Elys FX Trade claims to have multiple regulatory approvals, but investigations reveal serious issues with its regulatory information, prompting investors to remain vigilant.

Introduction

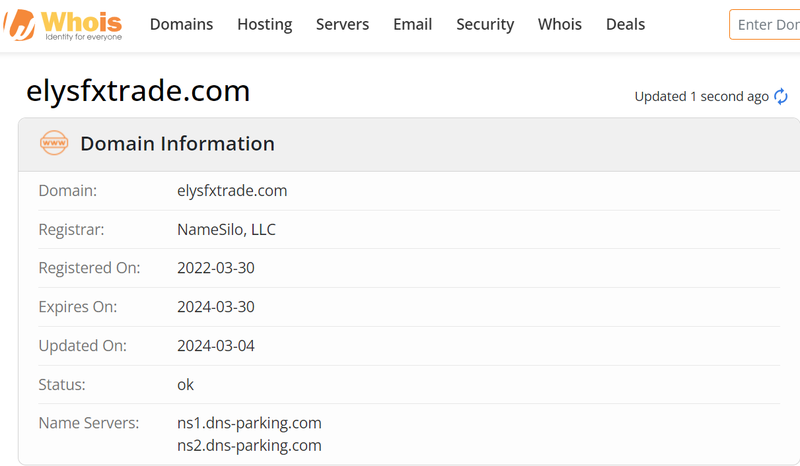

With the rapid development of global financial markets, forex trading has become an increasingly popular choice for many investors. Elys FX Trade, a newly registered forex broker since March 30, 2022, claims to provide various financial derivative trading services. However, concerns regarding its regulatory status and transparency have arisen. Although Elys FX Trade promotes itself as being regulated by multiple authorities, the reality may be quite different.

In this age of information overload, many fraudulent platforms exploit complex marketing strategies and fabricated regulatory information to attract investors, leading to significant losses for those who lack adequate caution. This article delves into Elys FX Trade’s background, regulatory status, and potential risks, analyzing real cases to detail the dangers and impacts of forex scams, helping investors better recognize and avoid similar risks.

Basic Information About Elys FX Trade

Elys FX Trade is a forex broker registered in 2022, primarily offering trading services for forex, stocks, indices, commodities, metals, and ETF CFDs. While Elys FX Trade claims to provide a wide variety of attractive products, its operational transparency and legality are under scrutiny.

1. Company Background

Elys FX Trade asserts that its headquarters is located in Cyprus and operates through multiple subsidiaries to present an international image. However, investigations reveal that the company’s registration information does not exist in the databases of various regulatory authorities. This situation is not uncommon in the financial sector, especially in forex markets where many platforms mislead investors to create a false sense of legitimacy.

2. Business Model

Elys FX Trade employs a typical “broker + platform” model, claiming to offer investors a seamless trading experience through an advanced trading platform. Its marketing heavily emphasizes high returns and low risks, a strategy that often attracts many novice investors. However, it is crucial to note that such high-risk, high-reward promises are frequently unrealistic.

Company Registration and Regulatory Status

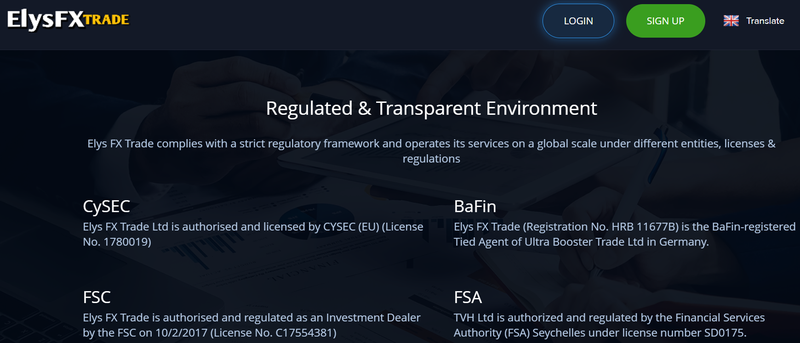

1. Claims by Regulatory Authorities

Elys FX Trade claims to be regulated by several authorities, including:

