Capital Manager, a new financial trading platform, lacks transparent regulation and corporate background. Investors should proceed with caution.

1. Overview of Capital Manager: A Brief Analysis of the New Platform

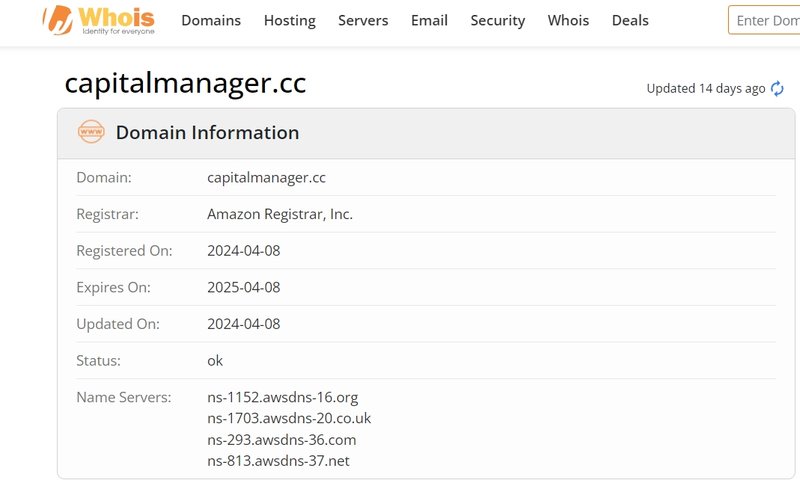

Capital Manager is a relatively new financial trading platform offering a range of products, including forex, cryptocurrencies, indices, stocks, ETFs, and commodities. Its domain was registered on April 8, 2024, indicating that the platform is a recent entrant to the market. While Capital Manager claims to offer a broad selection of products to meet the needs of various investors, it shows clear transparency issues, particularly in terms of corporate background and regulatory information. For any newly established financial platform, a lack of transparency can raise concerns about its legitimacy and operational security.

2. Lack of Corporate Background Transparency

A clear corporate background is essential for assessing a financial platform’s credibility, and Capital Manager falls short in this regard. On its website (https://www.capitalmanager.cc/), the platform does not disclose its operating address or provide details about its management team. This absence of information makes it difficult to verify the platform’s actual operational entity or the people behind it. A trustworthy financial platform usually reveals its headquarters and shares the professional credentials of its management team, helping to instill investor confidence.

Knowing the physical location of a platform is crucial for investors, as it not only ensures the platform’s legal operations but also provides a clear path for filing complaints or seeking legal recourse in case of issues. Capital Manager’s silence on these important details casts doubt on its transparency. When selecting a platform, investors tend to prioritize those with a clear operational address and publicly available team backgrounds. Capital Manager lacks this critical information, making it harder for investors to trust the platform.

3. Questionable Regulation: The Authenticity of NFA Certification

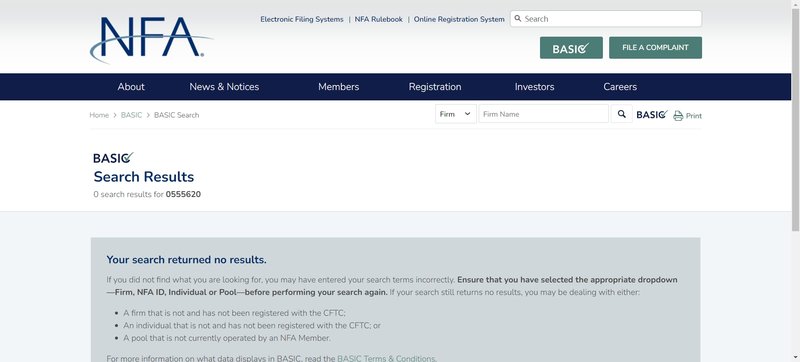

Another major red flag is the platform’s regulatory status. According to its website, Capital Manager claims to be regulated by the U.S. National Futures Association (NFA) under registration number 0555620. However, a check of the NFA database shows no record of the platform. This discrepancy indicates that Capital Manager’s regulatory claim is false, leaving investors without the protection of a legitimate financial authority.

Financial regulation is a crucial marker of compliance for trading platforms. Regulated platforms must adhere to strict legal frameworks designed to protect investors’ funds and rights. In contrast, unregulated platforms expose investors to high risks, including the potential for financial losses or platform failure, with little chance of legal recourse. The fact that Capital Manager falsely claims regulation should be a serious concern for investors. Before engaging with such platforms, thorough research is necessary, or better yet, they should be avoided altogether.

