STEP Markets is an emerging forex and Contract for Difference (CFD) broker, established recently with its domain registered in June 2023. Although its website claims that the company is registered in Montenegro, this information has yet to be officially verified. This article explores the background, services, potential risks, and key considerations when choosing such brokers.

1. Overview of STEP Markets: The Emergence of a New Broker

STEP Markets is a relatively new online broker aiming to provide forex, stock, and CFD trading services to global investors. Its key offerings include forex currency pairs, major global stock indices, and stock CFDs. As a broker still in its early stages, STEP Markets delivers diverse financial products primarily through its website, https://www.stepmarkets.com.

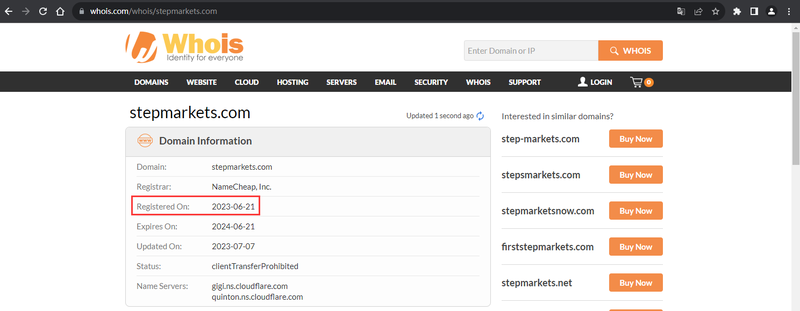

It’s worth noting that the domain for STEP Markets was registered on June 21, 2023, which means the company has been operational for less than six months. This indicates that the firm is still in its establishment and development phase, which brings certain uncertainties for investors due to its limited market presence.

2. Questionable Registration in Montenegro

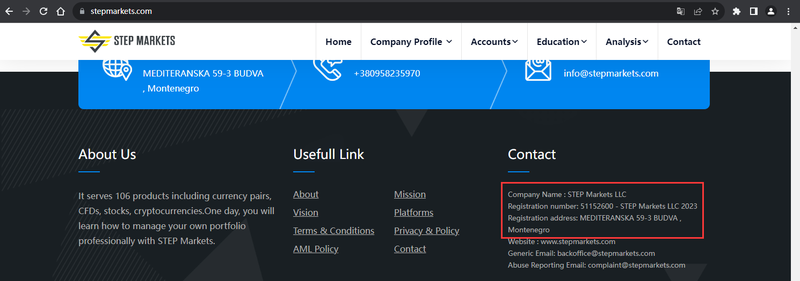

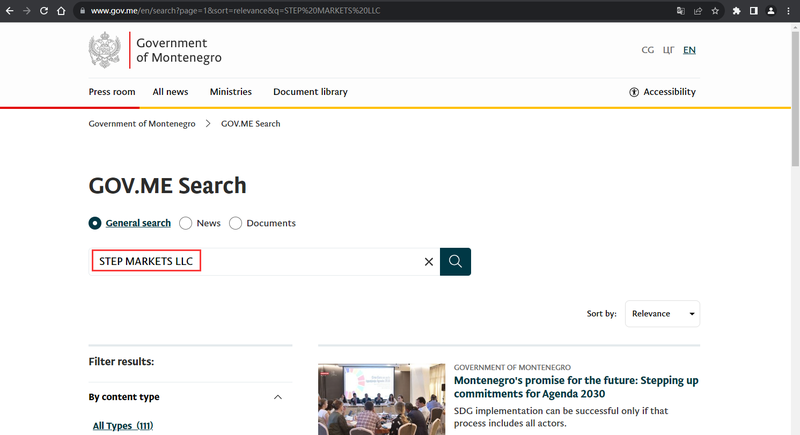

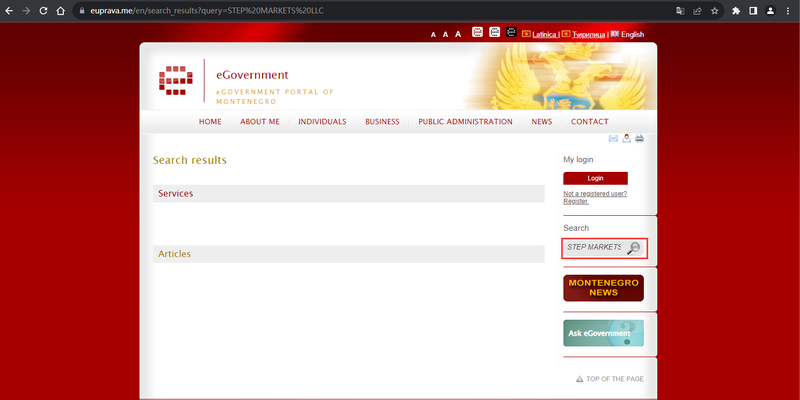

According to STEP Markets’ website, the company is registered in Montenegro. However, a search through Montenegro’s official registration platforms, including the Government of Montenegro and the eGovernment portal, yielded no results for STEP Markets.

This lack of transparency raises concerns for investors. Typically, a legitimately registered company should be traceable in its home country’s public registry. In this case, the absence of clear registration information suggests that investors should exercise caution, particularly regarding the safety of their funds.