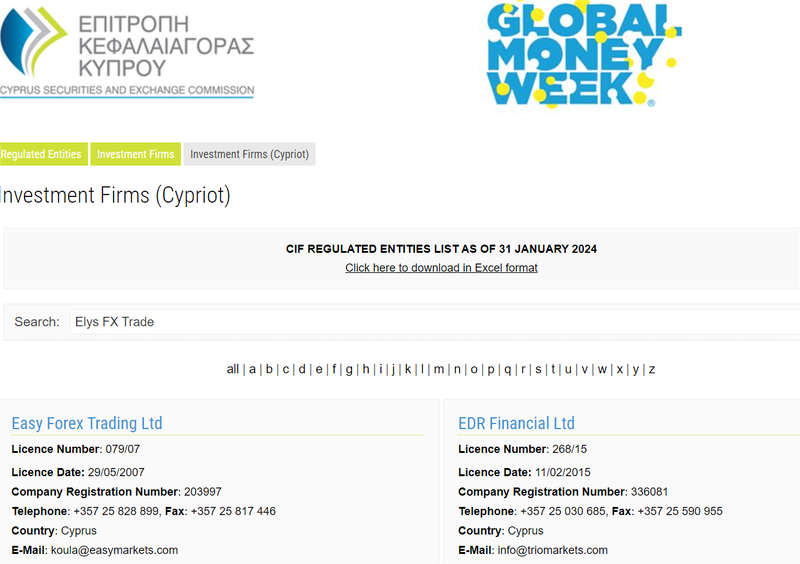

- Cyprus Securities and Exchange Commission (CySEC): License No. 1780019

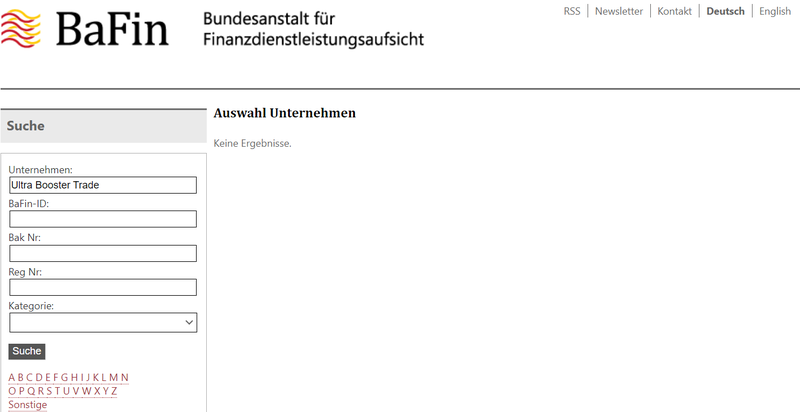

- German Federal Financial Supervisory Authority (BaFin): Registration No. HRB11677B

