TNFX is a broker claiming to offer trading services in forex, metals, energy, stocks, and indices to global investors. Despite claiming regulation and legitimate financial services, a deeper analysis reveals several issues with its registration and regulatory status. These concerns severely impact the platform’s credibility, and investors should remain cautious to avoid potential financial risks due to the platform’s lack of transparency.

Background of TNFX’s Operations

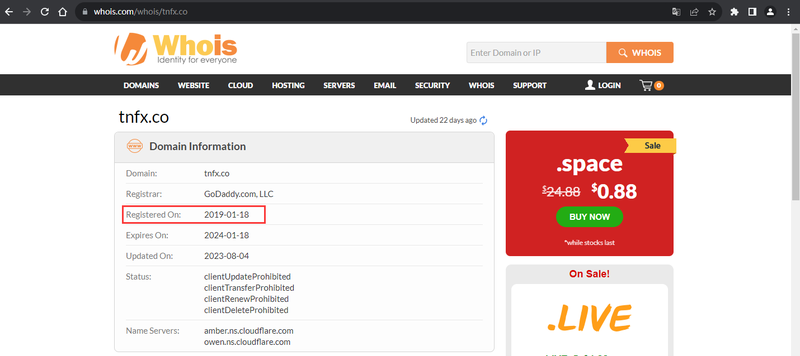

TNFX supports multiple languages, including English, Simplified Chinese, Spanish, Turkish, Pashto, and Arabic. This multilingual support helps attract investors worldwide, particularly in markets like forex, metals, energy, stocks, and indices. According to Whois data, TNFX registered its domain on January 18, 2019, and has been operating for over four years, giving the impression of a stable, international brokerage.

However, TNFX’s registration and regulatory background reveal significant concerns, especially regarding transparency and compliance.

