While NASDAQK LIMITED claims to provide a wide range of financial products and services, the discrepancies in its regulatory information raise serious concerns. Investors should be cautious of the potential risks to their funds. This article will delve into NASDAQK LIMITED’s business model, regulatory issues, and background, providing real-life case studies to help investors identify potential fraud.

1. Overview of NASDAQK LIMITED and Its Business Model

1.1 The Rise of CFD Trading

Contracts for Difference (CFDs) are financial derivatives that allow traders to profit from price movements of assets without owning the underlying asset. These products often include forex, stocks, indices, commodities, and cryptocurrencies. With the leverage effect in CFD trading, investors can control large sums with a small initial investment, offering high potential returns but also high risk.

According to NASDAQK LIMITED, the company offers a wide range of CFD products through a self-developed trading platform and mobile app, covering the following markets:

- Forex Market (Forex): Includes major, minor, and emerging market currency pairs.

- Stock Market: Offers CFDs on global blue-chip stocks.

- Futures Market: Includes energy, commodities, and other futures contracts.

- Cryptocurrency Market: Offers CFDs on major cryptocurrencies like Bitcoin and Ethereum.

- Precious Metals: CFDs on popular commodities like gold and silver.

However, after analyzing its regulatory information and company background, we found significant issues with false claims.

