1. Introduction

In recent years, the globalization of financial markets and the proliferation of online trading platforms have increased the number of trading opportunities available to investors. However, this has also led to a rise in financial frauds that exploit the trust and desire for profit of investors. This case analysis examines a typical financial fraud case where a user was lured into a scheme by Lucia Ricci, an Introducing Broker (IB), who directed them to the platform GCL GLOBAL LIMITED, ultimately leading to them being defrauded.

2. Background of the Incident

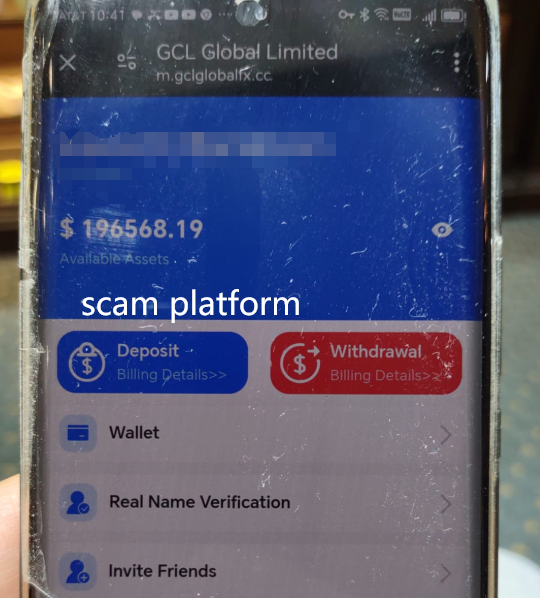

In this case, a user was contacted on social media by an IB named Lucia Ricci. She claimed to be a professional investment advisor and strongly recommended trading on the platform GCL GLOBAL LIMITED. GCL GLOBAL LIMITED claimed to be a legitimate international trading platform, offering a variety of financial products for trading.

Initially, the user made a small trade and earned some profit. Moreover, the platform allowed the user to withdraw a small amount of money, which increased the user’s trust in the platform. However, subsequent developments did not meet the user’s expectations, and under pressure from Lucia Ricci to invest more, the user ended up investing over $50,000.

3. Key Fraudulent Tactics

3.1 Initial Inducement

Lucia Ricci lured the user to GCL GLOBAL LIMITED by offering professional investment advice and promising high returns. She exploited the user’s desire for profit and their trust in her as a “professional” to draw the user into making an initial investment.

3.2 Small Profits and Withdrawals

To ease the user’s suspicion, the platform allowed the user to withdraw a small profit after making a minor investment. This move strengthened the user’s trust in the platform, leading to further investments.

3.3 Demand for Additional Investments

After gaining the user’s trust, Lucia Ricci and the platform requested additional investments, promising even higher returns. By this point, the user believed in the legitimacy of the platform and decided to invest more, expecting greater profits.

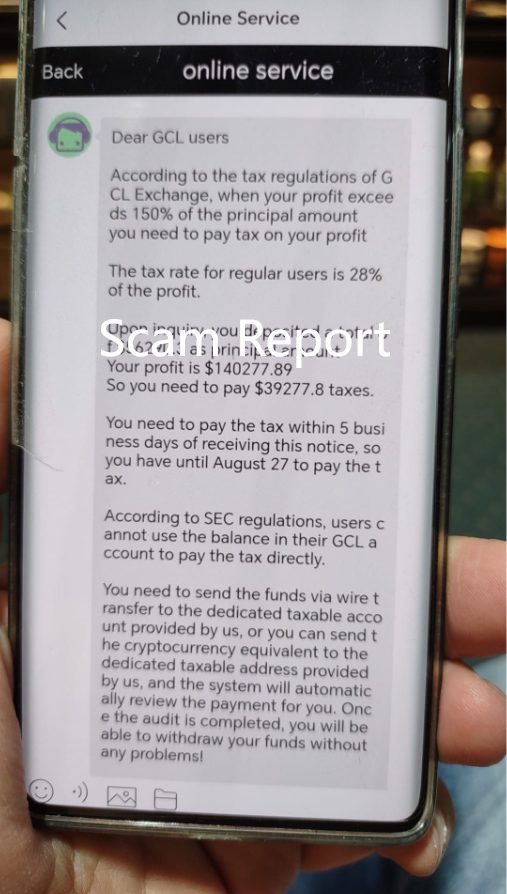

3.4 Freezing Profits and Demanding a High “Profit Tax”

When the user’s account profits reached $140,277, the platform suddenly refused the user’s withdrawal request, freezing the account on the grounds that the profits exceeded 150%. At this point, the platform demanded the user pay a 28% “profit tax,” claiming it was required by U.S. Securities and Exchange Commission (SEC) regulations.

