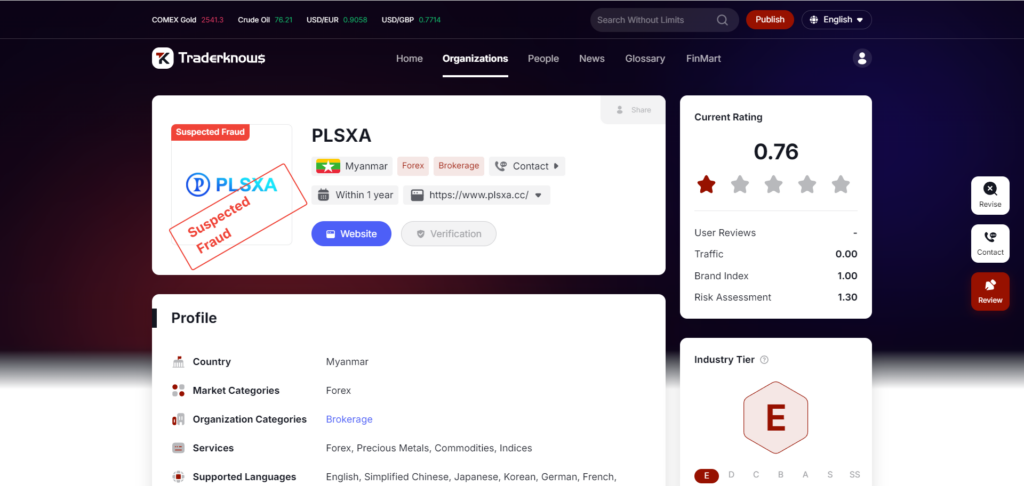

In the fast-paced world of forex trading, where new brokers continually emerge, PLSXA has caught the attention of many in the financial community. Launched in early 2024, PLSXA positions itself as a provider of various financial derivatives, including forex, precious metals, commodities, and indices. But, like many newcomers to the market, it raises questions about its legitimacy and the authenticity of its regulatory claims. This article aims to provide a thorough review of PLSXA, its services, regulatory status, and the concerns surrounding its operations.

PLSXA’s Services and Offerings

PLSXA markets itself as a versatile forex broker, offering a broad range of trading instruments to cater to the needs of diverse investors. These include:

- Forex Trading: PLSXA provides access to the global currency markets, allowing traders to speculate on the exchange rates of various currency pairs.

- Precious Metals: Investors can trade precious metals such as gold and silver, which are often seen as safe-haven assets during times of economic uncertainty.

- Commodities: The broker offers trading opportunities in commodities like oil and gas, which can serve as a hedge against inflation or currency fluctuations.

- Indices: PLSXA also provides access to global indices, enabling traders to speculate on the performance of major stock markets around the world.

While the range of products offered by PLSXA appears comprehensive, the lack of detailed information on their trading platforms, spreads, and fees is a notable omission. Transparency in these areas is crucial for traders to make informed decisions, and the absence of such information raises initial concerns.

The Question of Regulatory Compliance

Regulation is a critical factor in determining the credibility and trustworthiness of any forex broker. According to the information available on PLSXA’s official website, the company is registered as PLSXA Limited and claims to be regulated by several prominent financial authorities, including the United States National Futures Association (NFA) and the Financial Crimes Enforcement Network (FinCEN). Additionally, PLSXA states that it is a member of The Financial Commission, an independent organization that provides dispute resolution services for the forex industry.

However, a closer inspection of these claims reveals significant discrepancies:

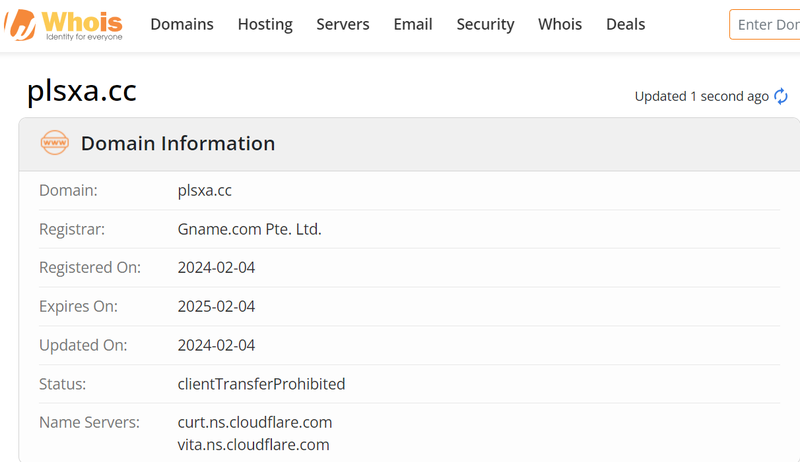

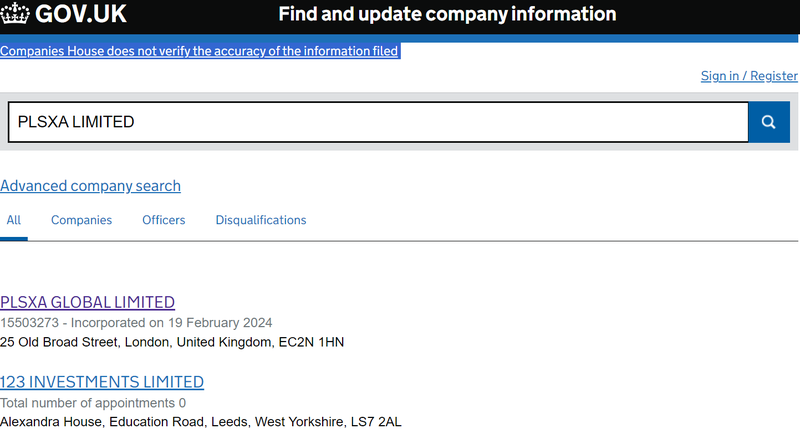

- Companies House (UK): Despite PLSXA’s claim of being registered in the United Kingdom, a search in the Companies House database does not return any entity named PLSXA Limited.