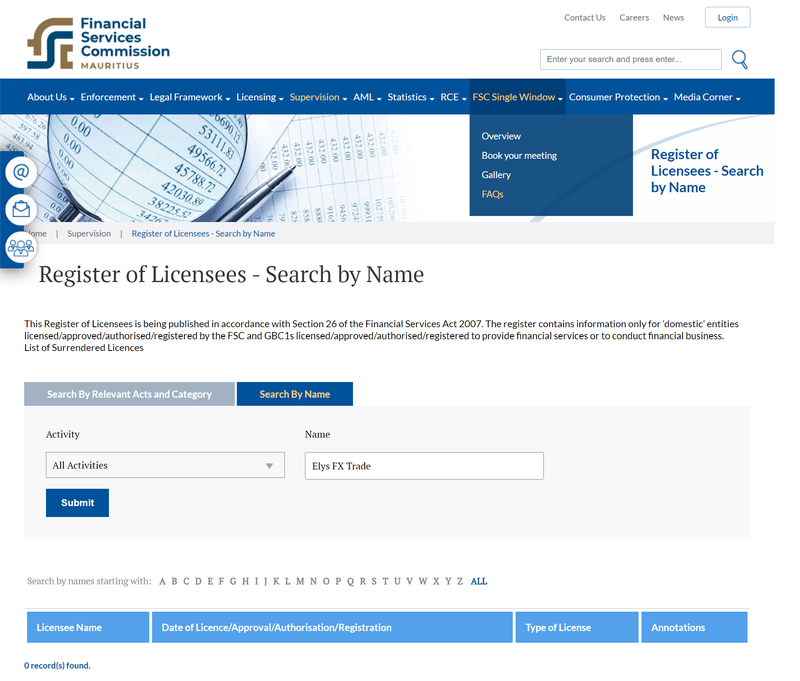

- Mauritius Financial Services Commission (FSC): License No. C17554381

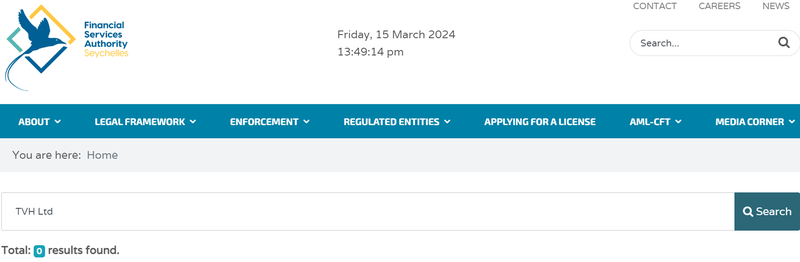

- Seychelles Financial Services Authority (FSA): License No. SD0175

However, detailed investigations show that these regulatory agencies do not have any registration information for Elys FX Trade on their official websites. This absence not only undermines Elys FX Trade’s claims of legitimacy but also raises doubts about its credibility among investors.

2. Lack of Regulatory Information

In the financial industry, transparency of regulatory information is crucial. Elys FX Trade displays claims of multiple regulatory approvals on its website, but the actual situation is concerning. If regulatory bodies lack relevant registration information, it indicates that the broker may be engaging in false advertising or non-compliant behavior. This scenario is prevalent in the industry, where many scam platforms use fabricated regulatory information to attract investors’ attention.

The Importance of Regulation

Regulation is not only a mechanism for protecting investors but also a vital tool for maintaining the stability of financial markets. Compliant financial institutions must adhere to a series of laws and regulations, providing transparent information and services. In the absence of regulatory support, these institutions may operate arbitrarily, ultimately placing investors at significant risk.

Real-World Case Analysis

1. Lesson from False Regulation

In the financial industry, many investors have suffered significant losses by trusting a platform’s regulatory information. For instance, one forex broker claimed to be regulated by several well-known financial institutions, attracting numerous investors. However, when these investors attempted to withdraw their funds, the platform delayed, citing “account verification” and “fees,” eventually absconding with all the money. This incident left hundreds of investors with millions of dollars in losses within months, many of whom ended up in severe debt and personal crises.

2. Cross-Border Scam Syndicates Changing Names

Another type of forex scam platform frequently changes its company name and website domain to evade regulation. Although these platforms have different names, they employ the same technological infrastructure and website templates for deceptive advertising to lure investors. One cross-border scam syndicate changed its name five times within two years, using forged regulatory information and promises of high returns to attract a significant number of investors. Ultimately, these investors discovered their funds were unrecoverable when attempting withdrawals, leading many to lose their life savings, with some even resorting to extreme measures.

3. Similarities with Elys FX Trade

Elys FX Trade exhibits patterns similar to the aforementioned scam platforms in its promotional strategies for products and regulatory information. Investors must remain vigilant when selecting forex brokers to avoid becoming the next victim. Despite claiming to have multiple regulatory approvals, Elys FX Trade’s lack of authentic registration information on its website closely resembles the behavior of many scam platforms.