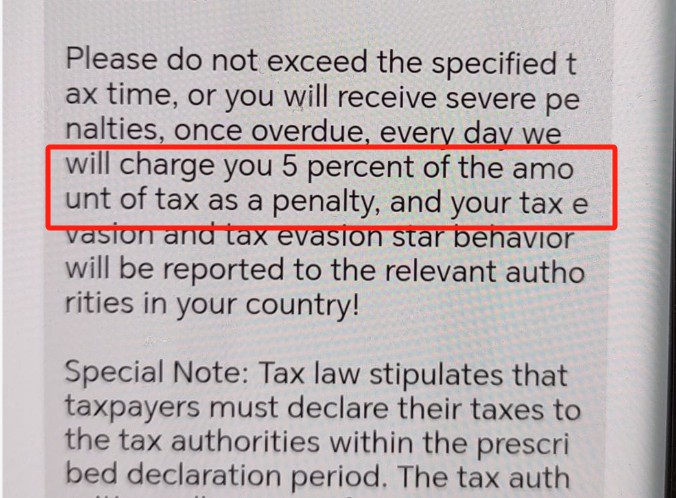

3.5 Coercion for Additional Large Deposits

The platform further pressured the user to make an additional deposit of $40,000 within five business days, claiming this would unlock the account and enable withdrawals. If the user refused, they were threatened with a 5% daily late fee, applying psychological pressure to the user.

4. Analysis of the Fraud Tactics

4.1 Exploiting Trust and Promising High Returns

Fraudsters successfully lure victims by exploiting their expectation of high returns and their blind trust in “expert” opinions. Lucia Ricci contacted the user via social media, using her falsely presented professional status and the initial profits from the platform to gradually ensnare the user.

4.2 Fabricating Legitimacy

GCL GLOBAL LIMITED created the illusion of legitimacy through initial profits and the withdrawal process, making the user believe in the platform’s legitimacy. After the user invested a significant amount, the platform froze the account for various reasons and demanded additional deposits and high taxes, revealing the core of the scam.

4.3 Misusing Legal Authority

The platform claimed the account freeze was justified under SEC regulations, demanding high taxes and additional investments. This tactic exploited the user’s fear of the law and respect for authority, disguising the fraudulent activity as legitimate.

5. How to Identify and Prevent Similar Scams

5.1 Always Verify the Legitimacy of the Platform

Before investing, it is crucial to verify the legitimacy and regulatory background of the trading platform. Checking the registration information with financial regulatory authorities can help confirm the platform’s legitimacy.

5.2 Do Not Easily Believe Promises of High Returns

Always be skeptical of investment advice that promises high returns, especially if it comes from unverified advisors or unknown sources.

5.3 Be Cautious of Unreasonable Demands for Additional Investments

Legitimate platforms do not require additional investments as a condition to unlock accounts or process funds. Any such request should be considered a major warning sign of fraud.

5.4 Understand Relevant Laws and Regulations

Investors should understand basic financial laws and regulations to avoid being exploited due to misunderstanding the law. This helps in identifying false demands and unreasonable fees.

6. Conclusion

The fraud by GCL GLOBAL LIMITED and Lucia Ricci is a typical financial scam case that demonstrates how fraudsters exploit people’s expectations of high returns and blind trust in “expert” opinions, gradually leading victims to invest large sums. During this process, fraudsters disguise their activities as legitimate and apply psychological pressure to achieve their illegal objectives. Such scams pose a significant threat to personal finances, and investors must remain vigilant, stay rational, and avoid becoming the next victim.

7. Frequently Asked Questions (FAQs)

Q1: How can I determine if a trading platform is legitimate and legal?

A1: You can verify the platform’s legitimacy by checking whether it is certified by international or national financial regulatory authorities, investigating its license number, and reviewing its registration information on the official website of the relevant regulatory body.

Q2: What should I do if I encounter a similar scam?

A2: Immediately stop all transactions with the platform, preserve all relevant evidence (such as chat logs, transaction records, etc.), and report the incident to local police and financial regulatory authorities.

Q3: Do legitimate trading platforms charge customers high profit taxes?

A3: No. Legitimate platforms do not refuse customer withdrawals for additional fees, nor do they charge excessive amounts.

Q4: What is an Introducing Broker (IB)?

A4: An Introducing Broker (IB) is an intermediary or company that introduces clients to a trading platform. Legitimate IBs are usually regulated by financial authorities and should have relevant qualifications.

Q5: How can I avoid becoming a victim of financial fraud again?

A5: Enhance your vigilance in investing, learn basic financial knowledge, choose reputable financial institutions for investments, and avoid trusting investment advice from strangers.

Q6: How can I avoid investment scams on social media?

A6: Be skeptical of any investment opportunities recommended via social media, especially when they promise high returns. Always conduct thorough background research and verification before making any investment decisions.

Please Note: The above content is for reference only. In case of similar situations, it is recommended to consult professional legal and financial advisors for detailed advice.

Final Reminder: Investment involves risk. Do not easily believe promises of high returns, and be cautious to avoid falling victim to financial scams.