Forex trading has attracted global investors for its high risk and reward. Established in 2021, TenX Prime, based in Australia, faces growing concerns over regulatory issues and potential risks.

Company Background: Global Expansion with Limited Services

TenX Prime Ltd is the parent company of TenX Prime. It was registered on September 8, 2021, in Saint Vincent and the Grenadines. The company’s address is Suite 305, Griffith Corporate Centre, Kingstown. TenX Prime, a globally focused broker, offers forex trading services through its website, [tenxprime.com](https://tenxprime.com/), which supports only English. However, it does not provide services to several countries, including Australia, the U.S., Canada, the U.K., and Israel. These restrictive service terms could indicate potential legal and compliance issues globally.

TenX Prime Ltd registered its parent company in Saint Vincent and the Grenadines. However, it operates from its headquarters in Australia. This is done through its Australian subsidiary, TenX Prime Pty Ltd. This subsidiary registered on September 9, 2022, in Australia, with the address ALEXANDRIA NSW 2015 and registration number 662551153.

TenX Prime’s Regulatory Status: Compliance Issues and Potential Risks

Regulatory Gaps in Saint Vincent and the Grenadines

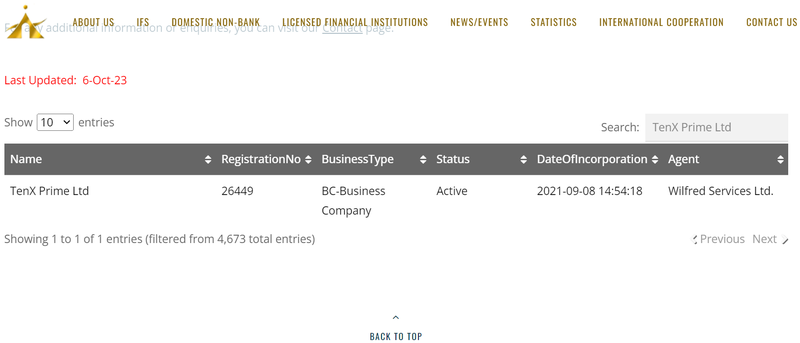

TenX Prime Ltd is registered in Saint Vincent and the Grenadines. It is authorized by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). The company’s license number is 26449. However, it is important to note that SVGFSA’s authorization does not equate to effective regulation of its forex trading activities. According to SVGFSA regulations, the authority ensures that Business Companies (BC) comply with the laws of Saint Vincent and the Grenadines. However, it does not regulate or monitor forex brokerage activities.

In other words, no meaningful external oversight regulates TenX Prime Ltd’s forex trading and brokerage operations, leaving investors without the protections provided by more stringent regulatory frameworks. This regulatory gap raises questions about the legitimacy and safety of TenX Prime Ltd’s operations.

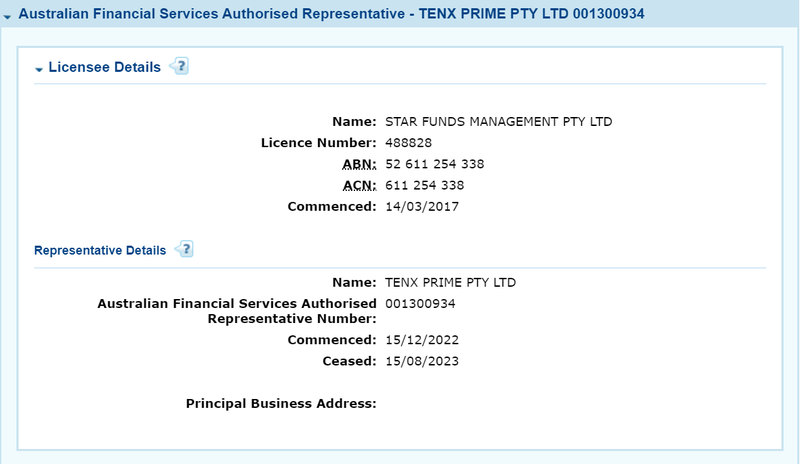

Australian Regulatory Status: Expired Authorization and Deregistration Risks

Similar to its situation in Saint Vincent and the Grenadines, TenX Prime faces significant regulatory challenges in Australia. TenX Prime Pty Ltd operates under the oversight of the Australian Securities and Investments Commission (ASIC), with its initial authorization granted by STAR FUNDS MANAGEMENT PTY LTD on December 5, 2022, under license number 001300934. However, TenX Prime’s authorization expired on August 15, 2023, and by October 2023, authorities had begun deregistering the subsidiary, highlighting serious regulatory risks for its Australian operations.

The expired authorization and deregistered status mean that TenX Prime’s forex business in Australia is highly uncertain. For forex traders, trading with a company that is no longer regulated undoubtedly increases the risk of the trade. This situation further heightens concerns about TenX Prime’s safety and compliance.

TenX Prime’s Business Model: A Risk-Reward Balance

Despite concerns over TenX Prime’s regulatory standing, the company’s forex trading services continue to attract investors. As a broker primarily offering forex trading, TenX Prime allows users to trade currency pairs on its platform, where investors can profit from price fluctuations.

