BBcapitals is an emerging forex broker offering a variety of financial products, but its lack of effective regulation means investors should approach it with caution.

1. Overview of BBcapitals

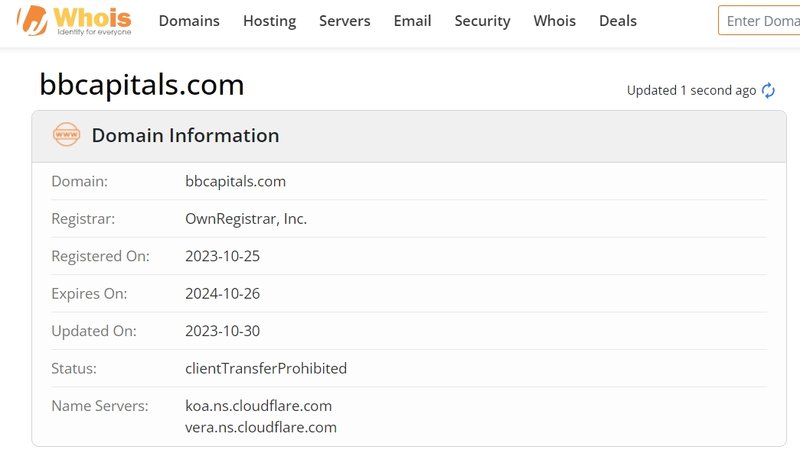

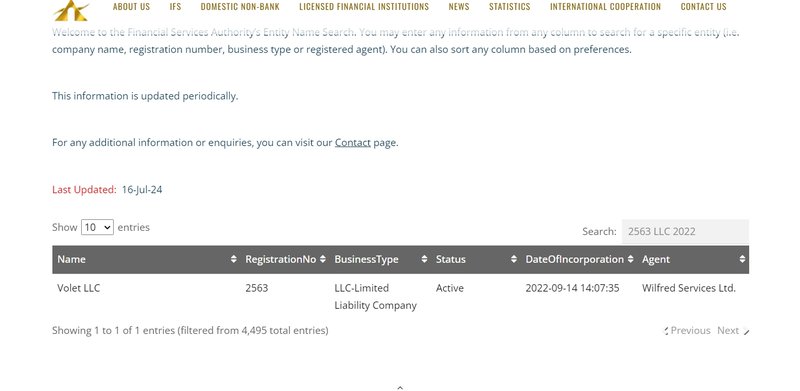

BBcapitals is a forex broker that claims to offer a wide range of financial derivative trading services to global investors. The platform registered its domain on October 25, 2023, making it a relatively new player in the market. It provides trading in stocks, indices, commodities, precious metals, and cryptocurrencies. BBcapitals is operated by Volet LLC, a company registered in Saint Vincent and the Grenadines under registration number 2563 LLC 2022, and aims to offer users a broad range of financial products and derivative trading opportunities.

Although BBcapitals’ website outlines its services and platform advantages, the platform’s legal and regulatory framework is highly uncertain, which means investors must exercise caution when using it. Compliance, regulatory status, and fund security are critical factors investors should consider, particularly in the high-risk derivatives market.

2. Corporate Background of BBcapitals

BBcapitals is operated by Volet LLC, a limited liability company registered in Saint Vincent and the Grenadines. According to publicly available information, BBcapitals is registered under number 2563 LLC 2022, and its domain was registered on October 25, 2023. This indicates that the platform is relatively new to the market as a provider of forex and contracts for difference (CFD) trading.

- Saint Vincent and the Grenadines Registration: Saint Vincent and the Grenadines is an offshore financial center that attracts many financial services companies for registration. However, the country’s Financial Services Authority (FSA) does not regulate forex brokers or financial derivatives trading. This means that although BBcapitals is registered under Volet LLC in this jurisdiction, it is not subject to strict regulatory scrutiny, making it difficult to ensure the security of investor funds and transparency in trading operations.