Lack of Company Registration Information

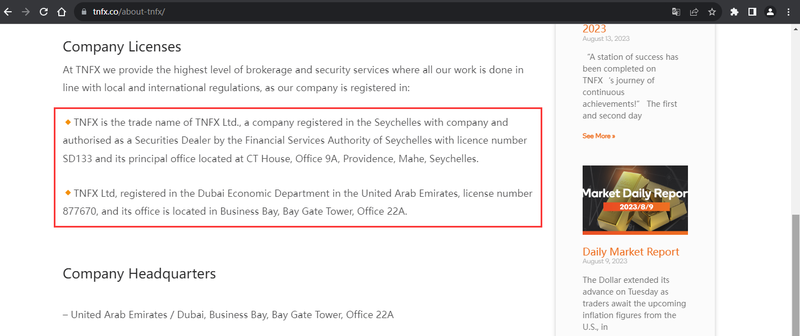

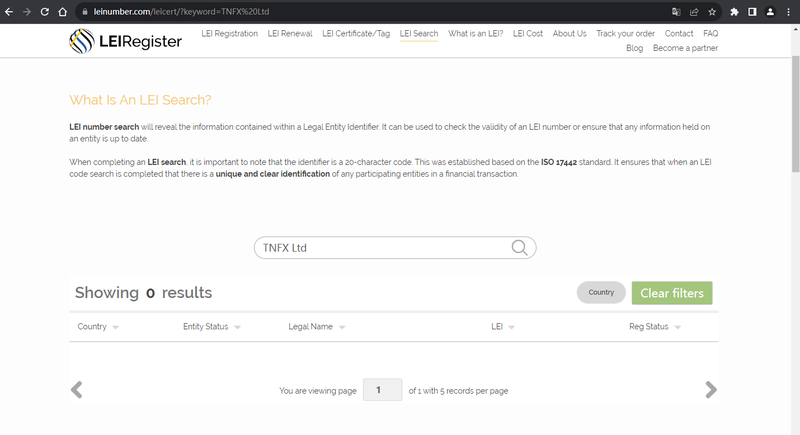

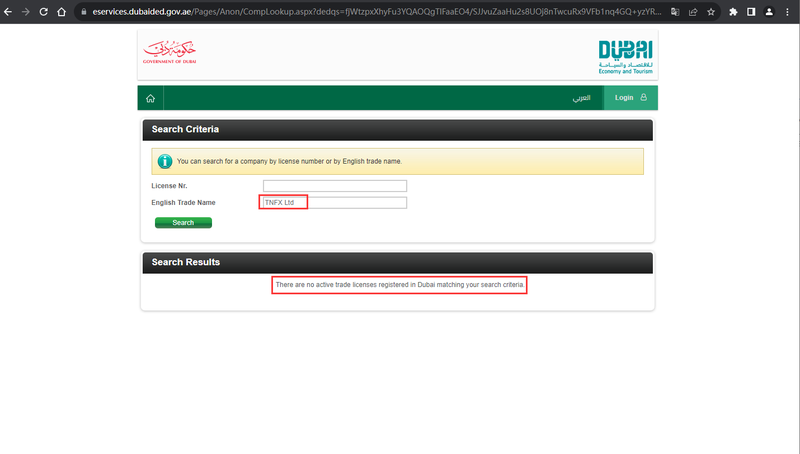

TNFX claims on its website to be registered in Seychelles and the UAE. However, further investigation through global business registries such as the LEI Register and the Government of Dubai found no records of TNFX. This means that TNFX lacks legal registration in both global databases and official Dubai channels.

This situation is highly concerning. The UAE, especially Dubai, is one of the world’s major financial hubs. Any legitimate financial institution operating in Dubai registers with the appropriate government authorities and follows strict oversight from local regulators. TNFX’s failure to provide valid registration details casts serious doubts on its legitimacy in the region.

The registration details in Seychelles are equally questionable. TNFX claims registration there but fails to provide enough public information for investors to verify its legitimacy. Given the absence of records on major global business platforms, investors should be highly skeptical of these claims.

Disputed Regulatory Information

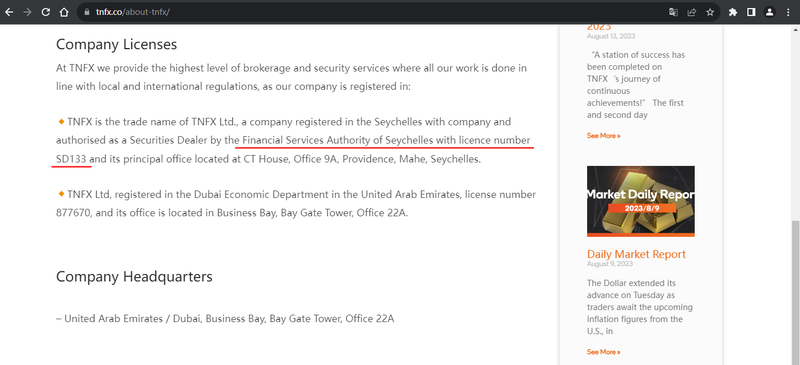

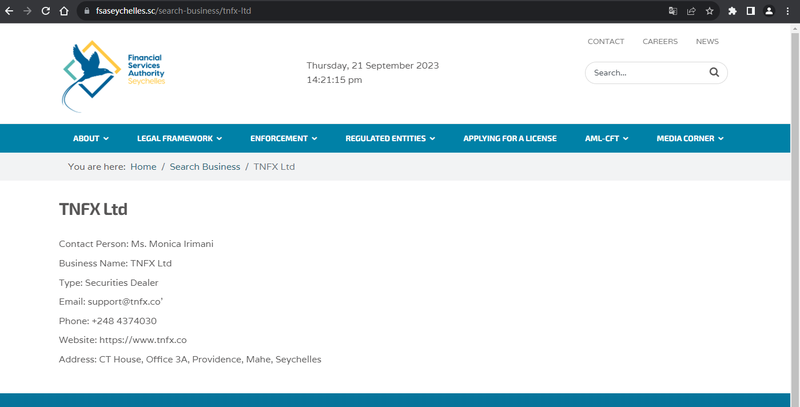

TNFX claims to be regulated by the Financial Services Authority (FSA) of Seychelles. A check on the FSA’s official website confirms this, as TNFX does hold an FSA license. However, this does not entirely alleviate concerns about the platform. While the FSA is a formal regulatory body, Seychelles has a relatively lax financial system, meaning the FSA does not provide robust oversight and offers limited investor protection.