2. Regulatory Issues with NASDAQK LIMITED

2.1 False ASIC Regulatory Claims

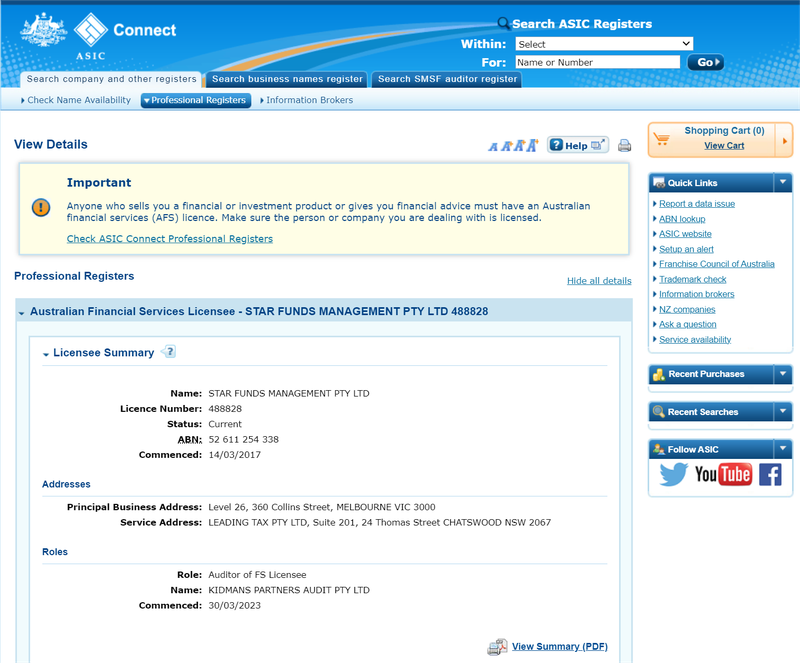

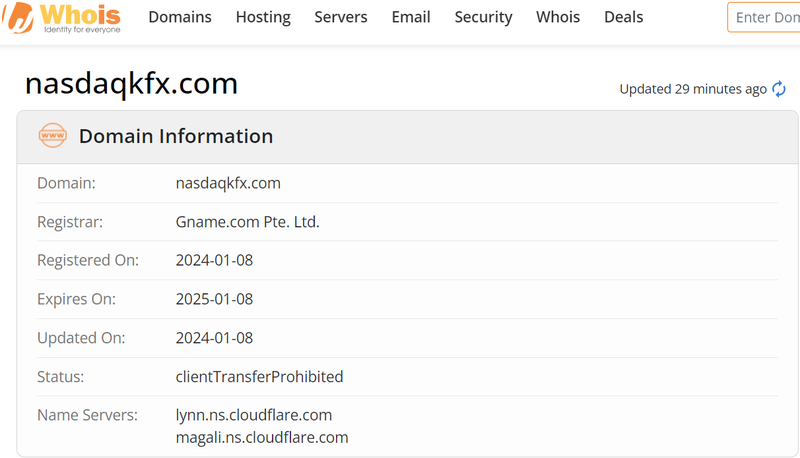

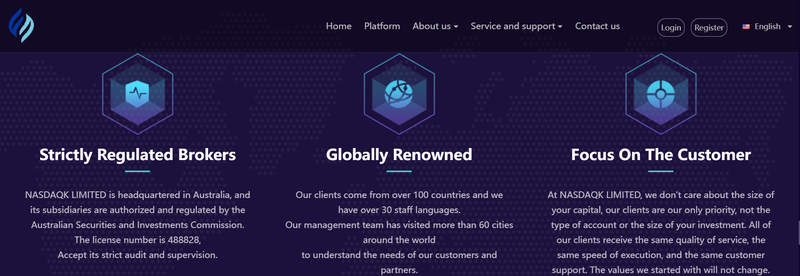

NASDAQK LIMITED claims to be based in Australia and regulated by the Australian Securities and Investments Commission (ASIC) under license number 488828. However, a search on ASIC’s official website reveals that this number belongs to another entity, “STAR FUNDS MANAGEMENT PTY LTD,” with no connection to NASDAQK LIMITED.

ASIC is Australia’s primary financial regulator, overseeing businesses and individuals in financial markets to ensure their legality and compliance. Legitimate ASIC-regulated brokers openly display their valid license numbers, which can be verified on the ASIC website. NASDAQK LIMITED has falsely used another company’s license number, misleading investors and rendering its regulatory claims untrustworthy.

2.2 False Claims of NFA and FinCEN Registration

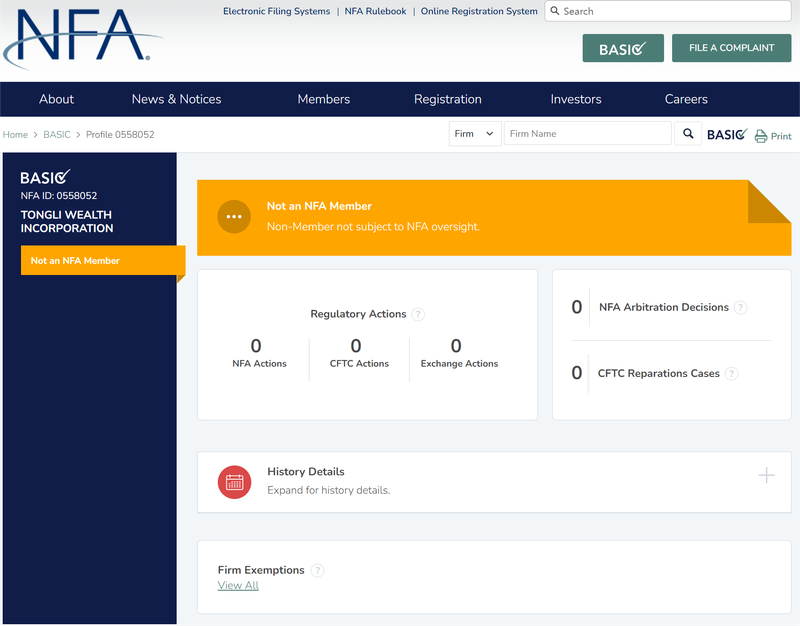

In addition to its false ASIC claim, NASDAQK LIMITED asserts that it is registered with the U.S. National Futures Association (NFA) under ID number 0558052. The NFA is a self-regulatory organization designated by the U.S. Commodity Futures Trading Commission (CFTC) to oversee futures and derivatives markets. Upon verification, this ID number belongs to a company named “TONGLI WEALTH INCORPORATION,” which is not an NFA member. This means NASDAQK LIMITED is not regulated by the NFA, making its regulatory status fraudulent.

Furthermore, NASDAQK LIMITED claims to be registered with the U.S. Financial Crimes Enforcement Network (FinCEN). A search of FinCEN’s official website, however, reveals no records of NASDAQK LIMITED. This further proves the company is attempting to mask its illegal operations with false claims.

3. Contradictions in NASDAQK LIMITED’s Corporate Background

3.1 Confusion Over Headquarters Location

NASDAQK LIMITED’s corporate background also shows significant contradictions. The company’s website claims its headquarters is in Australia but also mentions that it is a Japanese subsidiary of NASDAQK LIMITED based in Tulsa, Oklahoma, USA. These inconsistent statements raise questions about the company’s legitimacy and transparency.