4. Lack of Transparent Account Information and Trading Conditions

Capital Manager not only faces issues with its regulatory claims but also lacks transparency regarding its trading conditions and account types. Investors typically expect platforms to provide clear details about account options, minimum deposits, available products, spreads, leverage, and fees. However, Capital Manager fails to provide this essential information, leaving potential users uncertain about key aspects of the platform.

Transparent trading conditions are vital for risk management and planning investment strategies. Most reputable platforms offer clear and detailed information about account types and transaction costs, ensuring investors know the cost structure upfront. Capital Manager’s failure to disclose such details raises questions about its professionalism and increases the likelihood of hidden fees or unexpected costs.

5. Diverse Trading Products: Reality or Doubt?

Capital Manager claims to offer a wide range of financial products, including forex, cryptocurrencies, indices, stocks, ETFs, and commodities. While this variety may seem attractive, the platform’s lack of regulatory oversight and unclear corporate background make it difficult for investors to confirm the authenticity of these products or the platform’s execution capabilities.

Typically, regulated platforms work with established banks and liquidity providers, ensuring real market quotes and reliable trade execution for investors. However, unregulated platforms may manipulate market prices and order execution, leading to potential investor losses. Although Capital Manager claims to offer a diverse product range, its lack of regulatory backing makes the quality of its trading services highly questionable.

6. Fund Security and Investor Risk

Without proper regulatory credentials, Capital Manager presents significant risks in terms of fund security. Regulated platforms strictly separate client funds from company operational funds, protecting customer deposits during financial issues. Unregulated platforms like Capital Manager often mix these funds, raising the risk of misuse.

Another risk comes during the withdrawal process. Without oversight, investors may experience delays or outright refusals when attempting to withdraw funds. In cases of financial instability or sudden platform shutdowns, recovering deposits may be impossible. Investing in unregulated platforms not only heightens the risk of trade manipulation but also puts the security of investor funds at serious risk.

7. How to Ensure You Choose a Regulated and Legitimate Platform

When selecting a financial trading platform, investors should prioritize platforms regulated by reputable authorities. Such platforms typically operate under the supervision of financial regulators like the FCA, ASIC, or CySEC and undergo regular audits and compliance checks. These safeguards help ensure transparent fund management, fair trade execution, and protection of client rights. Before choosing a platform, investors should verify its regulatory status through independent channels, such as the regulator’s official website, by searching for the platform’s license number.

If a platform claims to be regulated but its credentials cannot be verified, investors should remain cautious. To avoid unregulated platforms, conduct thorough research into the platform’s history, reputation, and user experiences. Additionally, selecting a platform with a long operational history can further enhance investor security.

8. Investor Advice: Be Cautious and Avoid Risks

In summary, Capital Manager, though offering a wide range of trading products, presents serious concerns due to its lack of transparency regarding corporate background, trading conditions, and regulatory status. The platform’s false regulatory claims further increase the risks. Investors should look for strictly regulated platforms to ensure the safety of their funds and protection of their legal rights. It’s advisable to avoid unregulated platforms or those with unclear information.

By thoroughly reviewing a platform’s regulatory status, corporate background, trading conditions, and user feedback, investors can better protect themselves from potential risks and make informed decisions when choosing a trading partner.

Frequently Asked Questions (FAQ)

- Is Capital Manager regulated?

Capital Manager claims to be regulated by the NFA, but checks reveal no such registration. It is an unregulated platform. - What financial products does the platform offer?

Capital Manager claims to offer forex, cryptocurrencies, indices, stocks, ETFs, and commodities, but the lack of regulation raises doubts about the authenticity of these offerings. - How can I verify a platform’s regulatory status?

You can verify a platform’s regulatory status by visiting the official website of relevant financial regulators and searching for the platform’s license number. - Is Capital Manager’s fund security reliable?

Without regulation, Capital Manager offers no reliable fund security. The lack of oversight means your deposits are at risk. - How can I ensure I choose a legitimate platform?

Choose platforms regulated by reputable authorities like the FCA, ASIC, or CySEC, and verify their credentials through independent channels. - Is Capital Manager suitable for beginner investors?

Given its unregulated status and lack of transparency, Capital Manager is not recommended for any type of investor, especially beginners.

More Information:https://www.inves2win.com/