- Lack of Corporate Transparency: While BBcapitals provides registration details and corporate background information, it lacks transparency regarding the specifics of its operations. For example, the platform does not disclose the backgrounds of its management team or its financial status. Investors typically seek this information to assess the platform’s stability and long-term viability. The lack of transparency in these areas raises concerns about BBcapitals’ legitimacy and safety.

3. BBcapitals’ Regulatory Information

Although BBcapitals provides information about its registration and operating company, investors should be aware that companies registered in Saint Vincent and the Grenadines are not necessarily subject to the country’s financial regulatory oversight. The Financial Services Authority (FSA) in Saint Vincent and the Grenadines oversees certain financial service providers but does not regulate forex or financial derivatives brokers. As a result, BBcapitals, while registered in this region, is not under strict financial regulation.

- Importance of Regulation: Financial regulation aims to protect investors by ensuring platforms follow transparent, legal procedures and avoid misusing client funds. Globally recognized financial regulatory bodies, such as the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC), conduct regular audits and closely monitor the financial institutions they regulate. These measures reduce the risk of financial fraud and ensure investor fund safety. However, BBcapitals has not been licensed by any of these regulatory authorities, meaning investors trading on the platform may not benefit from these protections.

- Case Study: Risks of Unregulated Platforms

In 2017, YouTradeFX, a platform offering forex and CFD trading services, was similarly registered in a low-regulation offshore jurisdiction. It claimed to provide trading services to clients worldwide. However, as time passed, many investors encountered difficulties withdrawing their funds, and the platform could not provide financial audit reports. Ultimately, YouTradeFX faced warnings from multiple financial regulators due to its lack of regulation and fund management issues, leading to its shutdown. This case illustrates the significant financial risks posed by unregulated platforms.

4. BBcapitals’ Trading Products and Services

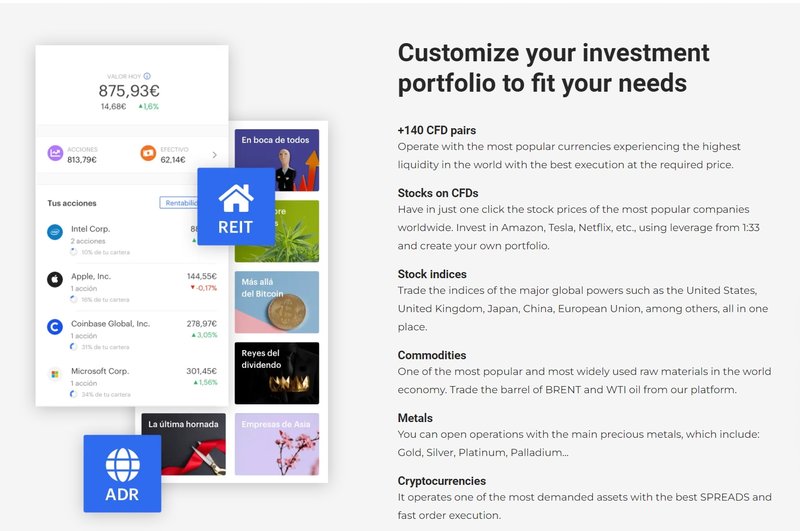

BBcapitals offers a wide range of trading products, providing global investors with diverse choices across various asset classes, including forex, stocks, indices, commodities, precious metals, and cryptocurrencies. Whether you’re an active trader seeking short-term opportunities or a long-term investor looking to build a diversified portfolio, BBcapitals’ platform provides the tools and services to meet different investor needs. However, investors must closely monitor market volatility and apply appropriate risk management strategies when utilizing these products.

4.1.1. CFD Currency Pairs

BBcapitals offers over 140 CFD (Contract for Difference) currency pairs for investors. These currency pairs include the most popular major, minor, and emerging market currencies worldwide, allowing investors to capitalize on the high liquidity and volatility of the forex market. Through BBcapitals’ platform, investors can execute trades efficiently at their desired price, benefiting from competitive spreads and optimal execution.

4.1.2. Stock CFDs

BBcapitals allows investors to trade CFDs on the stocks of globally renowned companies, such as Amazon, Tesla, and Netflix. With leverage starting at 1:33, investors can create their own portfolios with lower capital requirements, gaining greater market exposure. This leverage mechanism offers the potential to amplify returns, but it also increases the risks associated with market volatility.

4.1.3. Stock Indices

Through BBcapitals, investors can trade stock indices from major global economies, including the U.S., UK, Japan, China, and the EU. All trades can be executed on a single platform, simplifying cross-market trading and enabling investors to diversify their portfolios easily and capture the overall performance of global markets.

4.1.4. Commodities

BBcapitals also offers a broad selection of commodities for investors to trade. Investors can access widely-used and popular raw materials in the global economy, such as BRENT and WTI crude oil. These commodities are essential components of the world economy, and their price fluctuations provide investors with significant trading opportunities.

4.1.5. Metals

For investors seeking stability and wealth preservation, BBcapitals provides trading in major precious metals, including gold, silver, platinum, and palladium. These metals are often considered safe-haven assets during times of market volatility, attracting investors looking to safeguard their wealth in uncertain markets.

4.1.6. Cryptocurrencies

BBcapitals also supports cryptocurrency trading, catering to investors interested in these emerging asset classes. Investors can trade in-demand cryptocurrencies such as Bitcoin and Ethereum while benefiting from BBcapitals’ competitive spreads and fast order execution. The high volatility of cryptocurrencies presents potential opportunities for both day traders and long-term investors.

5. Investor Protection and Fund Security

Fund security is a top priority for all investors. Reputable trading platforms typically implement various measures to safeguard client funds, such as fund segregation, regular audits, and negative balance protection. However, BBcapitals has not clarified whether it employs these basic fund protection mechanisms.

- Fund Segregation: Regulated platforms usually separate client funds from the company’s operating funds, ensuring that client funds remain safe even if the platform faces financial difficulties. BBcapitals has not explicitly stated whether it uses fund segregation, making it difficult for investors to evaluate the safety of their funds.

- Lack of Transparency in Fund Deposit/Withdrawal Process: BBcapitals has not provided clear information on its deposit and withdrawal processes or associated fees. Legitimate platforms typically display transparent fund transfer timelines, procedures, and fees, ensuring clients understand all potential costs. The lack of this information on BBcapitals may create uncertainty and potential risks during fund transactions.

6. Case Study: The Importance of Fund Security

The FX Trading Corporation case from 2019 highlights the critical importance of fund security. This platform claimed to offer high-return forex and cryptocurrency trading services, attracting a large number of investors. However, due to a lack of transparency in its fund management, many investors found themselves unable to withdraw their funds. FX Trading Corporation was ultimately shut down for illegal operations and misappropriation of funds. This case underscores the importance of choosing a regulated platform with a clear and transparent fund management system.

FAQs

- Is BBcapitals regulated?

BBcapitals is operated by Volet LLC, registered in Saint Vincent and the Grenadines. However, the FSA in Saint Vincent does not regulate forex or financial derivatives brokers. - What trading products does BBcapitals offer?

BBcapitals offers financial derivative trading in forex, stocks, indices, commodities, precious metals, and cryptocurrencies. - Is BBcapitals’ deposit/withdrawal process transparent?

BBcapitals has not publicly disclosed its deposit and withdrawal processes or related fees, raising concerns about transparency. - How can investors verify the legitimacy of a platform?

Investors can verify a platform’s registration and regulatory information by checking official websites of global regulatory authorities or business registration databases. - Does BBcapitals offer fund protection?

BBcapitals has not stated whether it uses fund segregation or provides negative balance protection, so investors should be cautious about fund security. - Why is choosing a regulated platform important?

Regulated platforms ensure fund security, follow transparent trading rules, and provide protection measures such as compensation programs for investors.

More Information:https://www.inves2win.com/