Offshore regulators like the FSA often impose fewer restrictions on forex and CFD brokers compared to stricter bodies such as the UK’s Financial Conduct Authority (FCA) or the European regulators like CySEC. The weaker regulatory framework in offshore jurisdictions provides less protection for investor funds, and it can be difficult to seek compensation or refunds in the event of financial disputes.

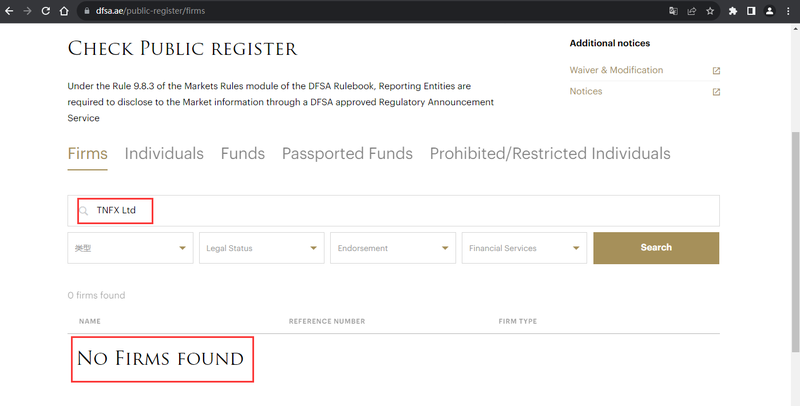

Even more concerning, TNFX asserts it operates in the UAE and claims regulation by the Dubai Financial Services Authority (DFSA). However, a search on the DFSA’s official website shows no evidence of any regulatory oversight or authorization for TNFX. This raises further questions about the platform’s legitimacy and suggests that its regulatory claims may be misleading.

Suspected Fraudulent Activity by TNFX

Based on the analysis above, TNFX shows signs of potentially fraudulent behavior. Although TNFX is regulated in Seychelles, the weak regulatory environment raises doubts about its compliance. Furthermore, TNFX’s registration and regulatory claims in Dubai cannot be verified, which further amplifies concerns about the platform’s transparency.

A legitimate forex broker must provide clear and transparent registration information and be authorized by trusted regulatory bodies. TNFX not only fails to provide verifiable information in global business registries but also makes misleading claims about its regulatory status in Dubai. These factors suggest that TNFX may be trying to attract investors through opaque methods while avoiding stricter global financial regulations.

TNFX presents itself as a broker offering a wide range of financial products, but its registration and regulatory issues raise doubts about the platform’s safety and legitimacy. While it is regulated in Seychelles, the lenient regulatory environment offers limited investor protection. Meanwhile, the company’s lack of verifiable registration and regulation in Dubai adds to the suspicion of potential fraud. Investors should remain highly cautious to avoid potential financial losses due to the platform’s questionable practices.

Frequently Asked Questions (FAQ)

- Is TNFX regulated?

TNFX claims to be regulated by the Financial Services Authority (FSA) in Seychelles, and this is confirmed. However, its claims of regulation in Dubai remain unverified. - Is TNFX legally registered in Dubai?

Dubai’s Government and DFSA databases contain no records of TNFX, indicating the company lacks legal registration and regulation there. - Is FSA regulation reliable?

While the FSA is a legitimate regulatory body in Seychelles, its oversight remains weak compared to stricter financial regulators. FSA-regulated platforms offer limited investor protection. - Can I trust TNFX for trading?

Given TNFX’s lack of transparency and unverified registration and regulation, investors should exercise caution and consider choosing brokers that are subject to more stringent oversight. - When was TNFX’s website domain registered?

According to Whois, TNFX registered its domain on January 18, 2019, indicating it has been operating for over four years. - Why can’t I find TNFX’s regulatory information in Dubai?

Although TNFX claims regulation by the DFSA in Dubai, the DFSA’s official website provides no records of the company, suggesting it does not legally operate or receive regulation in Dubai.

More information:https://www.inves2win.com/