FXC is a forex broker registered in Saint Lucia in August 2023. Although it offers a range of financial trading services, its regulatory transparency is lacking, and investors should be aware of potential financial fraud risks.

FXC: Background of an Emerging Forex Broker

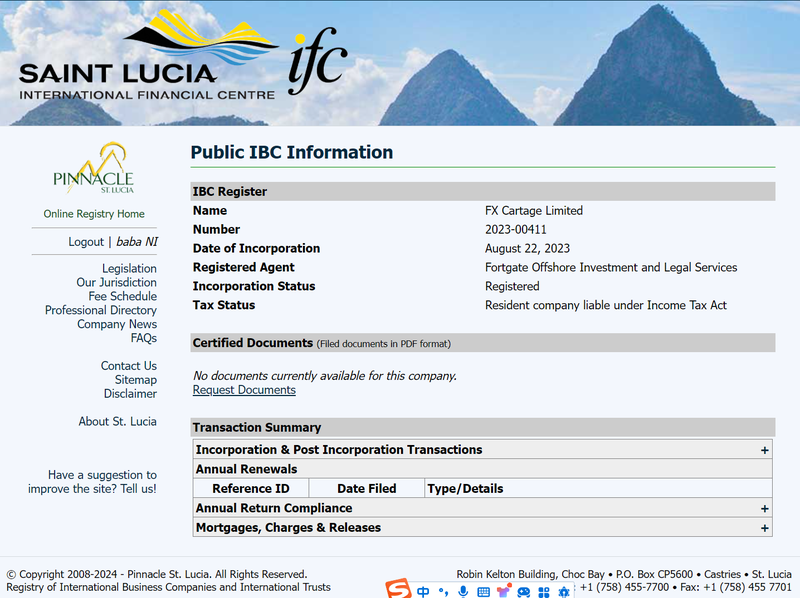

FXC, fully named FX Cartage Limited, was officially registered in Saint Lucia on August 22, 2023. The company aims to provide global investors with a variety of financial trading services. As a forex broker, FXC claims to offer trading in forex, precious metals, cryptocurrencies, stocks, indices, and options, covering multiple key areas of the financial markets.

According to its official website, FXC does not provide services to certain jurisdictions, including but not limited to the United States, Cuba, Iraq, Myanmar, North Korea, and Sudan. This restriction likely stems from the strict legal or regulatory requirements for forex trading and cryptocurrency in these countries. Especially in countries like the United States and Japan, where financial regulations are particularly stringent, unlicensed forex brokers are typically unable to operate legally.

It is worth noting that FXC has not disclosed its company headquarters’ location. Its registered address is listed as Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia. This address serves as the company’s legal office in Saint Lucia, but it does not necessarily indicate the actual location of operations. The lack of clear information about its headquarters raises concerns about the company’s operational transparency among investors.

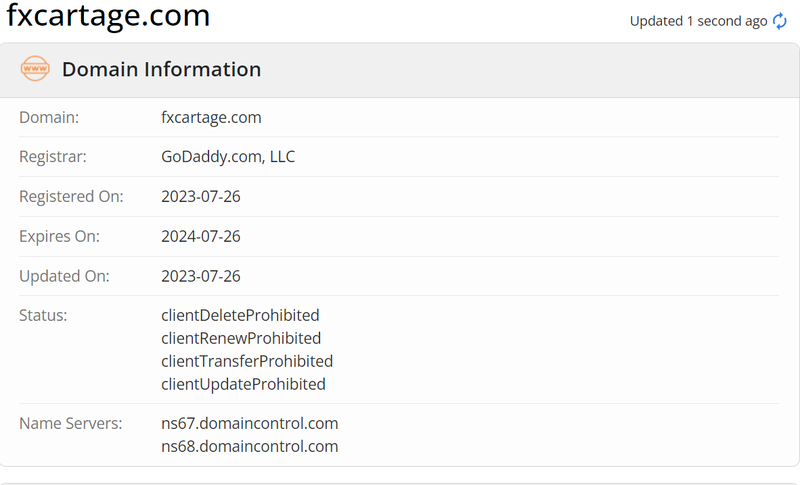

Furthermore, a Whois search shows that FXC’s official domain was registered on August 22, 2023, which aligns with its company registration date. This indicates that the company has been online for only a few months. For investors, such newly established platforms may pose higher risks due to their limited operating history.

FXC’s Regulatory Information and Compliance Concerns

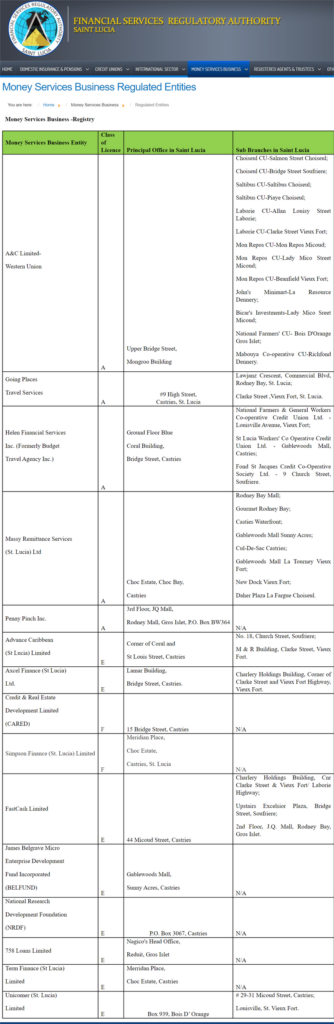

Although FXC claims to be a forex broker providing various financial trading services, it has yet to present clear regulatory information. A search of Saint Lucia’s International Business Companies and International Trust Registry (IFC) confirms the registration of FX Cartage Limited, with a registration number of 2023-00411. However, FXC is not listed as a registered broker with the Financial Services Regulatory Authority (FSRA) of Saint Lucia.