However, forex trading is highly speculative, and with TenX Prime’s unclear regulatory status, investors need to exercise greater caution. In an unregulated trading environment, investors’ funds and the fairness of trades may lack adequate protection. Even more concerning, TenX Prime might exploit its informational advantages to manipulate prices and generate more profits from trades—actions strictly prohibited under stringent regulatory conditions.

Transparency Issues with TenX Prime: Registration and User Experience Gaps

In the forex brokerage industry, transparency is a key indicator of a company’s credibility. In TenX Prime’s case, several transparency issues arise across different aspects of the business.

Lack of Transparency in Domain Registration Information

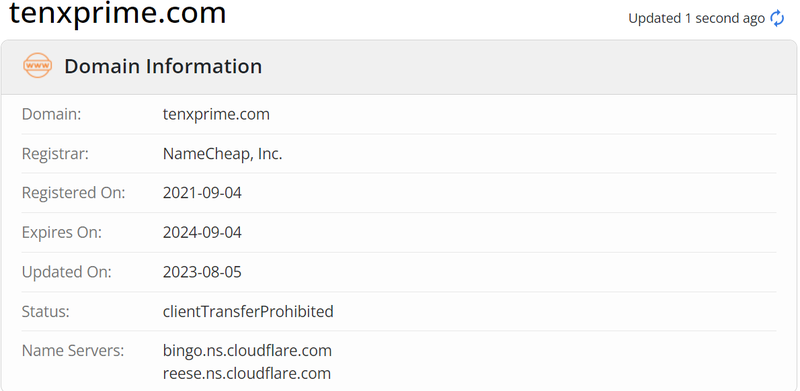

According to Whois queries, TenX Prime’s official website domain was registered on September 4, 2021, just four days before the company was officially established. While quick domain registration is not uncommon, combined with subsequent regulatory gaps, investors have reason to question the platform’s long-term planning and development prospects.

Limited User Experience and Market Feedback

TenX Prime currently provides services only through an English-language website, but there is relatively little user feedback and reviews about its platform. Despite being in operation for two years, TenX Prime has not built up a significant amount of customer reviews or a strong market reputation on third-party platforms. This lack of user experience makes it difficult for new investors to gauge the actual performance of the platform based on past experiences.

Moreover, TenX Prime has not disclosed detailed information about its customer service team or provided much insight into its management structure. This lack of information makes it challenging for investors to assess the platform’s level of service and professionalism when deciding whether to engage with the broker.

The Importance of Choosing a Regulated Forex Broker

An analysis of TenX Prime’s operational status and regulatory issues clearly highlights the critical importance of selecting a regulated forex broker. Regulation not only enhances platform transparency but also ensures investor fund security and fair trading practices.

Here are key reasons why choosing a regulated broker is essential:

- Fund Protection: Regulated brokers strictly segregate client funds from company funds, reducing the risk of fund misuse.

- Legal Support: Regulatory bodies protect investors’ legal rights in regulated markets and provide complaint and appeal channels.. Unregulated platforms, however, lack such legal support, often leading to disputes.

- Trading Transparency: Regulatory systems effectively prevent brokers from manipulating market data or interfering with client trades, ensuring a fair and transparent trading environment.

- Strong Reputation: Regulated companies usually have higher market credibility, building trust over time through stable operations and positive customer experiences.

Choosing a regulated broker not only helps investors mitigate potential risks but also provides a reliable foundation for long-term investments.

Potential Risks of TenX Prime and Investor Considerations

In summary, TenX Prime offers trading services as an emerging forex broker. However, its lack of regulation and transparency poses significant risks for investors. There are regulatory gaps in Saint Vincent and the Grenadines. Additionally, its license in Australia has expired. These issues raise concerns about the company’s legitimacy and safety.

In the forex market, choosing a regulated broker with a solid reputation is crucial to ensuring fund security and fair trading. Investors considering TenX Prime must proceed with caution, thoroughly assess its potential risks, and avoid unnecessary financial pitfalls.

FAQ (Frequently Asked Questions)

- Is TenX Prime regulated?

Saint Vincent and the Grenadines registered TenX Prime, but the local regulator does not effectively oversee its forex activities. Additionally, its Australian license has expired, and the entity is currently in the process of deregistration. - What services does TenX Prime provide?

TenX Prime primarily offers forex trading services, allowing users to trade currency pairs and profit from exchange rate fluctuations. - How is the safety of funds ensured with TenX Prime?

Due to the lack of effective external regulation, the safety of investor funds with TenX Prime is at considerable risk. It is unclear whether the company adheres to fund segregation policies. - How transparent is TenX Prime?

TenX Prime faces transparency issues, with limited public information on the company and few customer reviews, making it difficult for users to fully assess the platform’s service quality. - How should investors choose a forex broker?

Investors should prioritize regulated brokers to ensure fund security and fair trading practices. Additionally, market reputation and user feedback are important factors when evaluating a broker. - Is TenX Prime trustworthy?

Given TenX Prime’s lack of regulation and transparency, investors should exercise extreme caution and carefully consider the potential risks before choosing this platform.

More information:https://www.inves2win.com/