For any legitimate financial institution, the registered office and headquarters information should be consistent and clear. The discrepancies in NASDAQK LIMITED’s location details suggest it may be a scam broker seeking to evade regulation and legal accountability.

3.2 Website Similarities with Other Suspicious Brokers

Upon analyzing NASDAQK LIMITED’s website, we noticed striking similarities with websites of known suspicious brokers, including SXHJAS, TNFL FX, ABUSA, Hengtuo Finance, VTPTRADE, CTRL FX, and others. These brokers often change names and website designs frequently to confuse investors and avoid regulation.

These brokers sometimes share the same technical platform and operate similarly, offering CFDs on forex, stocks, precious metals, and other assets. The high similarity between these websites suggests that NASDAQK LIMITED might be part of a larger network of suspicious brokers.

4. Real-Life Scam Broker Cases

To help investors understand how fraudulent financial platforms operate, here are some real-world cases of scam brokers and their tactics.

4.1 Case 1: Online Broker with a Fake License

A broker in Australia claimed to be regulated by ASIC and displayed a fake license to attract investors. Despite the professional appearance of its website and the provision of market data and trading tools, the company was unregulated. After investors deposited large sums of money, the company became unreachable, and the website shut down. Victims later discovered the broker was never listed under ASIC’s official regulatory authority. Such platforms lure investors with fake licenses, leading to substantial losses.

4.2 Case 2: Transnational Scam Network

Another broker claimed to have branches in multiple countries, but its regulatory information was inconsistent across jurisdictions. Eventually, it was revealed to be part of an international scam ring. The company enticed investors with promises of high returns and lucrative reward programs. However, when investors tried to withdraw their funds, the broker delayed or denied requests and froze accounts. The company then swiftly shut down all online platforms and disappeared without a trace.

These examples show that investors must remain highly cautious when dealing with brokers claiming global operations and multiple regulatory affiliations.

5. How to Avoid Falling for Scam Brokers

To protect yourself from brokers like NASDAQK LIMITED, which provide inconsistent and misleading information, investors can take the following steps:

5.1 Verify Regulatory Information

Always verify a broker’s regulatory status through the official website of the relevant regulatory authority. Reputable brokers should have their license information available on the regulatory body’s website. If you cannot verify the broker’s claims or suspect it is using someone else’s license, proceed with caution.

5.2 Check Company Address and Headquarters Information

Avoid brokers that claim to have multiple headquarters in different countries or have inconsistent address information. Legitimate financial institutions maintain a consistent, publicly transparent address and registration. Frequent address changes are often a tactic used by scam brokers to avoid liability.

5.3 Be Wary of Similar Website Designs and Content

If multiple broker websites appear almost identical in design, content, or terms of service, they may belong to the same scam network. Compare services, regulatory information, and user feedback across platforms to assess their legitimacy.

5.4 Evaluate User Feedback on the Platform’s Reputation

Before making investment decisions, check user reviews on social media, financial forums, and regulatory bodies’ complaint records. Brokers with frequent complaints often have underlying issues.

6. FAQ – Frequently Asked Questions

6.1 Is NASDAQK LIMITED really regulated by ASIC?

No, NASDAQK LIMITED claims to be regulated by ASIC, but it is using another company’s license number and is not regulated by ASIC.

6.2 How can I verify a broker’s regulatory information?

You can verify a broker’s regulatory status by visiting the official website of the relevant regulatory body and searching for the broker’s license number or NFA ID. Legitimate regulated companies should appear in the database.

6.3 Where is NASDAQK LIMITED’s headquarters?

NASDAQK LIMITED provides conflicting information on its website, making it unclear where the company is actually based. This is a red flag that suggests the company may be illegitimate.

6.4 What should I do if a broker’s regulatory information is false?

If you find that a broker’s regulatory information is false, stop investing immediately, report the broker to the appropriate financial regulatory body, and protect your funds.

6.5 Is CFD trading suitable for all investors?

CFD trading carries high risks and may not be suitable for all investors. Individuals should fully understand market risks and only trade with regulated platforms.

6.6 What is the user feedback on NASDAQK LIMITED?

User feedback for NASDAQK LIMITED is generally negative, with most investors reporting issues with fund withdrawals and a lack of transparency.

More information:https://www.inves2win.com/