The FSRA, as the primary financial regulatory body in Saint Lucia, is responsible for overseeing companies that provide financial services within the country. Any legitimate forex broker should be authorized by the FSRA or other reputable regulatory bodies to ensure the legality and compliance of its operations. FXC’s absence from the FSRA’s registered brokers list raises doubts about its status as a legitimate financial service provider. Additionally, FXC has no registration records with other major regulatory bodies, such as the UK’s Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

This leaves FXC in a position where it operates without oversight from any major financial regulator. For investors, regulation is a fundamental safeguard in financial markets. Unregulated brokers often lack basic transparency and customer protection measures, making them vulnerable to becoming platforms for fraudulent activities.

The Spread of Financial Fraud: Alarming Proportions

In recent years, financial fraud has rapidly spread across the globe, particularly in the forex and cryptocurrency markets, where the risks to investors are increasing. According to data from financial crime investigation agencies, the number of financial fraud cases worldwide grew by over 20% in 2023, involving billions of dollars. Due to their high leverage and lack of transparency, the forex and cryptocurrency markets have become prime targets for fraudsters.

Compared to compliant platforms, many fraudulent platforms operate from offshore jurisdictions with lax regulations. FXC fits this model of offshore registration. With little oversight from major financial regulators, investors face significant uncertainties regarding the safety of their funds. Fraudulent platforms often lure investors with promises of high returns, exaggerated profits, and falsified trading data, especially targeting novice investors who lack a deep understanding of financial markets.

Fraud tactics are becoming increasingly sophisticated. Illegitimate platforms often simulate legitimate trading interfaces, enticing investors to continually invest more. However, when investors attempt to withdraw their funds, the platforms may freeze their accounts without reason or refuse withdrawals altogether. This scenario is particularly common in the forex and cryptocurrency markets, with investors realizing they’ve been scammed only after making substantial investments.

How to Guard Against Financial Fraud: Raising Investor Awareness

In today’s environment of rampant financial fraud, investors must learn to recognize and avoid potential scams. The following tips can help investors mitigate the risks of fraud:

- Verify the Platform’s Regulatory Status

When choosing a financial platform, ensure that it is regulated by a reputable authority. Financial regulators like the UK’s FCA and Australia’s ASIC provide robust protection for investors. If a platform cannot provide proof of legitimate regulation, particularly those registered offshore, investors should be cautious.

- Don’t Trust Promises of High Returns

Fraudulent platforms often lure investors with promises of high profits and quick wealth. However, high returns typically come with high risks. Any platform that claims to offer “risk-free high returns” is almost certainly a scam. Investors should take a rational approach to market returns and avoid blindly pursuing excessive profits.

- Test with Small Amounts and Check Transparency

For unfamiliar platforms, investors should start with small investments to test the platform’s withdrawal processes, transaction transparency, and customer service. If the platform exhibits delays in payments, inconsistent data, or account irregularities, investors should stop trading and reassess the platform’s credibility.

- Check Market Feedback and User Reviews

Before using a platform, investors should review user feedback on forums, social media, and industry websites. If there are numerous complaints or negative reviews, it’s best to avoid investing through that platform.

Investors Should Be Wary of Fraud Risks

Based on FXC’s current background and regulatory status, investors should remain highly cautious about using the platform. FXC has been in operation for less than six months and has not provided any valid regulatory certifications. Combined with its registration in the lightly regulated jurisdiction of Saint Lucia, this forex broker may pose significant fraud risks. Investors must thoroughly verify the platform’s legitimacy before committing any funds, avoiding scams that promise high returns.

Given that FXC is not regulated by any recognized financial authority, investors are encouraged to prioritize brokers certified by reputable agencies to ensure the safety of their funds. By conducting detailed platform investigations, taking careful steps, and consulting with professionals, investors can better protect themselves against the potential risks of financial fraud.

FAQ:

- What is FXC?

FXC is a forex broker registered in Saint Lucia in 2023, offering financial trading services in forex, metals, cryptocurrencies, stocks, and other markets.

- Is FXC regulated?

As of now, FXC has not provided evidence of regulation by any financial authority, and no records of its registration exist with major regulatory bodies.

- How can I identify a fraudulent platform?

You can spot fraudulent platforms by checking their regulatory status, verifying user feedback, testing with small investments, and being cautious of high-return promises.

- Why is the forex market a target for fraud?

The forex market’s high leverage, volatility, and lack of transparency attract many fraudsters who exploit these features to scam investors.

- How can investors protect themselves from financial fraud?

Investors should choose regulated platforms, conduct thorough market research, avoid chasing high returns, and continuously monitor the movement of their funds.

- What should I do if I suspect a platform is fraudulent?

If you encounter delayed withdrawals or account irregularities, stop trading immediately and contact the relevant financial regulators for assistance.

More information:https://www.inves2win.com/