The Impact of Being Scammed

1. Financial Losses

Victims of scams often face substantial financial losses. Many individuals invest their entire savings in seemingly legitimate platforms while pursuing high returns, only to find that their invested funds have vanished. Such losses are not only monetary but can also push individuals toward bankruptcy.

2. Psychological Trauma

After being scammed, many investors experience severe psychological trauma. Feelings of guilt, self-blame, and even depression can arise, affecting their daily lives and potentially straining family relationships. Many lose confidence in financial markets after suffering such losses, making them reluctant to invest again.

3. Legal and Credit Issues

Once investors realize they’ve been scammed, many seek legal avenues to recover their losses, but success rates are often low. Victims may face legal fees and credit problems, sometimes leading to bankruptcy. This situation exacerbates anxiety and uncertainty, causing investors to lose faith in financial markets.

4. Decreased Market Trust

Frequent occurrences of scams damage the overall credibility of the forex market, leading to decreased trust among investors in legitimate platforms and discouraging them from investing. This erosion of trust affects market liquidity and may inhibit new investors from entering the market. Trust is foundational to the normal operation of any market; any instance of fraud can have lasting repercussions.

Potential Risks of Elys FX Trade

1. Lack of Operational Transparency

Elys FX Trade fails to provide effective contact details and operational information on its website, increasing the likelihood of investor fund risk. Legitimate forex brokers typically offer various contact methods—such as phone, email, and physical addresses—allowing customers to reach the company easily.

2. Risk to Fund Security

When selecting a forex broker, fund security is a top concern for investors. If a platform lacks effective regulation and transparent operational methods, investor funds are at considerable risk. Elys FX Trade’s lack of transparency and false regulatory information means investors’ funds are not safeguarded.

3. Information Asymmetry

Elys FX Trade attracts investors through deceptive advertising and exaggerated returns, creating information asymmetry. Many investors fail to conduct adequate market research and information validation when selecting a platform, leading them to invest without knowledge. This asymmetry directly contributes to significant losses during investment.

4. Potential Risks in the Trading Environment

Although Elys FX Trade claims to have a stable and technologically advanced trading environment, there is a lack of actual user feedback and independent market reviews to support this claim. Many investors may end up investing without genuine trading data, further amplifying the risks involved.

Conclusion

Elys FX Trade claims to possess multiple regulatory approvals; however, investigations reveal that the authenticity of its regulatory information is questionable. Investors must stay vigilant when selecting forex brokers, confirming the platform’s legality and safety to avoid potential financial losses and psychological trauma. By enhancing scrutiny and understanding of platforms, investors can better protect their financial security and avoid becoming victims of fraud.

In a financial market filled with opportunities and risks, understanding and mastering correct investment knowledge can pave the way for investors’ futures. Whether a novice or a seasoned trader, maintaining sensitivity to the market and exercising caution with information will help them navigate the complexities of the financial landscape successfully.

Frequently Asked Questions (FAQ)

- Is Elys FX Trade legally regulated?

No, although Elys FX Trade claims to be regulated by several authorities, verification reveals that this regulatory information is not genuine. - Is Elys FX Trade headquartered in Cyprus?

Elys FX Trade claims to be based in Cyprus, but the lack of registration information in relevant regulatory agencies suggests that this claim may be false. - Why does Elys FX Trade resemble other platforms?

The website design and operational model of Elys FX Trade closely align with several questionable platforms, indicating a possible connection to the same scam network. - How can investors verify a broker’s legitimacy?

Investors should check the registration information of brokers on the official websites of financial regulatory authorities to confirm their legitimacy. - What should I do if I’ve invested in Elys FX Trade?

If you have invested in Elys FX Trade, it is advisable to stop trading immediately and attempt to recover funds through your payment channels while reporting the platform to the relevant regulatory authorities. - How can I protect myself from forex scams?

Stay alert, educate yourself about market fundamentals, and carefully research any forex broker’s registration information and user feedback to avoid blind investments.