is regulated?

You can check a broker’s registration status on the official websites of relevant regulatory authorities, such as the FCA.

4. What should I do if I suspect I’ve been scammed?

If you suspect fraud, immediately cease all communication with the broker and report the incident to local financial regulatory authorities.

5. What signs should I watch for in a potential scam?

Be cautious of a lack of transparency, unrealistic promises, aggressive marketing tactics, and withdrawal difficulties.

6. What are the risks of investing with non-regulated brokers?

Investing with non-regulated brokers can lead to financial losses, lack of accountability, and potentially manipulative practices that adversely affect traders.

7. How can I protect myself from financial scams?

To protect yourself, always research a broker’s regulatory status, look for verified user reviews, and remain skeptical of offers that seem too good to be true.