3. Overview of the Forex and CFD Market

When selecting any forex or CFD broker, understanding the market landscape is crucial. The forex market is the largest financial market globally, with a daily trading volume exceeding $6 trillion, attracting both individual and institutional investors. CFD trading offers investors the ability to trade without owning the underlying assets.

Forex and CFD markets are characterized by high leverage and high risk, so investors must understand market trends, risk management strategies, and the broker’s compliance standards. Since STEP Markets’ registration details have not been fully verified, investors should be highly vigilant when considering this platform.

4. Legitimacy and Regulatory Issues in Financial Services

Legitimate brokers should be strictly regulated by financial authorities in their home countries or regions, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). These regulatory bodies impose strict capital requirements, fund segregation rules, and transparency standards to protect investors from fraud and platform risks.

STEP Markets claims to be registered in Montenegro but has not been listed with any well-known financial regulators. Montenegro is not a major global financial hub, and its regulatory framework is relatively lenient, lacking the strict oversight seen in major economies. This situation raises concerns about the platform’s transparency and the safety of client funds.

As an investor, it’s essential to ensure that the platform is strictly regulated, as regulated brokers typically place greater emphasis on client fund security and trading transparency. Compared to regulated brokers, companies like STEP Markets, with unclear regulatory information, pose a higher risk to investor funds.

5. Trading Platform and Features of STEP Markets

In modern trading, the technology and functionality of the platform play a key role in shaping the user experience. As an emerging broker, STEP Markets has not disclosed detailed technical information about its trading platform. Most brokers typically use popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader, which are well-regarded for their rich technical analysis tools, charting capabilities, and user-friendly interfaces.

There is no clear information indicating whether STEP Markets uses these mainstream platforms or a custom platform. Therefore, investors should ensure that the trading software provided by the broker is stable and fully functional, especially for high-frequency traders and those relying on advanced technical indicators.

6. Customer Support and Language Services

STEP Markets’ website supports only English, which could present language barriers for non-English-speaking users when communicating with the platform or executing trades. This is a potential drawback for a broker seeking to enter international markets, especially as multilingual support has increasingly become a standard feature of trading platforms. The lack of language support may limit its global expansion potential.

Additionally, customer support is a critical factor in assessing a platform’s service quality. Emerging platforms often have limited resources for customer support, so it’s recommended that investors test the platform’s response time and professionalism before making a choice.

7. Fund Security and Account Types

Fund security is one of the primary concerns for investors when choosing a forex or CFD broker. Compliant brokers typically segregate client funds from company operating funds to ensure that client money is not misused in case the company encounters financial difficulties.

However, STEP Markets has not provided specific information about its fund protection mechanisms. The lack of disclosure increases the risk to client funds, particularly since the platform is not regulated by any well-known financial authorities. Investors should proceed with caution in this regard.

8. Business Prospects of STEP Markets

Since STEP Markets is a relatively new company, its future development remains uncertain. For an emerging broker, future success depends on several factors, including the platform’s technological support, customer service quality, market reputation, and whether it can provide a transparent and trustworthy trading environment.

As competition in the forex and CFD market intensifies, STEP Markets will need to establish a credible brand, offer competitive trading conditions, and operate transparently to attract and retain clients. The platform’s long-term success will depend on its ability to meet investors’ high expectations for security, transparency, and technical performance.

9. Key Considerations When Choosing an Emerging Broker

Investors should pay close attention to the following points when selecting an emerging broker like STEP Markets:

- Check registration details: Ensure the company has a verifiable registration with relevant government platforms or financial regulatory authorities.

- Understand the regulatory environment: Choose brokers regulated by strict regulatory bodies to ensure fund security.

- Assess platform transparency: Ensure the company clearly discloses its fee structure, spreads, and fund safety policies.

- Test customer service: Contact customer support in advance to gauge response times and problem-solving capabilities.

- Evaluate risk tolerance: New brokers typically carry higher risks, so investors should assess their own risk tolerance.

10. Potential Risks of STEP Markets

As an emerging broker, STEP Markets offers a range of trading products such as forex, stocks, and CFDs. However, due to unclear registration information and a lack of strict financial regulation, investors should exercise caution. New platforms often face issues with immature technology and inadequate customer support, so investors should verify the platform’s compliance and fund safety measures through multiple channels.

Experienced traders may choose to test the platform with small trades to evaluate its trading conditions and service quality. For investors with lower risk tolerance, opting for a broker regulated by well-known financial authorities might be a safer choice.

FAQ

- What is STEP Markets?

STEP Markets is an emerging forex and CFD broker established in 2023, offering trading services in forex, stocks, and CFDs. - Where is STEP Markets registered?

According to the company’s website, STEP Markets is registered in Montenegro, but no registration record can be found on Montenegro’s official platforms. - Is STEP Markets regulated?

STEP Markets is not listed under any well-known financial regulatory bodies, so investors should be cautious regarding its compliance. - What trading products does STEP Markets offer?

STEP Markets primarily offers forex, stock CFDs, and other financial products, allowing investors to trade in global markets. - How can I contact STEP Markets’ customer support?

The website supports only English, and no multilingual customer support is available. Investors can contact the support team through the contact information provided on the website.

More Information:https://www.inves2win.com/