- NFA (United States): The NFA is a well-known regulatory body for futures and forex brokers in the U.S. However, the NFA’s database does not list PLSXA Limited as a registered member.

- FinCEN (United States): FinCEN oversees financial institutions to ensure compliance with anti-money laundering regulations. Again, PLSXA Limited does not appear in FinCEN’s registry.

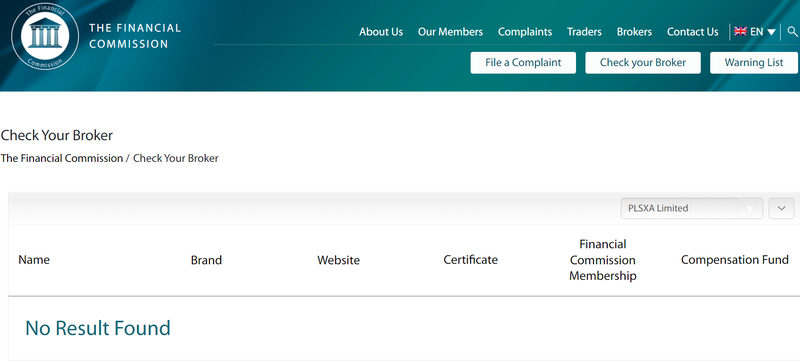

- The Financial Commission: While PLSXA claims membership in The Financial Commission, which is a reputable body that offers a level of security for traders, no records of PLSXA Limited are found on The Financial Commission’s official website.

These findings raise significant red flags regarding the authenticity of PLSXA’s regulatory status. The lack of verifiable registration and regulation casts doubt on the broker’s ability to operate legally and protect its clients’ interests.

Concerns Regarding Transparency and Website Content

One of the most striking issues with PLSXA is the lack of transparency on its official website. For a forex broker, clear and detailed information on terms and conditions, trading platforms, spreads, and fees is essential. However, PLSXA’s website falls short in this regard. For example, the “Terms and Conditions” section on the website is virtually non-existent, displaying only icons without any accompanying text. This omission is not only unusual but also troubling, as it prevents potential clients from understanding the broker’s legal framework and their own rights as traders.

Moreover, the absence of any detailed content on the broker’s regulatory page further exacerbates these concerns. Reliable forex brokers typically provide exhaustive information on their licensing, regulatory status, and operational jurisdictions, yet PLSXA provides minimal and unverifiable details. This lack of transparency makes it difficult to trust the broker and raises questions about its legitimacy.

Geographical Restrictions and Compliance

PLSXA’s website indicates that it does not offer services to jurisdictions where its operations might violate local laws or regulations, explicitly mentioning countries like the United States, Iran, and North Korea. While this is a standard disclaimer for many brokers, it does not offset the concerns raised by the lack of verifiable regulatory information. Traders should be particularly cautious when dealing with brokers that have unclear regulatory standings, as this can impact the legal recourse available to them in the event of a dispute.

Implications for Potential Investors

Given the discrepancies in PLSXA’s regulatory claims and the lack of transparency on its website, potential investors should approach this broker with caution. The forex market is notorious for its risks, and dealing with an unregulated or poorly regulated broker can exacerbate these risks significantly. Without credible regulatory oversight, traders are left vulnerable to issues such as unfair trading practices, withdrawal problems, and even potential fraud.

What to Look for in a Reliable Forex Broker

For those considering PLSXA or any other forex broker, it’s essential to know what to look for in a reliable and trustworthy broker:

- Regulatory Status: Always verify a broker’s regulatory status through official channels. Reputable brokers are registered with recognized financial authorities and have their registration details readily available for verification.

- Transparency: A trustworthy broker provides clear information on its trading conditions, including spreads, fees, and terms of service. If this information is hard to find or incomplete, it’s a significant red flag.

- Customer Reviews: Look for reviews and feedback from other traders. While online reviews can sometimes be biased, they can provide insights into the broker’s reputation and the experiences of other clients.

- Customer Support: Reliable brokers offer robust customer support, with multiple channels of communication available to assist traders in resolving any issues.

- Platform and Tools: Ensure the broker provides a stable and user-friendly trading platform with the necessary tools for effective trading. A demo account is also a good sign, allowing traders to test the platform before committing real funds.

Conclusion

PLSXA is a forex broker that, on the surface, offers a wide range of trading instruments and claims to be regulated by multiple authorities. However, upon closer examination, there are serious concerns about the legitimacy of these claims. The lack of verifiable regulatory information and transparency on its website should be a major warning sign for potential investors. In the highly competitive and risky world of forex trading, dealing with a broker that does not provide clear and trustworthy information can lead to significant financial losses.

As with any investment decision, due diligence is crucial. Before engaging with PLSXA or any other forex broker, investors should thoroughly research the broker’s background, verify its regulatory status, and consider the experiences of other traders. The importance of choosing a reliable and regulated broker cannot be overstated, as it is fundamental to ensuring a secure and successful trading experience.

Reference: